How Coronavirus is Affecting Ad Rates & Website Traffic (Live Updates)

Get helpful updates in your inbox

How Coronavirus / COVID-19 is Affecting Web Traffic & Ad Rates (Live Updates)

We will include ongoing updates with timestamps below. We’ll also keep our list of resources and advice updated as new information becomes available.

Resources:

- Our video at the bottom describes how the economy impacts ad rates right now

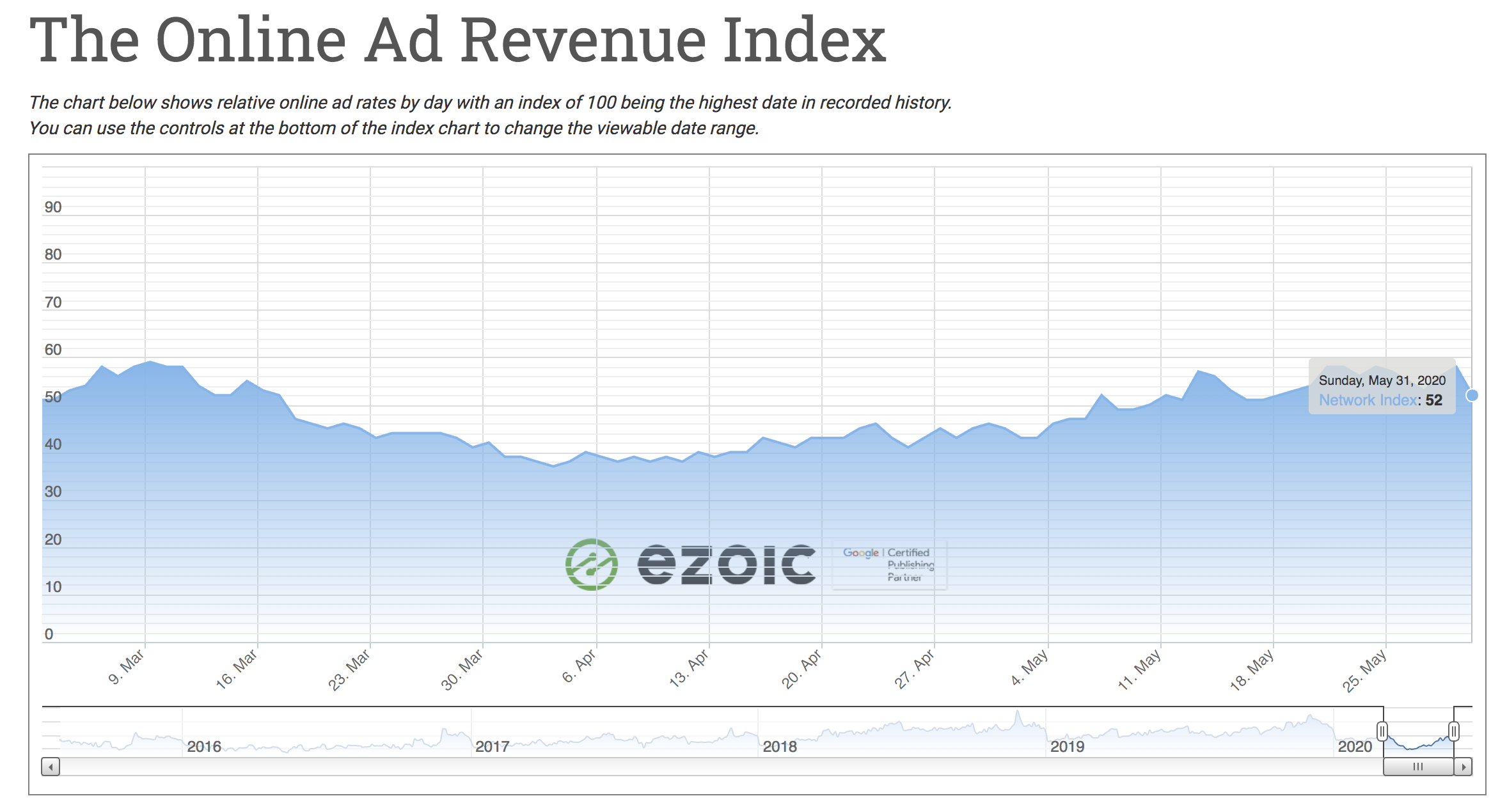

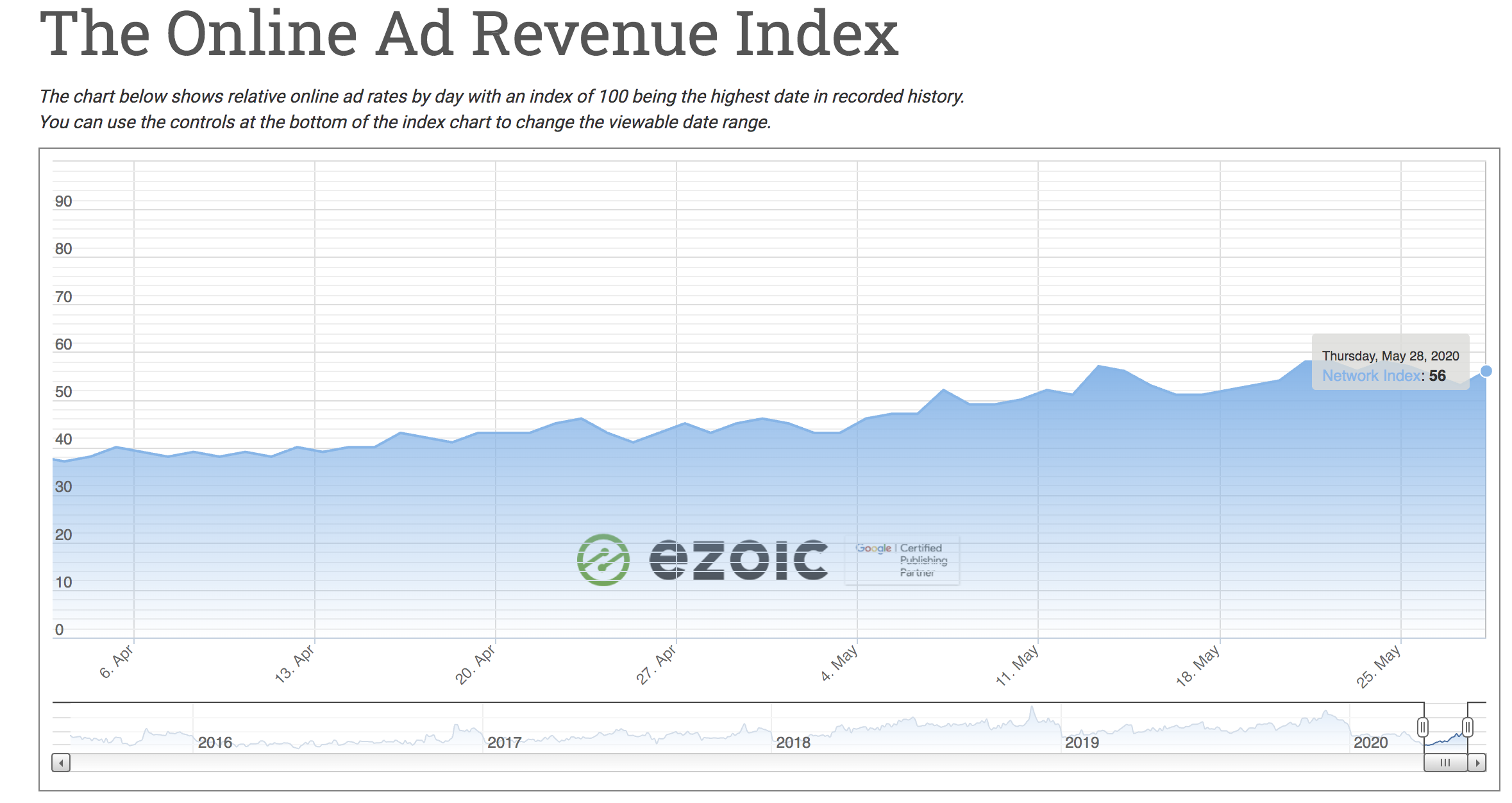

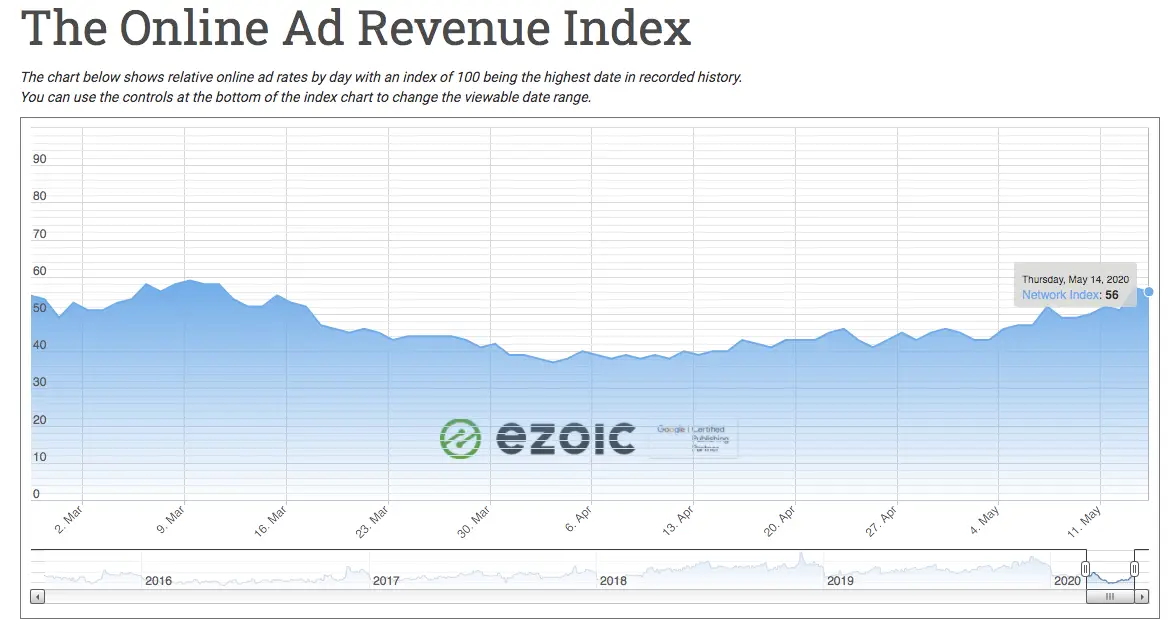

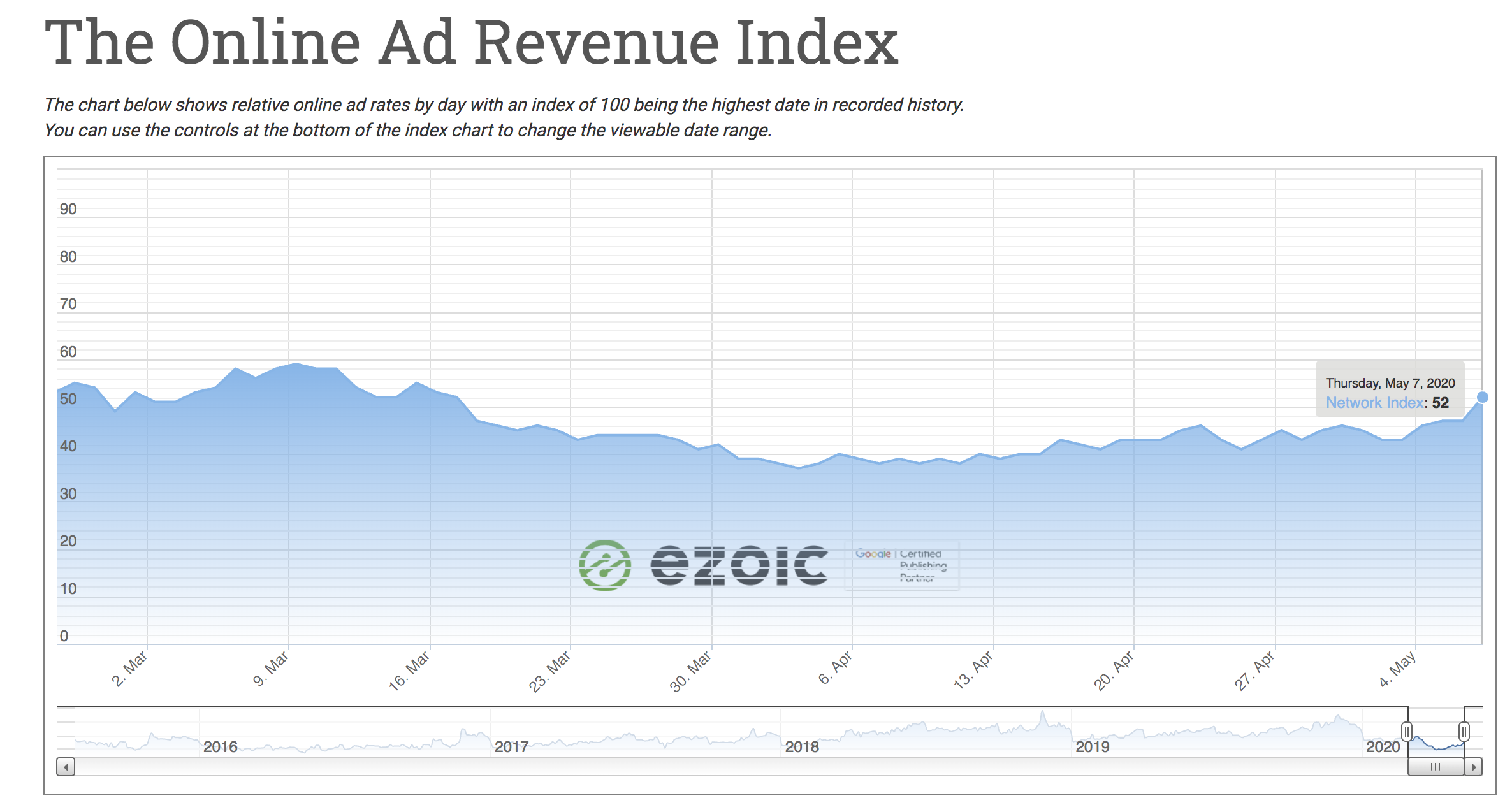

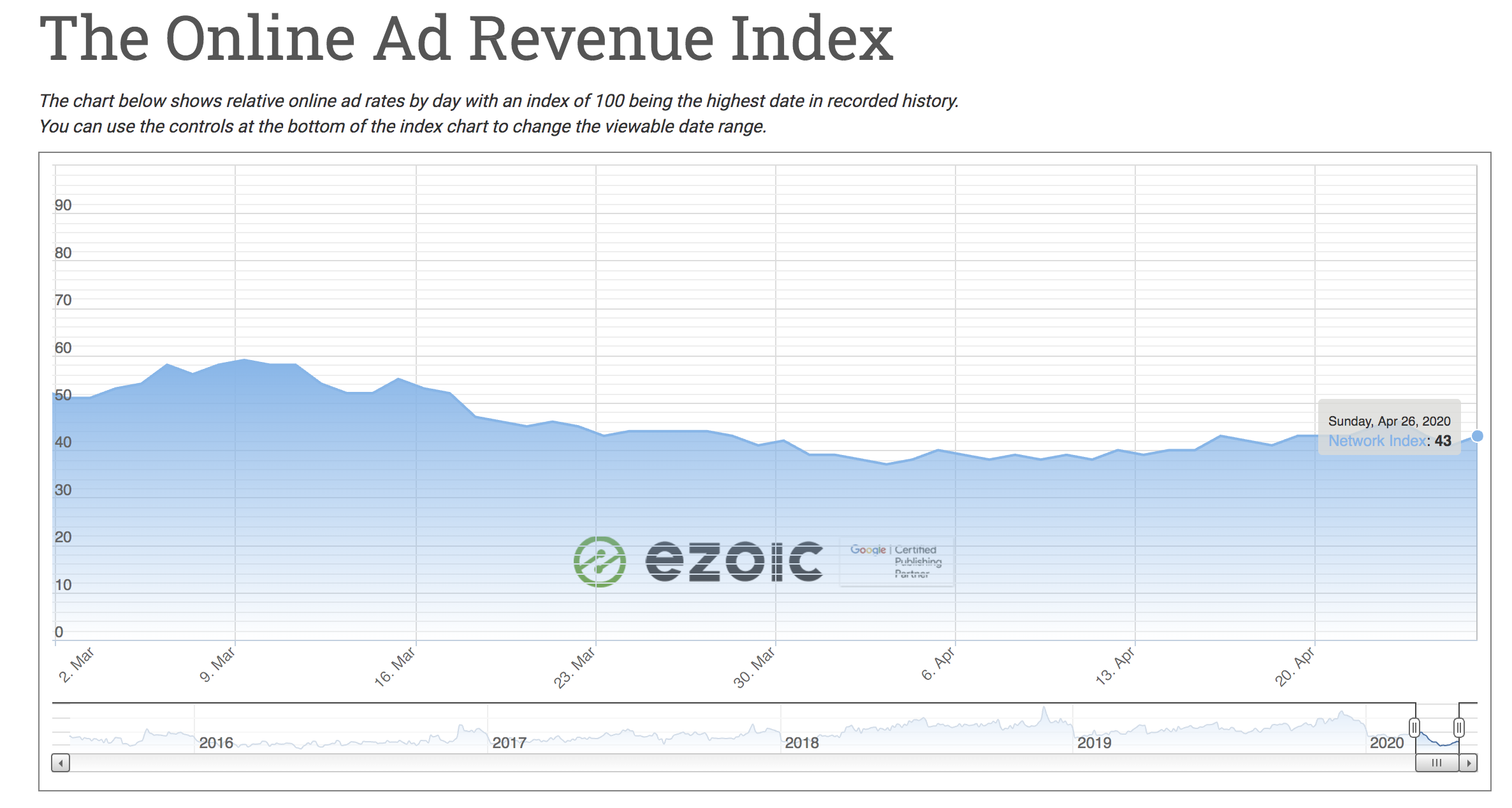

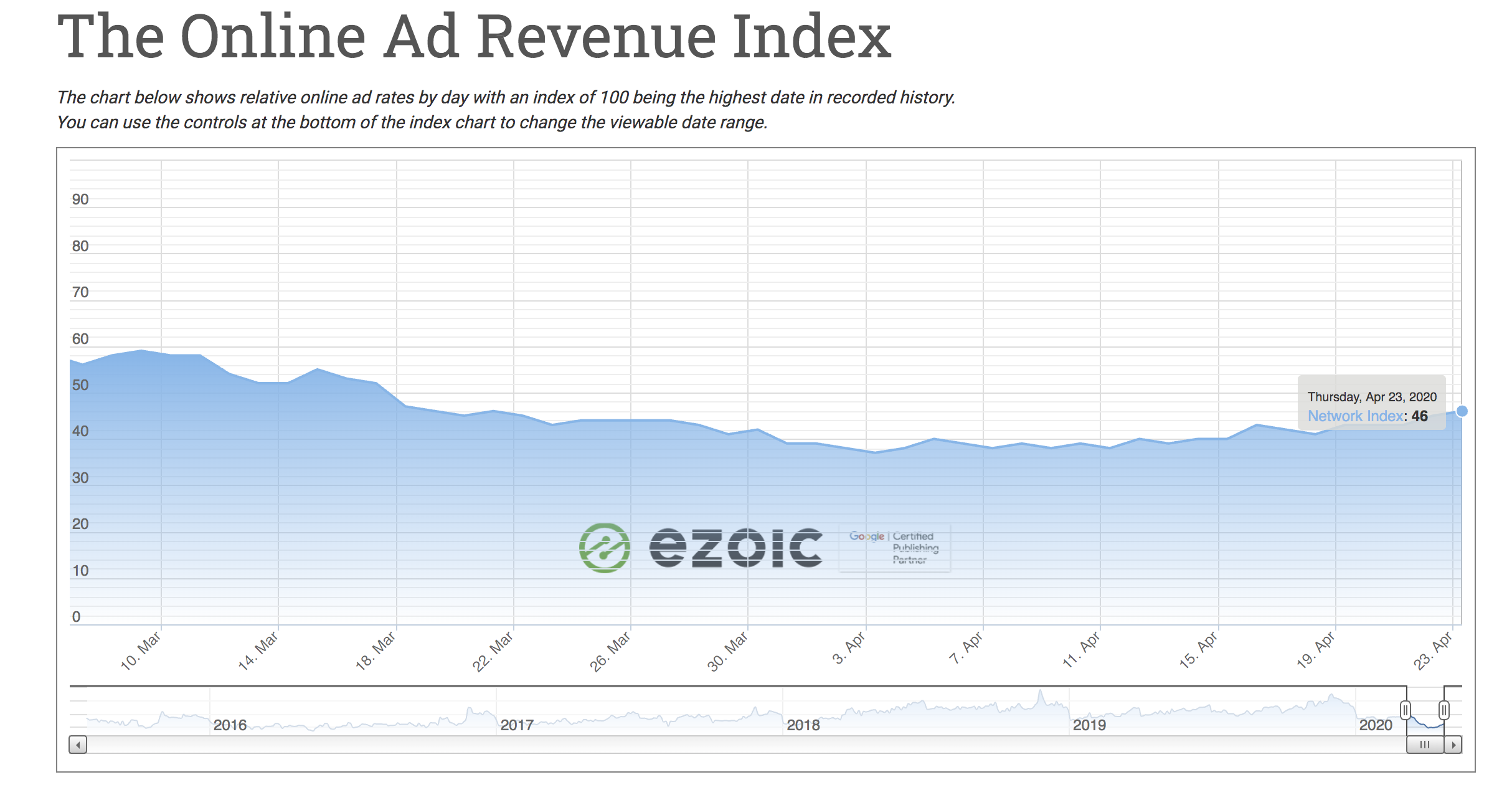

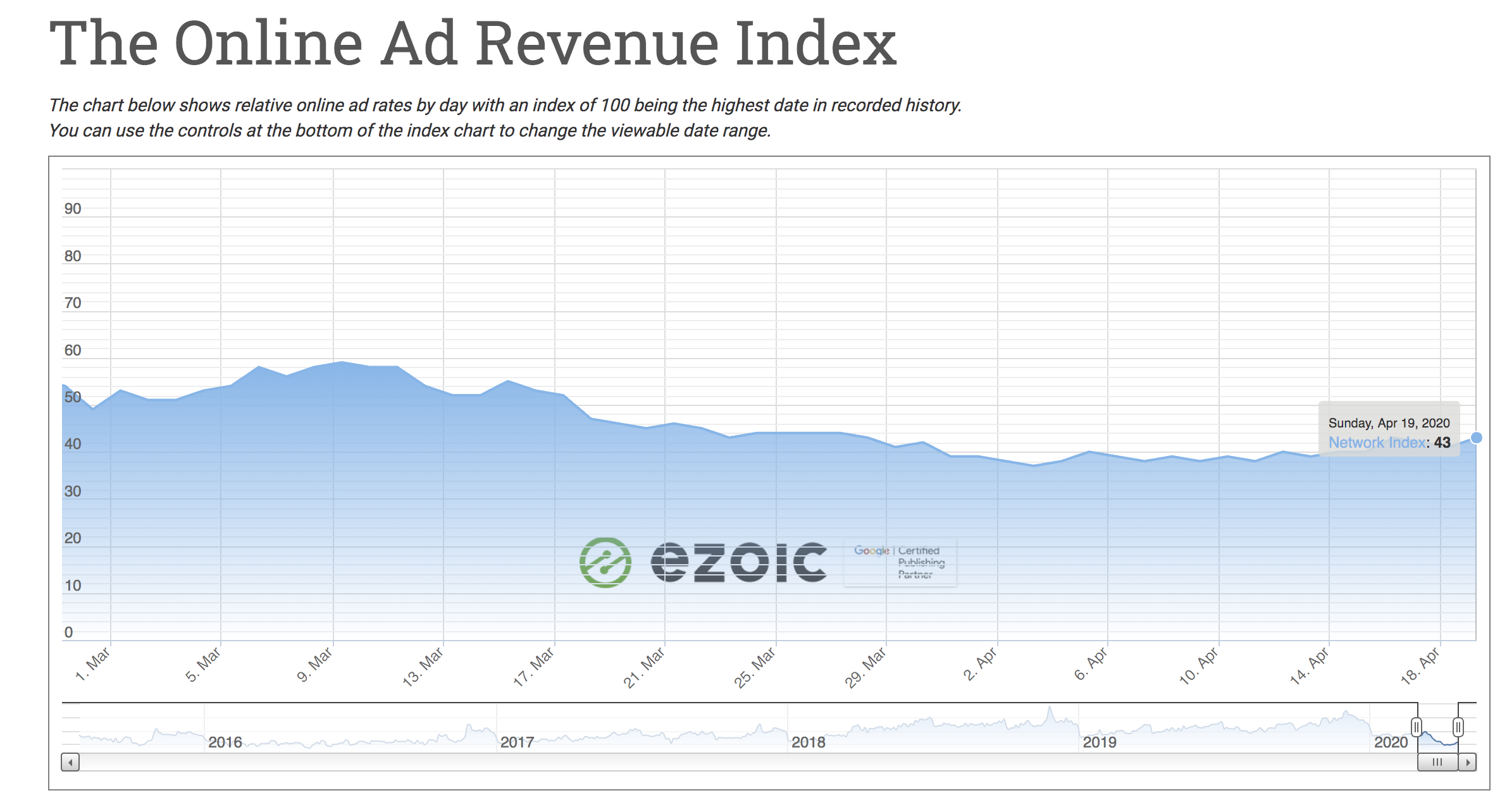

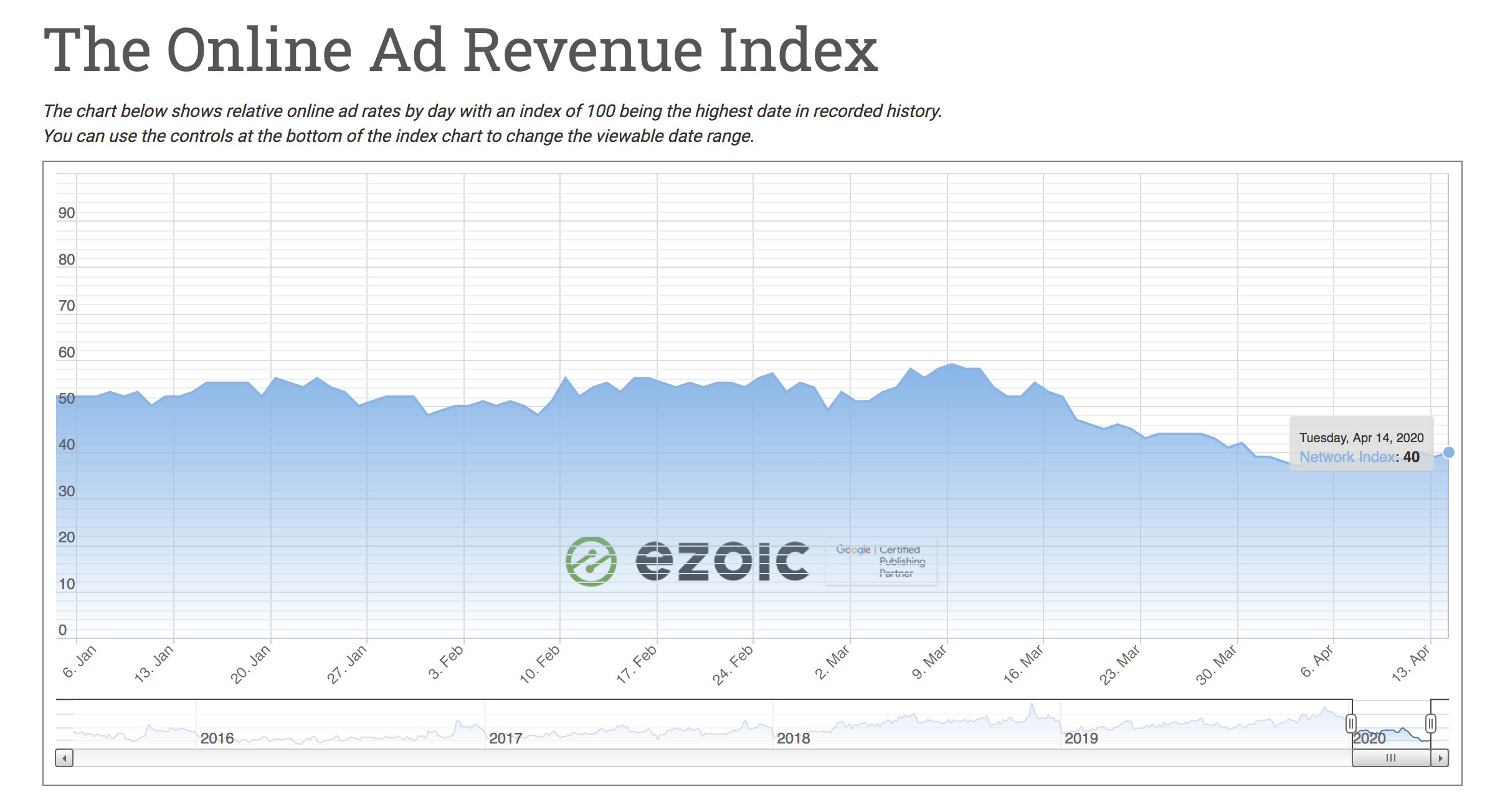

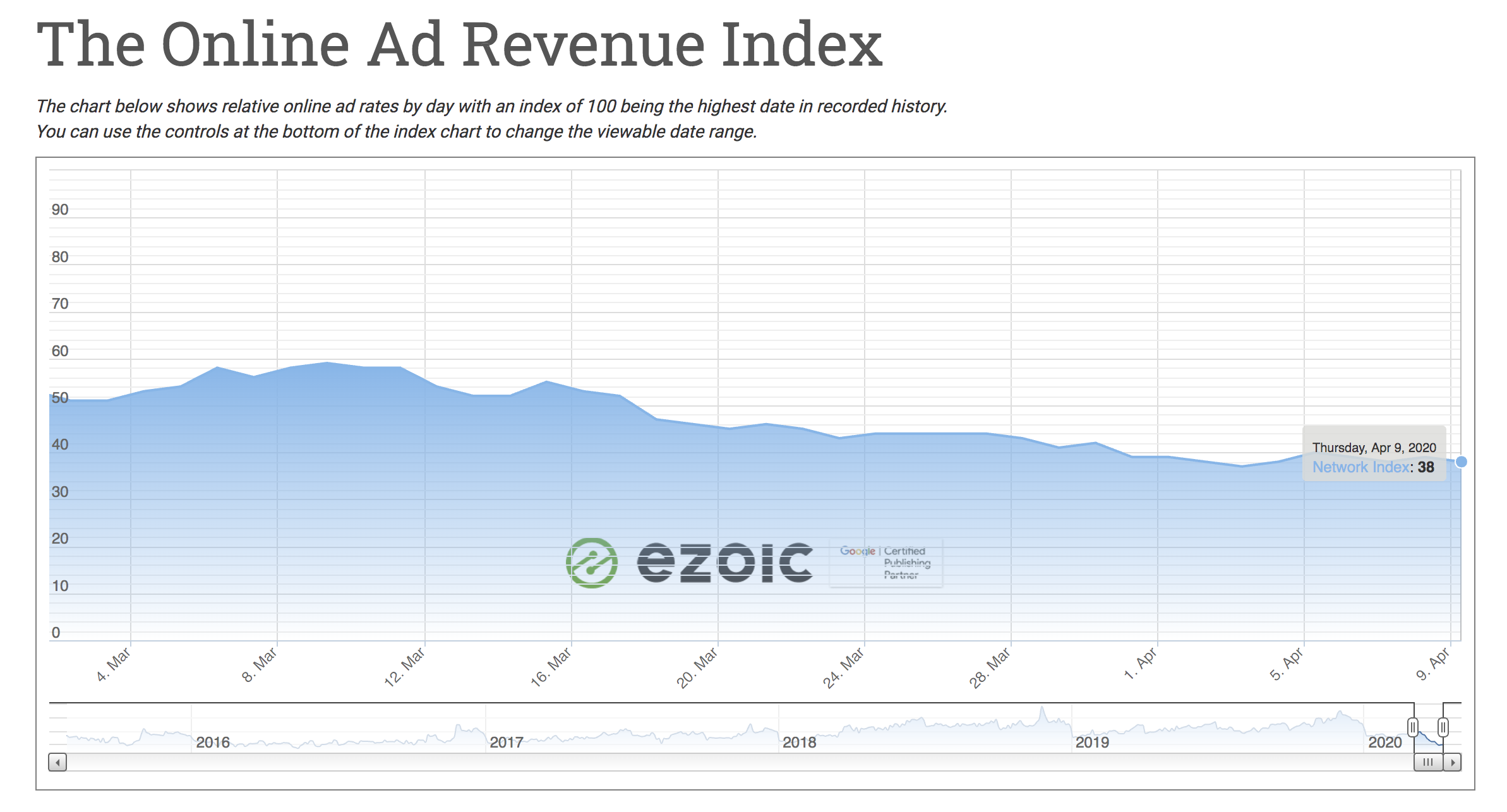

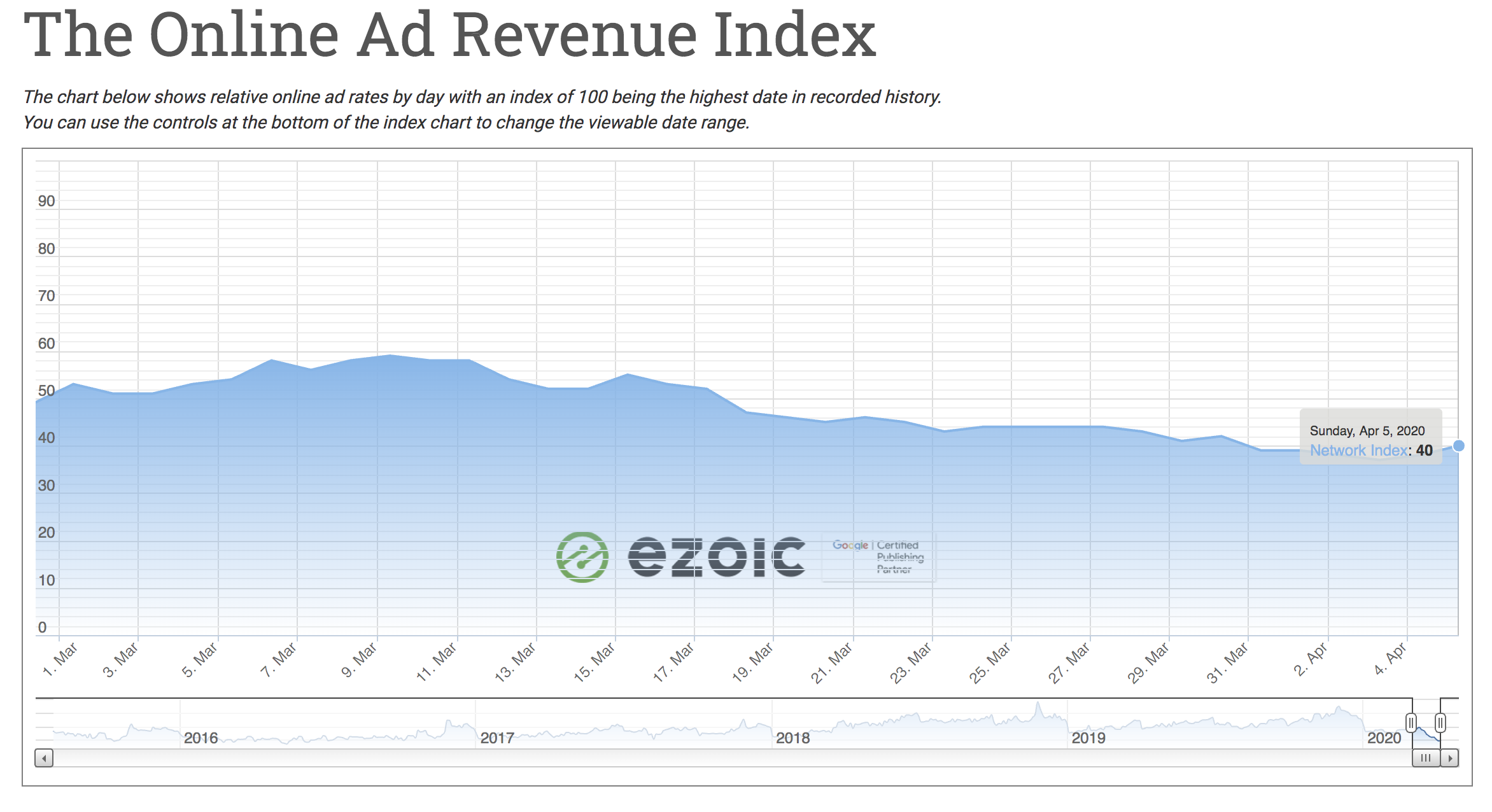

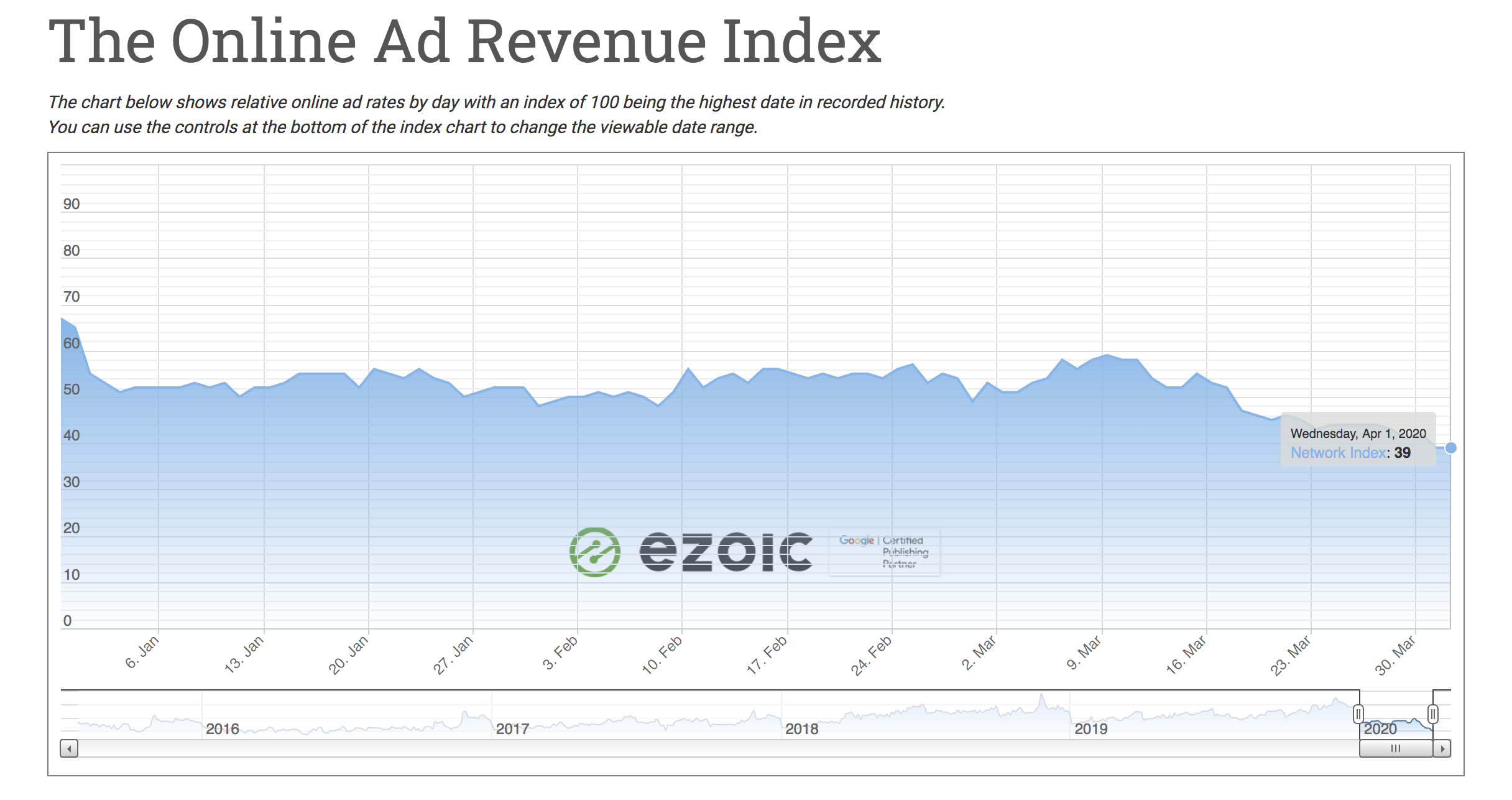

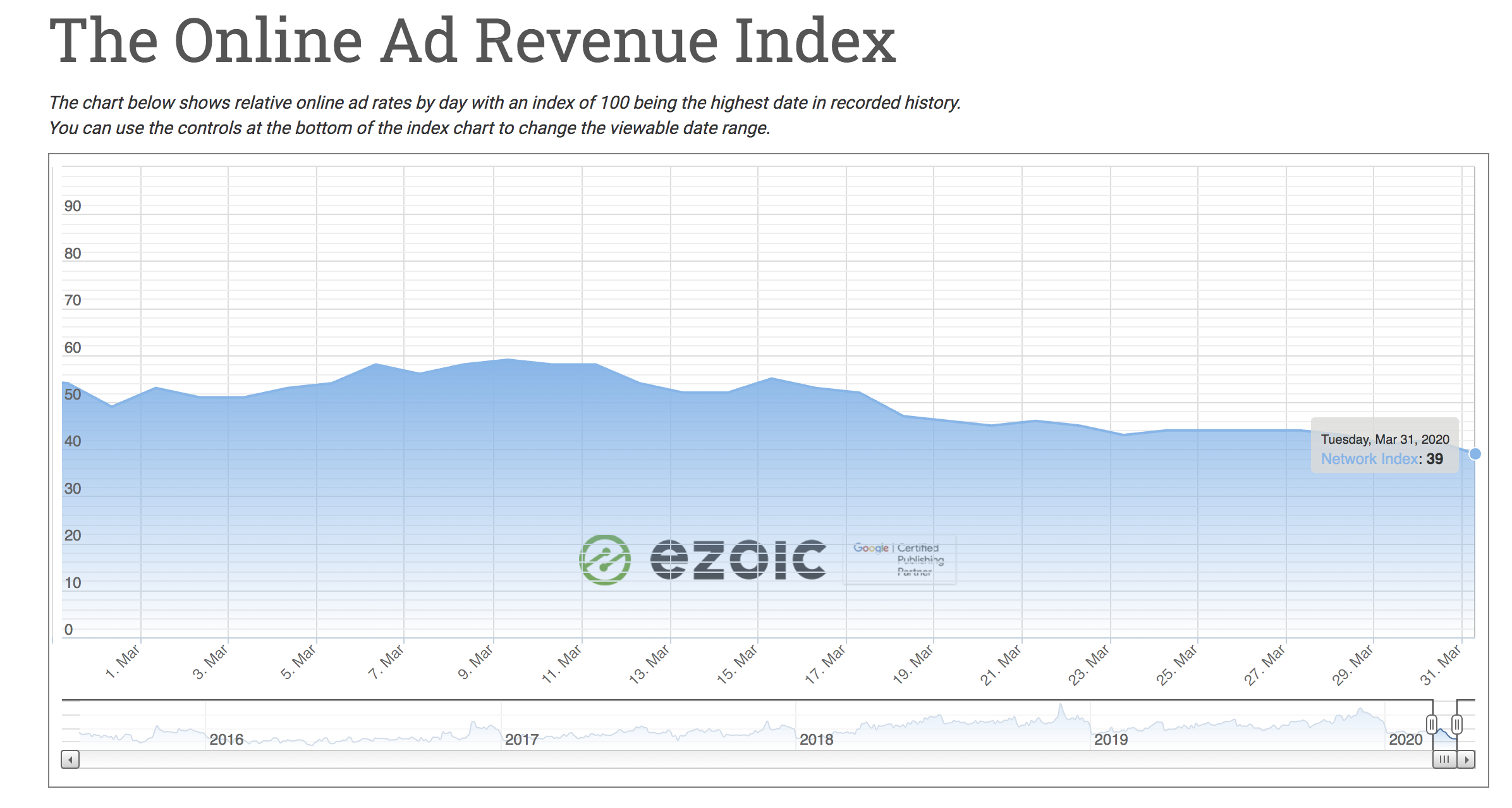

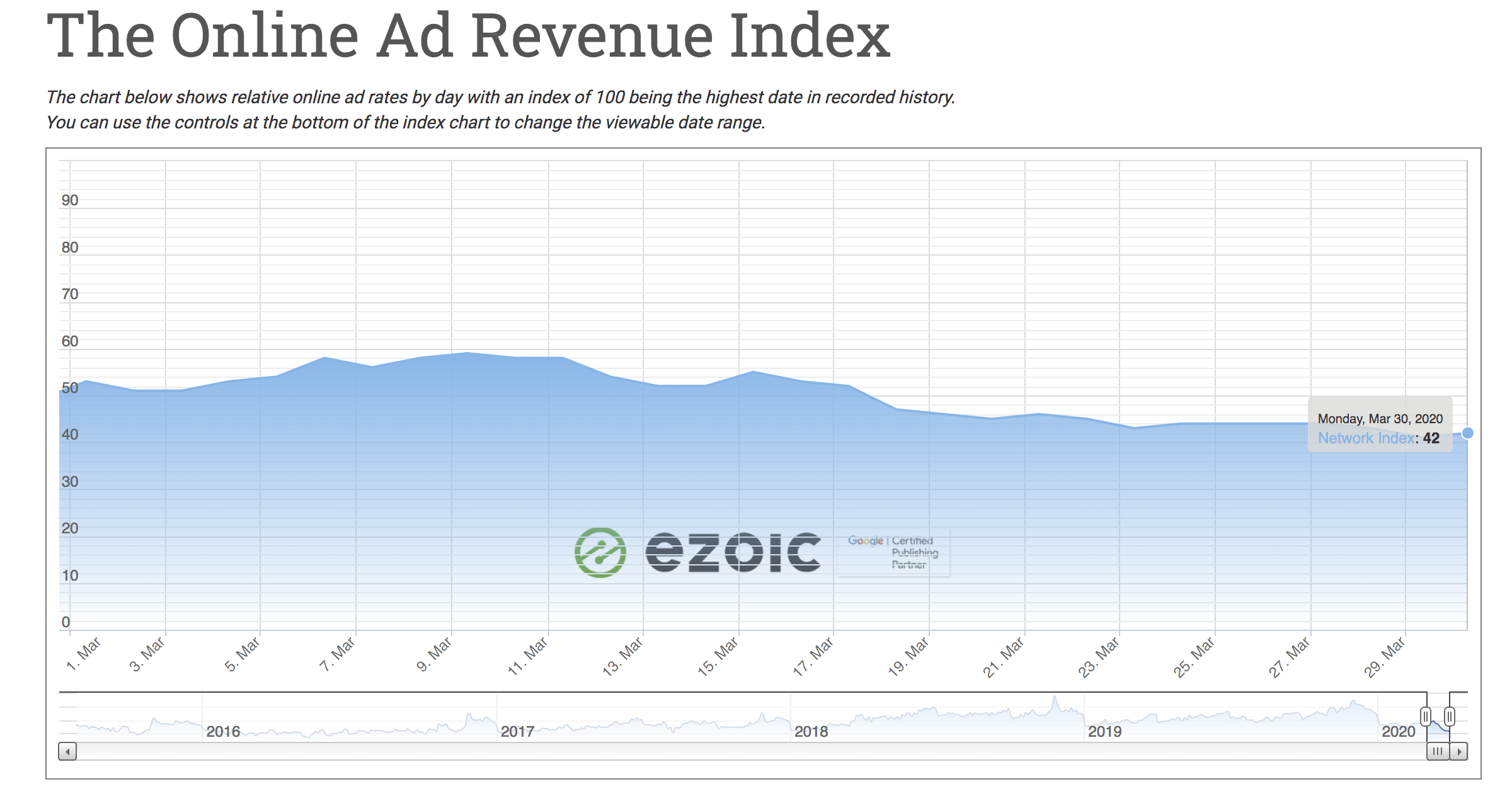

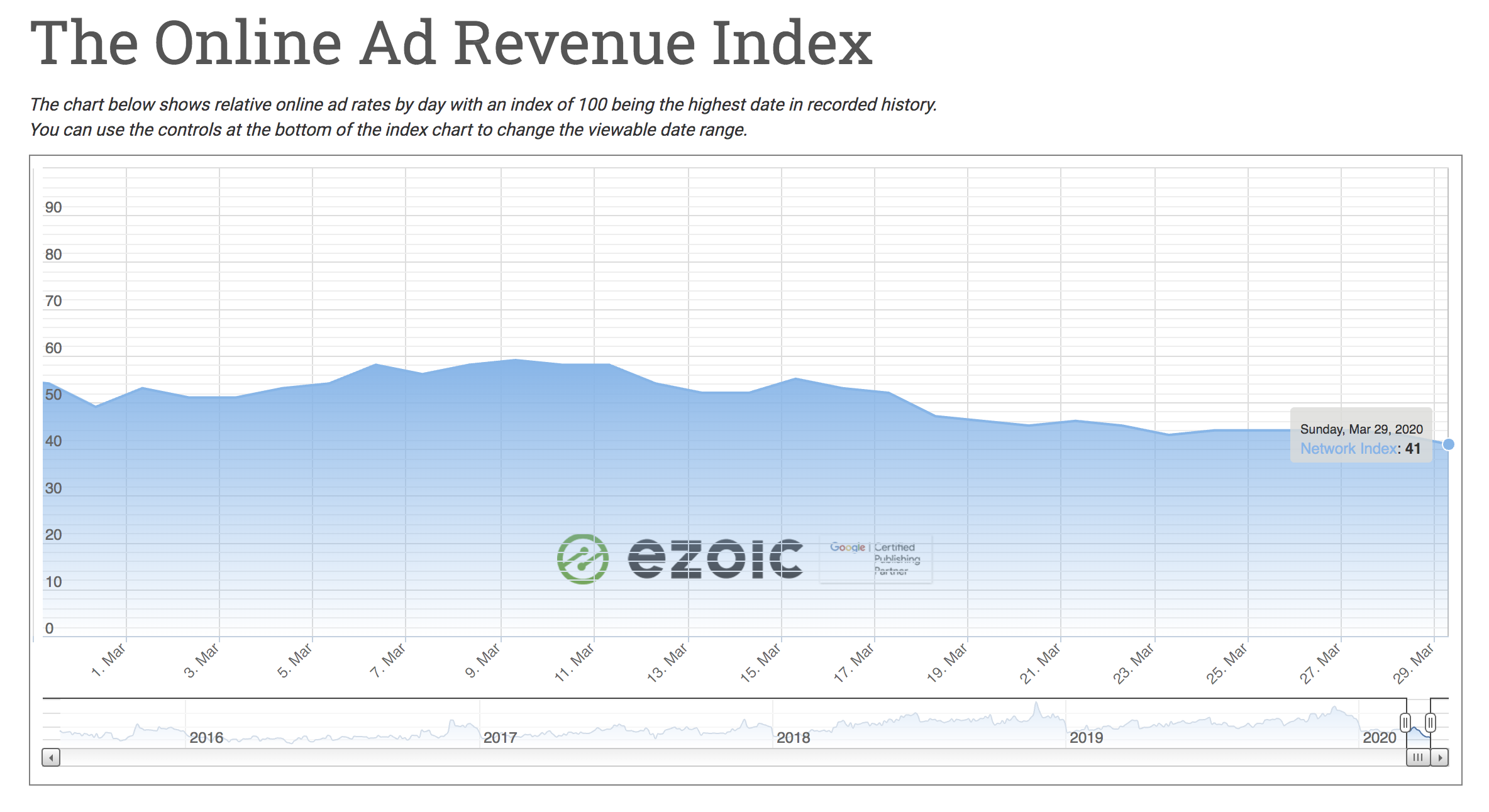

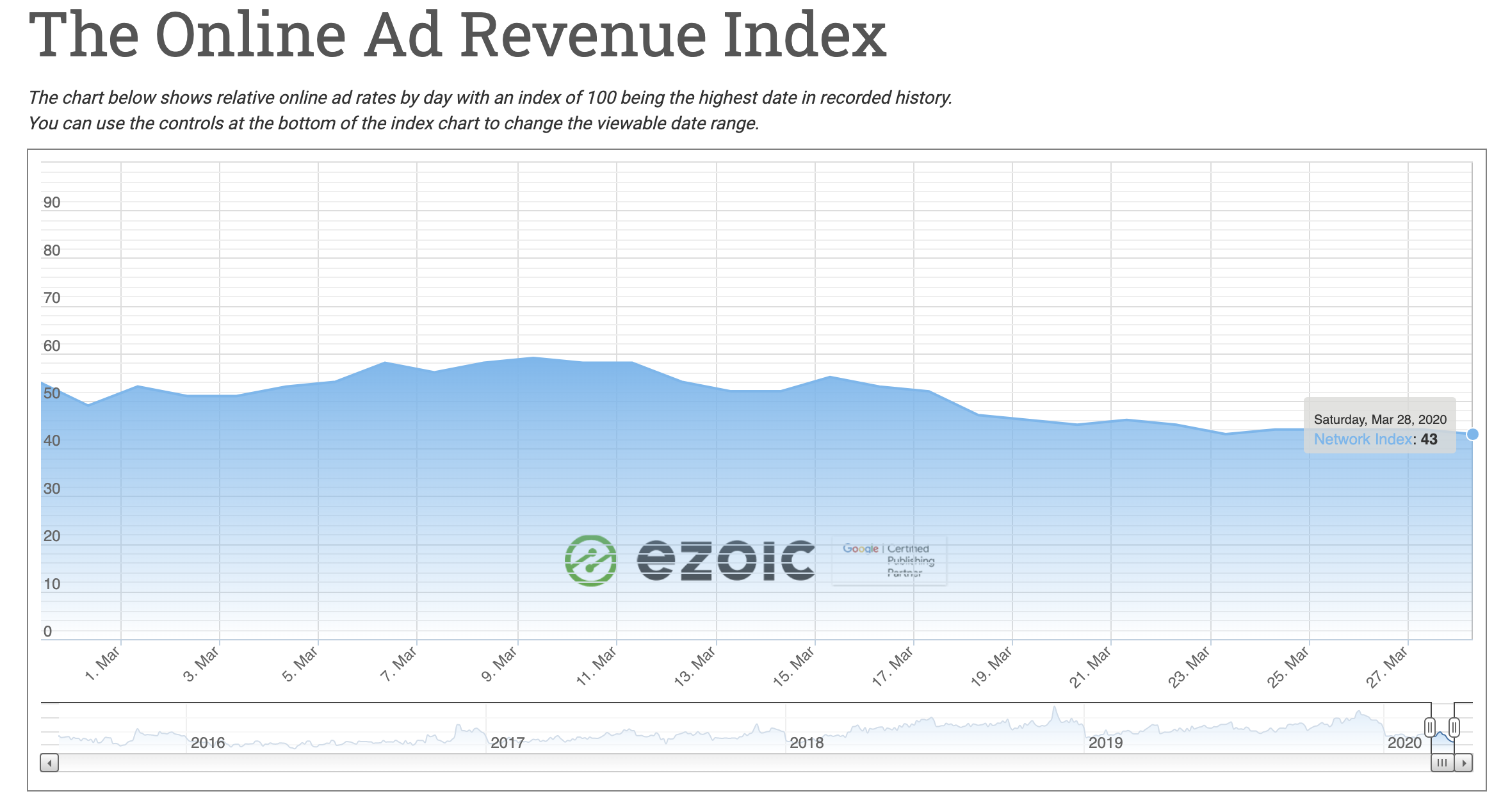

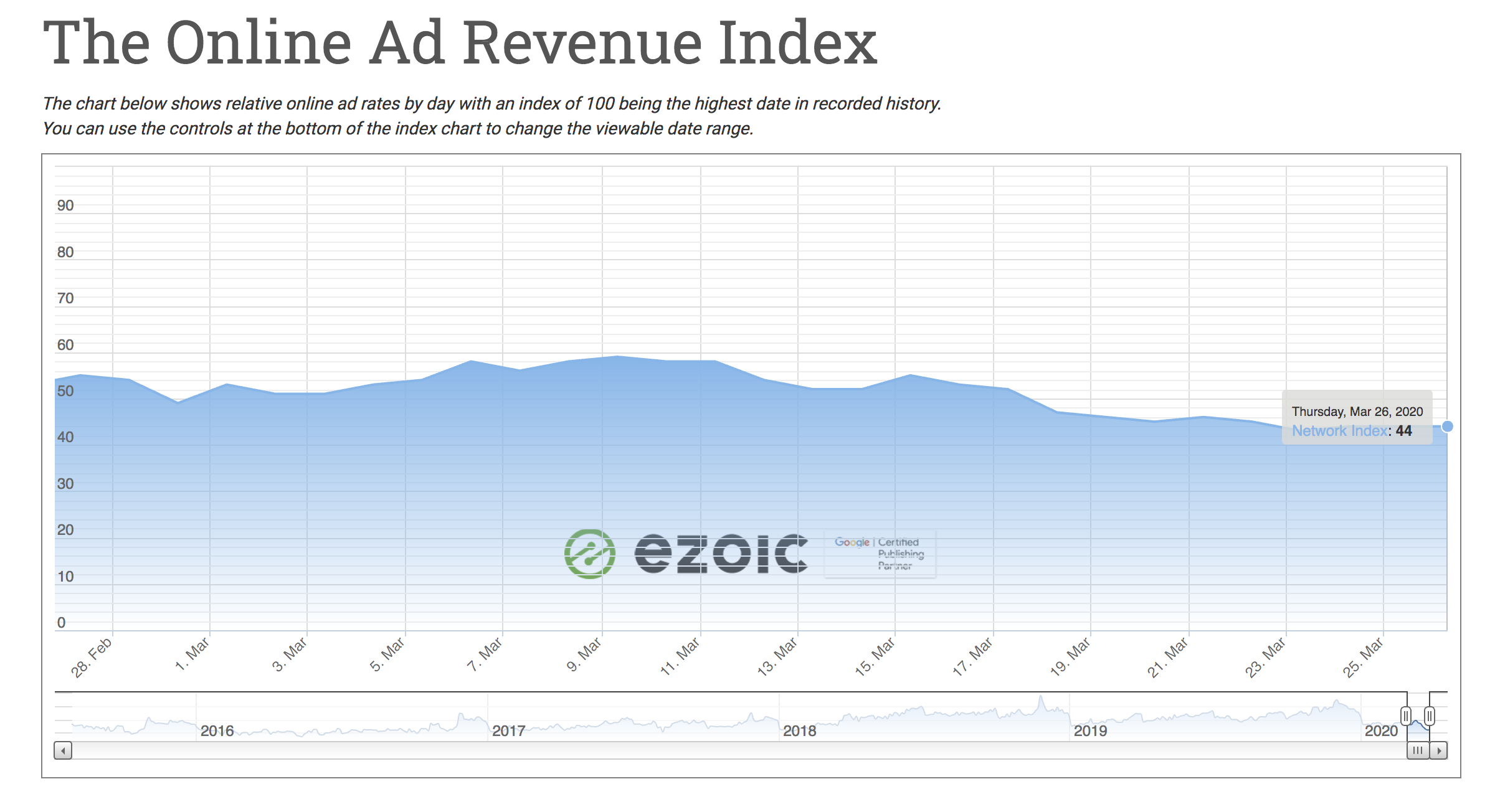

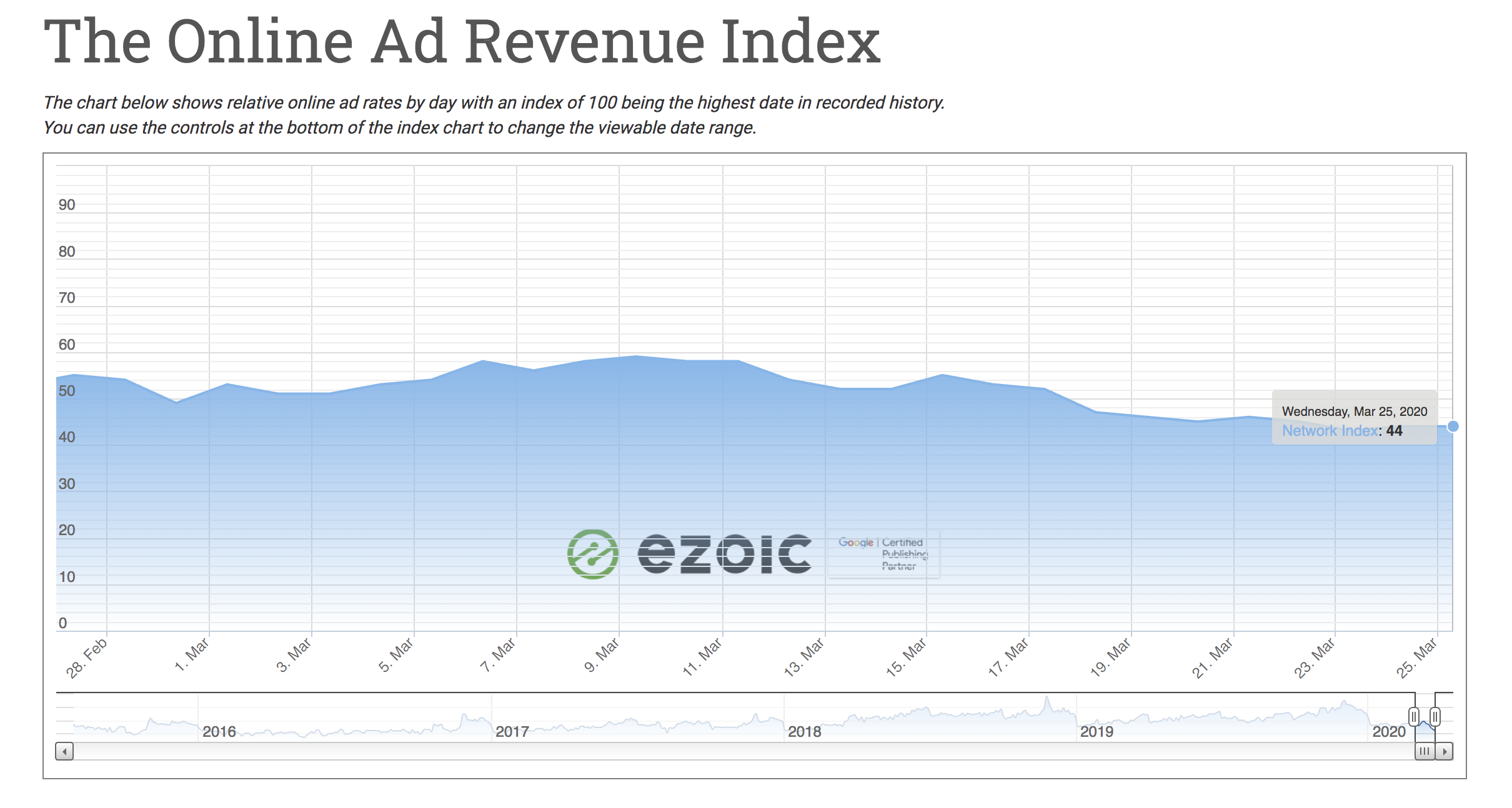

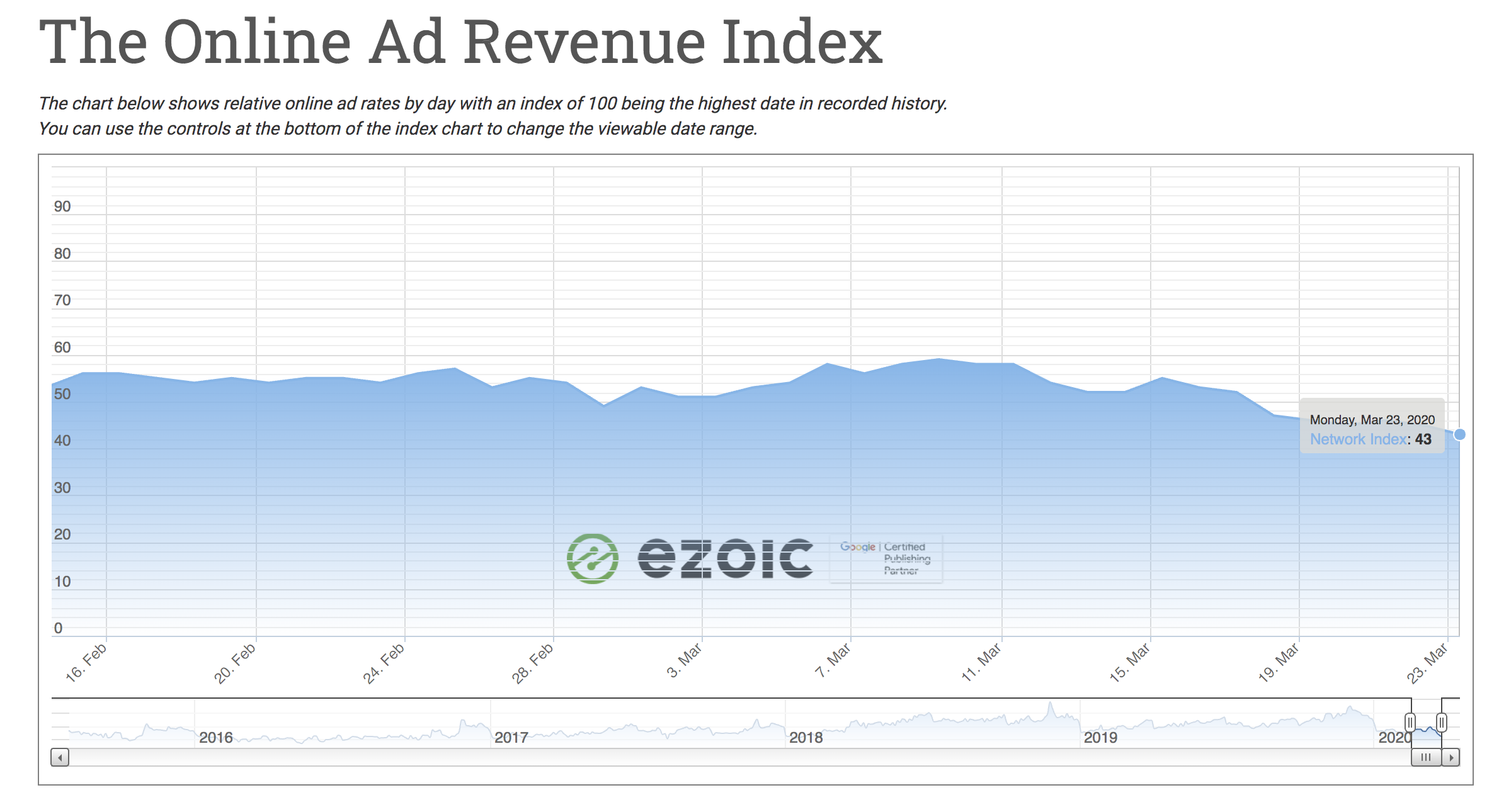

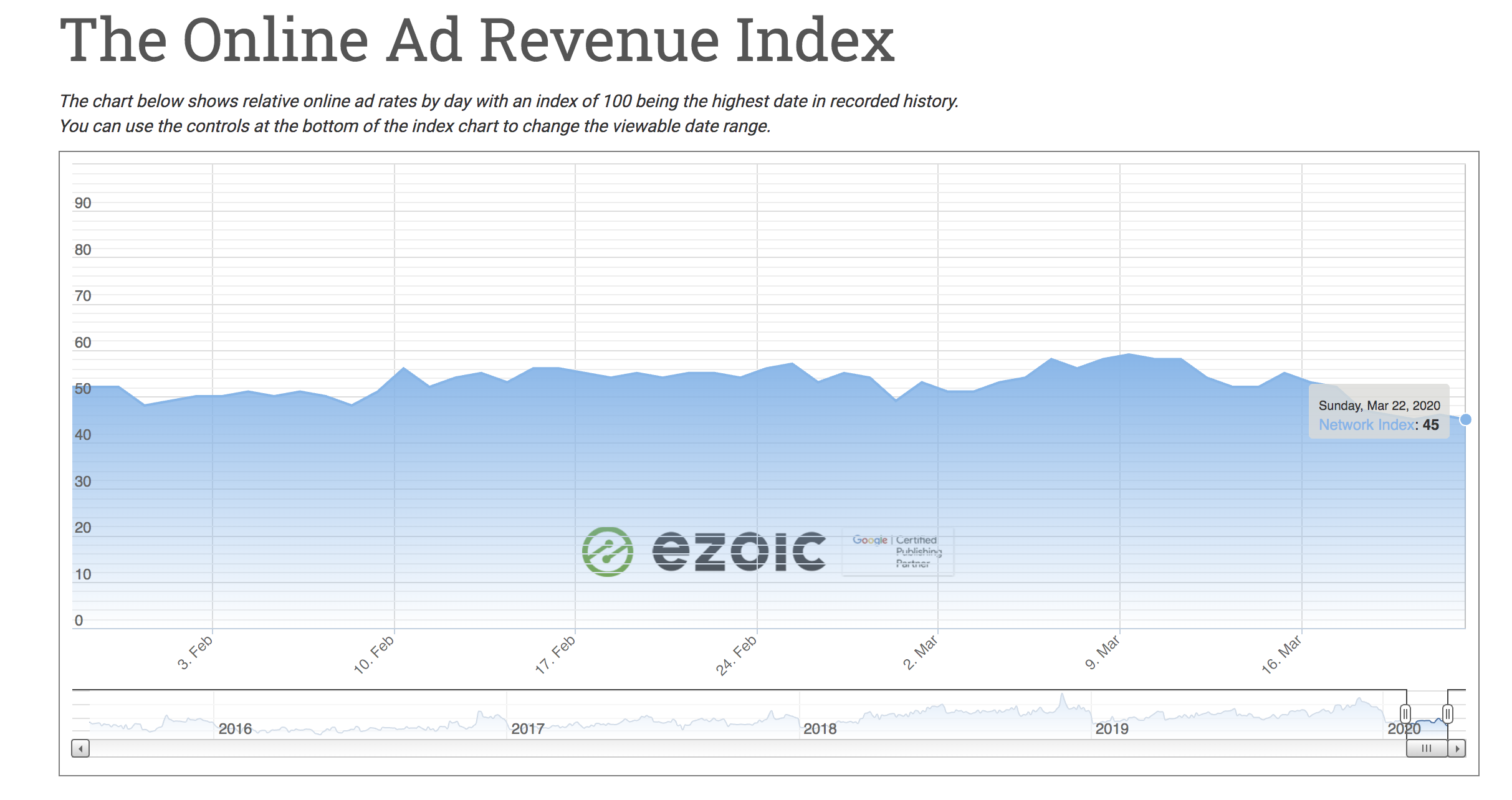

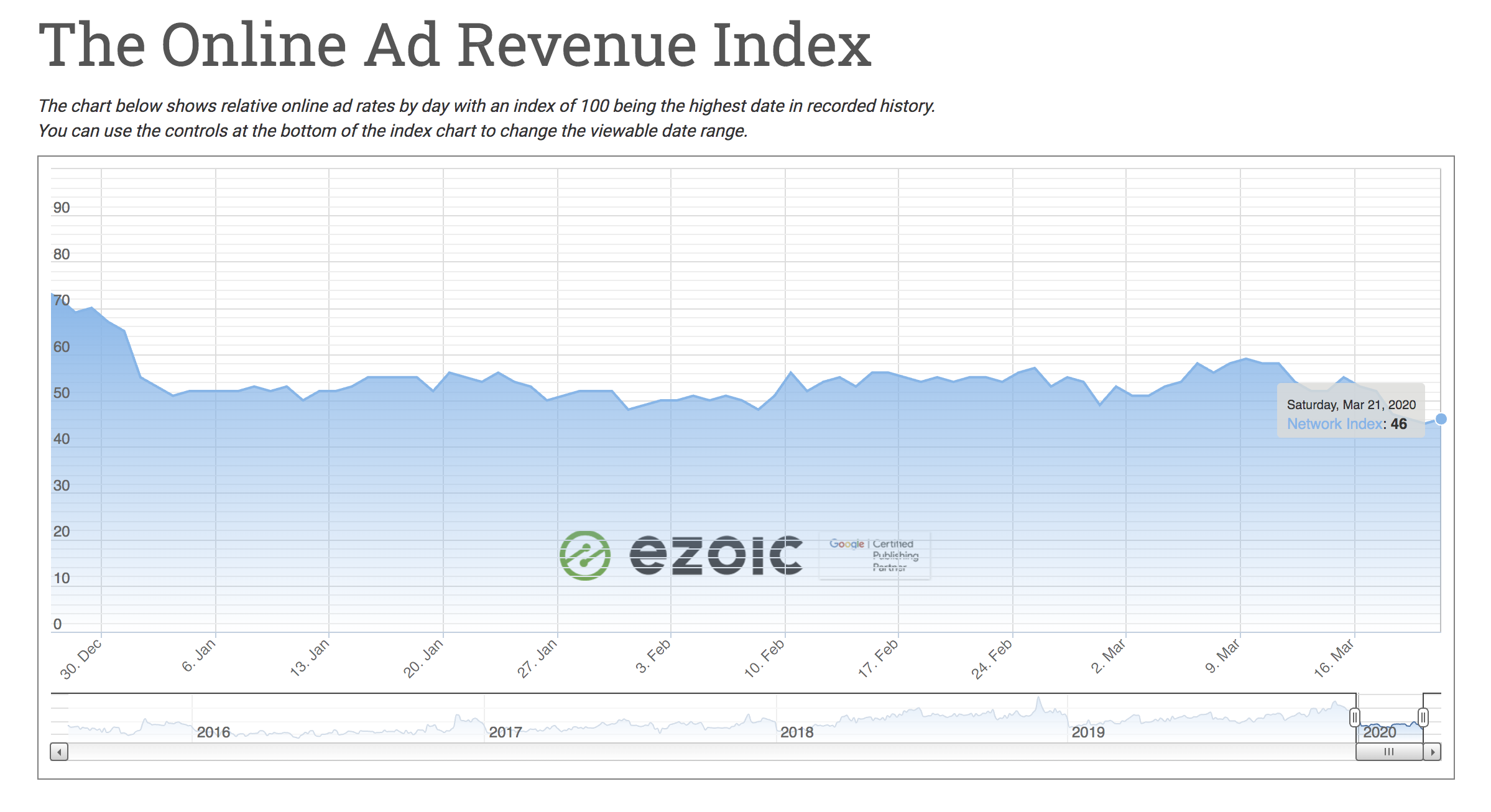

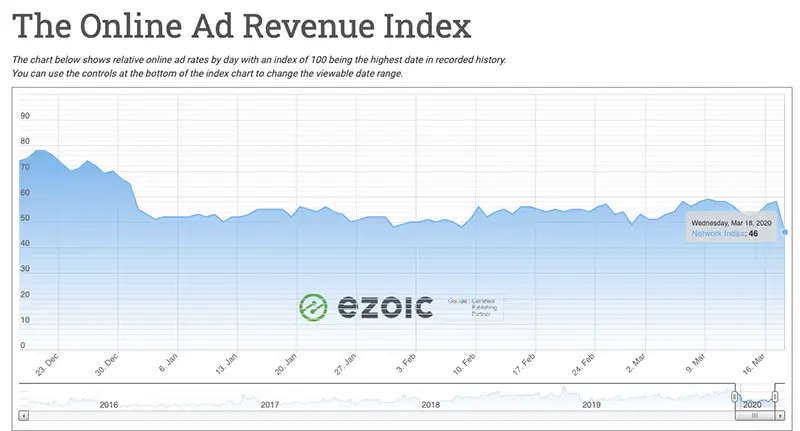

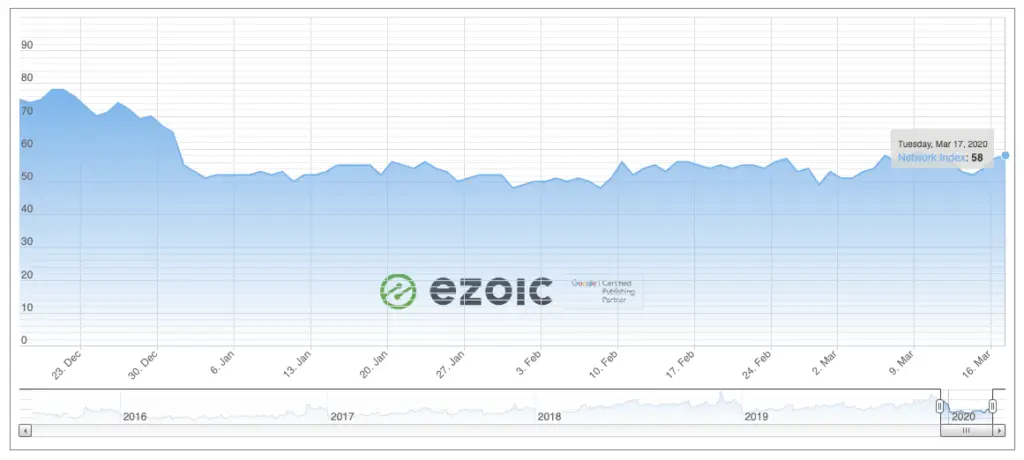

- The Ad Revenue Index can provide a look at global ad rates

- Watch our Q&A webinar on the coronavirus pandemic and what is going on in digital publishing

Coronavirus Digital Impact Updates:

LAST UPDATE: August 31, 5:14PM PDT

[/et_pb_text][et_pb_text admin_label=”Most Recent Spreadsheet Chart Image (2019 vs 2020 Monthly Ad Rates) Only” _builder_version=”4.5.8″ custom_padding=”||0px|||”]

— August 31, 5:14pm PDT —

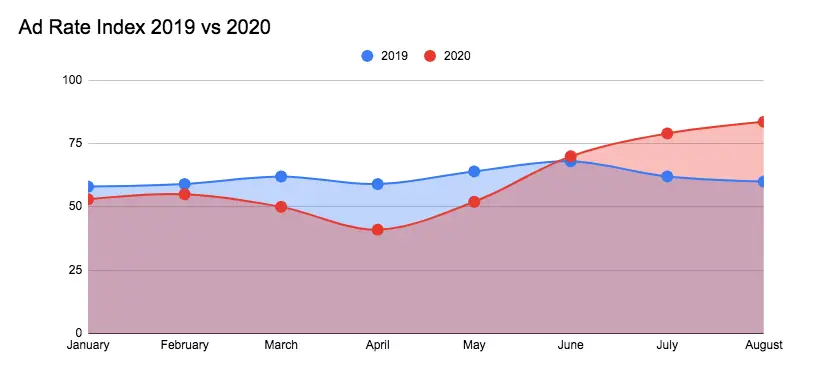

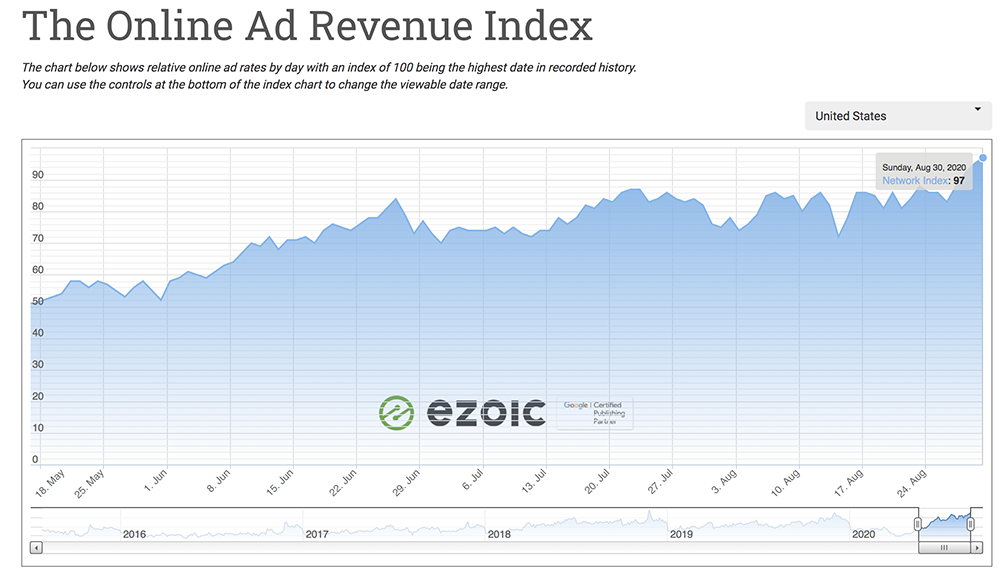

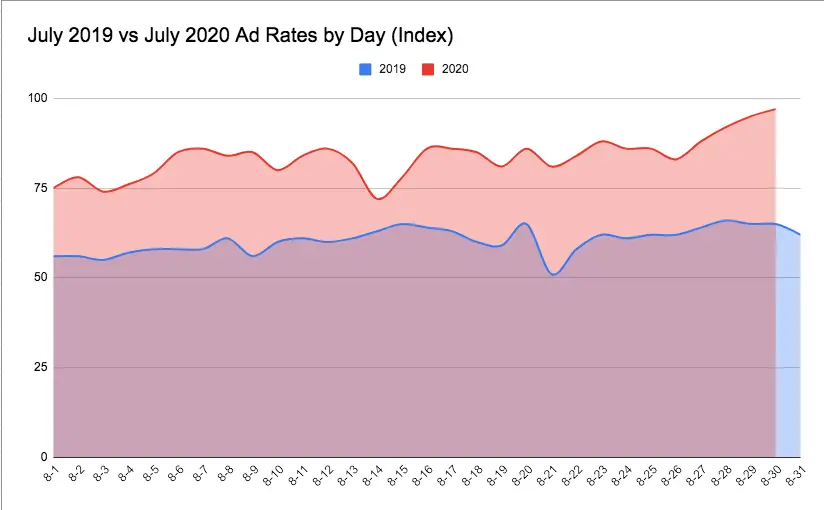

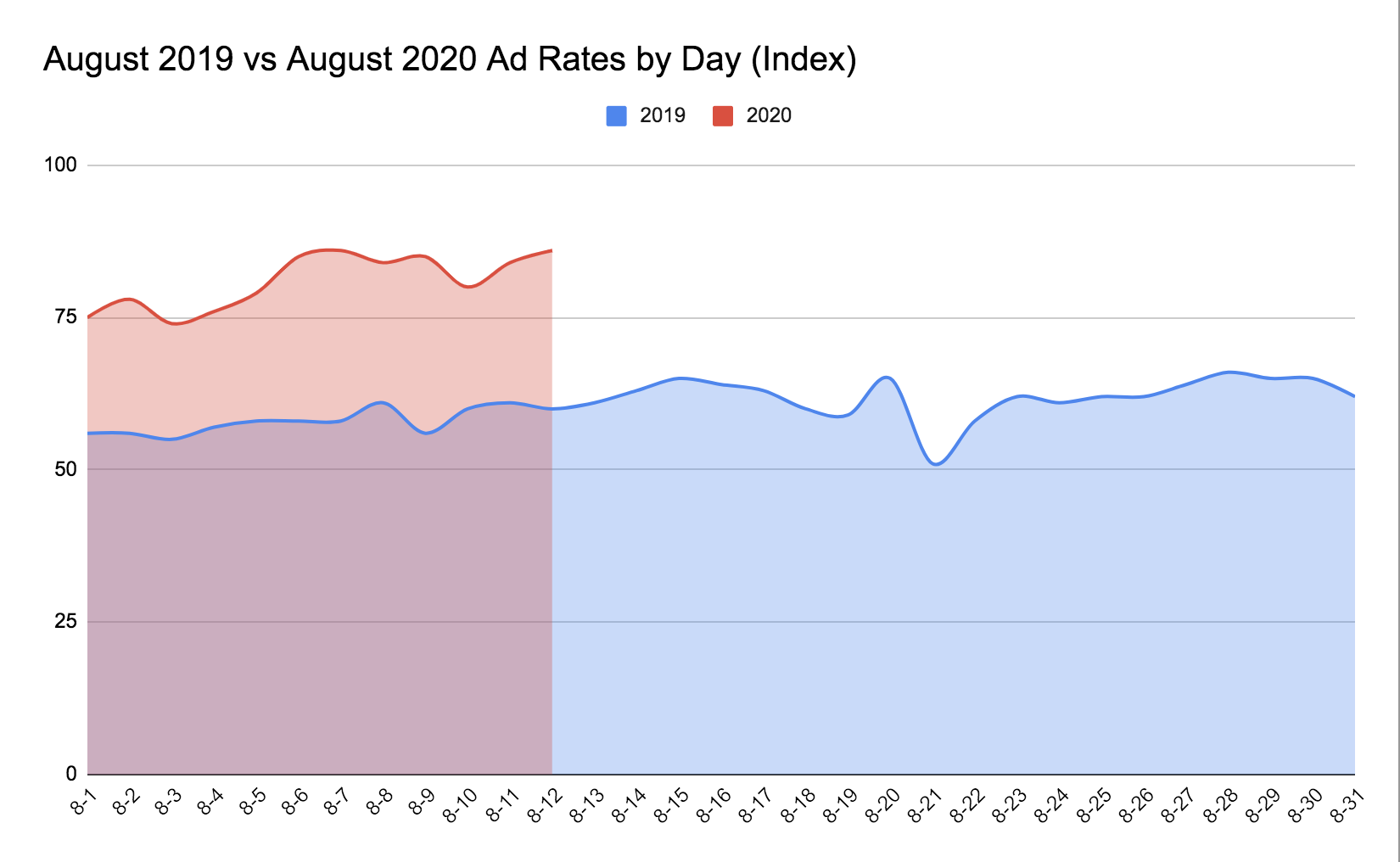

Ad rates continue to rise throughout August, hitting a peak of 97 on August 30th. For August, ad rates are 39% higher than last year.

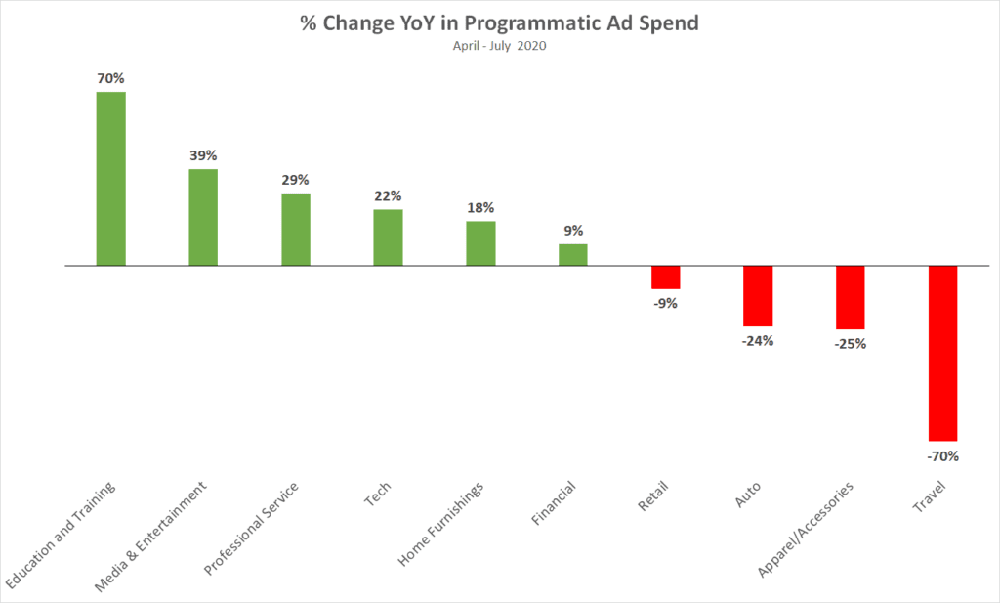

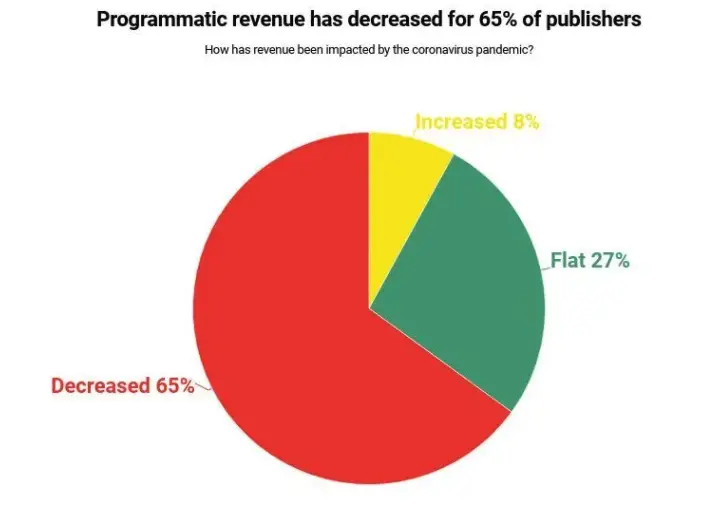

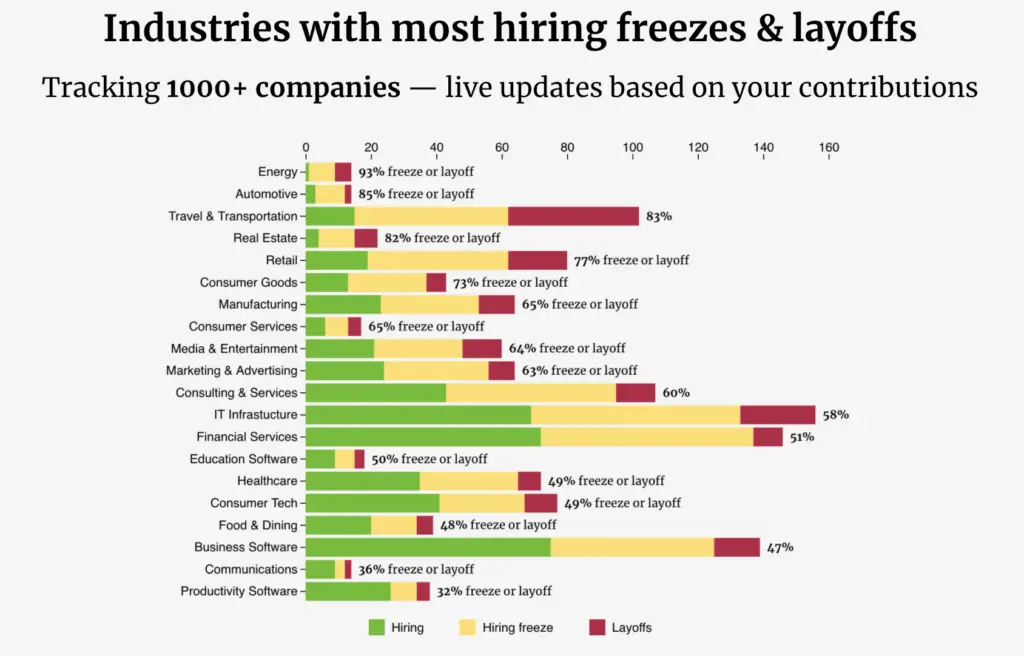

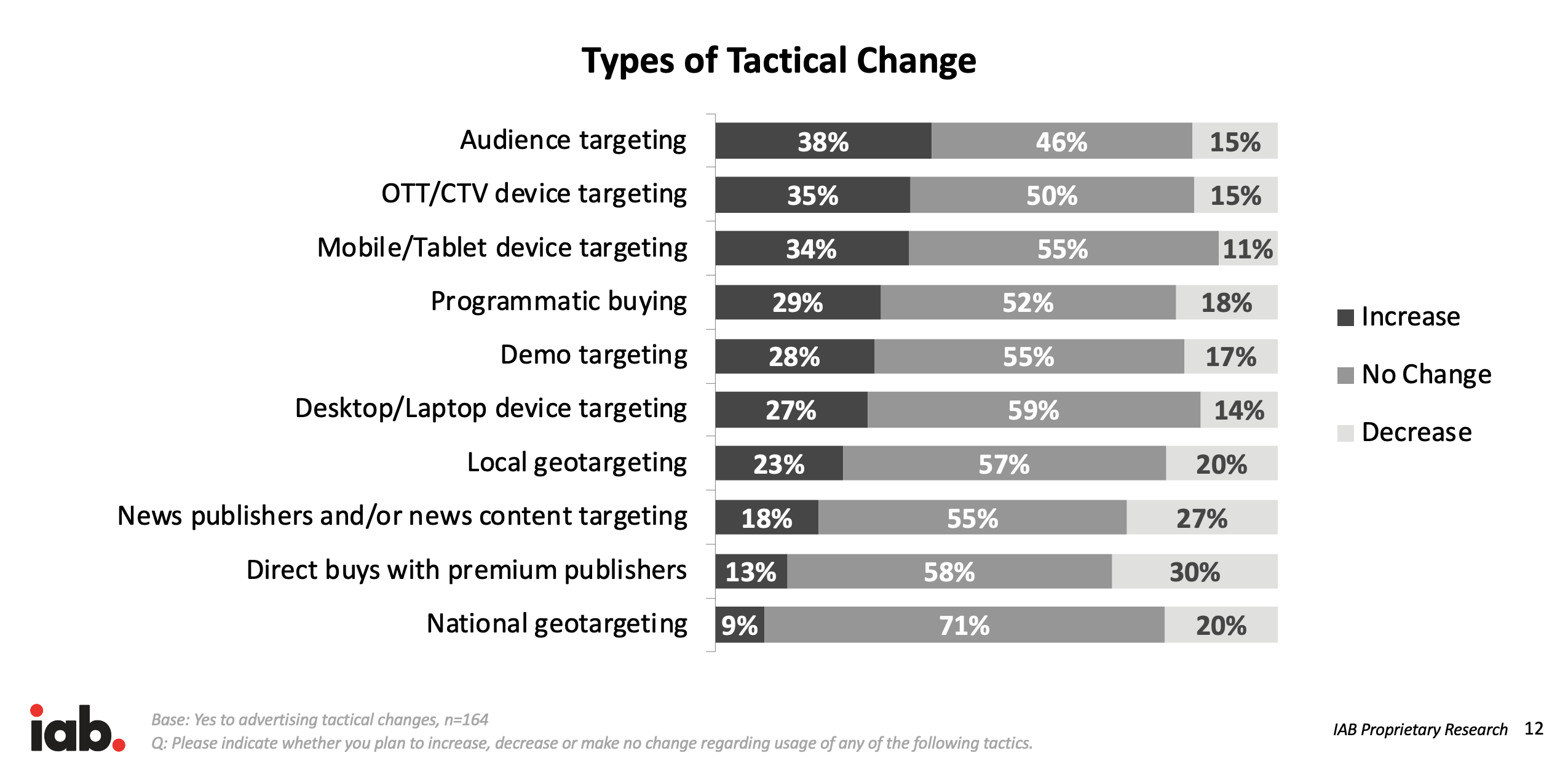

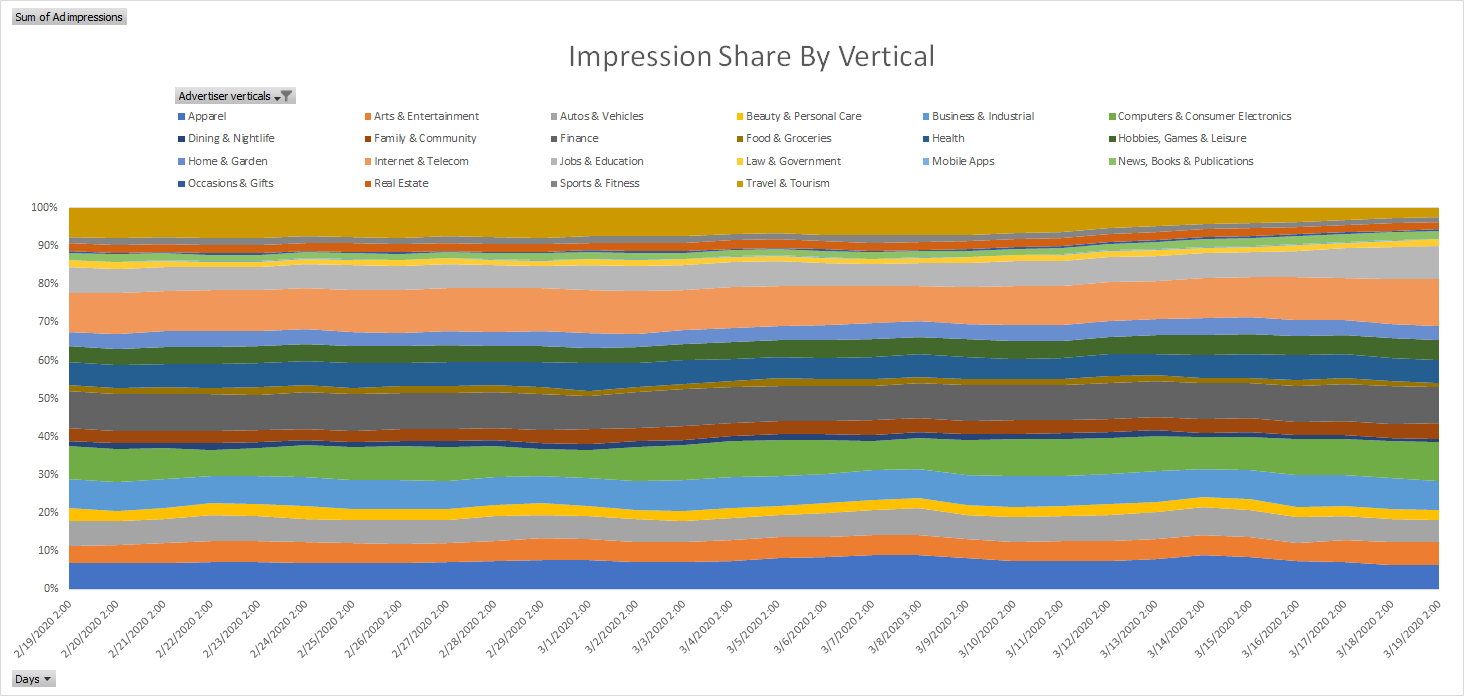

Programmatic was one of the first things to be hit hard by the pandemic, as it was easy for advertisers to pivot and pull campaigns. However, for this same reason, it has also had the quickest and most resilient turnaround. This, of course, varies depending on vertical; categories that require in-person interactions like travel and retail saw negative percent changes between April and July 2020 while online education and media and entertainment have seen positive changes.

Ecommerce is still thriving and expected to continue as the holiday season comes in; it is expected that ecommerce will increase by 18% this year and that 47% of shoppers will use ecommerce channels to do their holiday shopping. Nearly 75% of people in the US say they are going to shop more online this year than previous years and are more likely to look online for gift ideas. Additionally, more than 50% of global shoppers will use Google to find new brands 48% of US shoppers will look online for deals or promotions before purchasing.

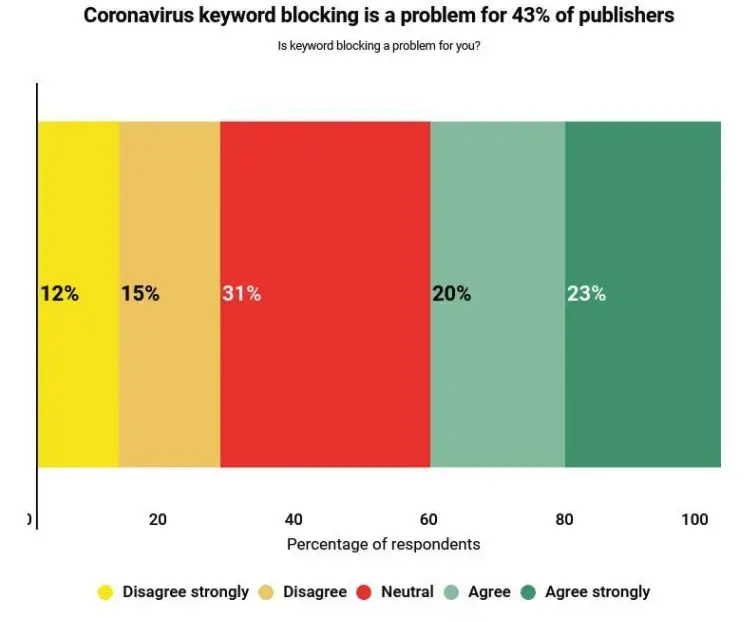

Keyword blocking in regards to pandemic-related material is still a common practice by advertisers, though it will negatively affect both advertisers and publishers alike. News publishers will lose an estimated nearly £50m ($66.83m) in online ads due to keyword blocking of content related to coronavirus.

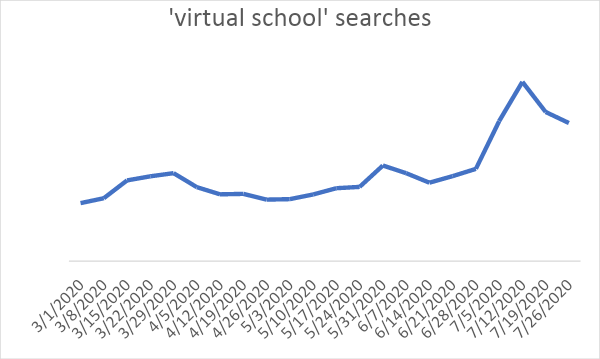

Search is looking different this year than previous ones with many parents and teachers trying to navigate the varying ways students are returning to school. Searches like ‘virtual schooling’ saw an increase of 238% in searches between March 1 and August 1, 2020. Homeschooling saw a spike as well, with school curriculum searches up nearly three times as much from the beginning of July to August. Searches for things like ‘desks’ are up ten times the usual number while backpack searches are down 50% compared to last year.

Search isn’t the only place back-to-school norms have changed. Coronavirus continues to upset the ad marketplace, and this will continue into autumn. Along with back to school looking different than other years, regular football seasons are altered or even canceled and advertisers are still reserved about traditional holiday advertising; currently, back-to-school advertising is down 70% when compared to last year.

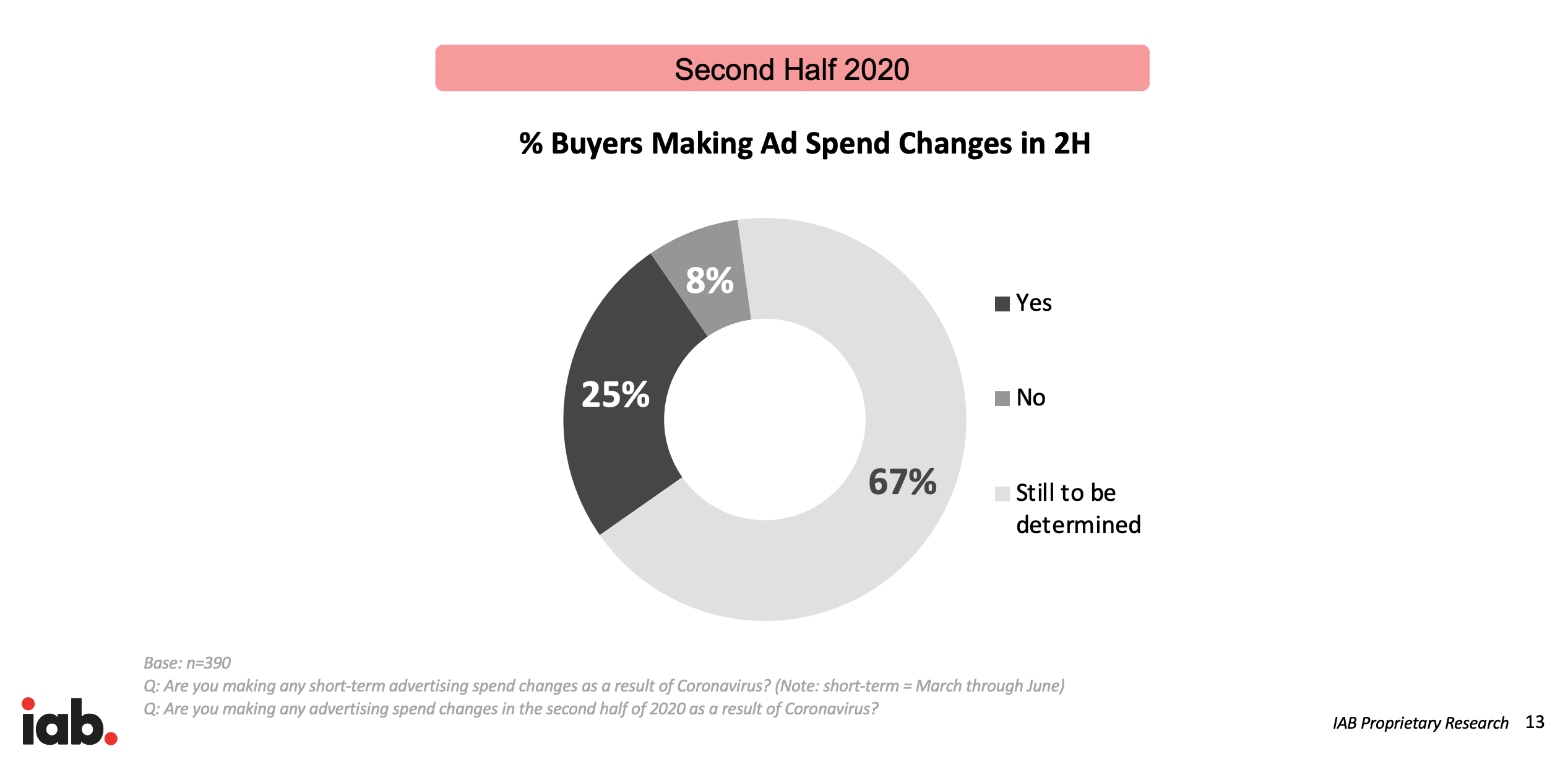

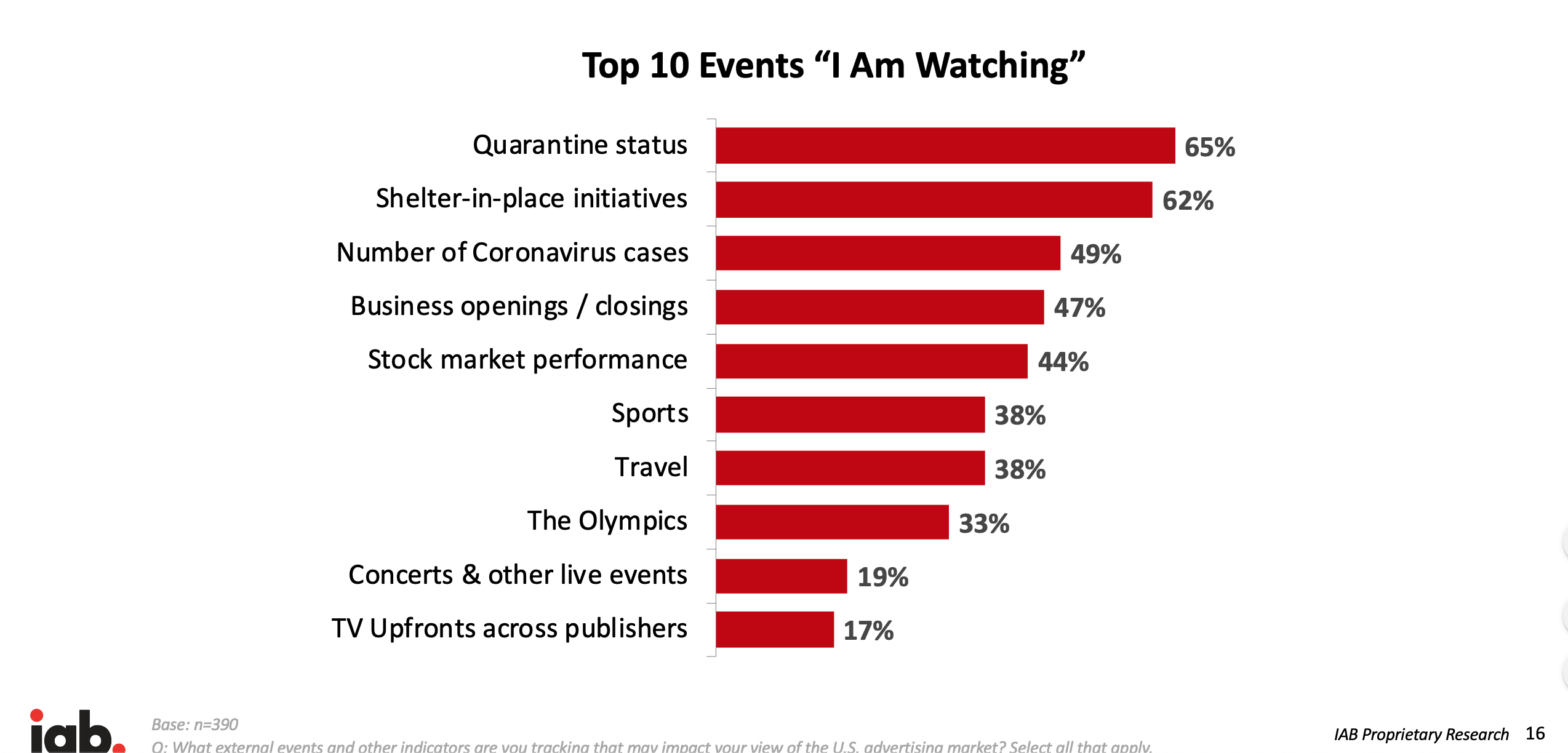

Overall, many advertisers don’t want to commit to anything specific and are waiting to see what happens before making their next move. With so much of the year already in upset, advertisers can’t rely on traditional advertising tactics on consumers.

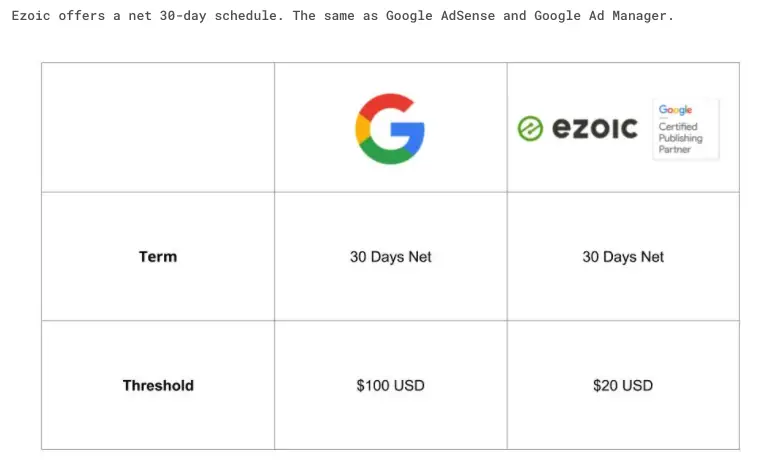

Publishers should remain vigilant in partnering with ad partners and advertisers with a strong track record and consistent practice of communicating and paying out their publishers on time. Sites should be wary of new parties to the ecosystem and those lacking known credentials or certifications like Google’s Certified Publishing Partner Program.

[/et_pb_text][et_pb_text admin_label=”August 14 Updates” _builder_version=”4.4.8″ header_3_font=”Open Sans||||||||” custom_padding=”||0px|||”]

— August 14, 2:33pm PDT —

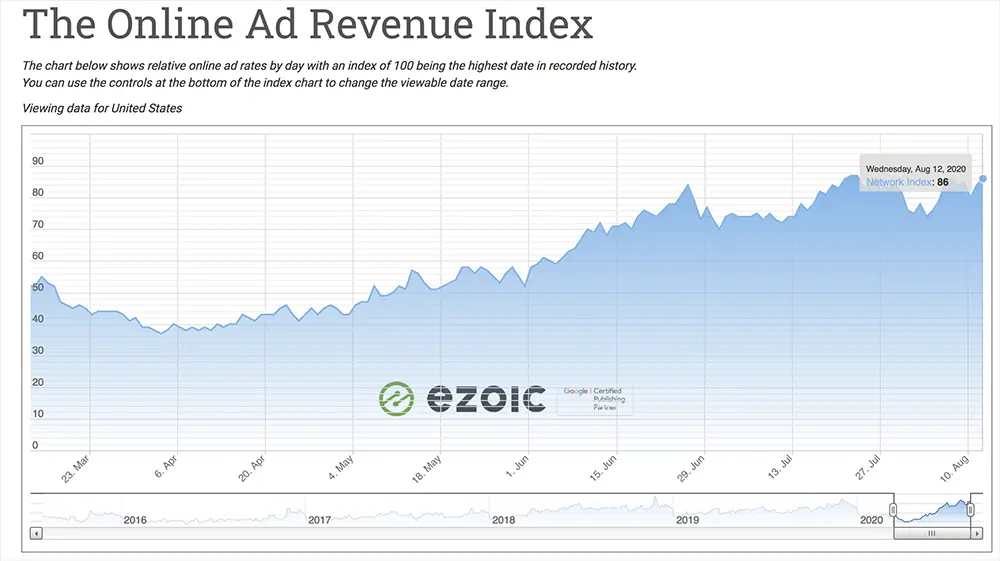

Ad rates continue to be in the 80s and remain higher than they were this time last year. It is unlikely we would see a major dip in ad rates once more like in April because companies are now investing in the future.

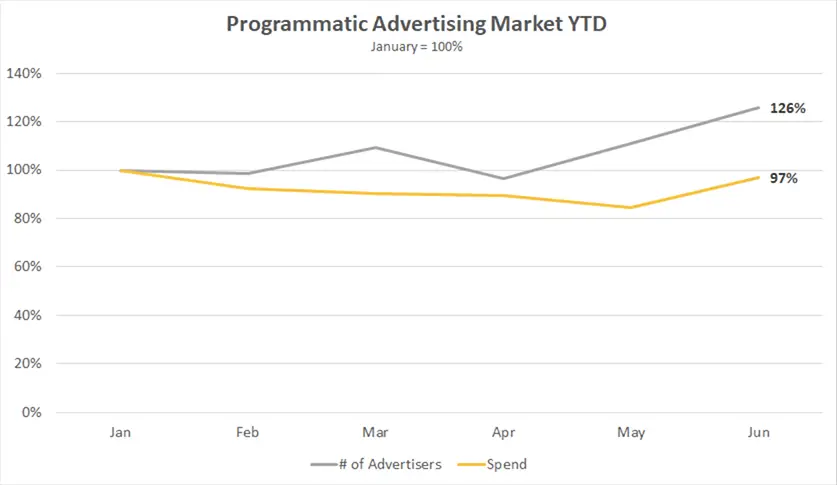

Research by MediaRadar shows that programmatic advertising is up 26% since January, with spending levels hitting their highest point in June.

Global ad rates

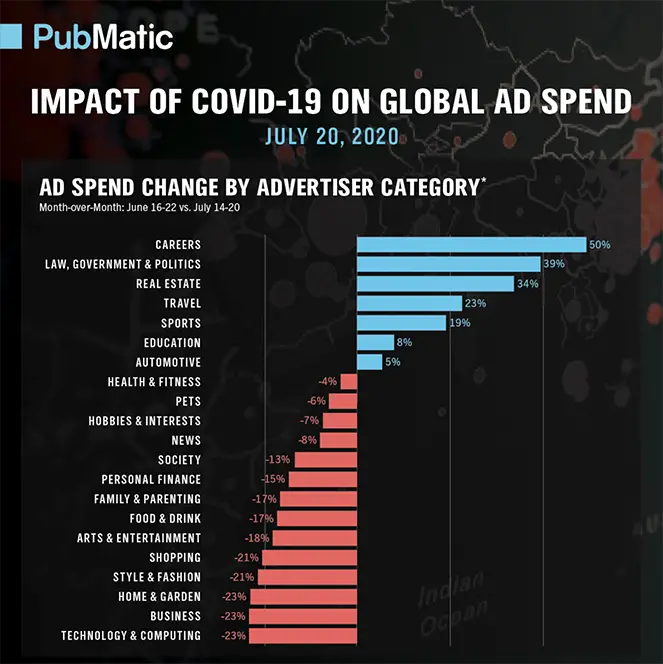

Behavior in the digital ad space is changing, despite rising COVID cases. There has been increases in digital ad spend in categories that were previously suffering; according to Pubmatic, travel ad spend amongst advertisers has increased by 23%, sports has increased 19%, and education has increased 8%.

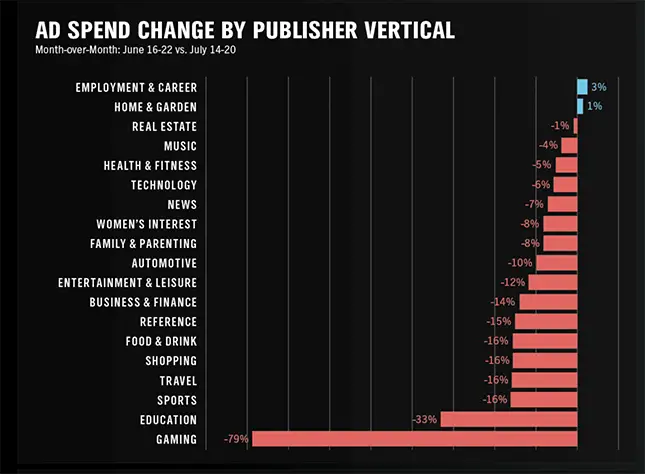

However, in ad spend by publisher vertical, nearly all categories are down except employment and career at 3% and home and garden at 1%.

We recently published an informative piece on global ad rates and digital publishing trends in 2020. While most of the ad rates we focus on are the US’s, this piece also covers Canada, the United Kingdom, France, Germany, and India.

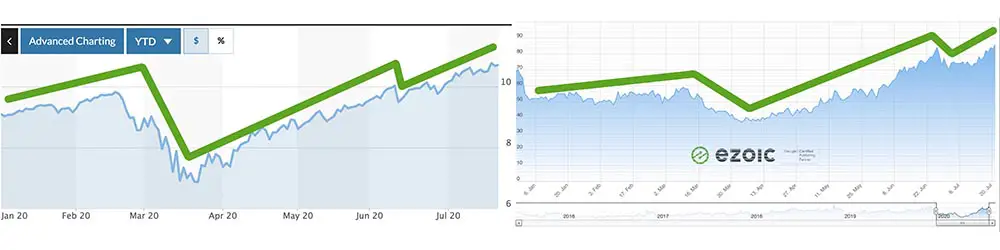

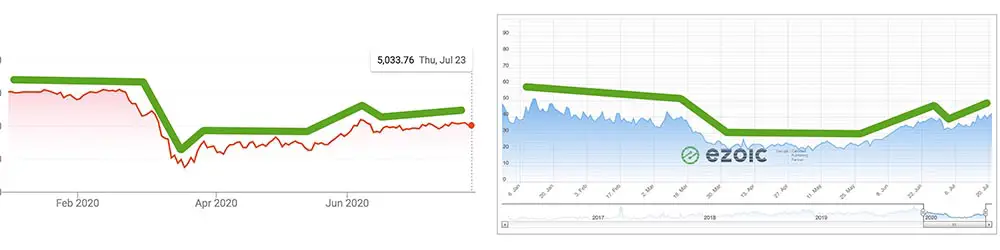

We have discussed this before, but ad rates follow the market. Currently, businesses are spending more money and advertising once more because they have confidence in what is to come for the economy, even though coronavirus cases are up in the United States. This trend can be seen if we compare the NASDAQ, which is more tech-heavy than it has ever been, to the Ad Revenue Index.

We can see this same trend if we look at France’s Ad Revenue Index and the CAC40.

Again, in Germany, we can see that the DAC and the German Ad Revenue Index follow the same pattern.

France and Germany have similar economic and ad revenue rates because of their close government ties; this will likely continue, as the two countries just agreed on a major economic deal in July that would bring €500 billion to the EU.

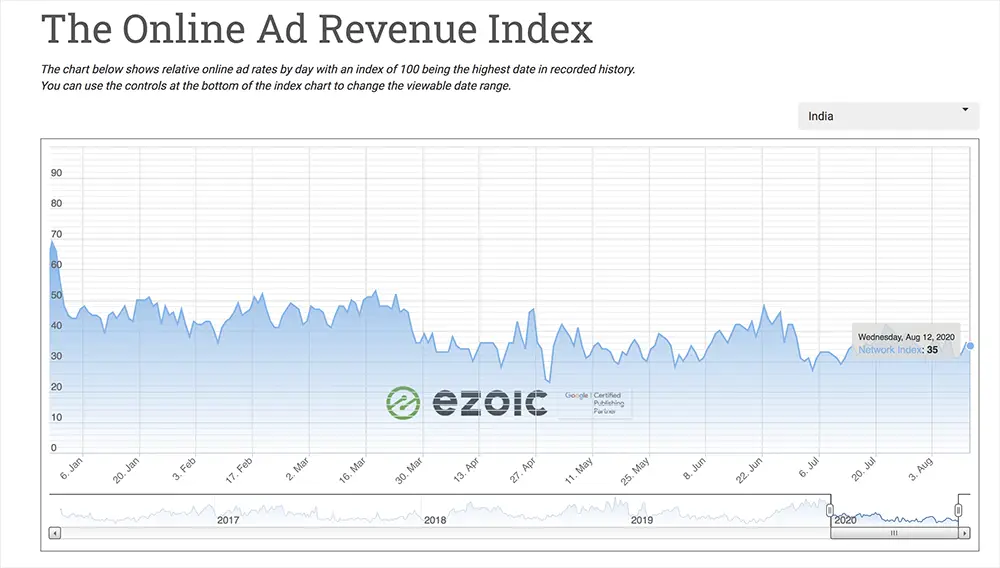

While ad rates in most places are up, India has not seen the same uptick. India’s ad rates are already typically lower than most countries’, but stagnation has persisted while other countries have seen growth.

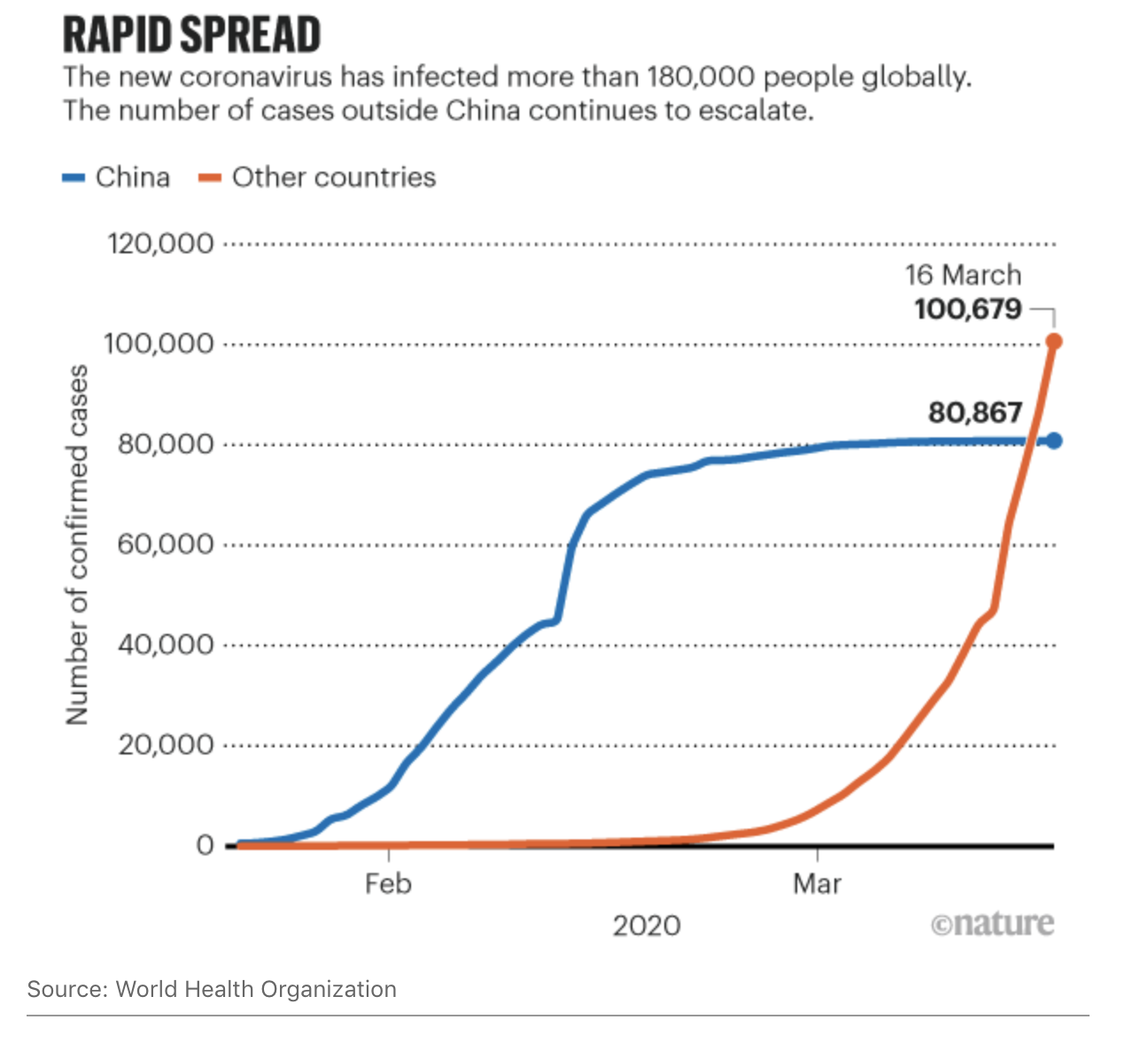

This is likely because COVID rates are just now getting worse, and coronavirus cases are also directly tied to how the economy and ad rates perform; India did not see the original spike in cases in March and April like many other countries.

Trends in digital publishing

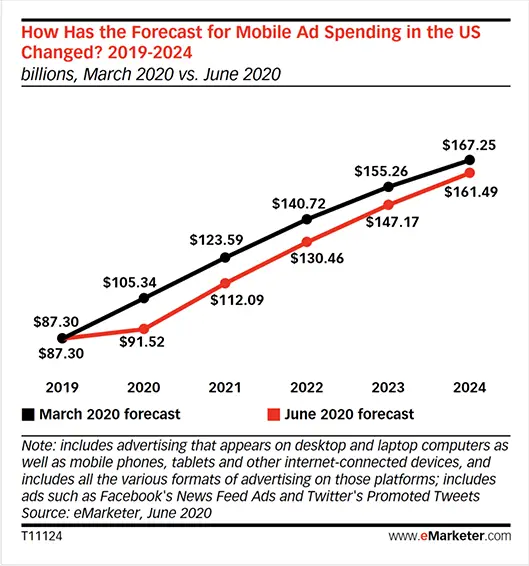

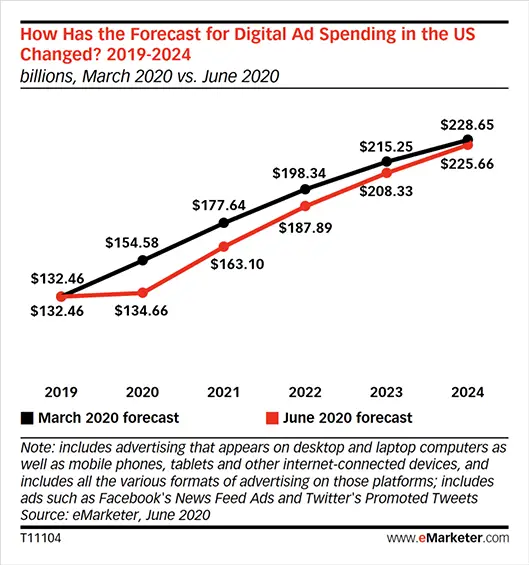

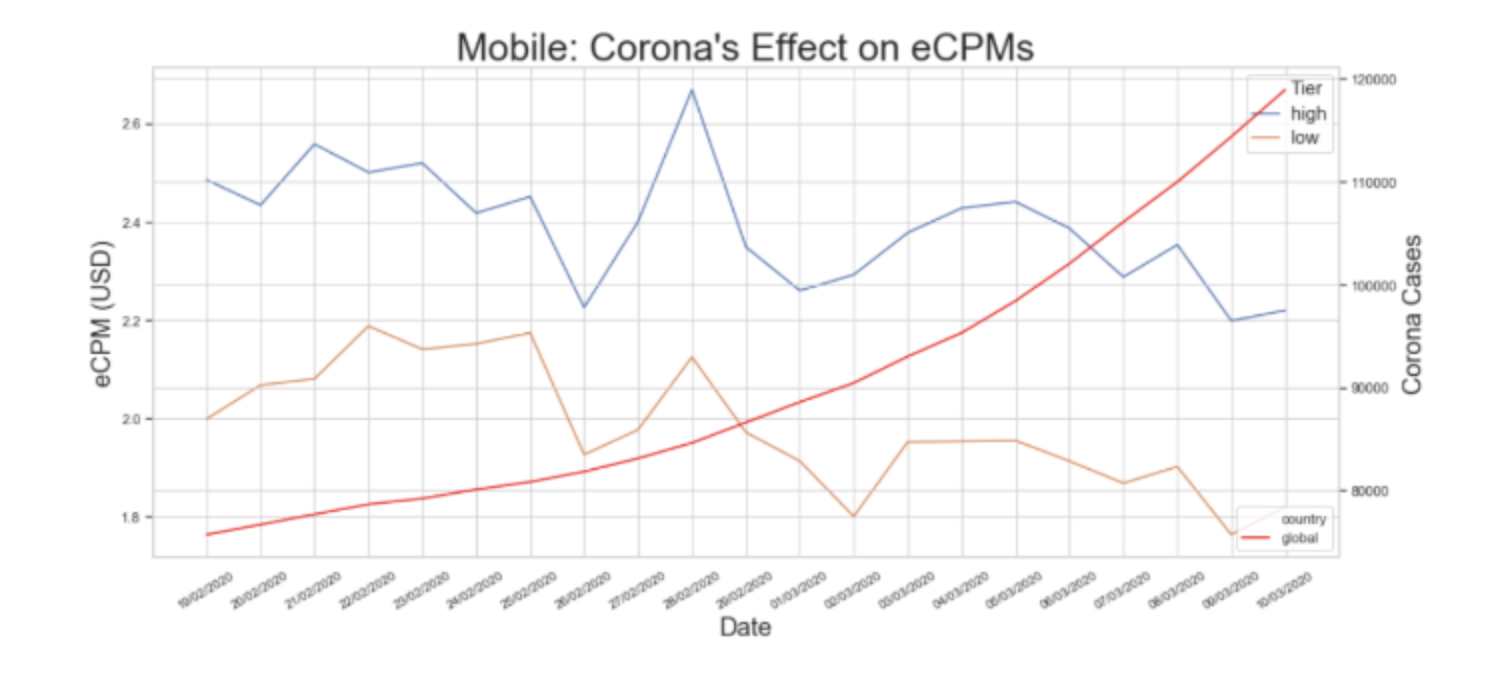

Mobile ad spend has suffered from the pandemic but has altogether fared better than most. US digital ad spend is now primarily made up of mobile at 66%. It is estimated that digital ad spend will only grow $2.20 billion this year to $134.66 billion, and without mobile would actually decrease.

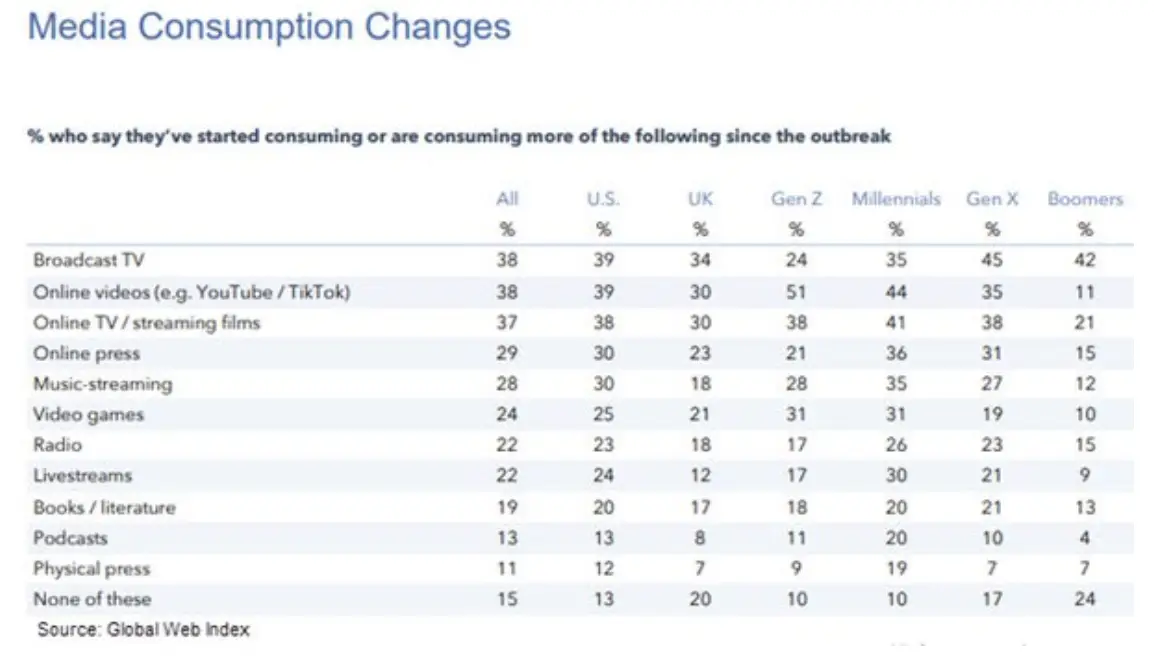

Time spent on mobile has increased globally, and much of mobile ad spend is a direct correlation of how much time people are spending on social media, video, and gaming.

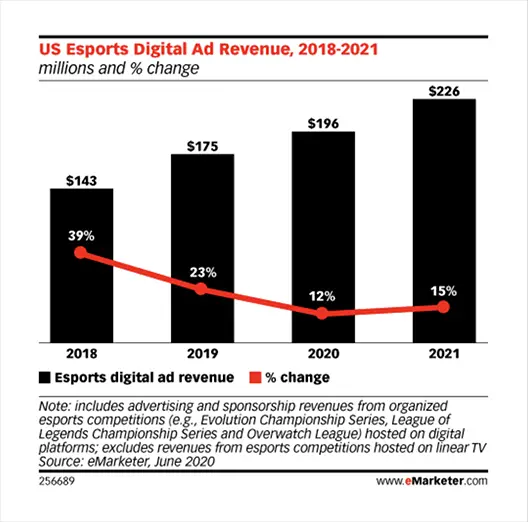

Esports has proven to weather the storm more than traditional sports. While major and college sports require person-to-person contact, Esports was able to easily switch from indoor arenas to completely online.

As Esports grows, it is becoming increasingly more appealing to advertisers. Though Esports ad revenue will not reach previously anticipated levels, it is still estimated to grow 12% to $196 million. It is expected to keep growing by 15% by 2021, reaching $225 million, making up for video ad revenue losses this year.

Ecommerce and the holidays

Due to coronavirus, ecommerce has been booming. Data shows that a year’s worth of ecommerce growth happened in a single month during 2020.

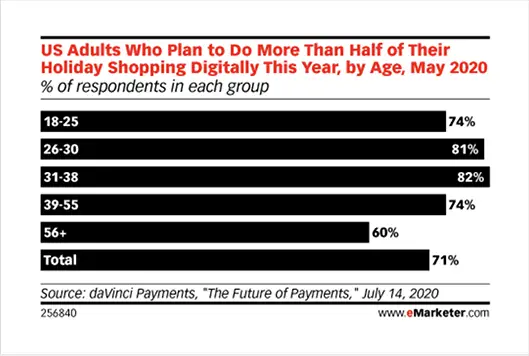

It is expected that ecommerce will continue to trend through the holidays–it is estimated that 71% of adults plan to do their holiday shopping online this year.

Boomers are increasingly using the internet and shopping online more; in a survey by eMarketer, 6 out of 10 respondents 56 and older will do over half their holiday shopping online.

With the holiday season only a few months off, it is unlikely companies will slow down their advertising. While ad rates may dip momentarily at the end of Q3, ad spending and ad rates will likely stay high and continue to grow throughout the rest of 2020.

[/et_pb_text][et_pb_text admin_label=”July 16 Updates” _builder_version=”4.4.8″ header_3_font=”Open Sans||||||||” custom_padding=”||0px|||”]

— July 16, 3:44pm PDT —

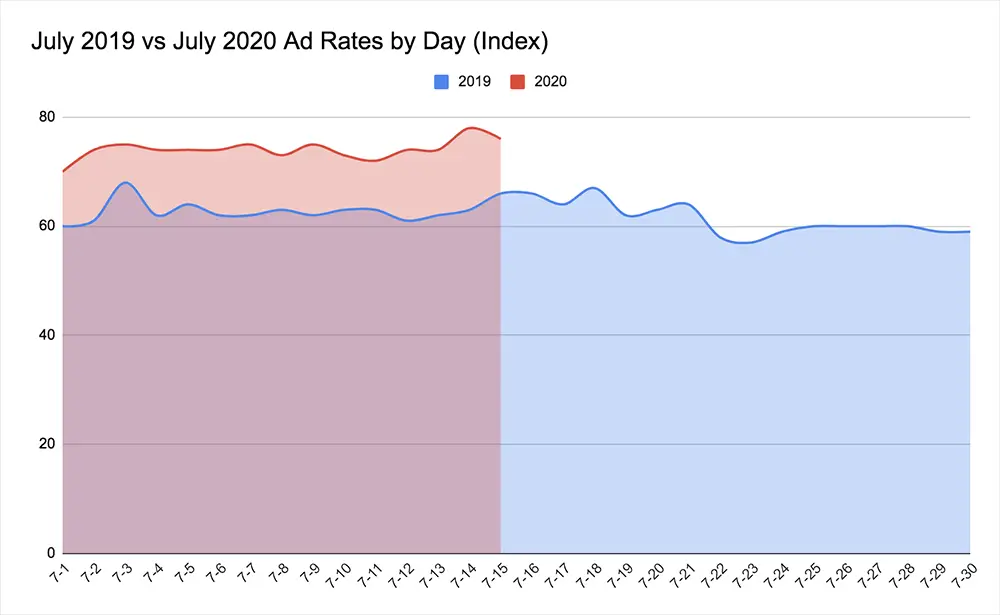

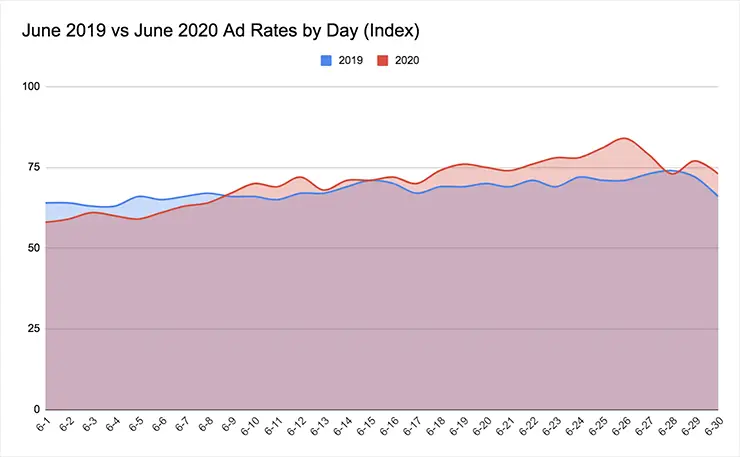

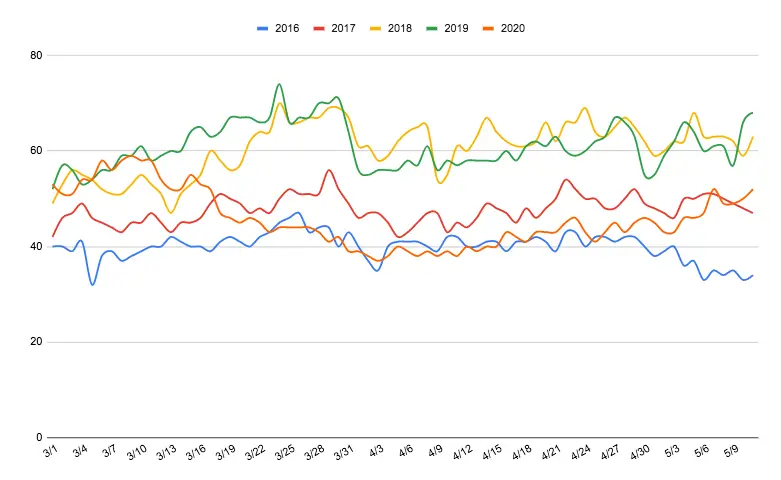

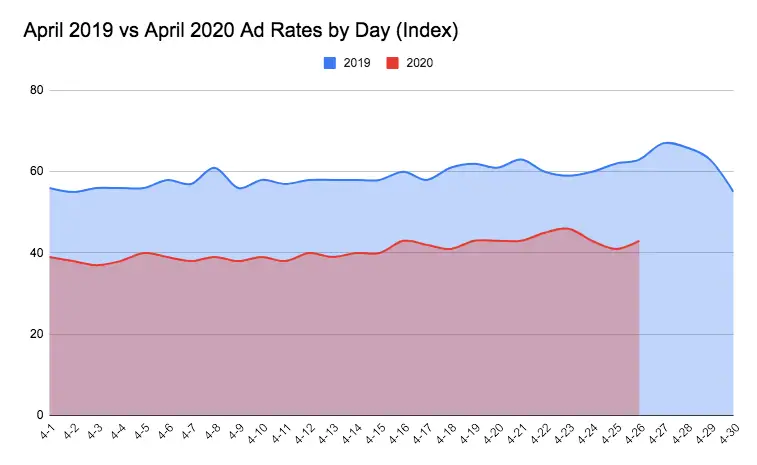

While we saw a major peak at the end of June/Q2 for ad rates, that growth has leveled out through July. However, ad rates are still above what they were last year at this time, which may come as a surprise to some.

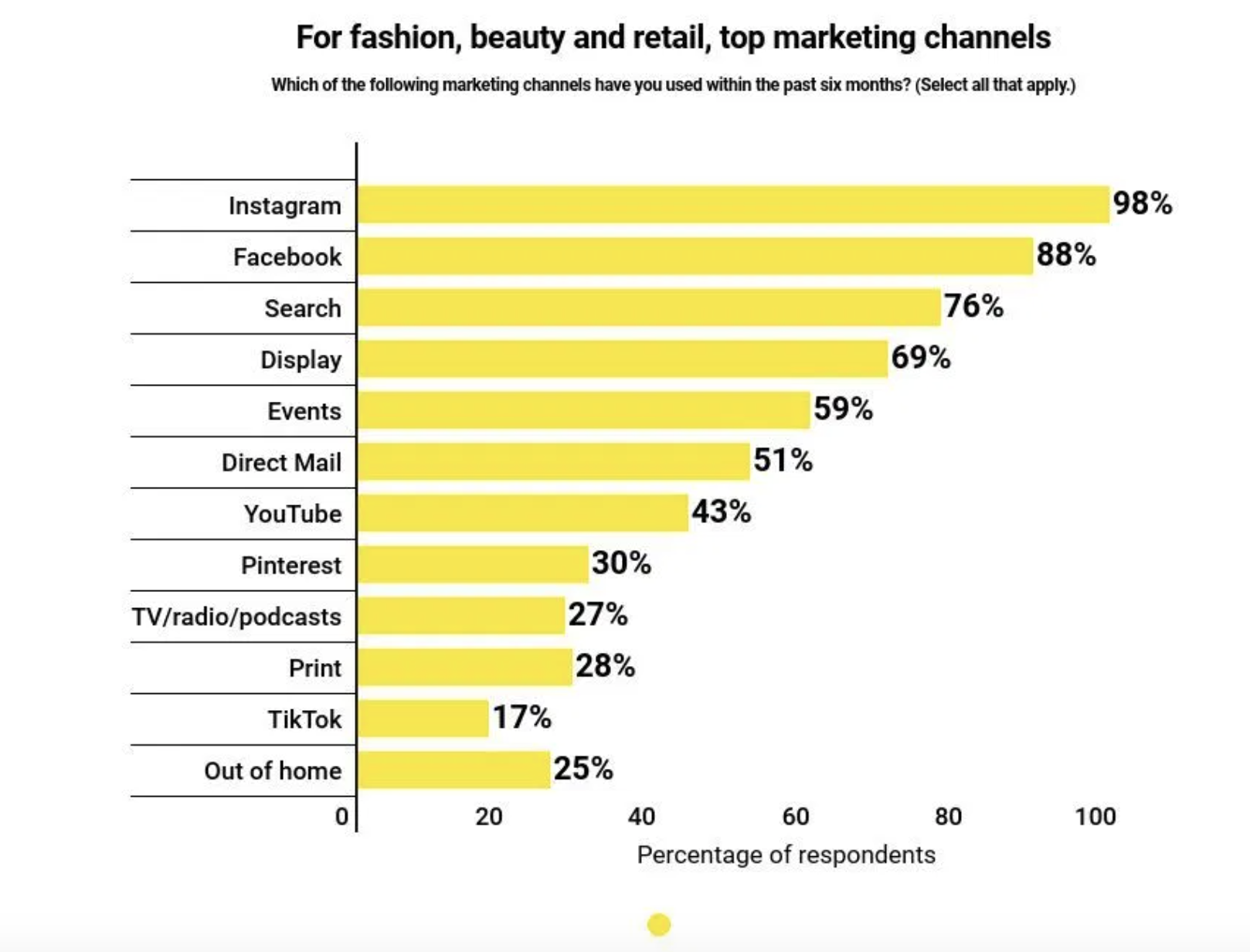

Social platform and podcast ad rates, ecommerce thriving despite pandemic

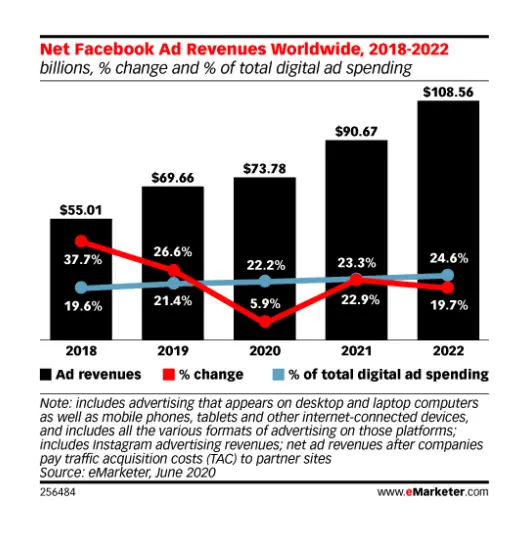

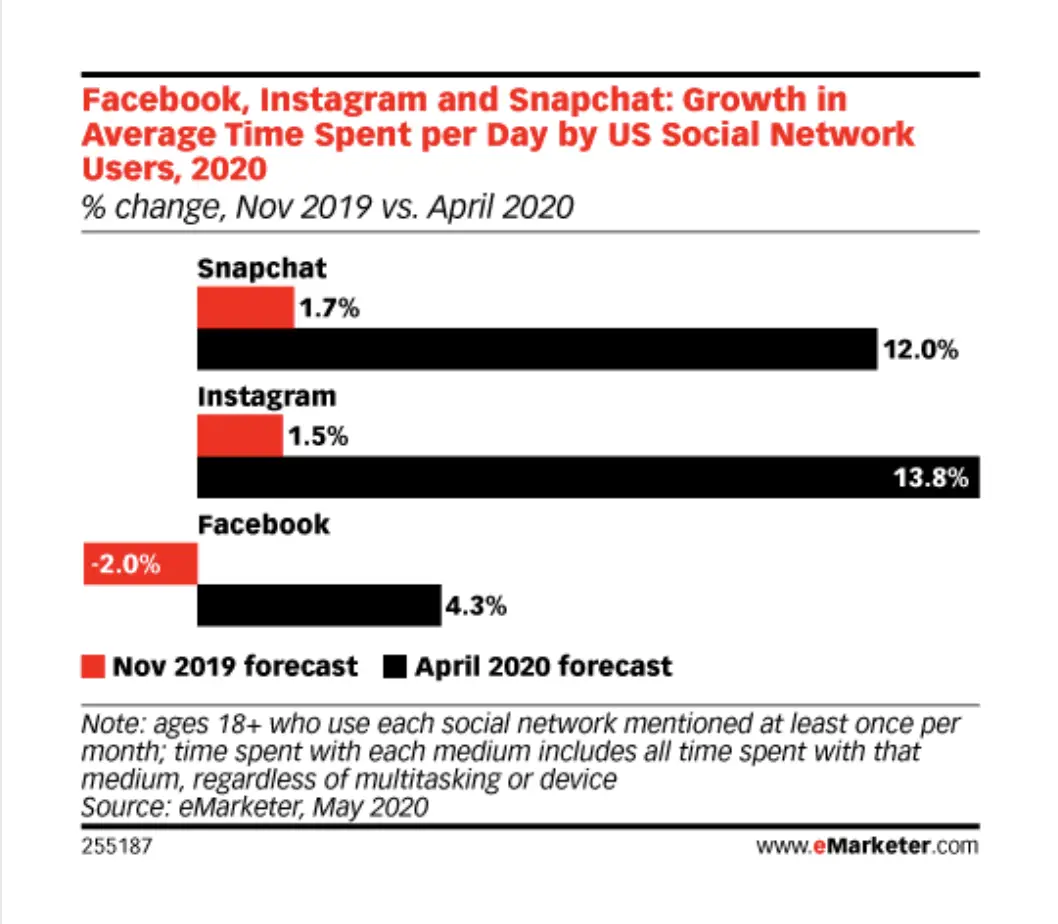

Despite the pandemic, Facebook, Instagram, and Snapchat’s ad revenues will grow globally in 2020. Twitter, on the other hand, is seeing revenue decline.

Facebook’s revenue increases may come as a surprise to some, considering the ad boycotting from the past few weeks, but it is predicted that the boycotts are more likely to affect Facebook’s image more than their revenue.

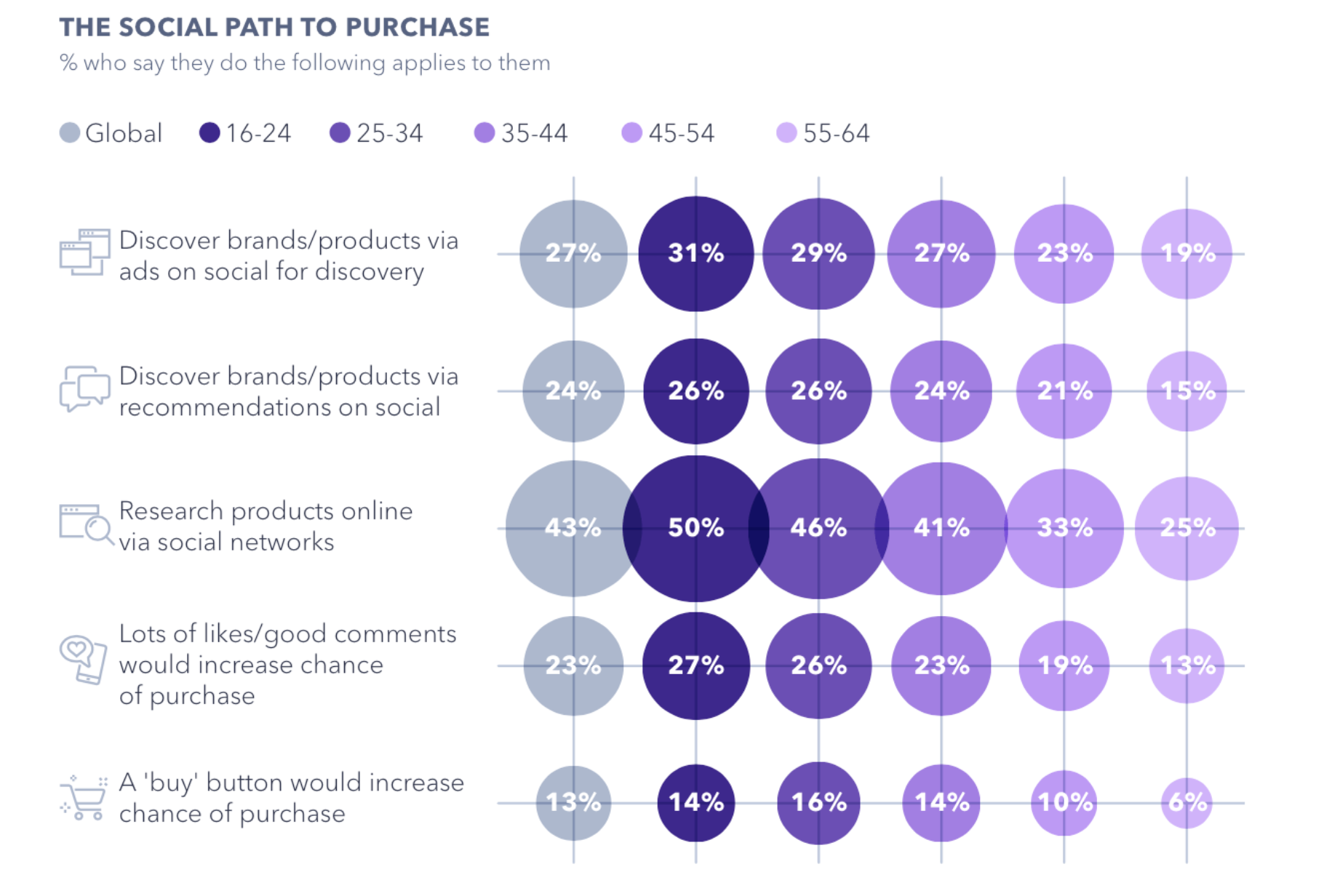

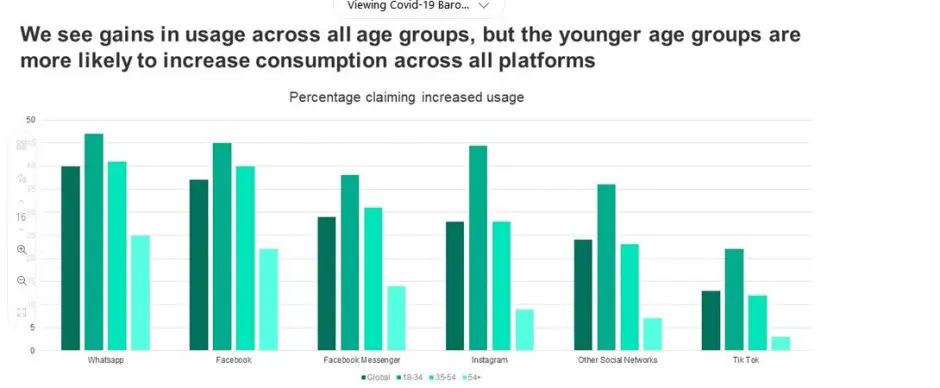

These revenue increases are predicted to continue as it is predicted that users are continually spending more and more time on social media during the pandemic.

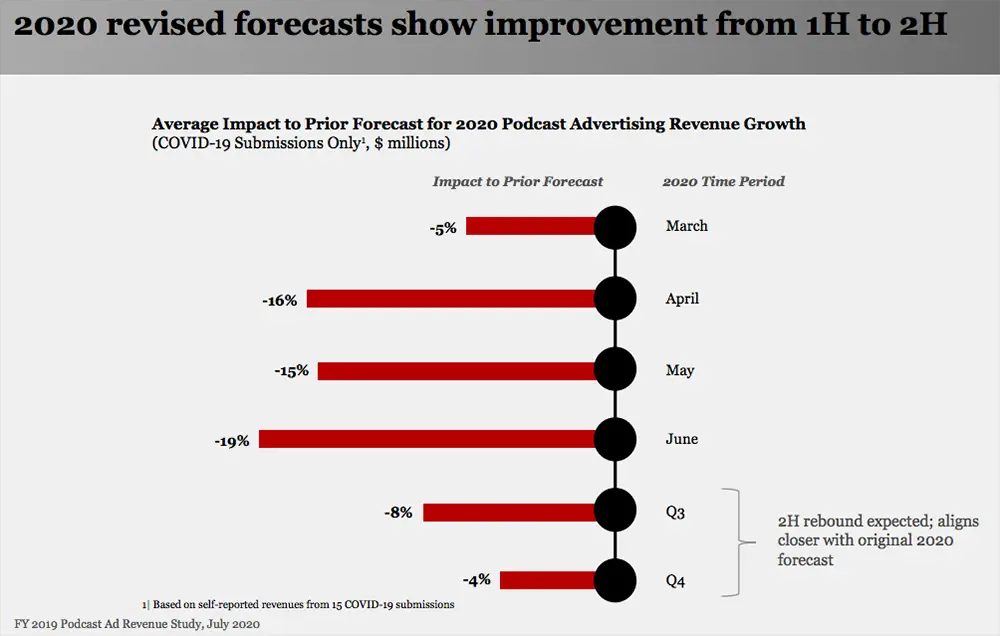

Podcasts are also rising in popularity, though this also was a trend before the pandemic began.

IAB’s recent Podcast Advertising Revenue Report shows that podcast revenue is likely to increase over 14% in 2020, regardless of coronavirus. Podcasts advertising revenue is already close to $1 billion. This may be in part to the flexibility that podcasts provide; companies are more likely to spend on advertising during unstable times if they know they can easily switch gears.

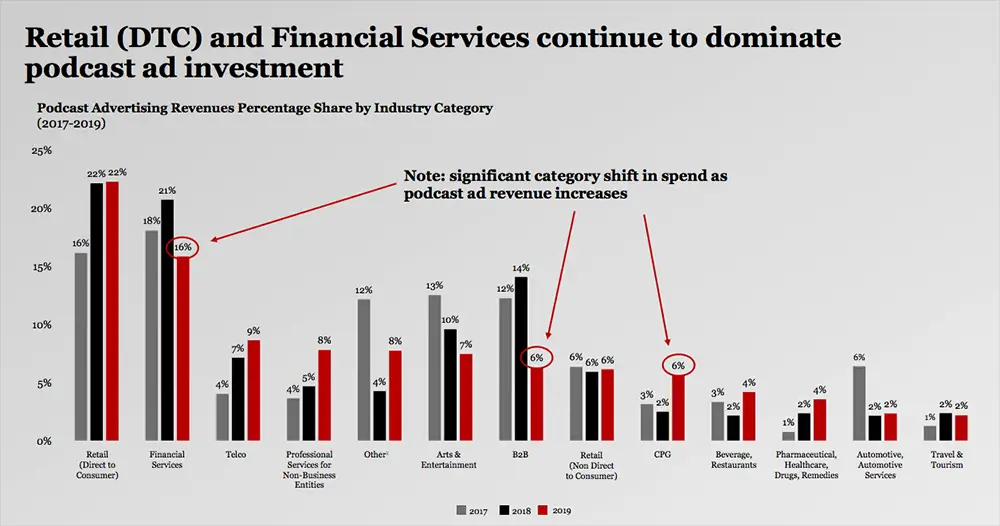

Also, despite news’ difficulties in online publishing, news podcasts are becoming the preferred medium of consumers and advertisers. News podcasts make up 22% of podcast advertising revenue. Retail and finance are the top investors in podcast advertising.

Though podcasts and advertising are doing well, they are not completely exempt from the effects of the coronavirus; before the pandemic, podcast advertising revenues for 2021 and 2022 were expected to grow 55% and 36% YoY.

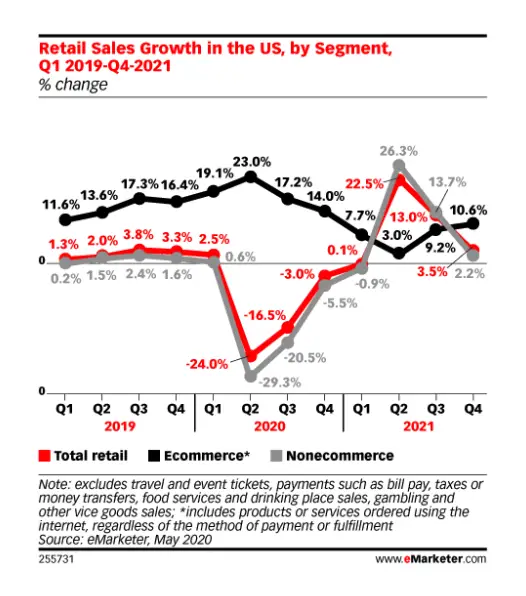

While retail sales are to decline 10.5% in the US this year, ecommerce is still expected to grow 18%, up from the nearly 15% increase in 2019. This growth is primarily due to brick and mortar shops’ closure during the pandemic, though online shopping was already pushing out traditional retail before coronavirus. The pandemic is simply expediting this trend and is something that will continue after COVID-19.

Global ad spend and rates for 2020

Many small businesses have moved from advertising on more local channels to some of the giants, like Facebook and Google. This is predicted to last even past the pandemic.

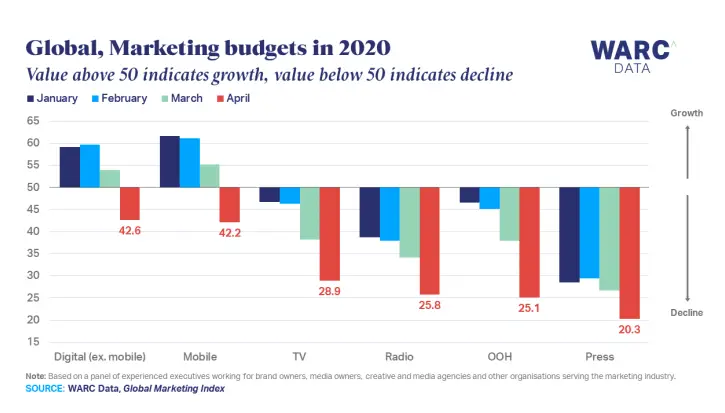

Traditional publishing forms, like radio and print, have had deep declines in ad spending, especially more locally-sourced publishing. However, that slack has been reallocated into digital; since March, digital ad spend is up 11% YoY.

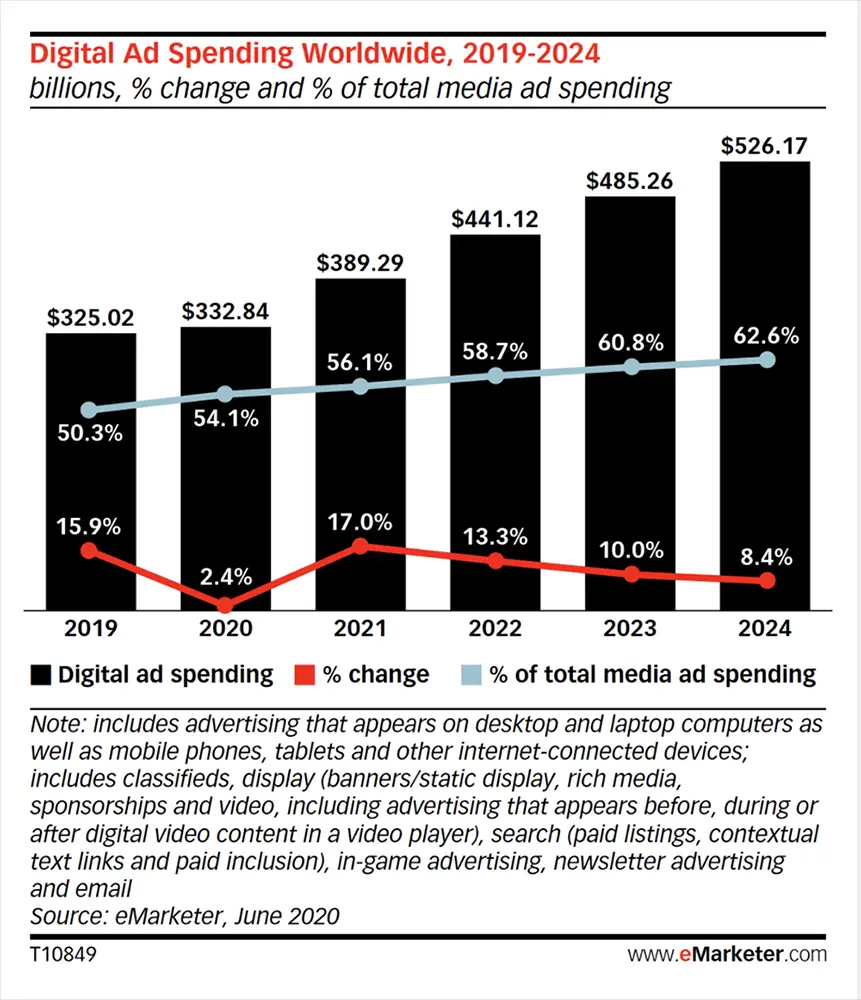

Even though digital ad spend is up YoY, it still is not growing like it was predicted for 2020. Originally, it was predicted by eMarkerer that this year would see a 7% growth for 2020 global ad rates. However, overall ad spending is in decline by nearly 5% globally. This is a significant 11% drop, as last year ad spending grew by 6.3%.

Digital ad rates will only see a 2.4% increase this year, which is the lowest ever recorded, as digital ad rate growth has never been in the single digits. Search ad spending is even worse–it is estimated that international search ad spending will actually decline by 0.2% in 2020.

Some verticals performing well and others poorly

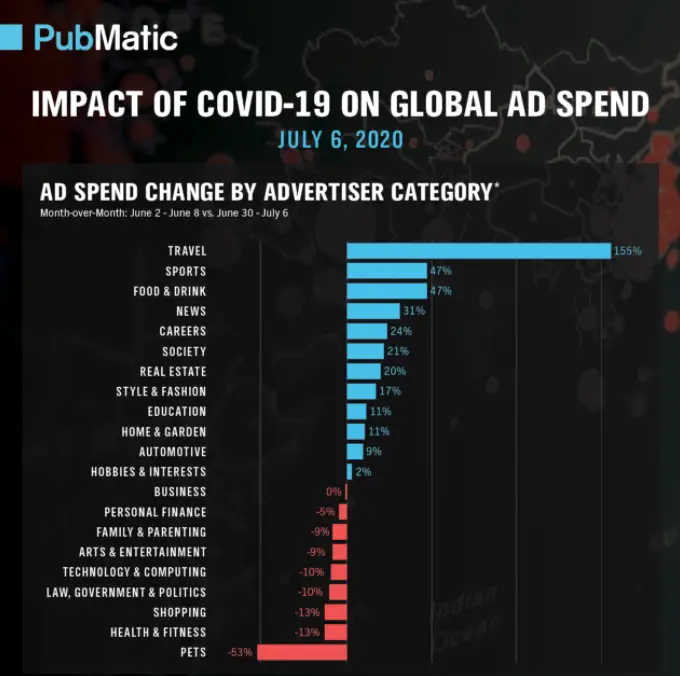

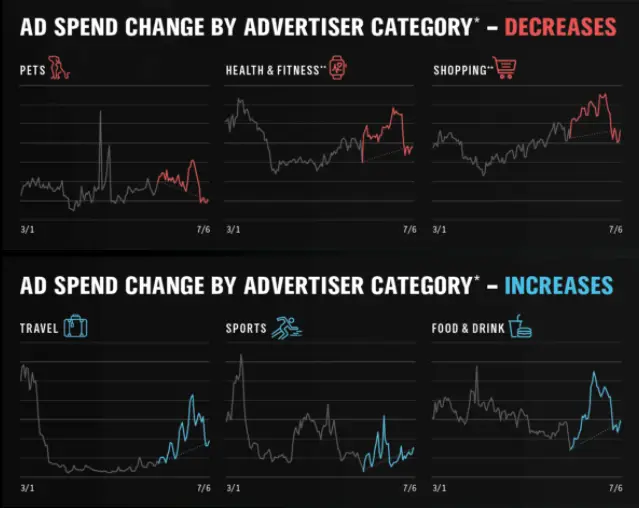

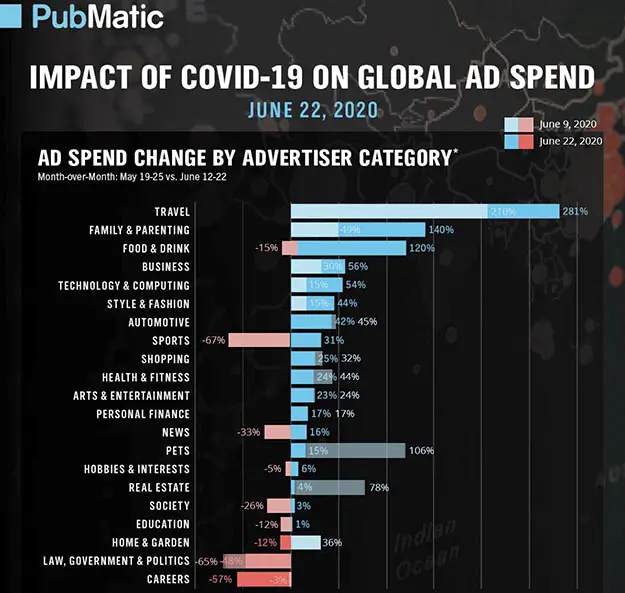

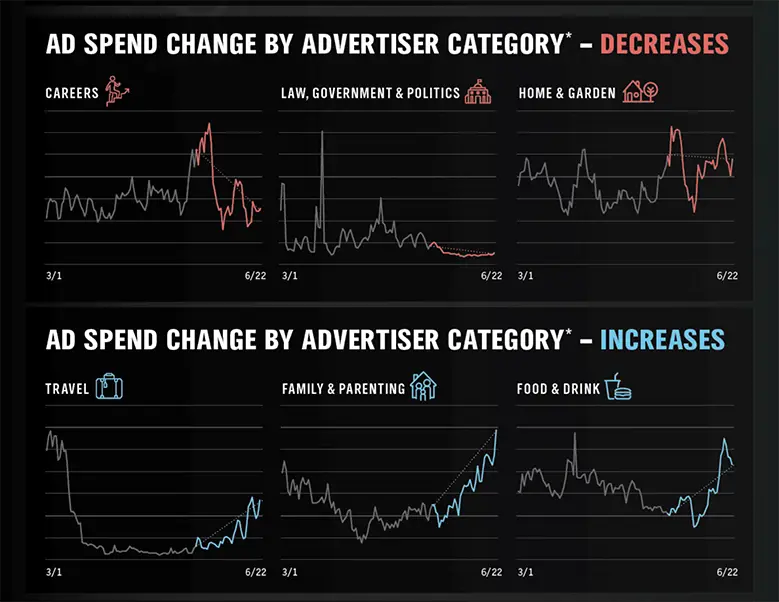

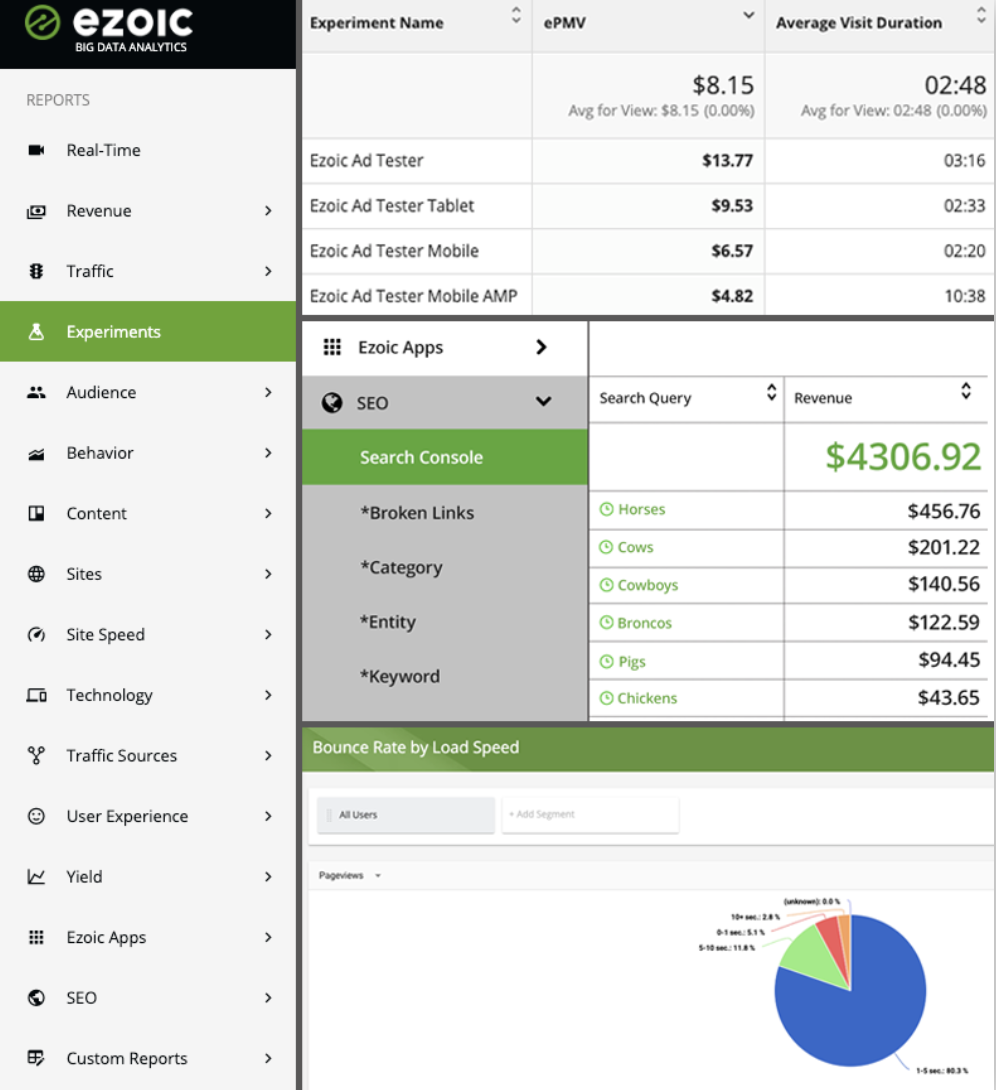

According to PubMatic, Food & Drink, Technology, Business, Personal Finance (sites like The Financial Geek), and Shopping are the drivers of ad spend recovery. This is because many of these categories were doing especially horrible in the beginning of the pandemic but have seen significant turn-around as the year has gone on.

Other categories, like Travel, Sports, Health & Fitness, and Real Estate are slower to recover to pre-pandemic ad rates and are likely to continue to see slow growth as lockdowns are re-implemented amid rising pandemic numbers.

Pets, Health & Fitness, and Shopping are still seeing the biggest declines in ad spend compared to what they usually look like outside of the pandemic.

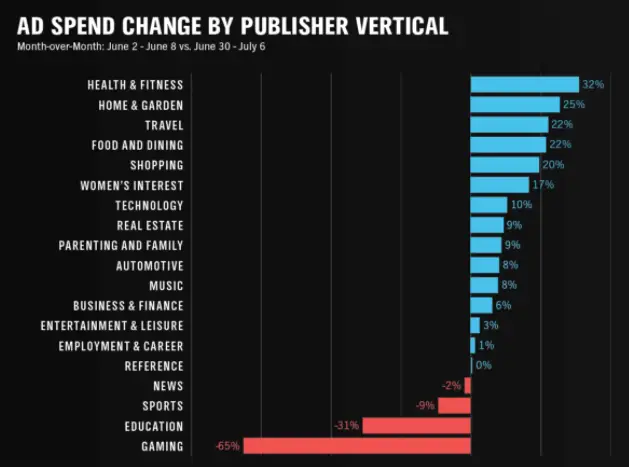

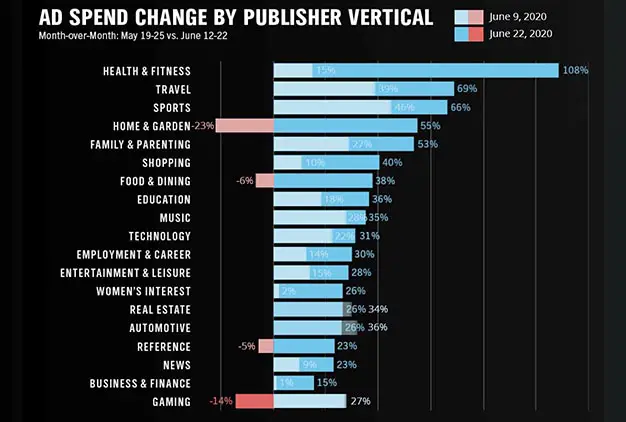

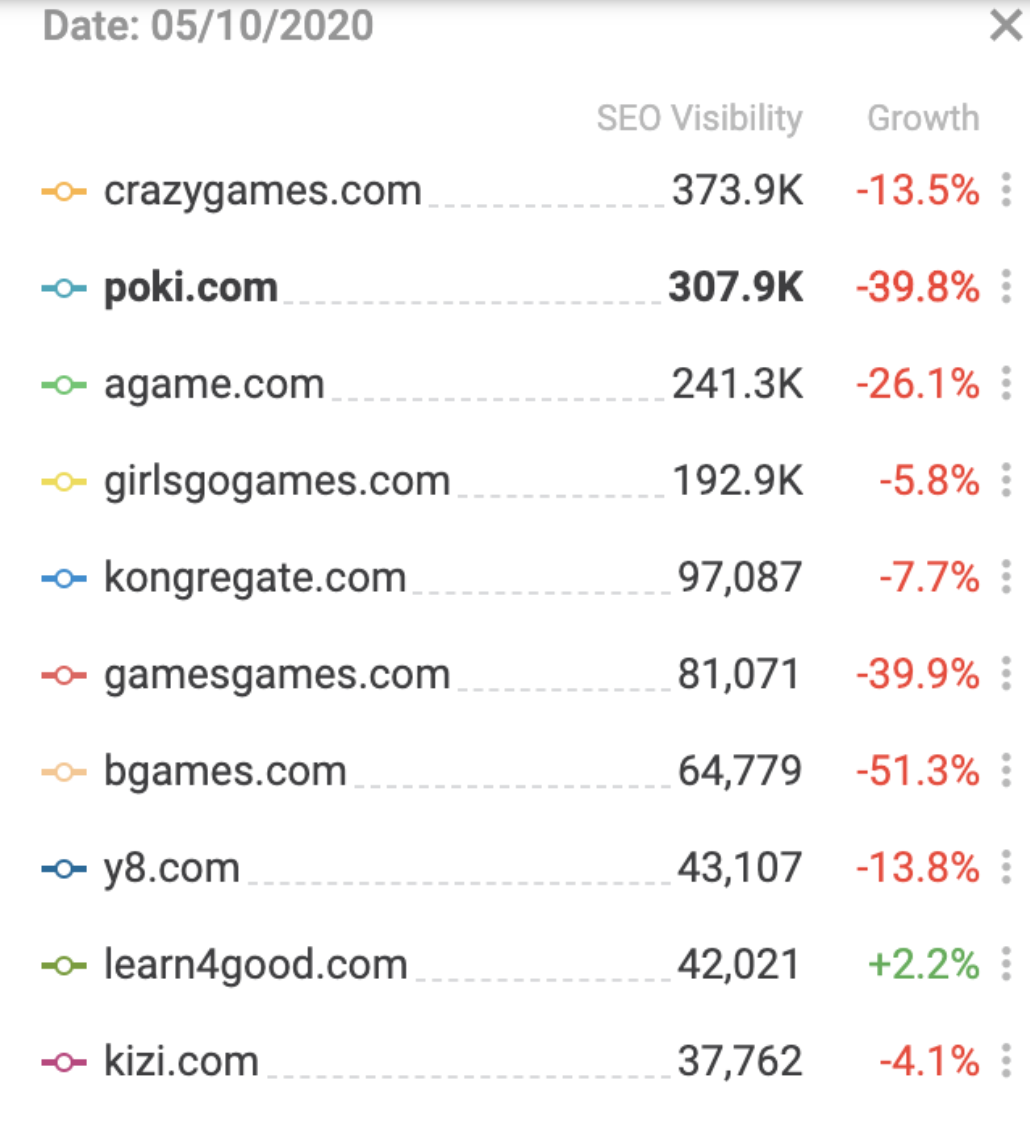

For publisher verticals, Health & Fitness is still on the rise while Gaming has taken a steep decline.

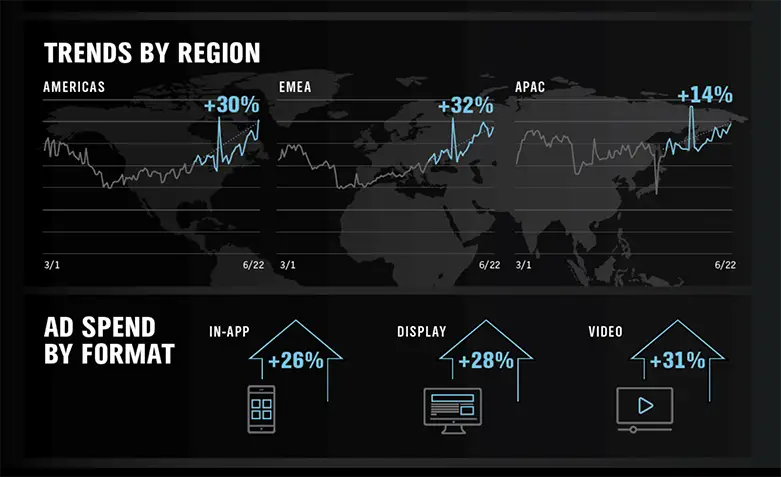

In-app and video are still seeing increases in ad spend, while display advertising remains down 12%.

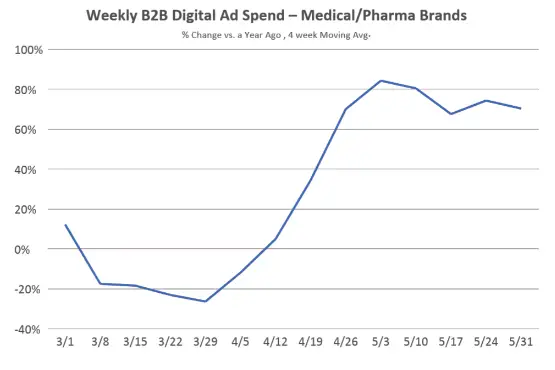

While pandemic numbers are increasing, some B2B brands will see increased opportunities. Health and Pharmaceutical companies are performing well right now, as health is obviously a popular topic. These categories have increased their ad spend throughout the pandemic, with its highest numbers in April; this makes sense because April was the original peak of pandemic numbers.

Another category that has seen increases in ad spending is Industrial, as it is the third-largest B2B product category within B2B advertising. These sites have seen an average weekly revenue increase of 65% during the pandemic. This includes Heavy Machinery, Construction, and Agriculture.

The automotive industry has also experienced increases in ad spending; since April, B2B automotive advertising has increased 87% YoY. This is likely because people have been slowly getting back to driving places as things opened up and non-essential workers were able to go back to work (with necessary precautions).

Lastly, Professional Services has seen improvements. In April, it was down by nearly 33% YoY, but since the end of May has increased 13%.

What should publishers focus on?

Did you miss spring cleaning? With pandemic numbers rising once more, now is a good time for publishers to get back to the basics of their website.

In a column by AdExchanger, Media Tradecraft’s founder Erik Requidan suggests that publishers take a Marie Kondo (an organizing guru) approach to their website to see what is important for their website and cleaning out some of the cobwebs.

User experience is always the most important thing to consider first; if you don’t have an audience, you don’t have anything. Consider how you can make that experience better.

For some publishers, it may be a faster-loading website, creating new content, or augmenting old content. For others, it could mean cleaning house on shady or spammy ad partners.

Other things to acknowledge outside of user experience is reconsidering services you’re using that do not benefit your bottom line. While traffic and revenue are things that are only slightly in your hands, eliminating measurement, analytics, or SEO services that aren’t doing much for you is something you can actually control.

This is also a good time to think about any additional publishing mediums you have implemented and consider if they are working or not, or how you can make them better. Maybe your newsletter isn’t performing as well across the audience you originally intended, but it is popular amongst a certain niche audience. You could better cater your newsletter to that audience.

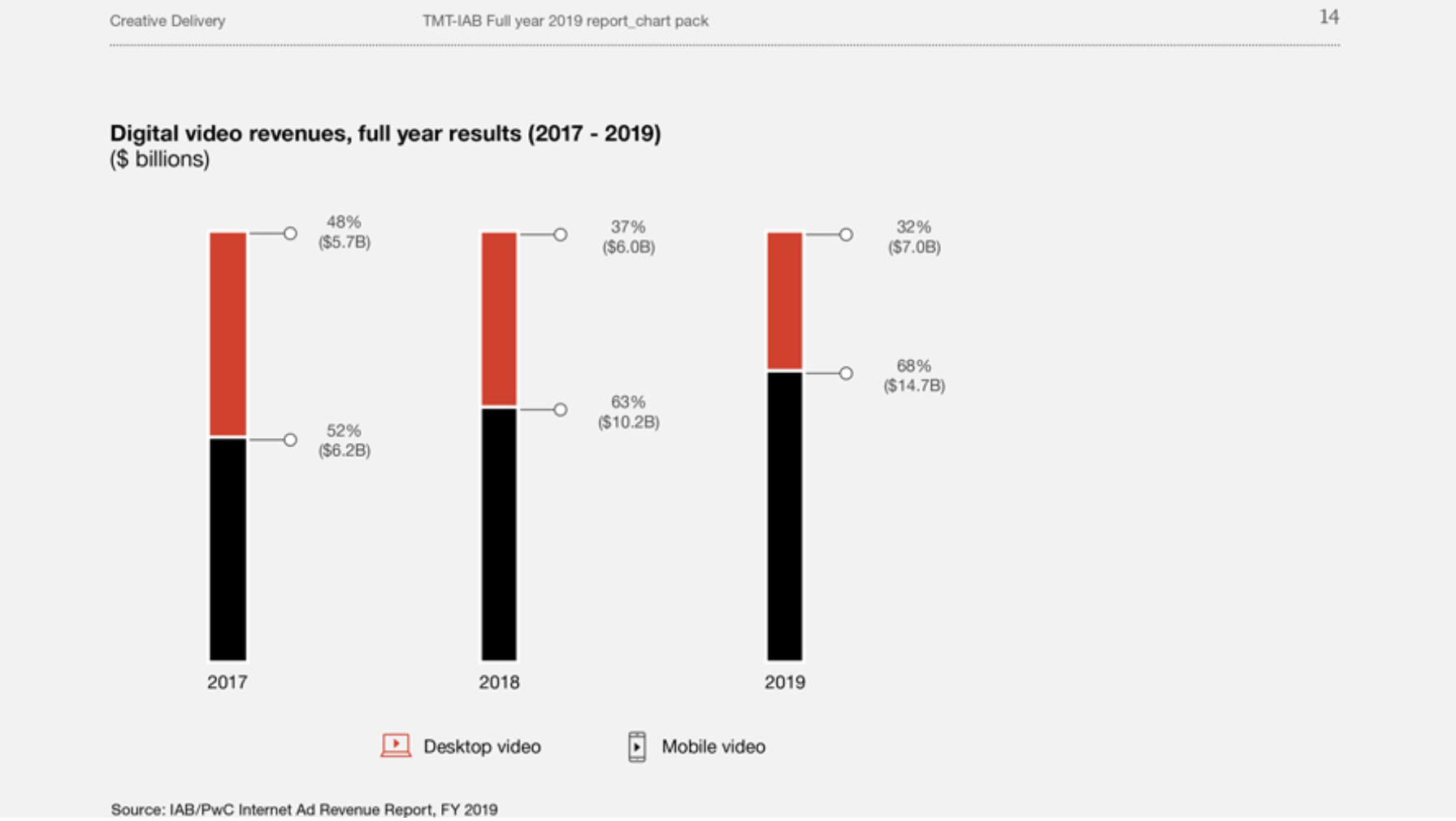

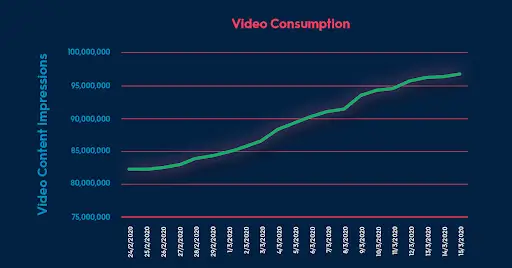

Consider also what your site is lacking; if you aren’t publishing videos, or at least supplementing your content with them, you’re losing out on engagement and possible revenue. While other mediums and ad spending is in decline, video is still growing throughout the pandemic.

With pandemic numbers rising once more, it’s better now to get back to improving the basics rather than grabbing at straws, which could affect the long term health of your website.

— July 1, 2:44pm PDT —

We saw a big spike at the end of June on Friday, June 26, as many ad campaigns had one final surge before the end of Q2.

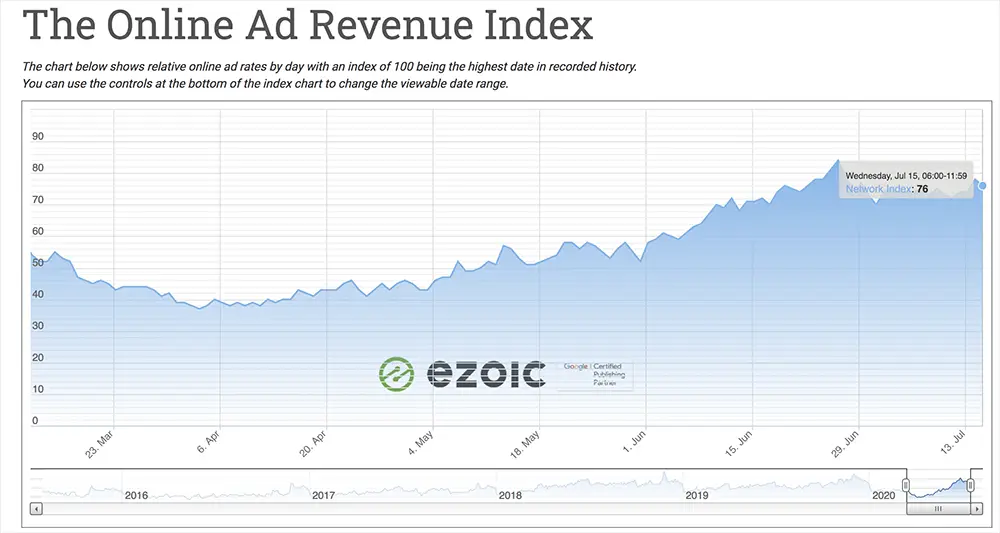

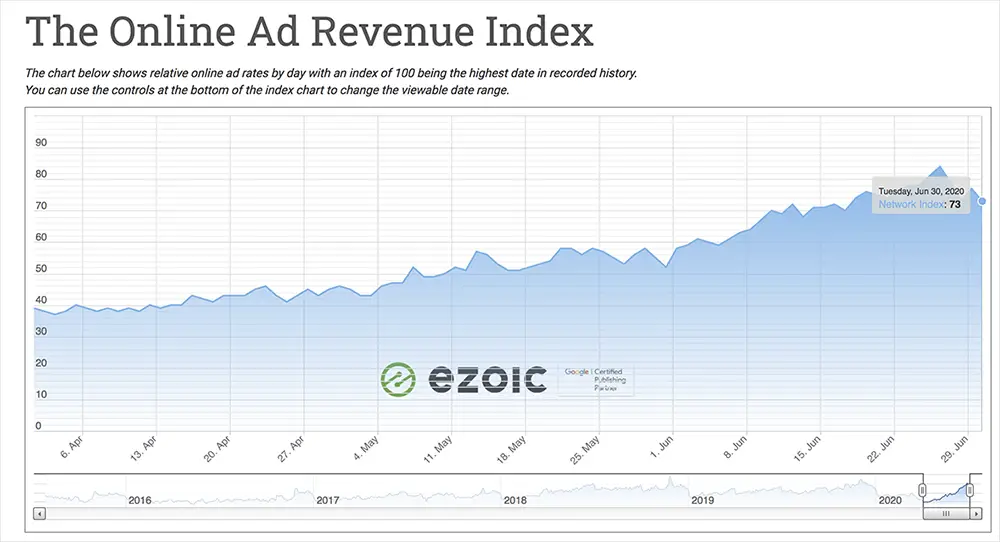

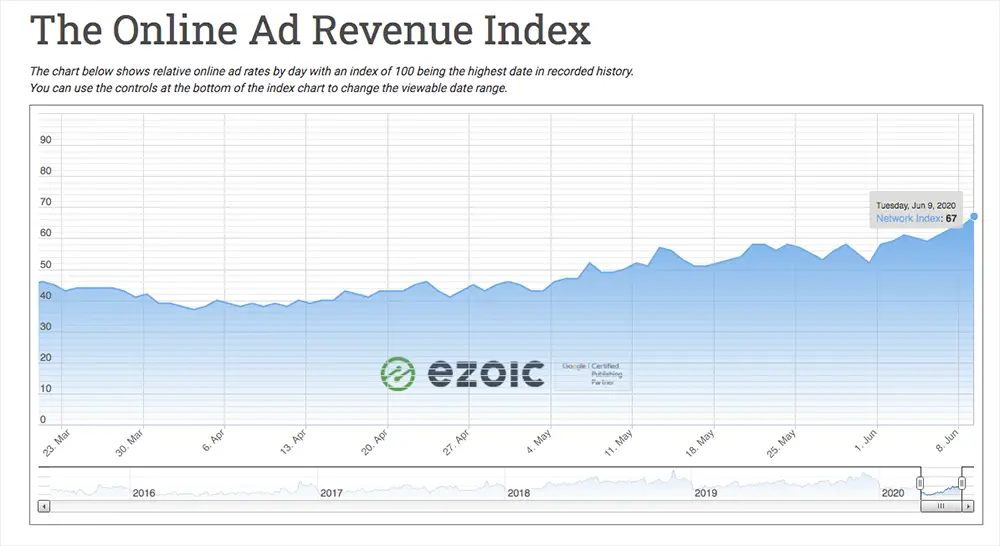

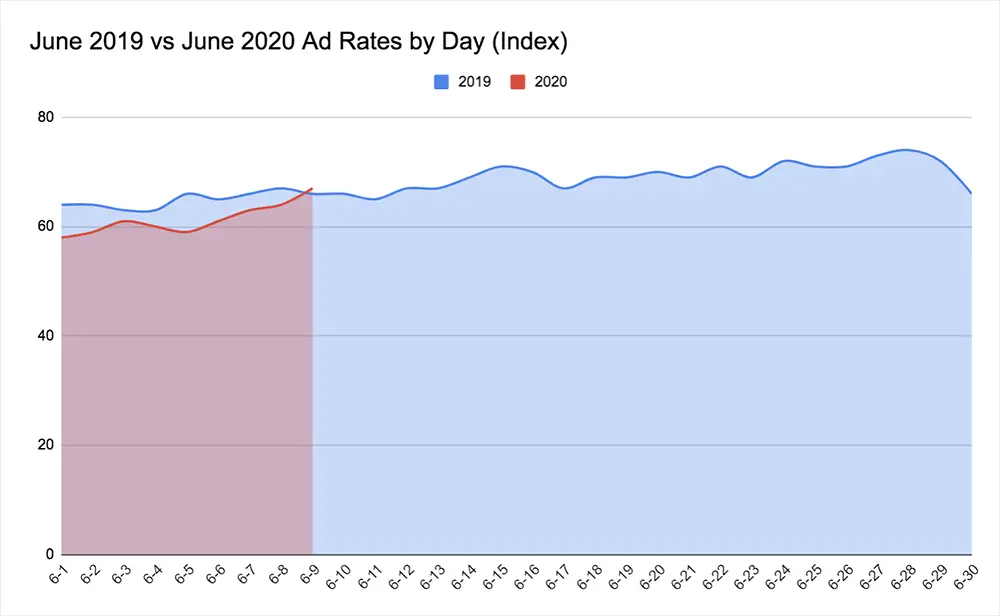

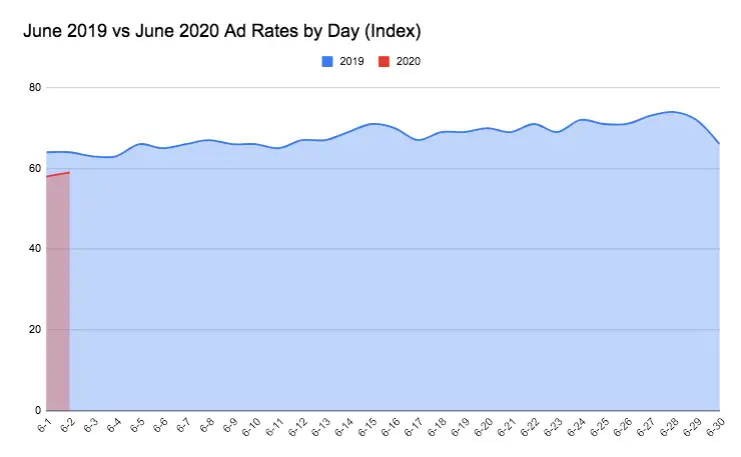

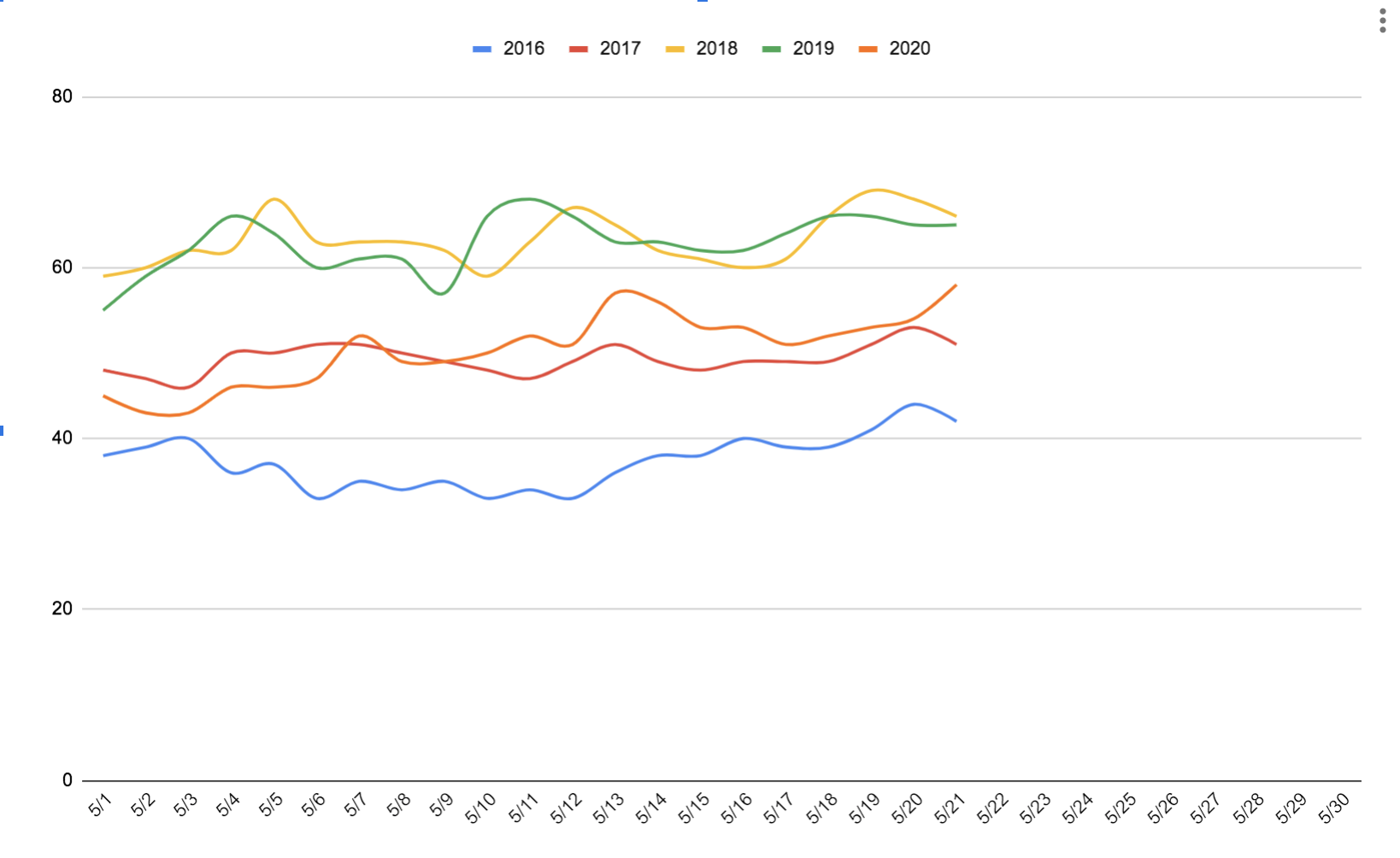

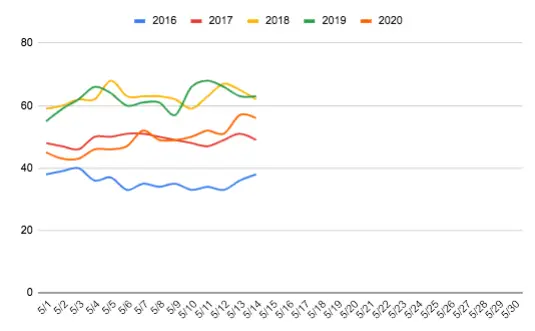

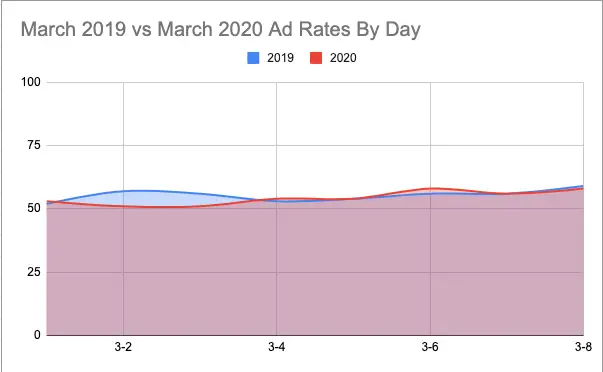

Our ad revenue index shows that ad rates are officially doing better this year than last year in June.

How publishers can adapt during the pandemic

What perhaps we are all learning the most during COVID-19 is just how able we are to adapt to major changes, whether that be the global economy or our day-to-day lives.

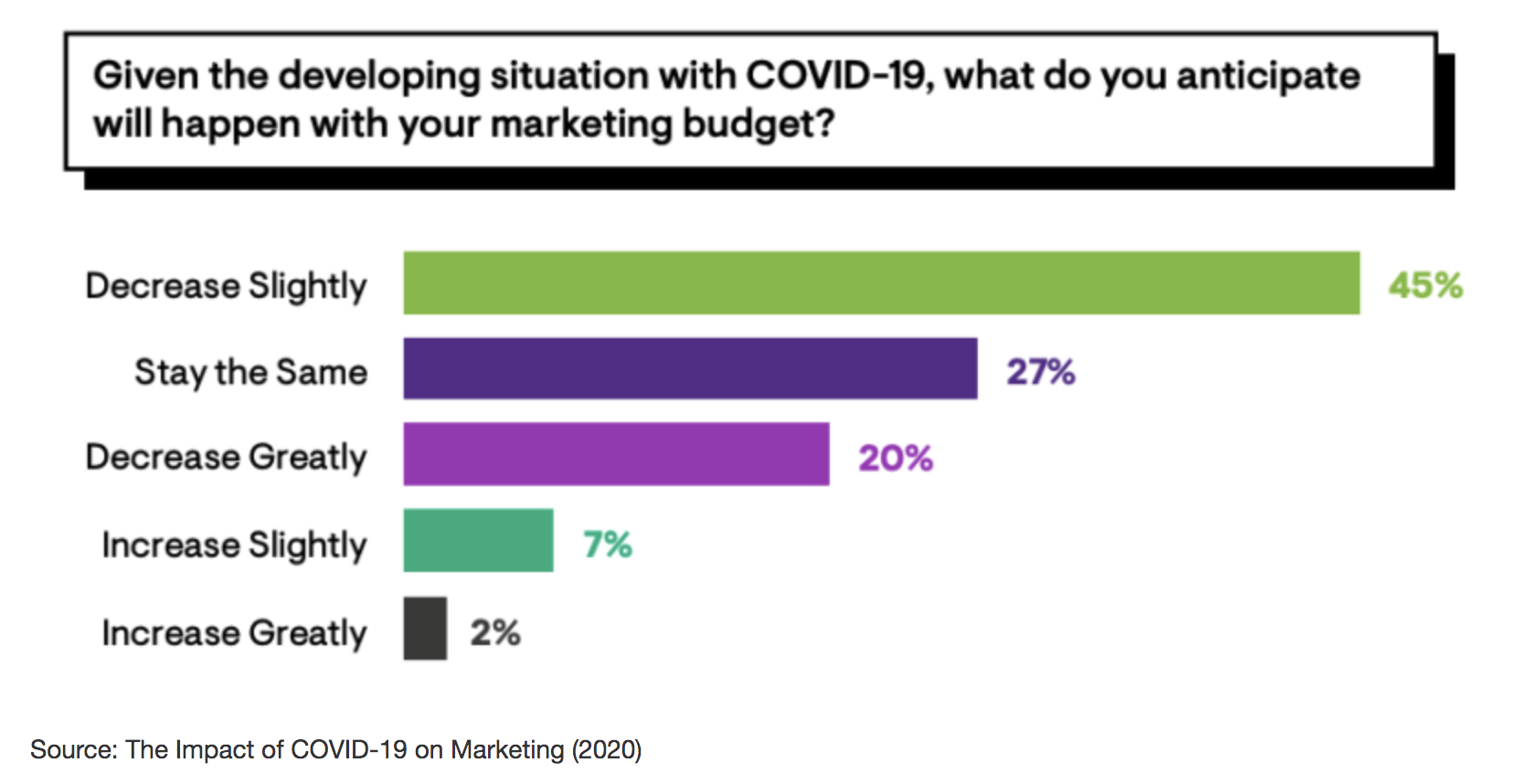

Large and small brands alike have had to change strategies, implement layoffs, and cut spending. 81% of brands have reported they will be reducing spend in 2020, much of which has fallen on digital advertising and thus publishers.

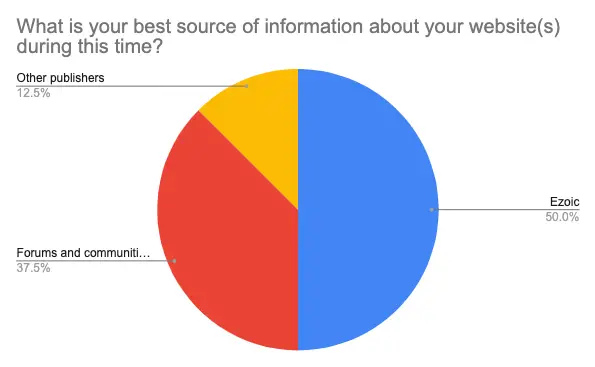

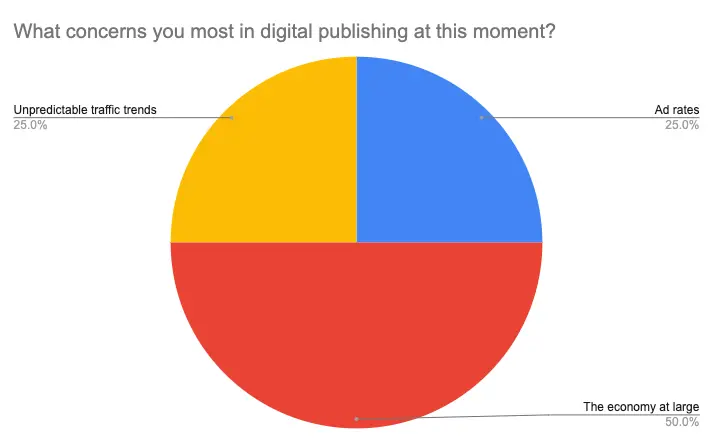

Ad security company GeoEdge recently conducted a survey amongst its partners and other businesses to assess what has been most helpful in staying afloat during coronavirus. There were four major themes amongst the respondents.

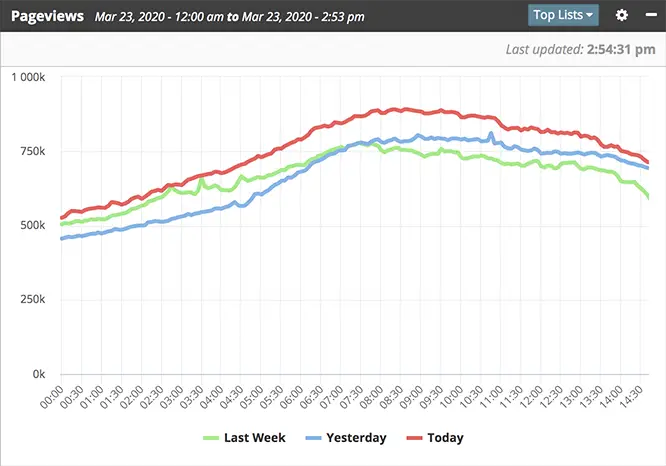

- Know your audience and understand its changesMost publishers have seen rises in traffic during COVID-19, but knowing who is participating is important to the health and future of your website. Since coronavirus, have there been any changes in what types of visitors are on your website? This could range from age, length of time on site, device type, pageviews, time of day, location, etc. During the last few months, have there been new surges of types of traffic? Since everyone is likely behaving differently now than they usually do outside of the pandemic, it is likely their browsing and web habits have changed as well. To keep traffic coming in and growing, publishers should study these traffic trends and make changes accordingly.

- Retaining your audienceNow that you have a larger audience, focusing on retention efforts will pay off in the long run once browsing habits change once again. Here are nine tips for reader engagement from large brands:- Logged-in users or free subscriptions

– Quizzes or surveys

– Contests or competitions

– Collaboration

– Sweepstakes

– Engage with your readers

– Spinning popular content

– Know your readers

– Experiment - Optimize demandWe’ve hit hard on this before, but one of the best things you can do right now to take care of your site in the long term is to make sure you have quality ad partners. Make sure you understand how advertisers are performing with your audience and that there are no shady ads on your website. Advertisers bid on historical data. If you are trying to make some quick bucks with low-quality or spam-like ads on your site, when things start to improve, you’re going to have a harder time driving up your revenue again.

- PartnersLearn and help other publishers in the space. While everyone is surely competing against each other for traffic and revenue, the system only works if there is a certain amount of balance. You can share what has helped you during this time and in turn maybe learn some other valuable lessons and tactics to try as well. During times like this, you want more friends than enemies.

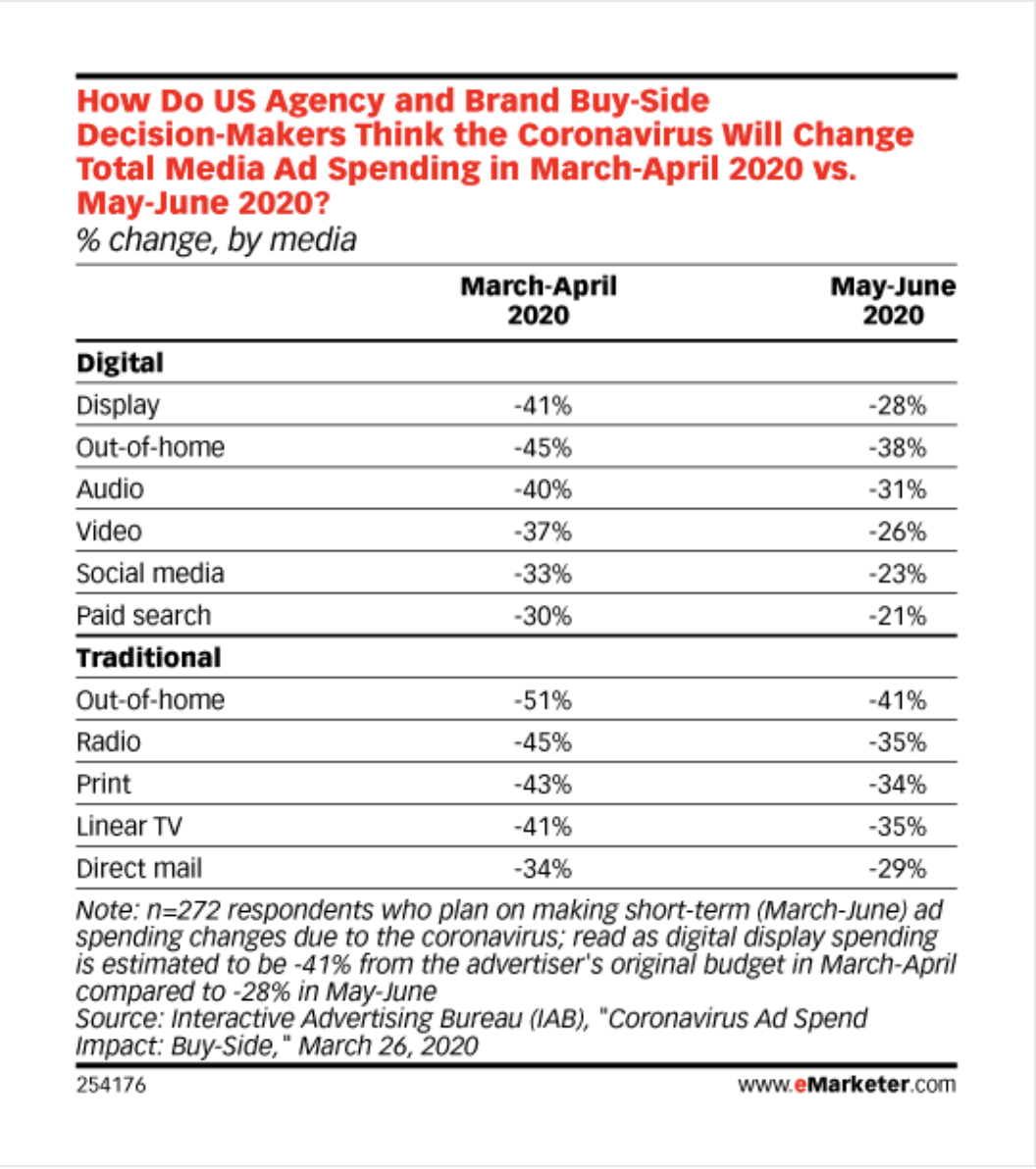

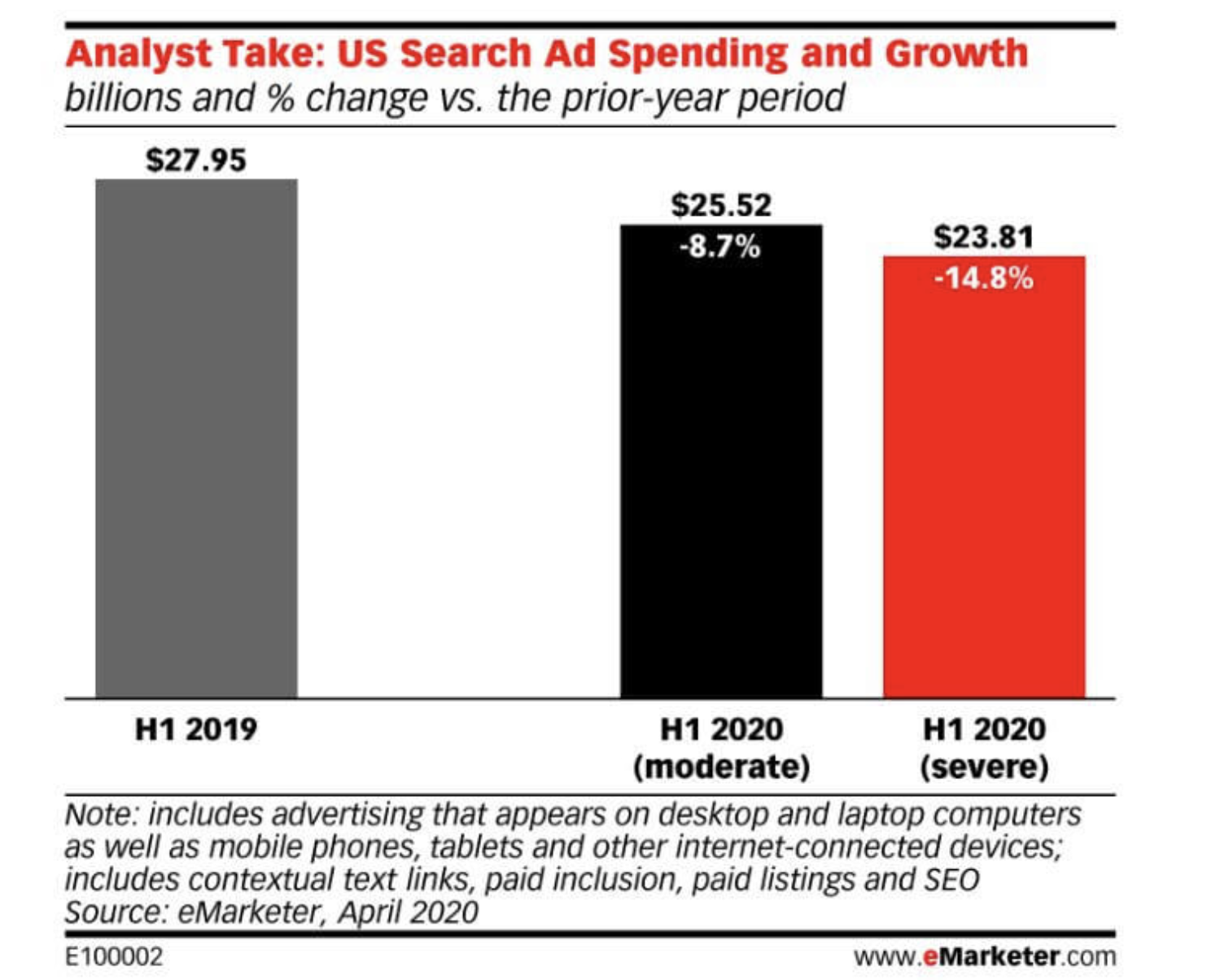

Ad spend in Q2

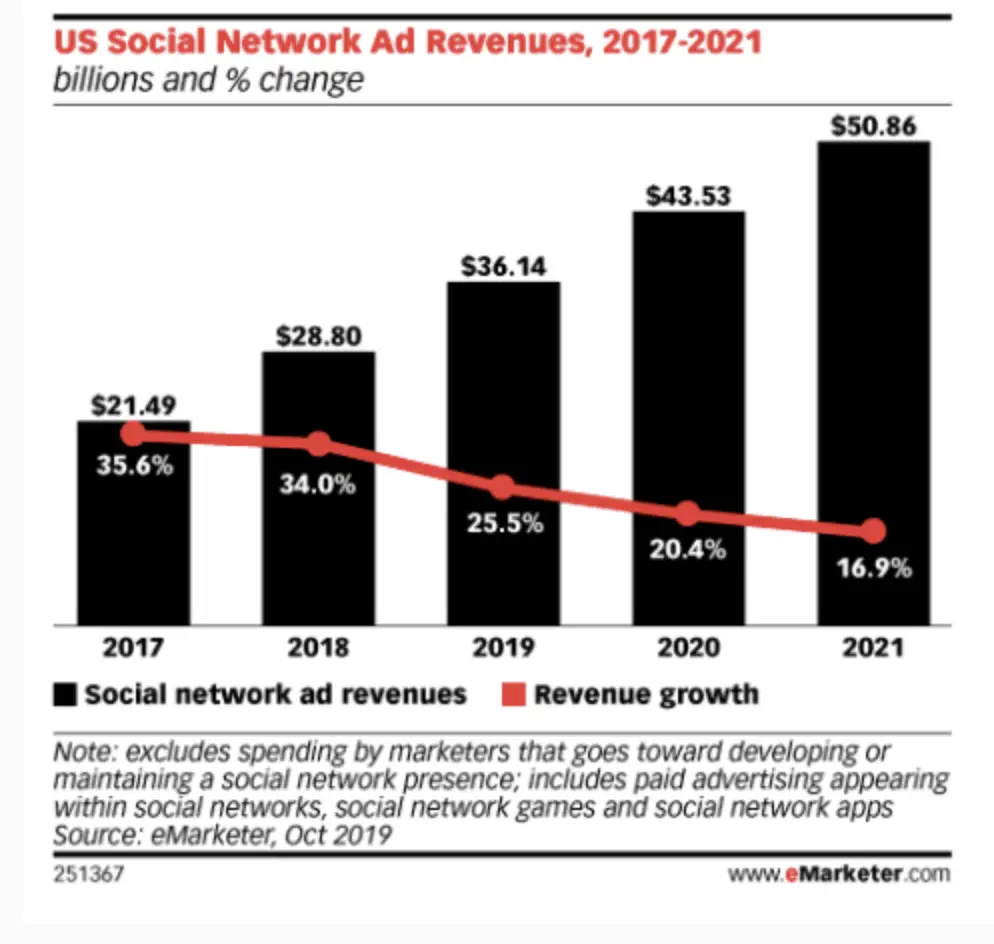

While digital ad spending is certainly down from the boom it has been seeing in recent years, there are still predictions it will see growth in 2020. eMarketer originally predicted there would be about 17% growth this year but they have now changed that number to 1.7%. This equates to about $22 billion in advertiser spending in digital to now just $2.2 billion.

Most of these changes will be seen in search spending, since the travel industry is usually so focused on it and has been suffering through the pandemic. Display, however, is expected to still rise since display also includes video, which is doing well right now.

However, Pubmatic’s recent report shows that travel is continuing to see growth both in ad spend change by category and ad spend change by publisher vertical when compared to its report a few weeks ago.

Comparing to Pubmatic’s last report on June 9, we can see that there have been many positive ad spend changes in the last few weeks; only a few categories, like Pets and Real Estate, are down.

One of the biggest changes since its last report is the positive increase for the Health & Fitness category within publisher verticals–in the last report, it actually saw a 13% decrease in ad spend change by publisher vertical but this time around, it is the top-performing category at 108% increase.

Travel is continuing to see increases in ad spend by publisher vertical as more regions lift restrictions and people anticipate traveling soon. Other important category increases are Home & Garden and Food & Dining.

Brands are relaxing a bit on keyword blocking, but those hit hardest continue to be news publishers. Data from Newsworks shows that news publishers are likely to see £50m ($62.4m) in losses from April to July due to brands keyword blocking words like coronavirus, COVID-19, and pandemic.

Image search spikes by keywords

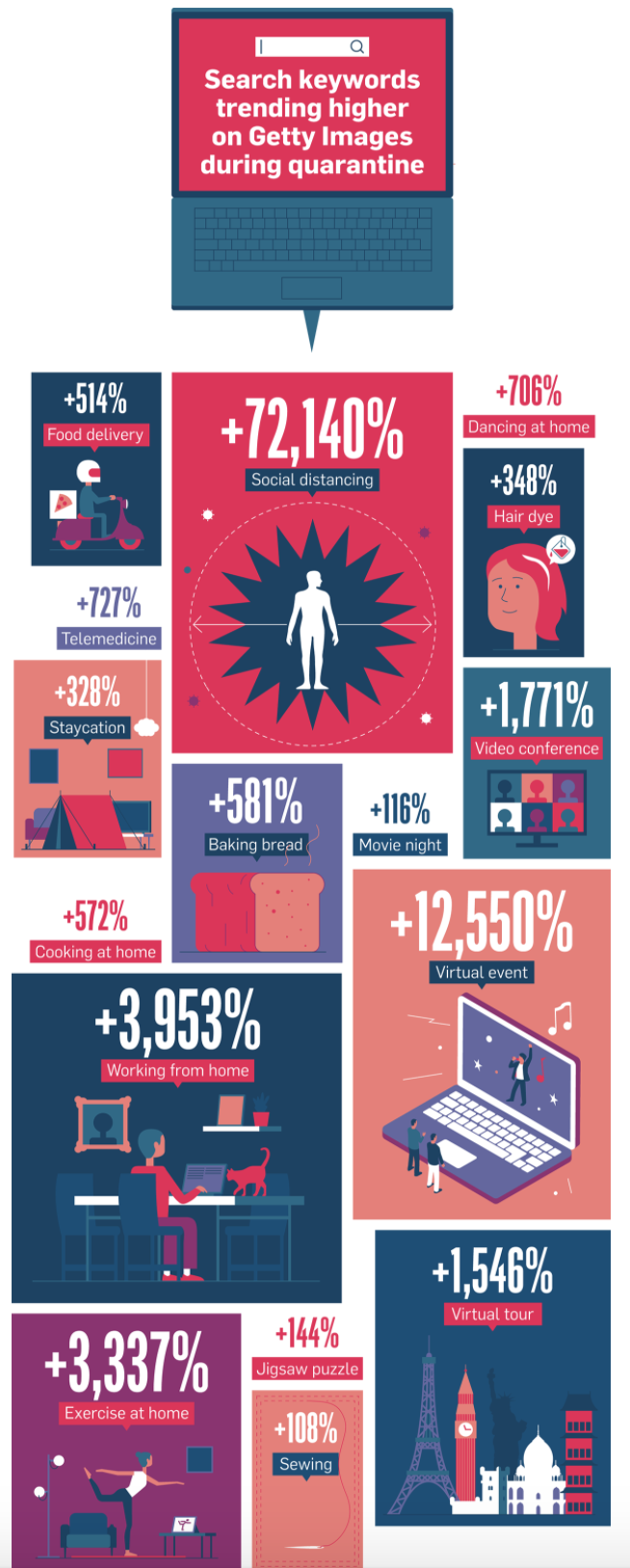

Getty images recently released a report of its most popular keywords from mid-March and April 2020, comparing their rate-of-search to April 2019.

The highest rate of increase was for ‘social distancing,’ which was up over 72,000% compared to April 2019 and ‘virtual event’ is up more than 12,000%. Additionally, ‘working from home’ and ‘exercise from home’ both saw increases of over 3,000% each.

— June 10, 5:26pm PDT —

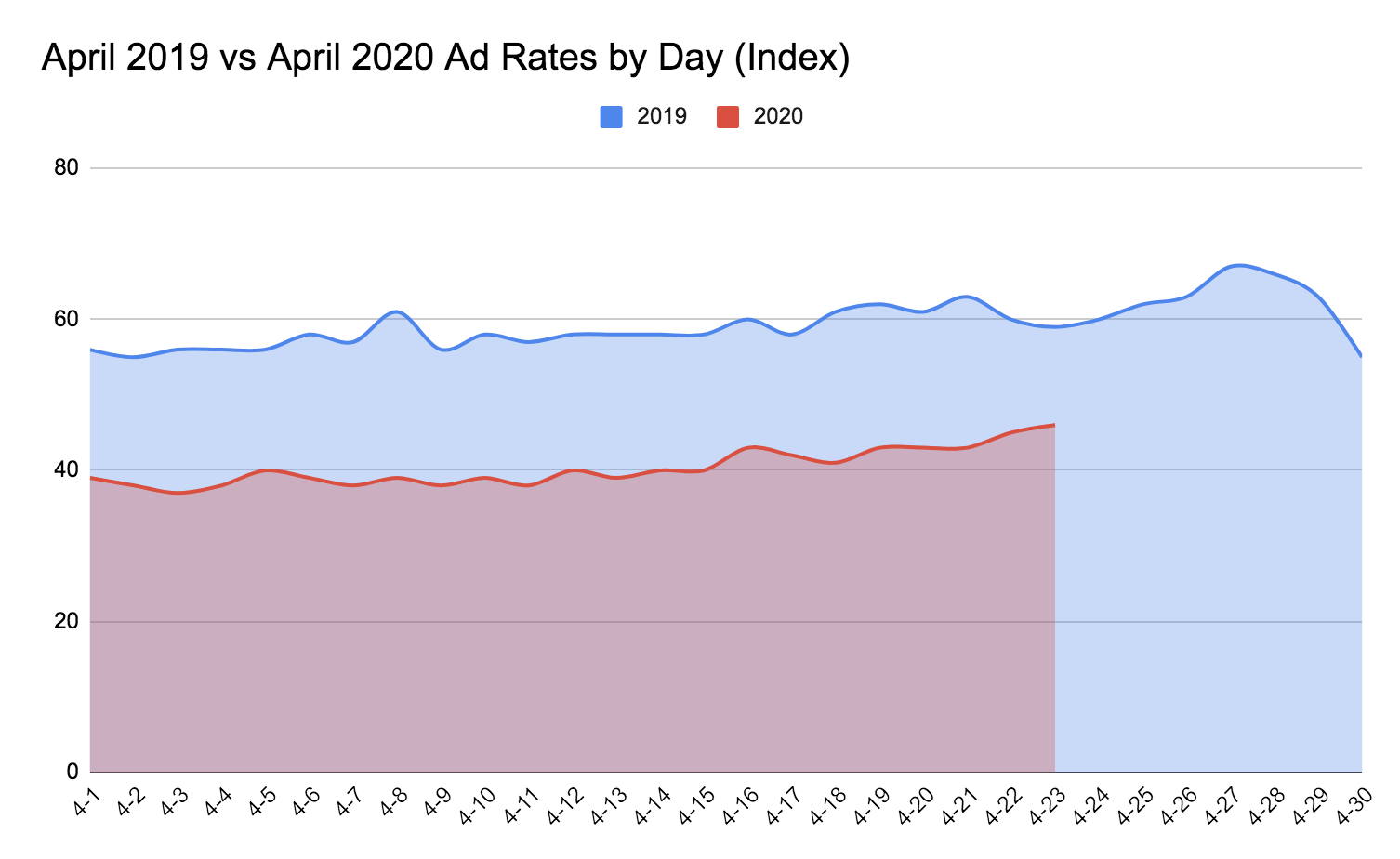

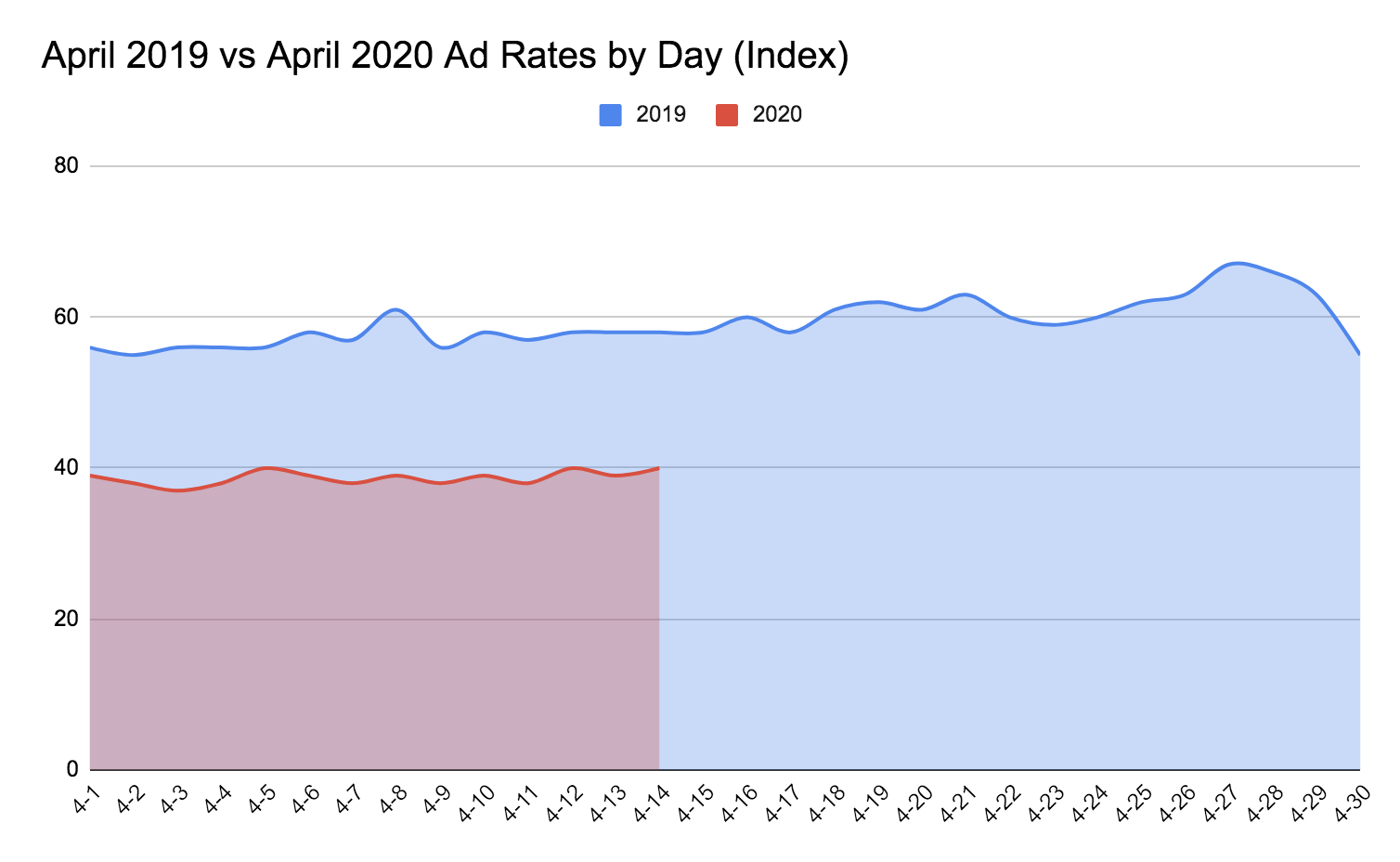

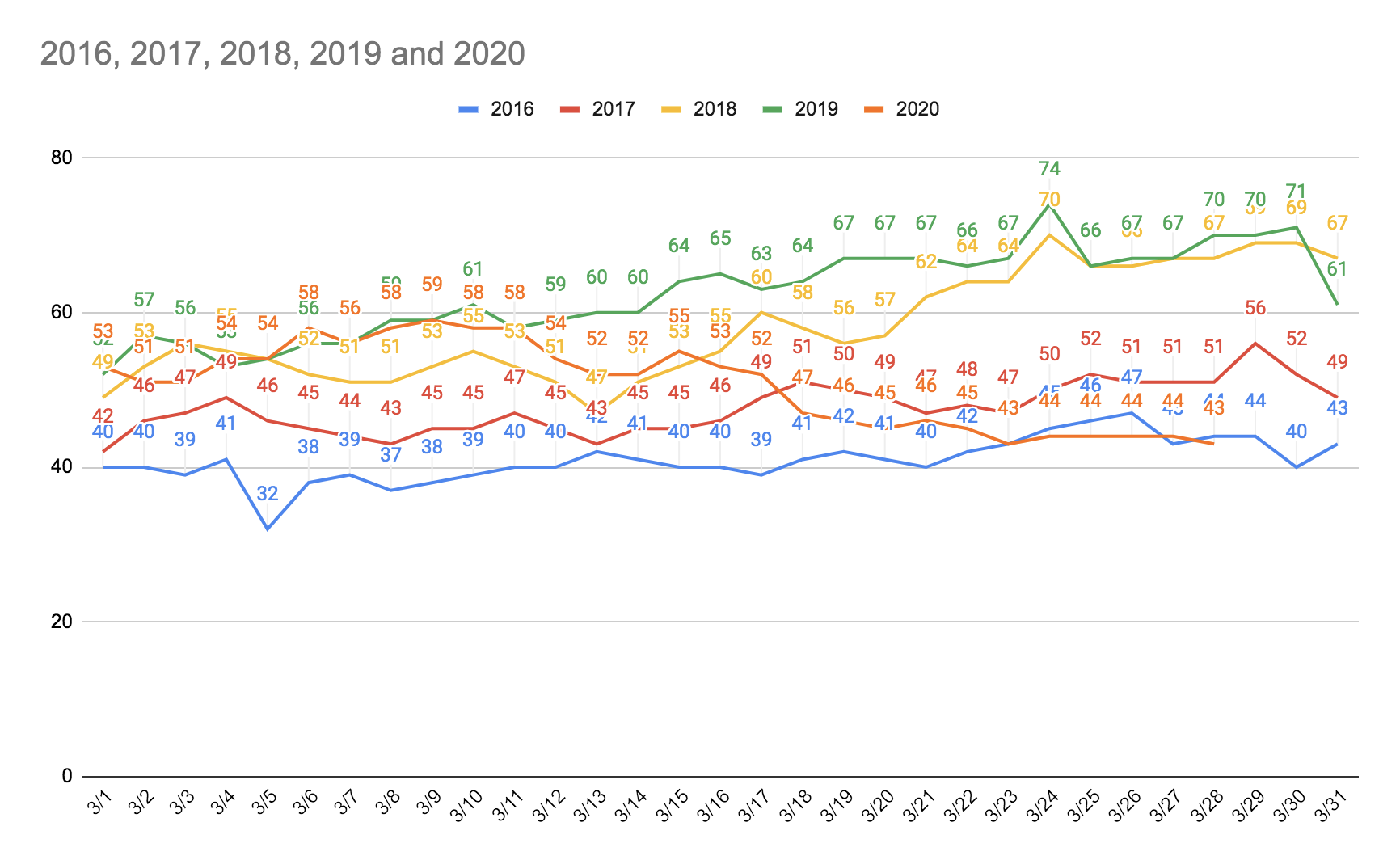

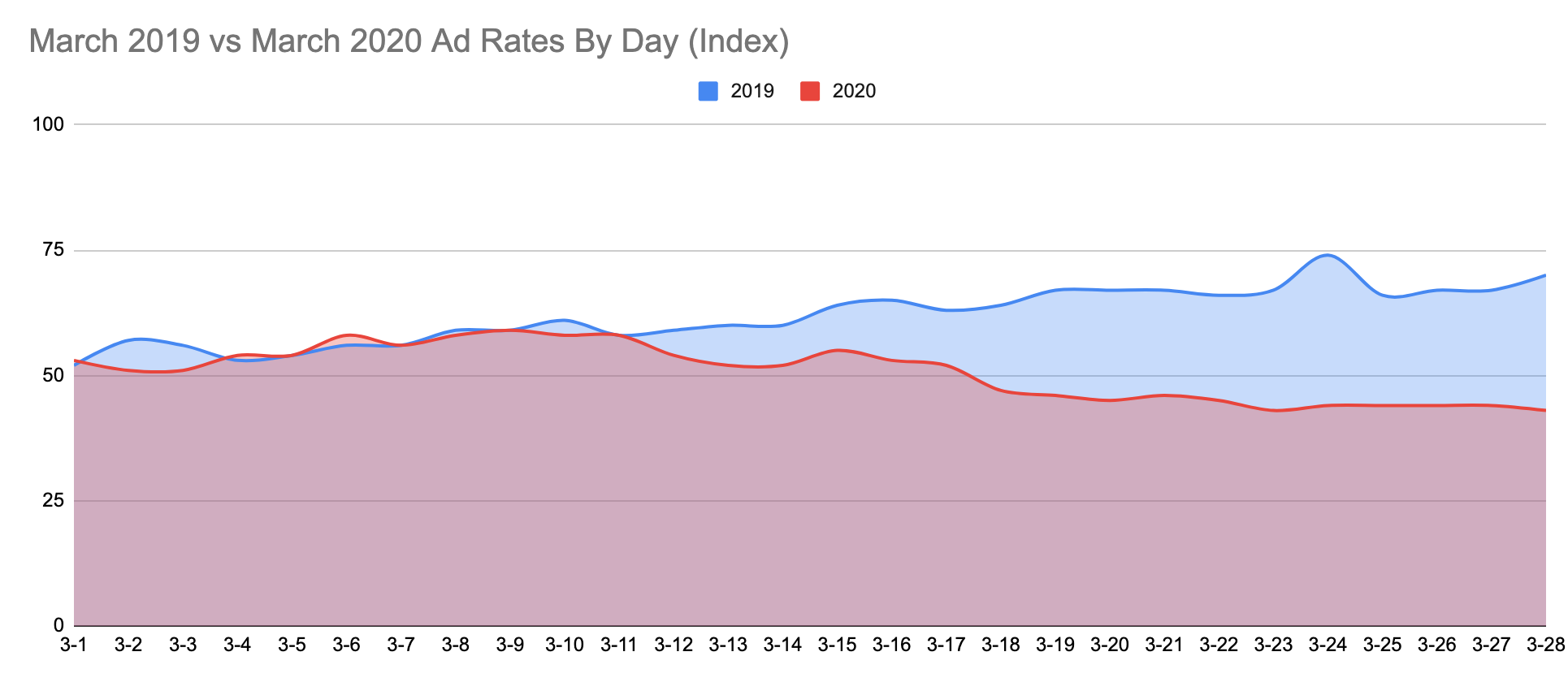

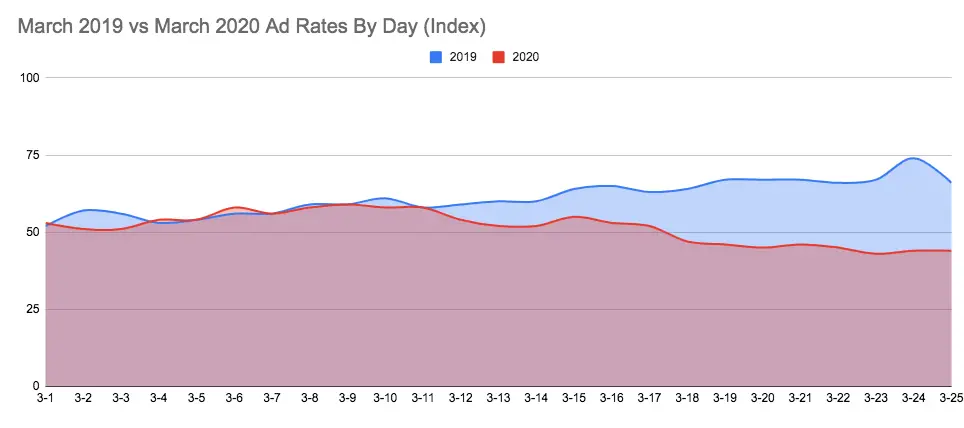

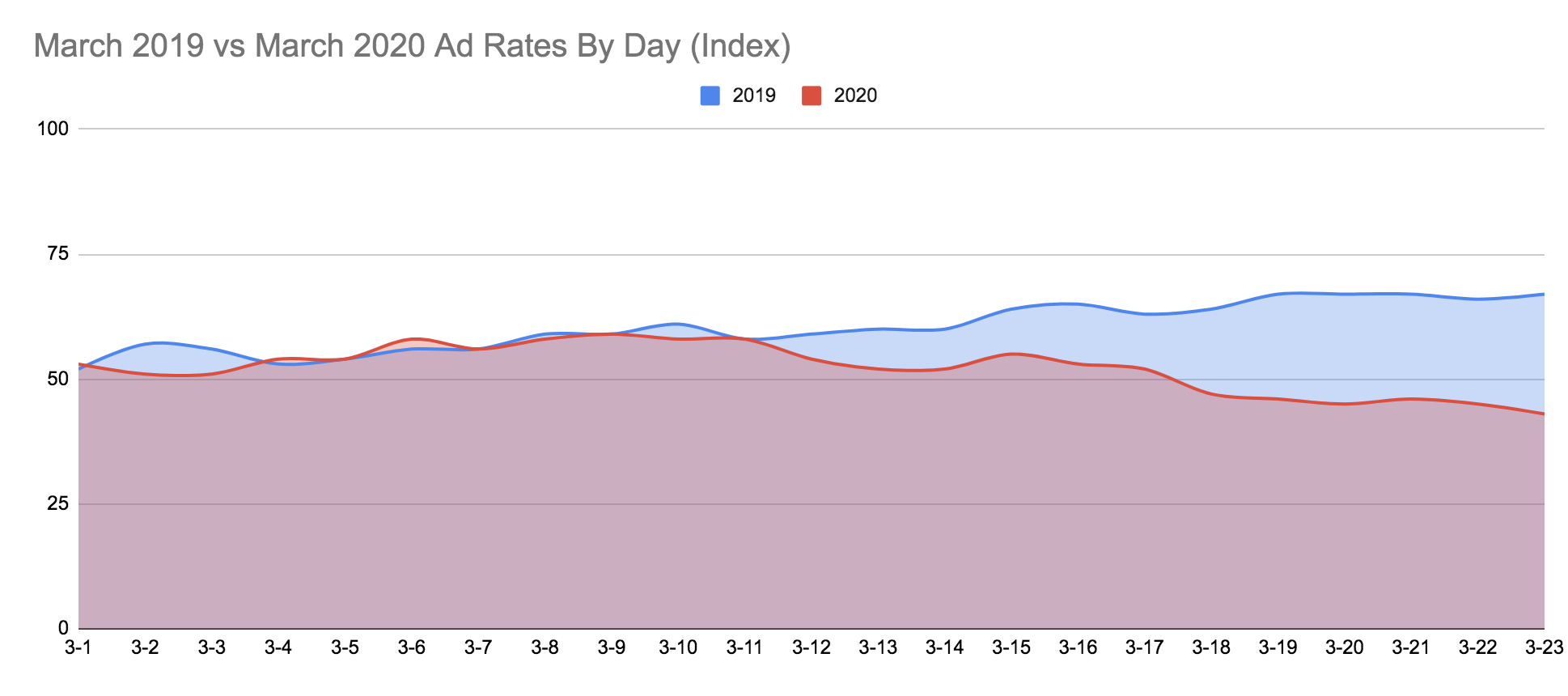

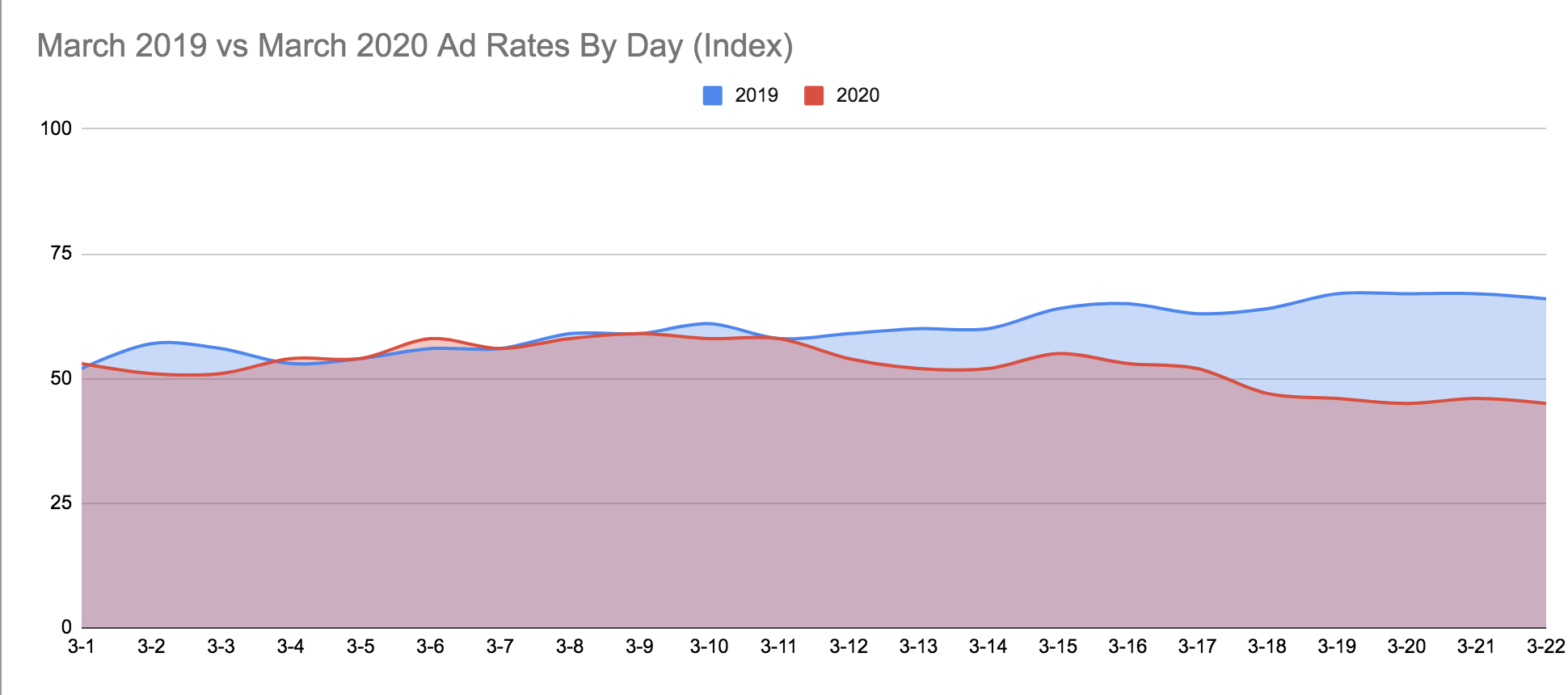

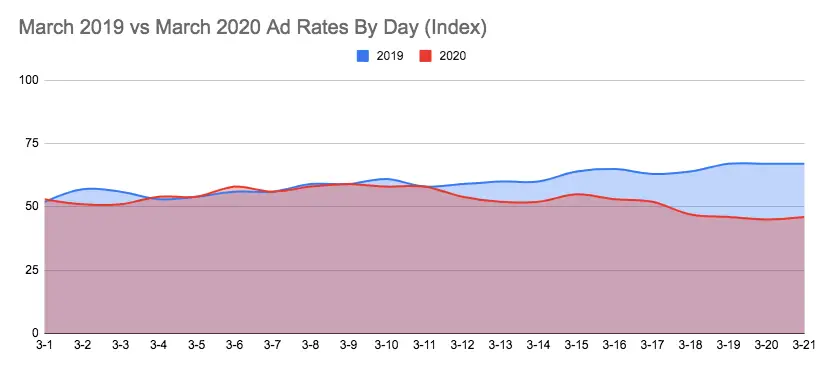

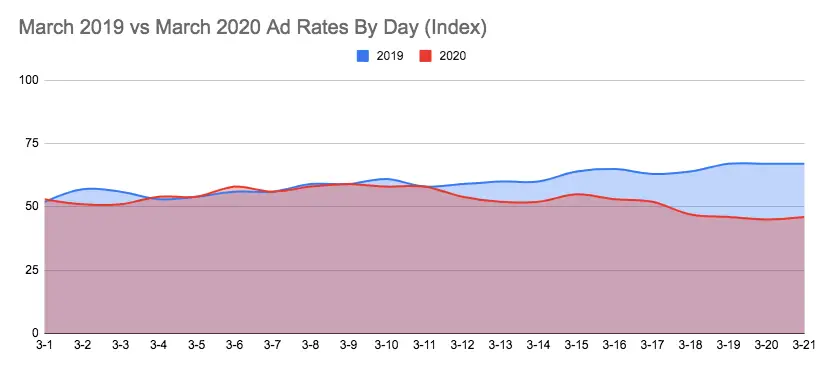

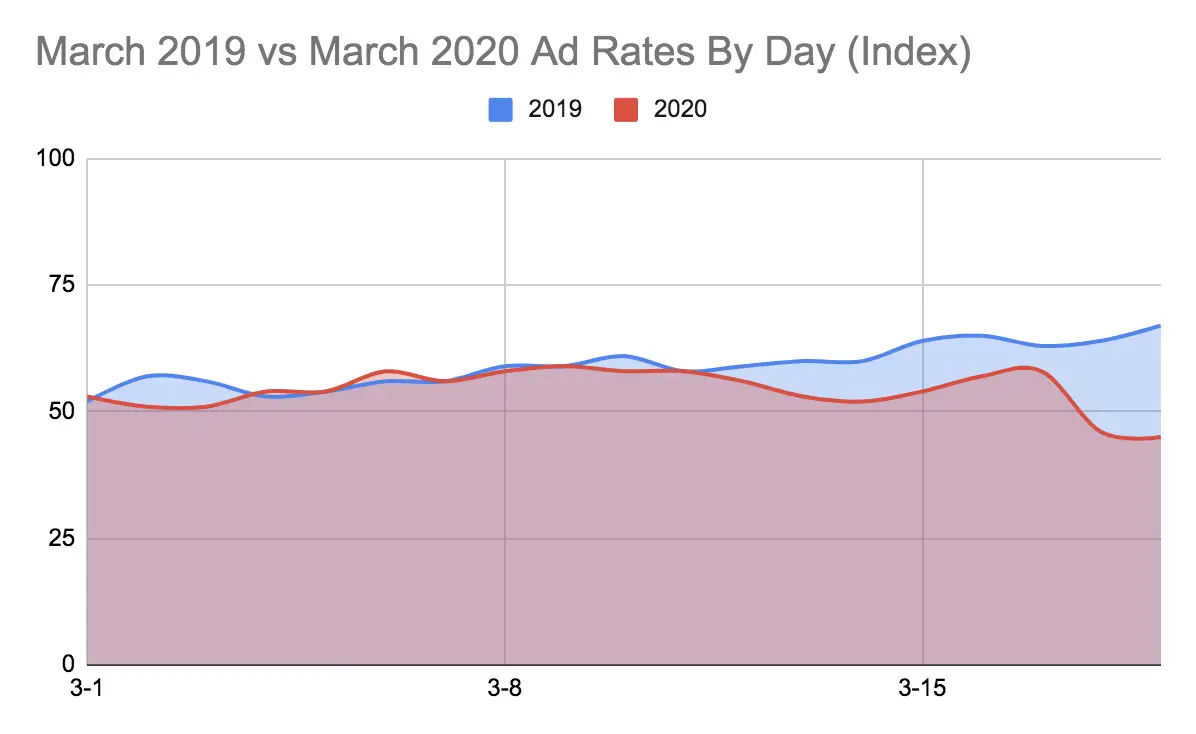

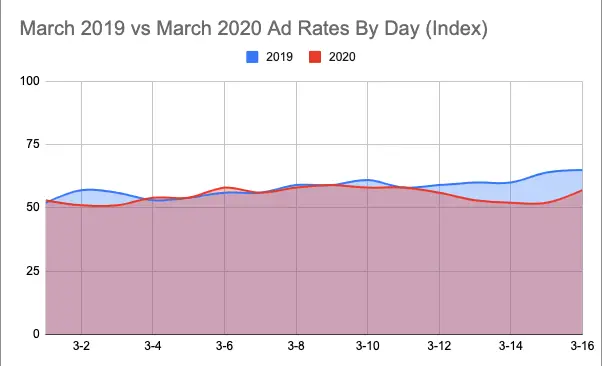

Ad rates reached well above 60 this past week, a trend that is likely to continue through Friday. Ad rates even reached above last year’s ad rates on June 9.

Ad rates reached well above 60 this past week, a trend that is likely to continue through Friday. Ad rates even reached above last year’s ad rates on June 9.

While climbing ad rates are following the usual Q2 trend—a gradual rise at the end of June—it’s hard to tell if there will be as big of a drop at the beginning of July as usual, since advertisers are just now starting to advertise once more as restrictions lift.

While many look forward to Q3 because of pandemic ad rate recovery, it is also important to note that Q3 is typically the slowest time of year for ad rates. This third quarter is going to look different than any Q3 in recent memory, as we will likely see unprecedented third quarter activity due to COVID-19 recovery and changing consumer habits.

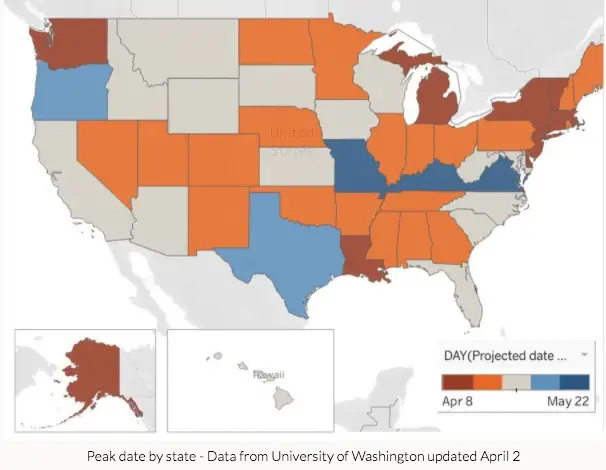

At 52%, most advertisers are still making changes to their Q3 and Q4 strategy as things change nearly every single day with the pandemic; some places in the world are under less restriction than others and advertisers have to strategize how to reach these different audiences effectively. Even in the US, restrictions and consumer behavior is different state-by-state and city-by-city. This means that publishers must also stay on their toes and keep up with advertising trends, as many changes have not yet been implemented and there more are to come.

“More than half of advertisers still plan to ramp up ad spending in the third quarter, while 28% are accelerating spending before the end of June,” stated Advertiser Perceptions, a business intelligence company for advertising, marketing, and ad technology.

Advertiser Perceptions also found that 58% of advertisers believe it is time to move on from coronavirus messaging and move back to product-specific advertisements—good news for publishers struggling to get COVID-19 content to rank, due to keyword blocking. Many consumers are behaving differently with lifted restrictions and plans for the future. Advertisements follow the general public, so more advertising on non-pandemic information or products means the public is more ready for non-coronavirus content as well.

Ad spend shifts: digital, consumer verticals, and TV

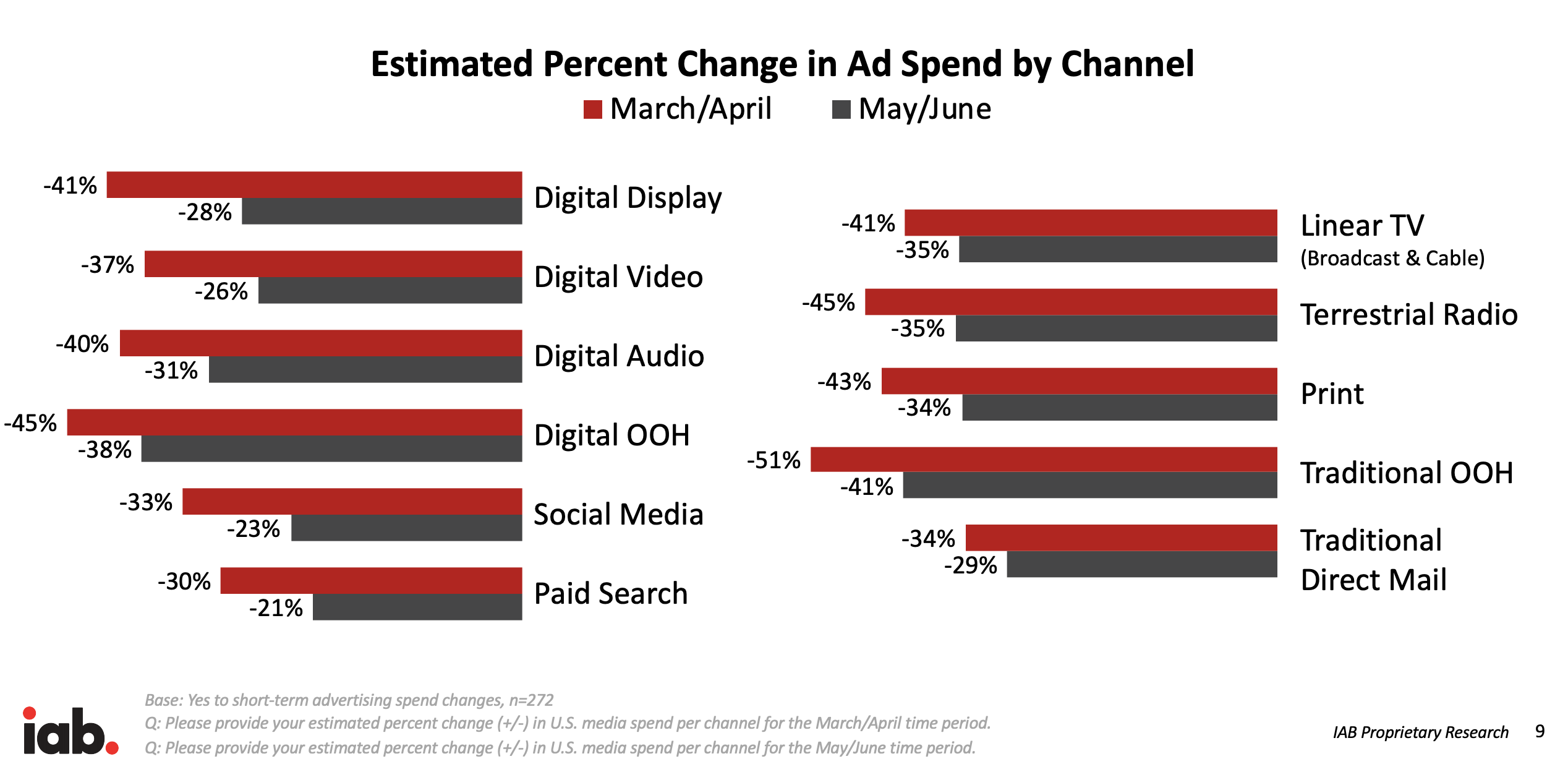

According to the International Advertising Bureau, total digital display ad spending—which does not include video and special media—decreased by 38% compared to the prior year in Europe in April. Additionally, the spend was down a quarter in May compared to last year. IAB predicts that June spending will still be down for June, but only by 16% compared to 2019. IAB Europe chief economist Daniel Knapp predicts that this information may mean that the ad spend and revenue crisis will be shorter than originally expected.

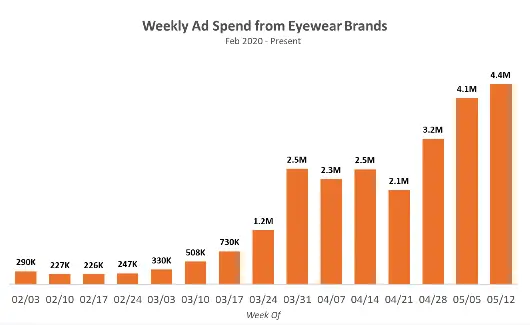

A recent study by MediaRader shows certain verticals are approaching and spending differently than others and are actually advertising more during COVID-19. For example, eyewear is up 208% YoY since March 8, with blue light glasses experiencing a big increase.

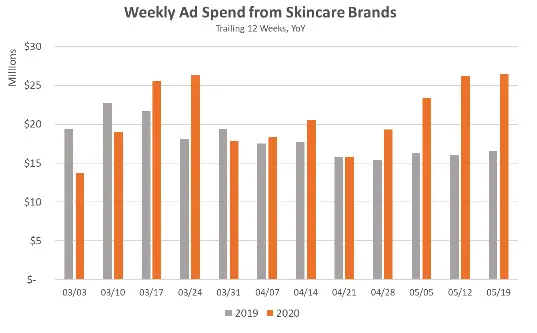

Skincare ad spending is also up 21% YoY due to ongoing Zoom calls and people spending more time at home with the bandwidth to focus on certain beauty concerns.

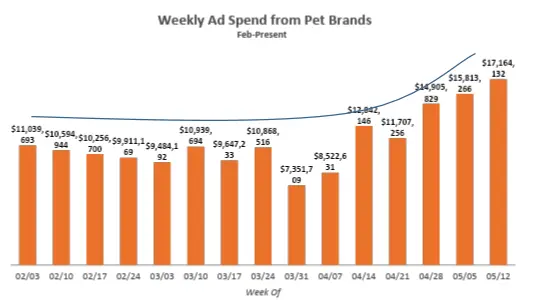

Pet adoptions are up 34% YoY, meaning pet brands have also increased their ad spend 51% YoY.

Ad spend is also shifting in TV. Like many pre-coronavirus trends, ad spend’s shift from TV to digital is increasing at a faster pace due to the pandemic. One reason is that digital ad spend and performance is easier to measure than TV ads and digital ads are generally cheaper. Additionally, TV ad revenue took a bigger dive during coronavirus than digital ad spend.

However, it is important to consider that though ad rates are rising, there is still a very real possibility that a second wave of the pandemic could hit after more businesses and communities open up. This would, likely, affect the economy once more and thus ad rates.

If we consider this, it is possible that a second wave of coronavirus could mean more penny-pinching from consumers and there will be an influx of ad supply. This could be in publishers’ favor for a moment but advertisers would likely be quick to pull advertisements again if consumers aren’t willing to spend money on products, and ad rates would go back down.

As we’ve stated before in this blog, advertising is one of the easiest things to cut back on and is usually one of the first things to go when companies fall on hard times. As the economy recovers or declines once more, ad spend is likely to follow, as ad rates typically follow the larger market.

Video advertising rising quickly out of pandemic rut

While ad revenue for video has certainly not recovered, it is one of the fastest growing ad revenue mediums for publishers. This increase in ad revenue is primarily due to Facebook, YouTube, and Snapchat videos. Ad revenue for the three continues to rise even though restrictions are lifting, meaning people may be on their phones less.

The biggest rebounds have been with Facebook and Snapchat. Video ad prices decreased by about 20% in April and Snapchat revenue per thousand unique views was at $1.50 in late March and early April. That has now increased to $3. For Facebook, the week of April 5 ad CPMs were at a 2020 all-time low of $4.83, according to Wpromote. The week of May 25, Facebook ad CPMs had nearly doubled, reaching $8.22; this was a 2020 high.

As advertisers have begun to approach advertising more eagerly again, much of their ad spend has been directed towards video, especially because of the low cost of producing video ads currently. Since video’s popularity has been expedited due to coronavirus, it is not necessarily surprising there has been an uptick in video revenue from these platforms.

Alternative revenue streams

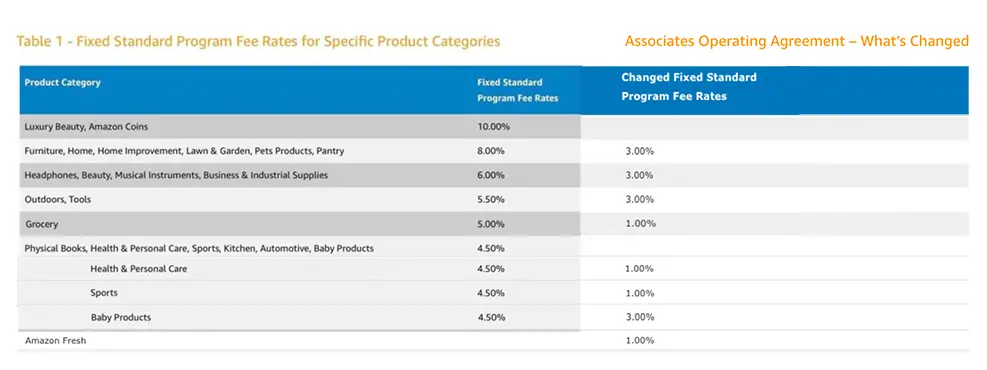

Many publishers were affected by Amazon’s affiliate rate cuts in mid-April, which was a low blow during coronavirus. This mostly applied to smaller publishers who made money off of referring products to their readers, but many larger publishers were spared during the cuts since they usually have their own specific deals with Amazon.

At the time of this publication, nearly 19,000 people have signed a Change.org petition to return affiliate rates to what they were. Amazon has not commented on the petition.

While Amazon may be hurting some publishers’ wallets, some publishers have seen great revenue success with direct-to-consumer advertisements. Many DTC brands have high acquisition rates through programmatic retargeting and spend largely on social platforms, which is usually automated and thus more precise.

Publishers have taken this opportunity to create better, deeper relationships with brands who are doing well during coronavirus. Many publishers are hoping these relationships will pay off even after the pandemic passes.

Subscriptions, keyword blocking, and privacy

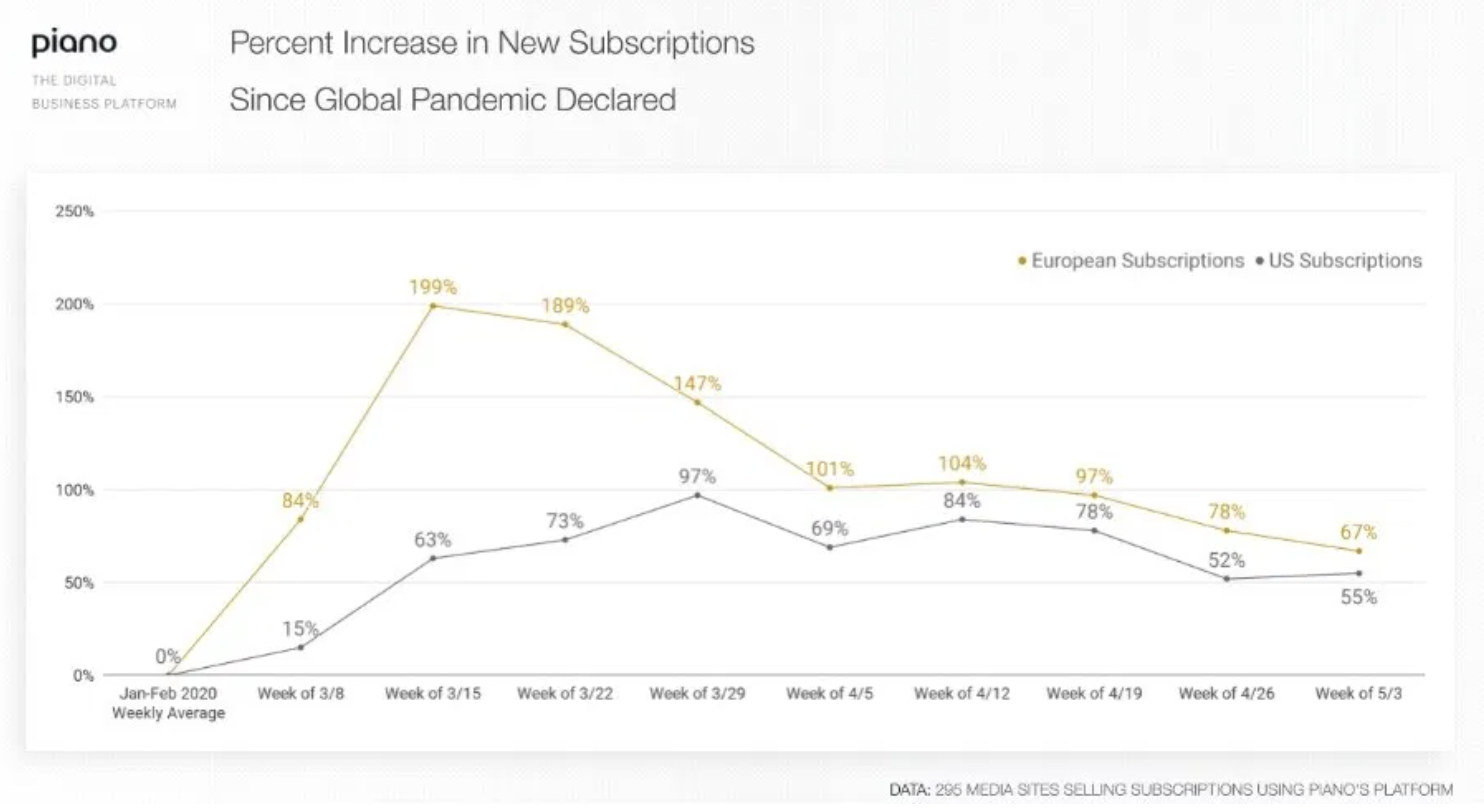

Some publishers have been able to successfully grow their subscription numbers during COVID-19 because many people have been looking for real, trustworthy information. Now, the trick will be to keep those subscribers as coronavirus habits begin to shift more towards pre-pandemic behaviors.

The key to this is to continue to prove why your content is so important.

Focusing on good and unique data is a crucial part of showing your visitors your value. As always, another part of value is quality and distinctive content that readers can’t get anywhere else and focusing on media platforms that are thriving right now. Many new subscribers are younger and more diverse than previous subscribers, and using popular platforms such as social media and newsletters can keep them further engaged outside of your content.

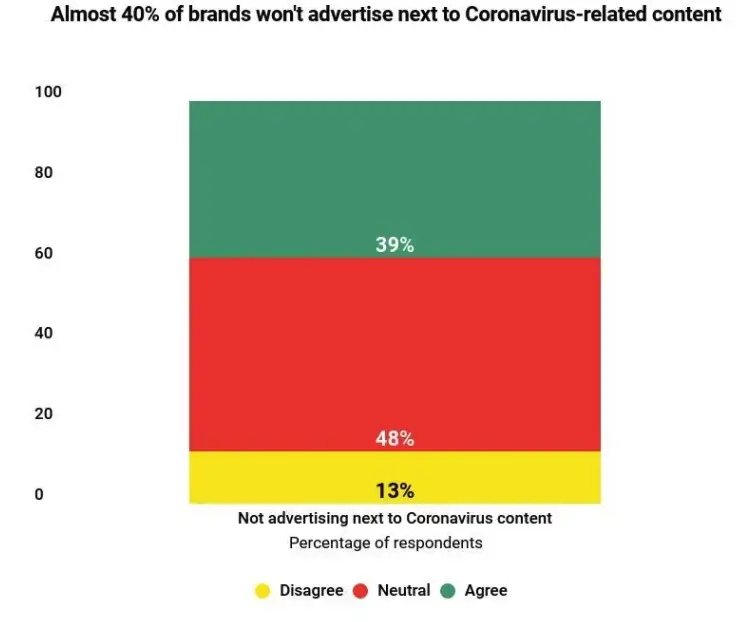

A new Digiday study of 127 publishing execs shows that 43% of publishers have experienced issues with coronavirus-related keyword blocking by advertisers. This concern is validated by the fact that a previous study shows that 40% of brands were not open to advertising alongside pandemic-related content.

This has caused many publishers to lower their Q2 ad revenue expectations.

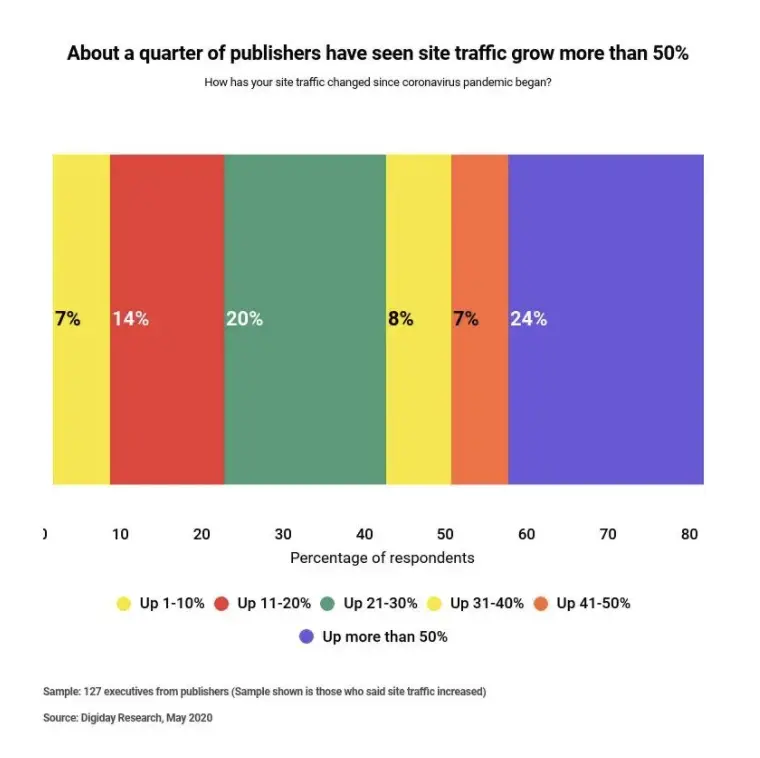

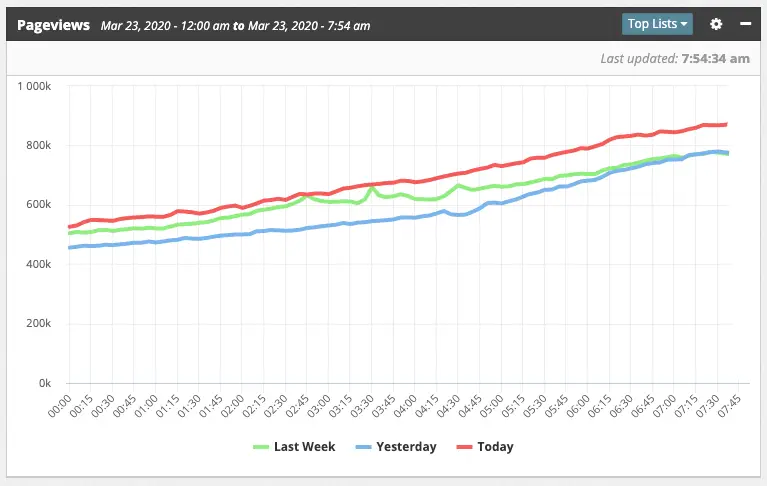

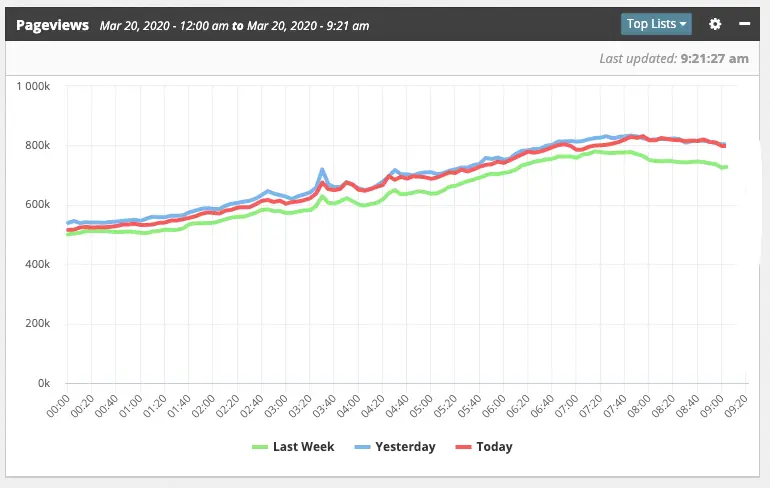

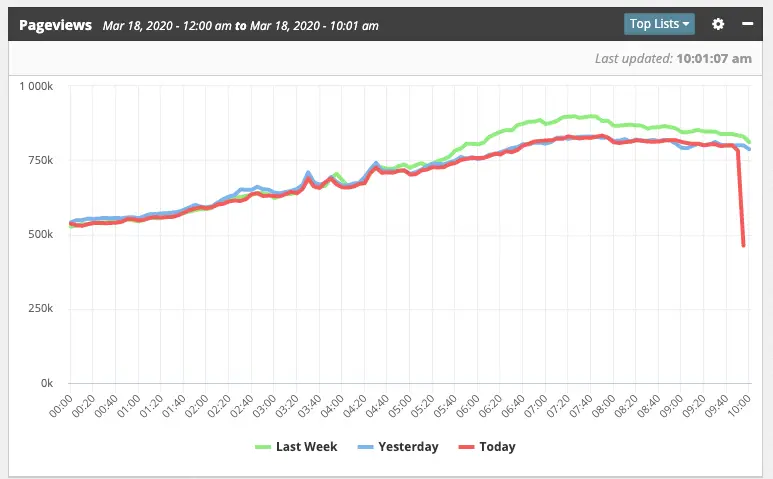

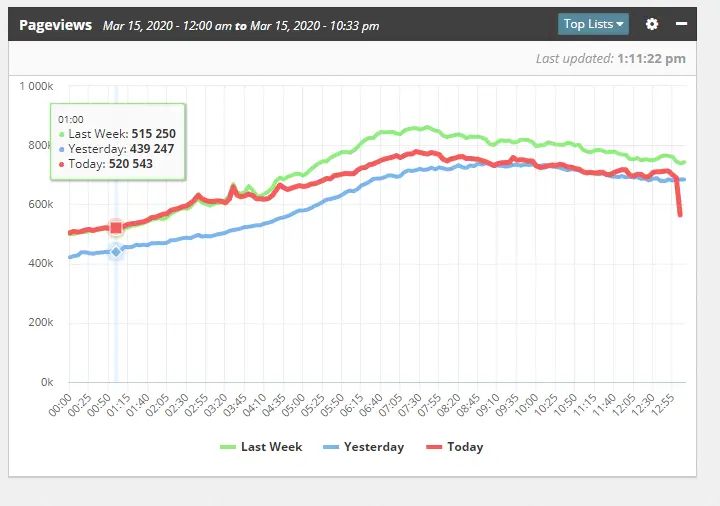

Digiday’s survey also showed that 80% of its publishers it interviewed have seen an increase in traffic and for nearly a quarter has been up more than 50% from before coronavirus, though as we all know, revenue has decreased.

Privacy was a hot topic before the pandemic but has taken a backseat to COVID-19.

A recent report by eMarketer states it’s possible tracking technology may be expedited into the mainstream more due to COVID-19. Artificial intelligence, location and contact-tracing trackers, and facial-recognition were already becoming more popular before coronavirus and this technology is growing even more rapidly because of its use in the pandemic.

Because tech is growing so quickly, it is possible things are falling through the cracks. There are pushes by legislators, regulators, and privacy advocates to continue focusing on security in the wake of hurriedly developed technology that was developed in response to coronavirus.

Consumers are still split about how privacy, regardless of the pandemic, is handled. Research has shown, however, that more consumers are willing to share their data with the government if it is related to keeping them and others safe and aren’t as open to marketers having their data.

[/et_pb_text][et_pb_text admin_label=”June 5 Updates” _builder_version=”4.4.6″ header_3_font=”Open Sans||||||||” custom_padding=”||0px|||”]

— June 5, 9:33am PDT —

Ad rates reached a new high this week at 59. Ad rates will dip over the weekend, but it is expected that ad rates will exceed 60 next week.

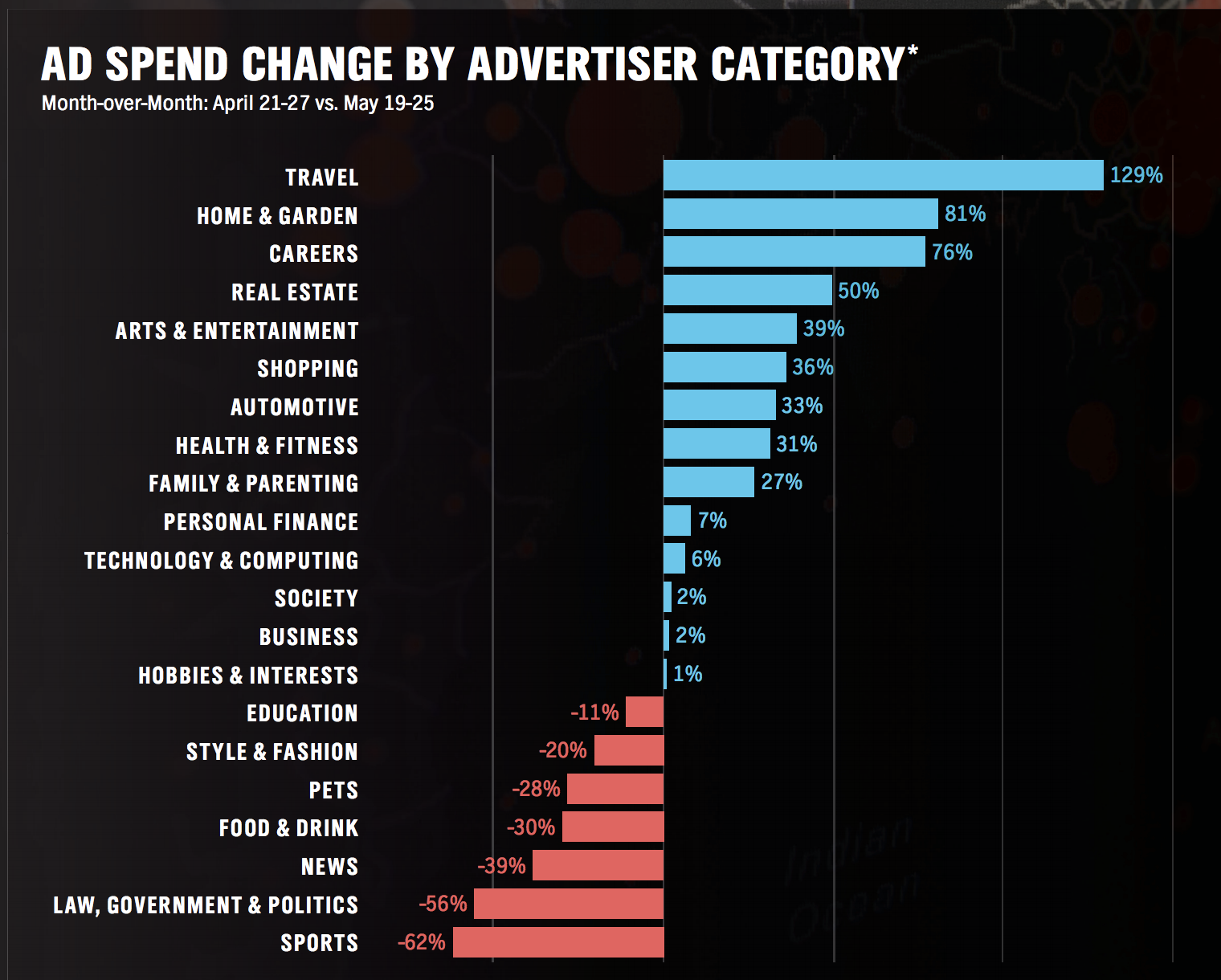

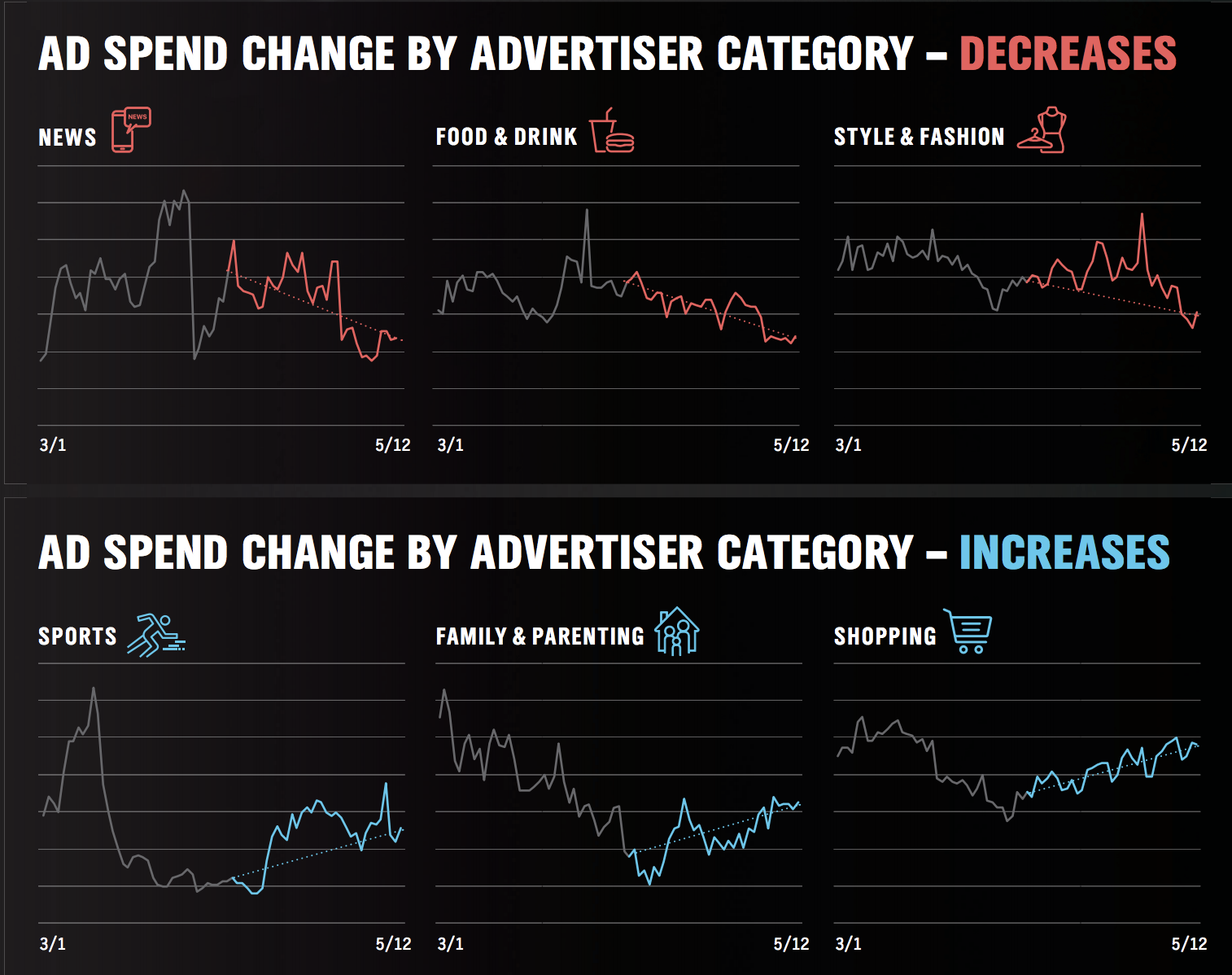

Pubmatic recently released a report about ad spend changes by advertising category and publisher category.

Month-over-month, April 21-27 to May 19-25, travel saw the biggest changes in advertiser categories at 129%. This is likely travel companies trying to take advantage of lifting restrictions and quarantine fatigue. Home and Garden is still performing well as well, since many homeowners are still in lockdown and doing home improvement projects.

As many people were laid off or furloughed during the pandemic, Career advertising is also up; many companies can now see the light at the end of the tunnel and are likely hiring once more, or career support services are advertising to help people find jobs.

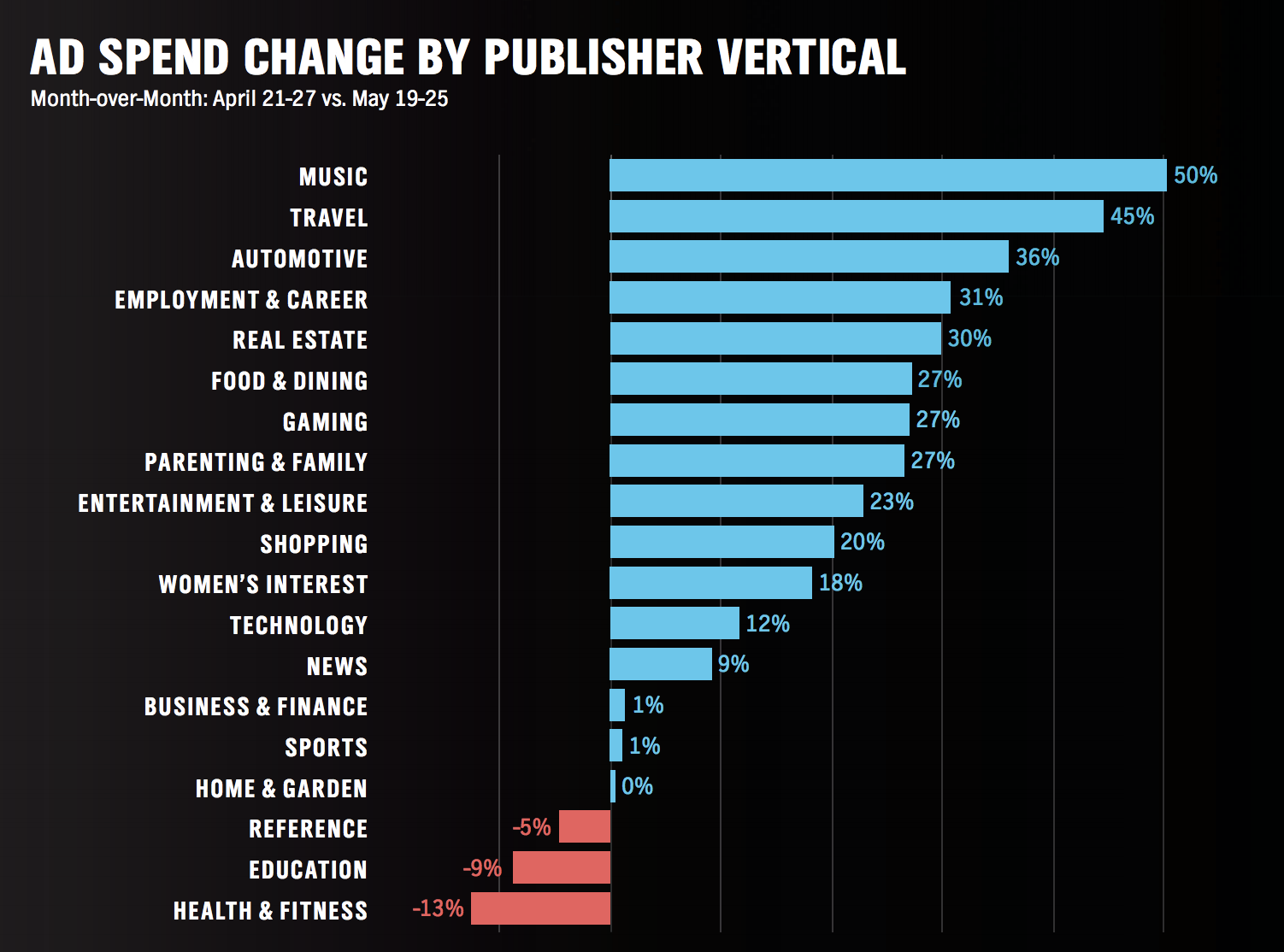

Almost all categories in publisher categories are experiencing positive changes. Publishers in the music, travel, automotive, employment and career, real estate, food and dining, gaming, and parenting and family, amongst many others, are seeing big improvements in ad spend as well. Publishers in these categories should focus on content so that relevant advertisements are more likely to end up on their web pages, increasing ad revenue.

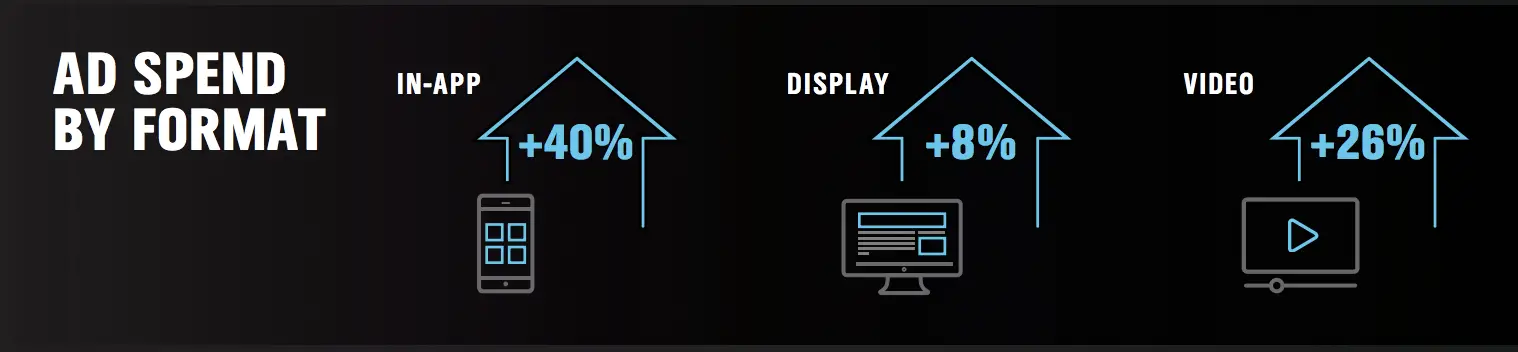

The majority of ad spend is being done within apps, followed by video and then display. Video’s popularity has been expedited due to the pandemic and it is not too late to jump on the bandwagon. Interest in video is only going to keep increasing, even after the pandemic, as it was already a trend before coronavirus started majorly affecting the world. We have a video guide on how to easily start a video series and a blog on how to create an engaging thumbnail.

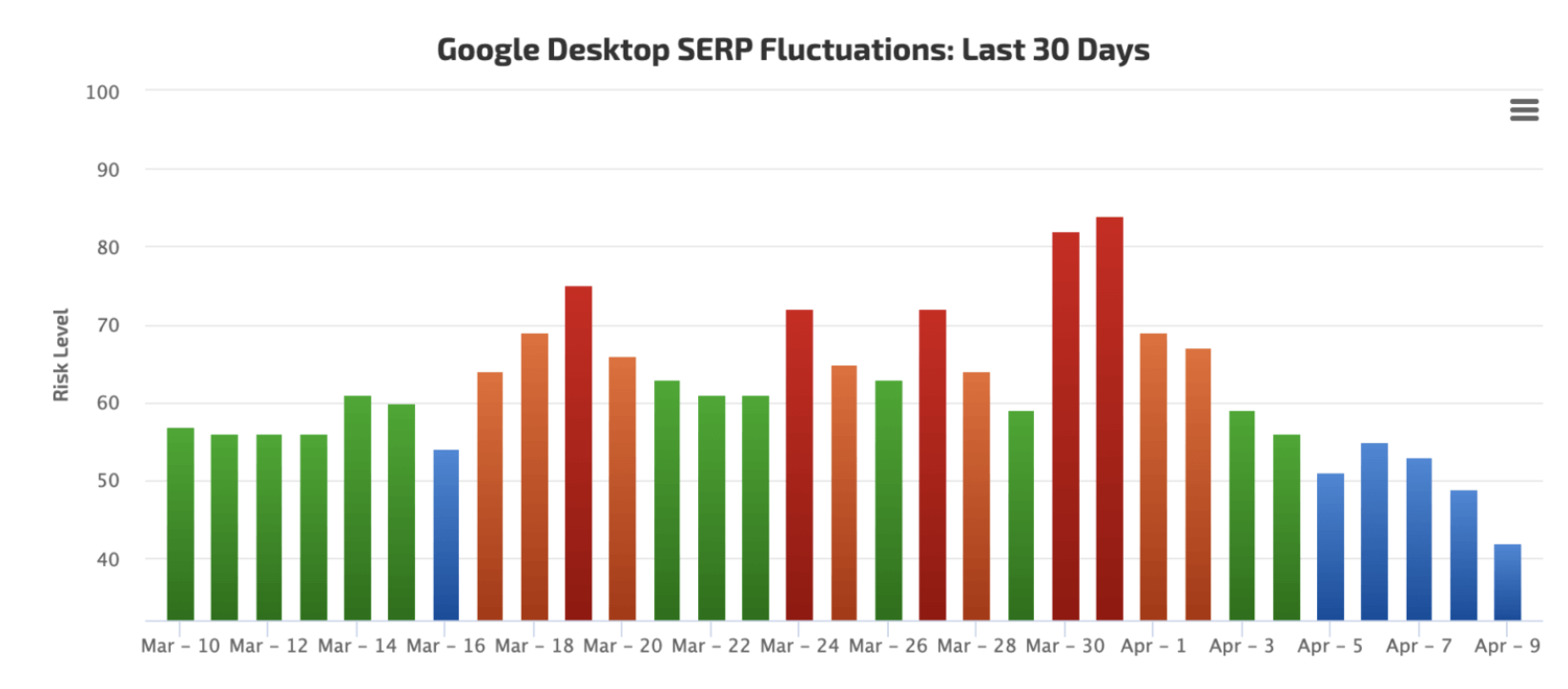

There was some slight ranking volatility the end of May/beginning of June, though Google has not come out and stated any specific changes. This may still be some of the aftermath of the Google May 2020 Core Update.

— June 1, 4:52pm PDT —

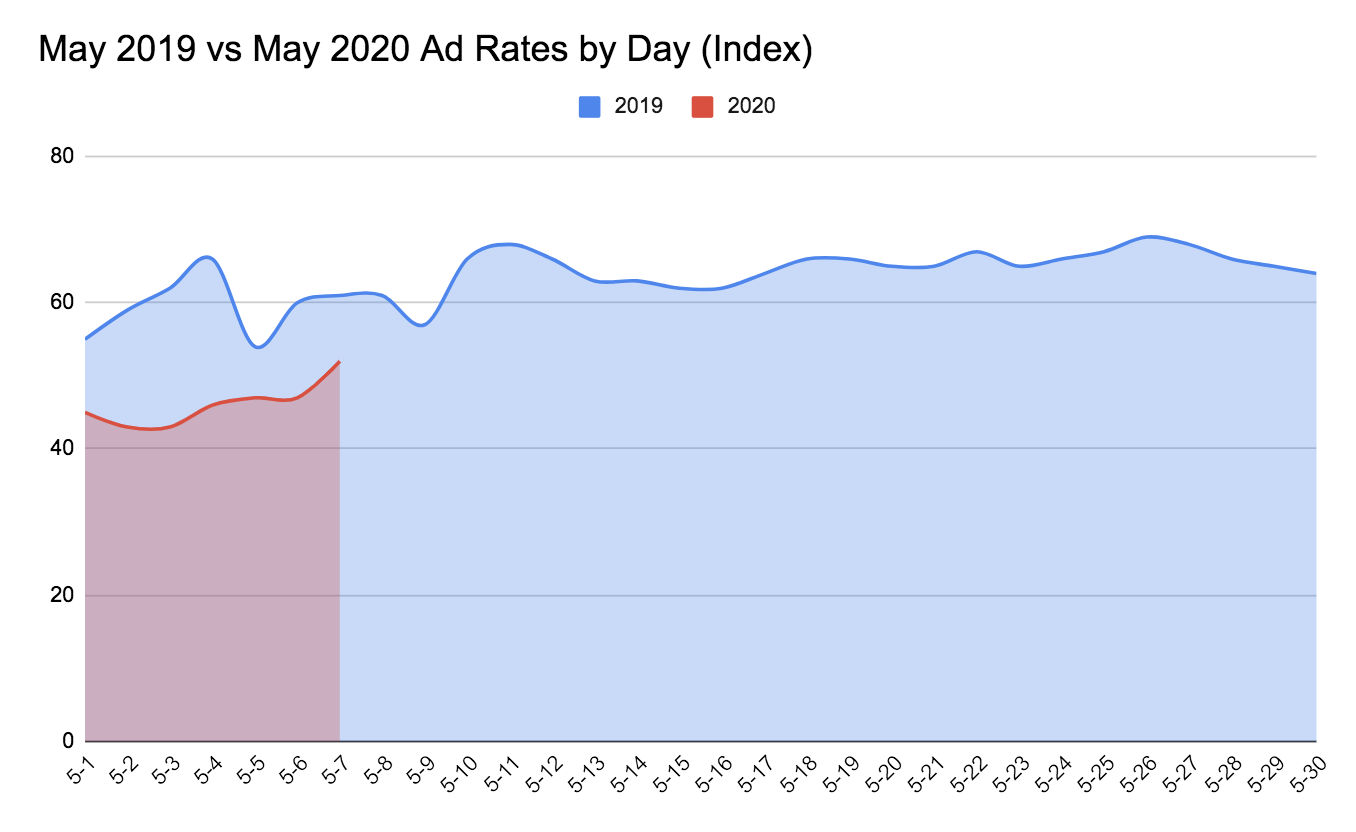

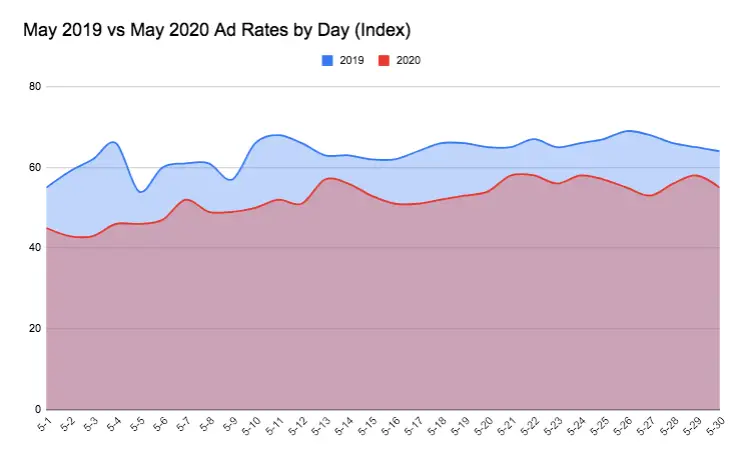

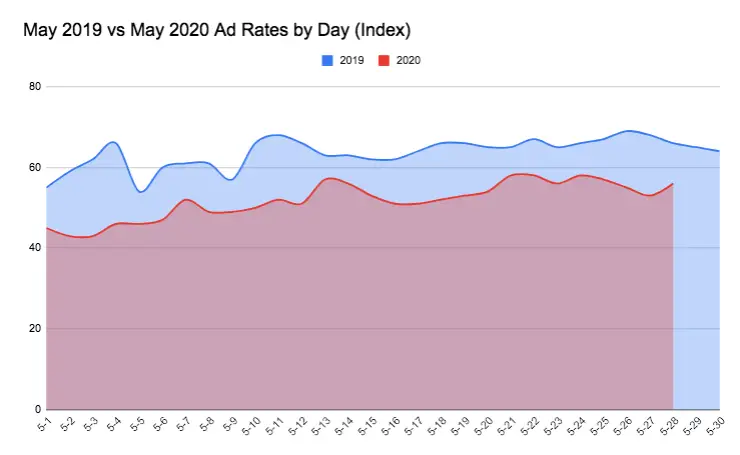

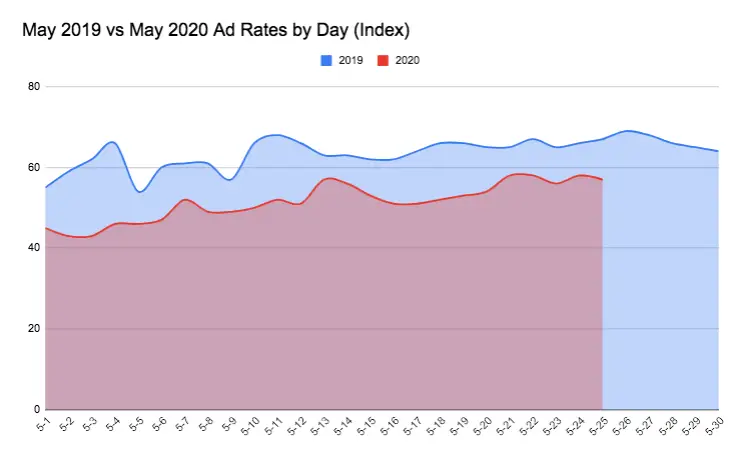

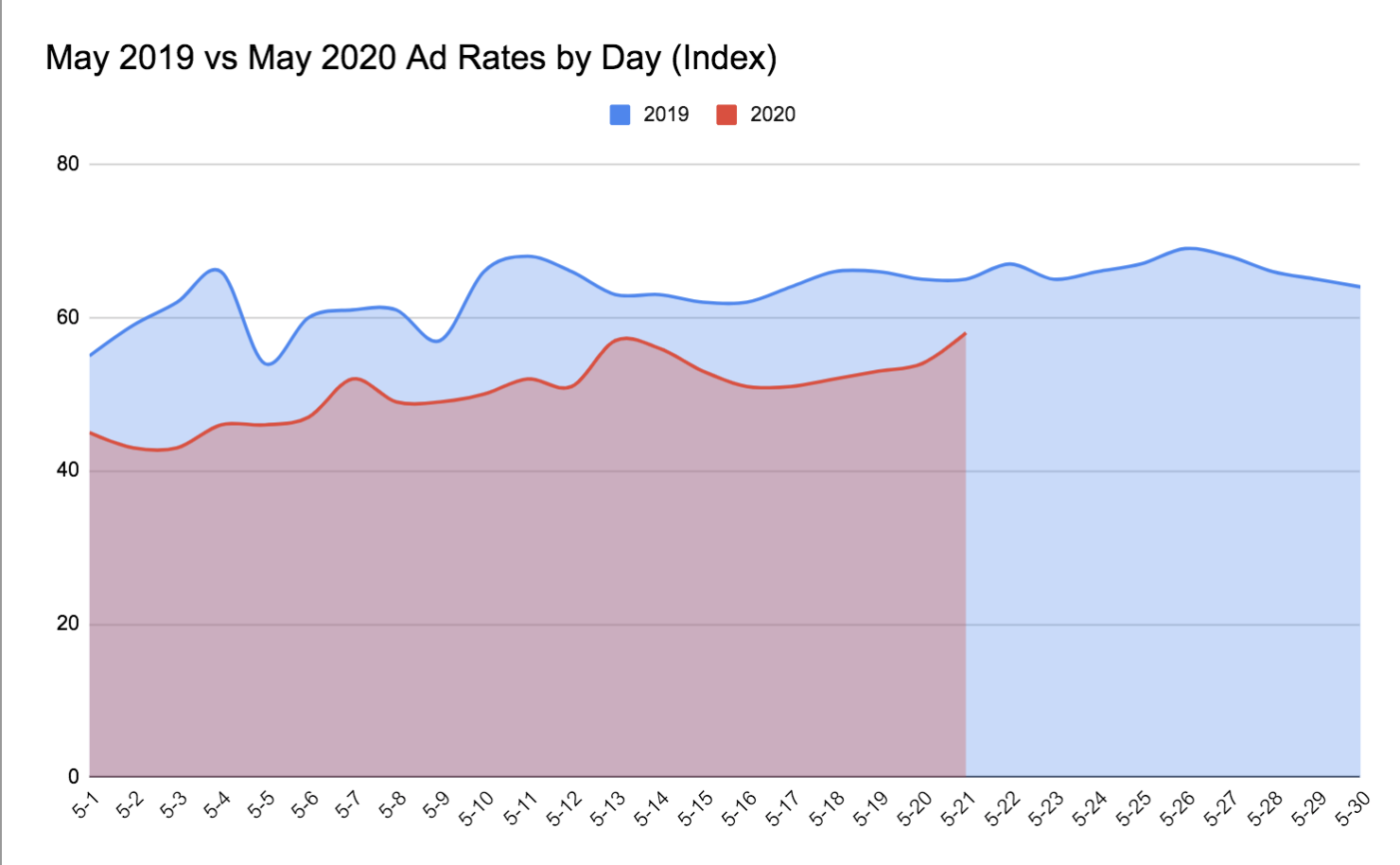

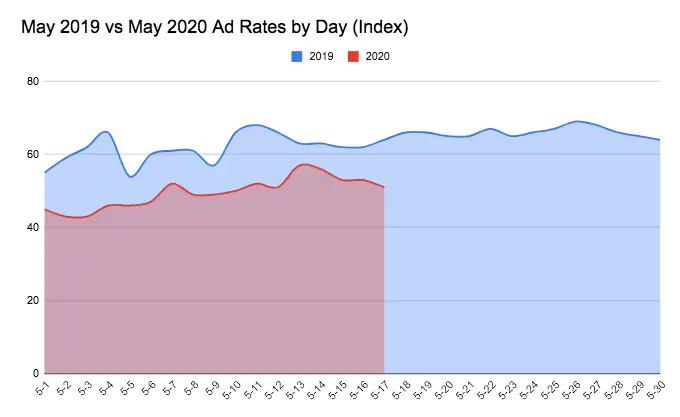

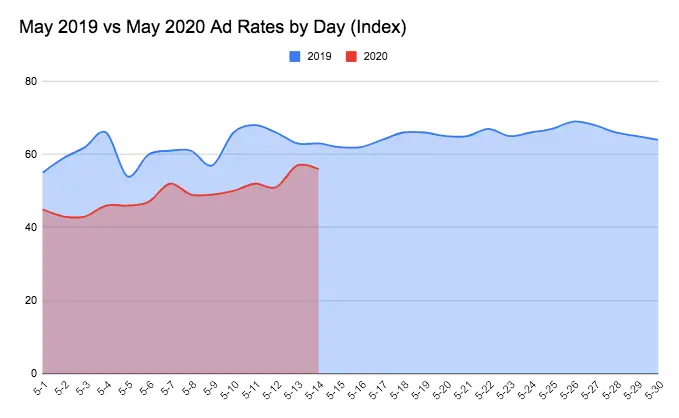

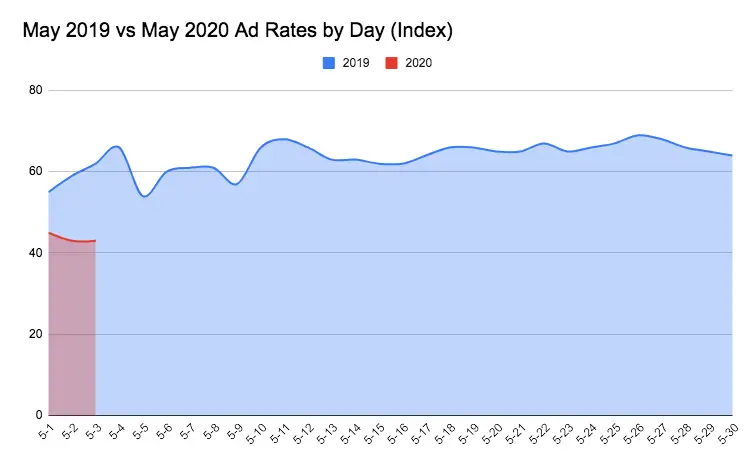

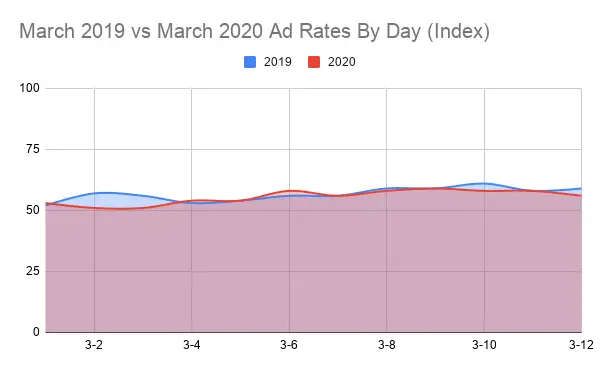

Ad rates reached up to 58 this past weekend and then dipped to 52, which is normal for weekend ad rates. May 2020 finished with ad rates continuing to climb back to a more normal number.

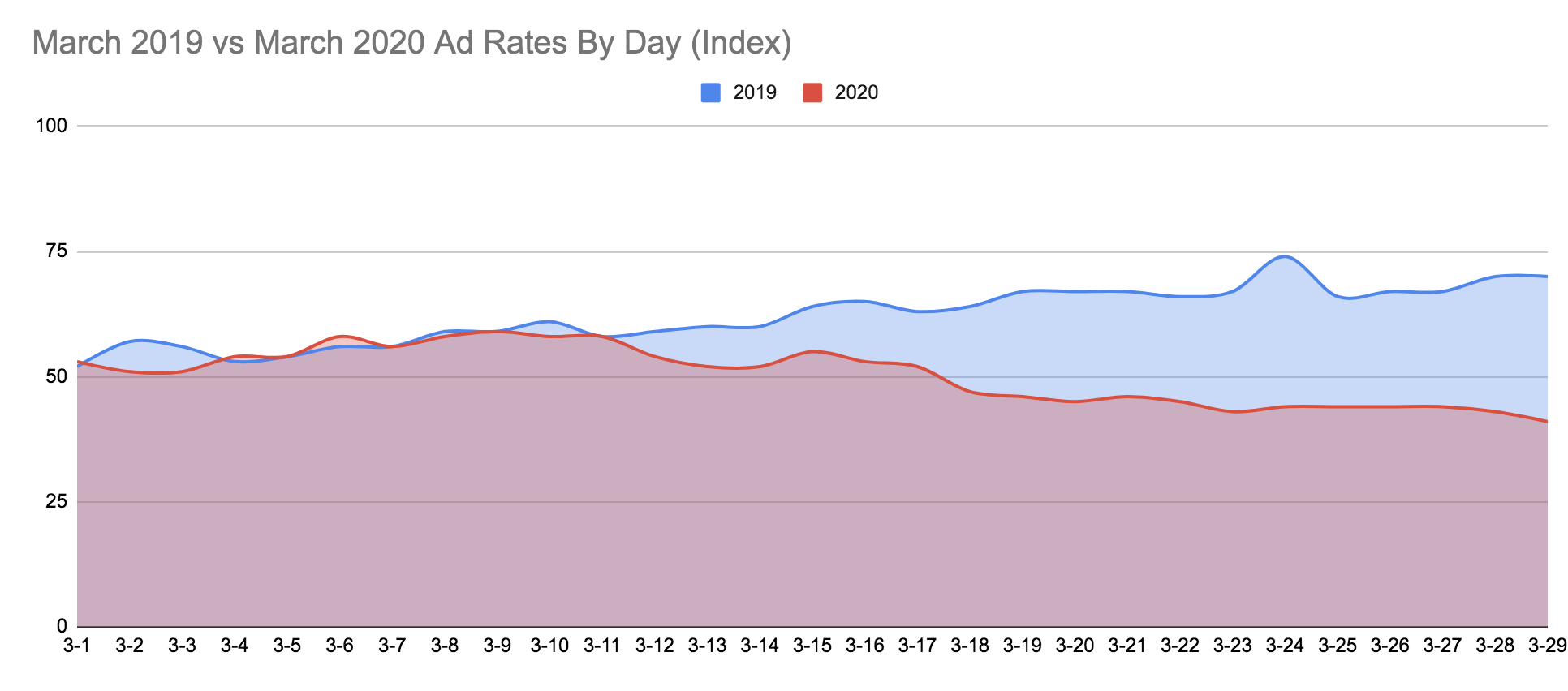

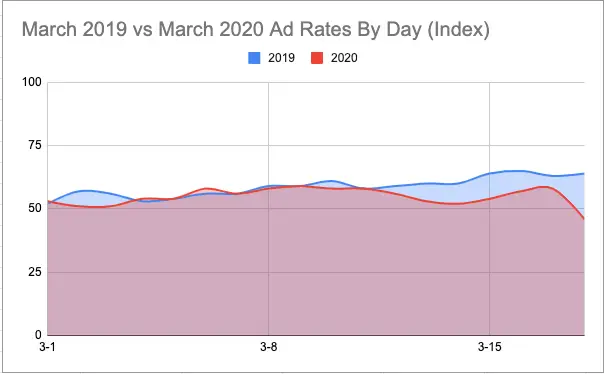

The gap between 2019 and 2020 ad rates is slowly getting closer together, though it is estimated that Q2 ad revenue will overall be worse than Q1, since the beginning of Q1 wasn’t volatile.

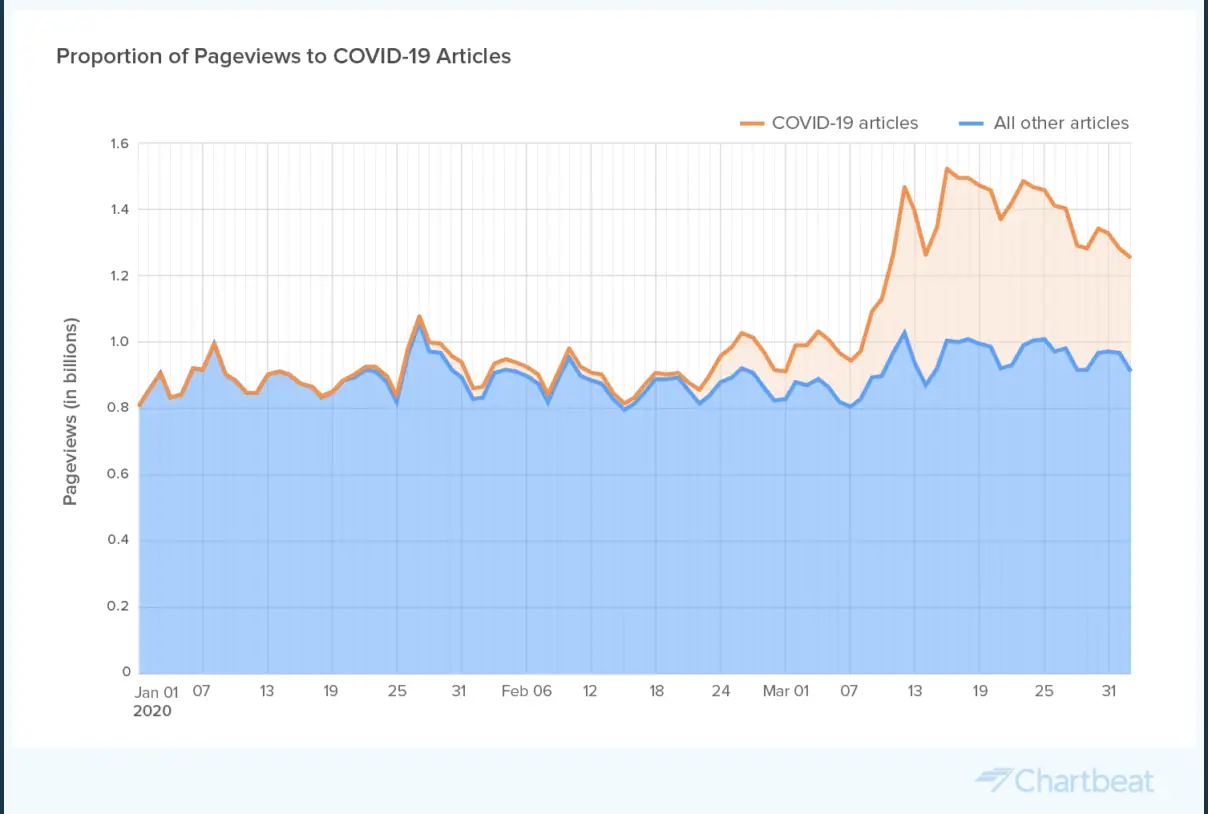

Coronavirus fatigue

Some publishers have seen their pandemic-related traffic decrease in the past few weeks. As far back as mid-April, coronavirus fatigue was evident within audience engagement data; earlier this month, PRWeek reported on a study conducted April 14-16 among 2,033 American adults and found that 93% of those surveyed wanted non-pandemic content. Additionally, 40% of respondents wanted to see stories of hope (41%) and 66% felt overwhelmed by coronavirus news.

Many readers are now ready to read content unrelated to COVID-19. The balancing act that many publishers will have to face is how to write outside of coronavirus without completely pretending it’s not happening.

Advice for publishers is to consider whether your niche is directly affected by COVID-19; if you’re an outdoor niche, it would be worth keeping updates in about what parks are open and how to remain safe. If you’re a food publisher that discusses restaurants, include what different cities’ restrictions are on dining out, what restaurants are open, and what they are doing to keep people safe.

On the other hand, if you’re an outdoor gear publisher, it probably isn’t necessary to include documentation on the pandemic since you’re just discussing specs and performance. And if you’re a recipe blogger, you could just focus on the food rather than include how the recipe is something to try out while we’re all in lockdown. Try to diversify your content and see what performs best.

Using virtual events for subscriptions

While events around the world have been cancelled or rescheduled, some have moved to being completely online. Some larger publishers have used this to their advantage to increase subscriptions to their content.

Publishers like TechCrunch have hosted online events that are for Extra Crunch members only, which has increased subscriptions by 600% YoY. Other publishers, like NYT, are trying to pay more attention to their non-subscriber virtual event attendees to get them to subscribe.

There has always been a relation between events and subscriptions but that conversation rate was pretty low. Publishers have an upper hand in getting attendees to virtual events to subscribe because they are already in the right place to both attend and subscribe—online. However, there is evidence to show that subscribers who had been to a physical event showed more engagement with the publishers’ content online 4 months after the event than before the event.

It is likely that even beyond the pandemic, digital events will be popular for publishers.

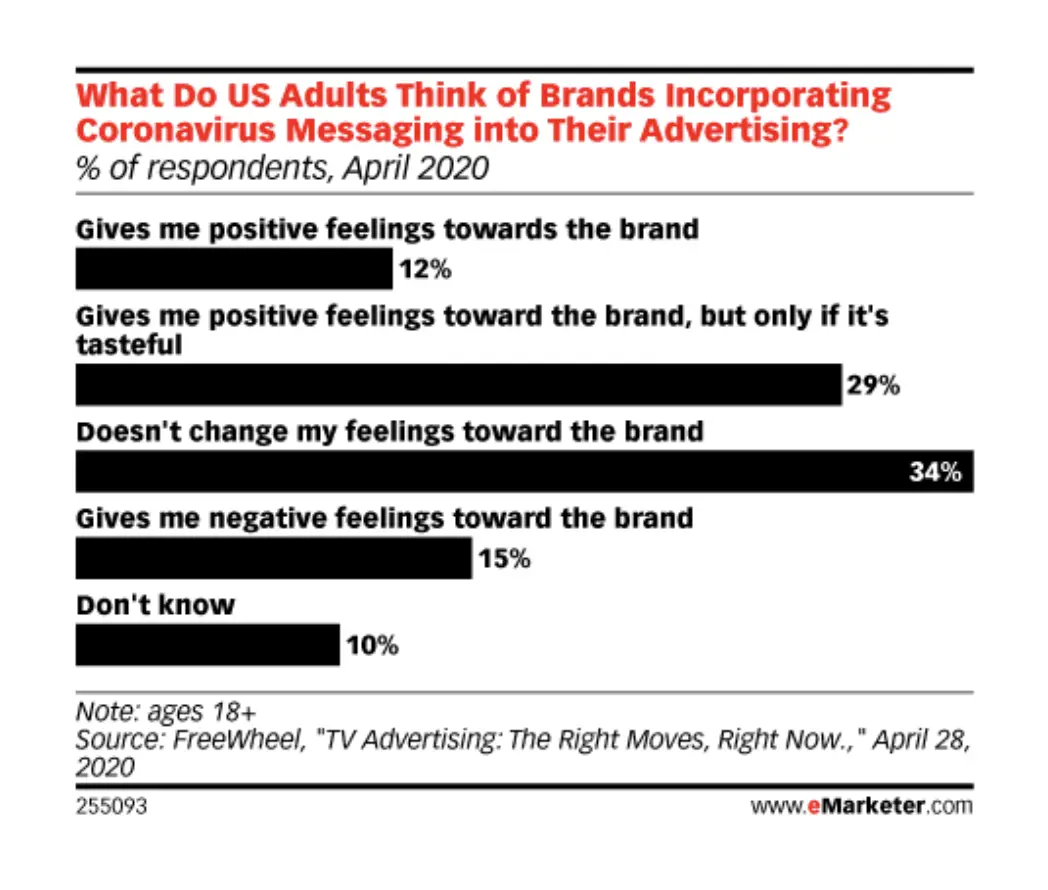

Ads next to coronavirus coverage

Consumers are open to seeing brands advertise next to COVID-19 content, though many brands are still weary of putting their products and services next to material that is “anxiety-inducing,” as stated by eMarket’s principal analyst Nicole Perrin in a recent podcast episode. In fact, many consumers have appreciated when brands have spoken up about coronavirus, as it shows they’re not just ignoring the pandemic or neutral about it.

Still, pandemic-related words are still being blacklisted from many brands’ keywords. “Blacklisting during the pandemic kept more than 1.3 billion ads from being displayed next to content featuring the word ‘coronavirus’ on websites, according to Integral Ad Science,” said Eric Haggstrom, eMarketer’s forecasting analyst.

With pandemic-related content fatigue, advertisers may have missed their chance to really take advantage of increases in traffic to websites, which would have meant more eyes on ads.

— May 29, 1:01pm PDT —

Ad rates have remained in the upper 50s and though they are still well below last year’s, there is still a positive trend upwards.

There was also a slight blip in search volatility earlier today, which is likely some residual effects of Google’s May 2020 Core Update.

Data on reduced ad spend and publisher revenue

A study by the World Federation of Advertisers (WFA) revealed 89% of large multinational companies have put marketing campaigns on hold for May while half are freezing spend for six months. This means that supply and demand between publishers and advertisers will continue to be skewed in advertiser’s favor. Beyond the pandemic, a two-year study by the Incorporated Society of British Advertisers (Isba) found that publishers only receive about 51% of advertiser spend.

Many advertisers are still blocking related words because they don’t want their brand associated with the virus or any negativity, even though it is the most important and relevant topic publishers can cover; Havas Media reported that nearly 80% of ad campaigns use coronavirus-related keyword ad blocking.

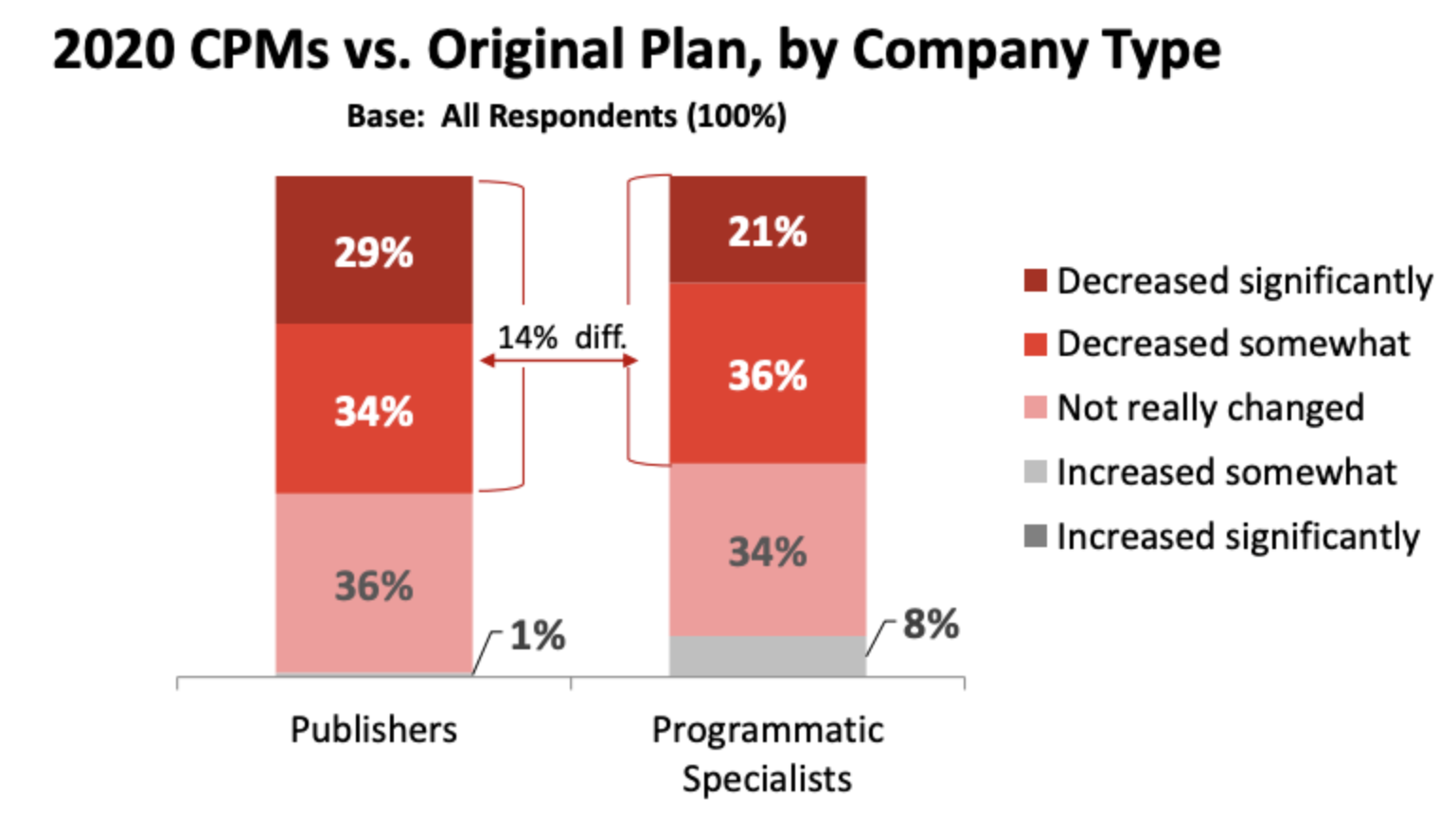

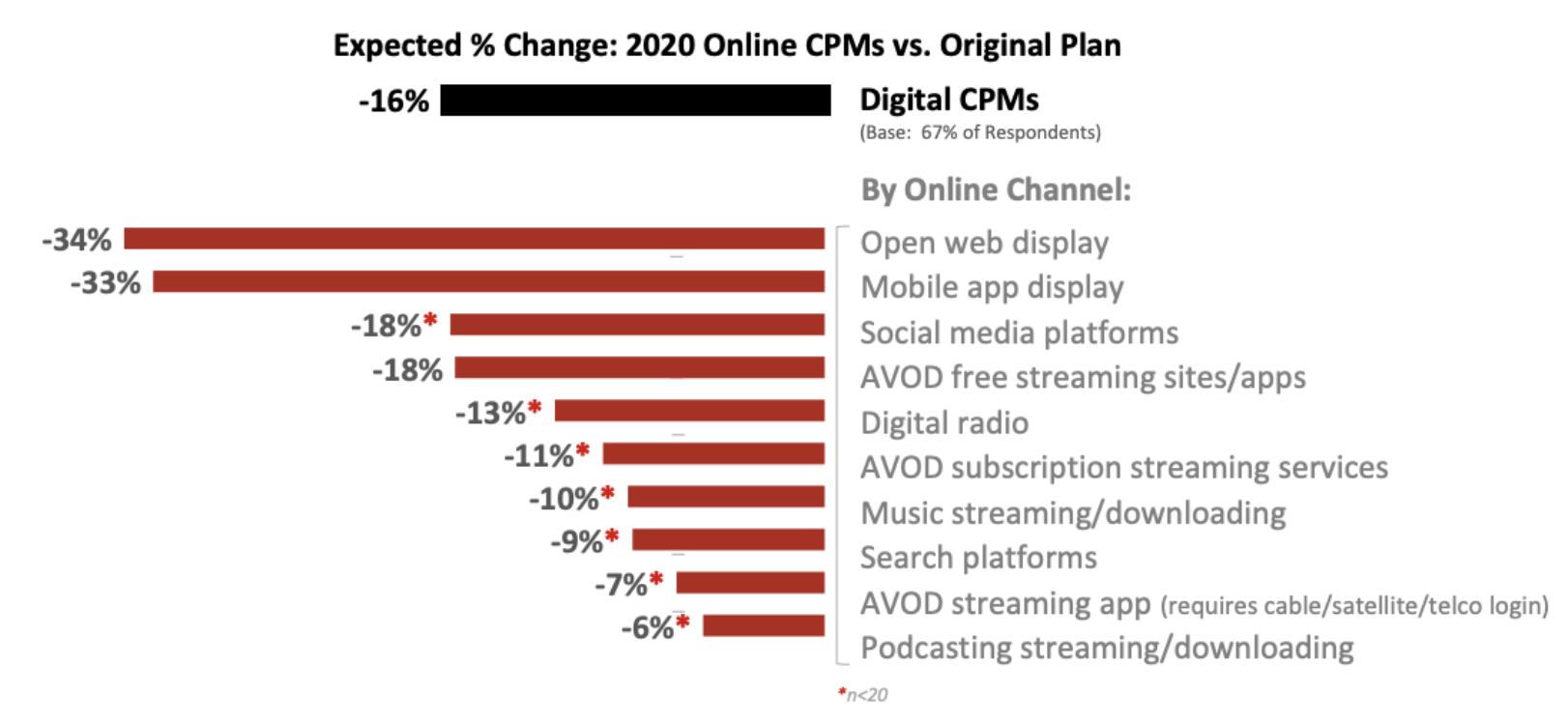

A study by the Interactive Advertising Bureau (IAB) and PricewaterhouseCoopers (PwC) on first quarter ad spend shows that CPMs were down 16% and that 62% of publishers have seen reduced CPMs. The largest drop was in open web display ads.

Despite low CPMs, Q1 ad revenue still increased by 12% to $31.4 billion.

Q2 is expected to be much worse, however, since much of the pandemic’s economic effects did not take place until mid-March and roughly 70% of advertisers either paused or cancelled their campaigns because of the pandemic. It is reported that desktop (27%), mobile (28%), and tablet (29%) advertisements are down, with a 30% decrease in CPMs for display ads on mobile and desktop.

Despite the large amount of advertisers still blocking pandemic-related keywords, there is a shift happening in the marketing world where we might see some begin to ease up. Brands are looking at what they consider safe and unsafe, and as the pandemic will continue to be discussed all over the web for many more months to come, some are relaxing what they blacklist. This should be taken lightly, however, as few have acted and it will likely take months to become more widespread.

Pinterest use skyrocketing during quarantine

People all over the world are looking for new things to do during lockdown and something to look forward to once things are more normal. Pinterest has been one of the most popular places these searches have been happening. It currently has more users than Twitter and Snapchat and has continued growth.

There are 367 million users on Pinterest now and Pinterest revenue reached $1 billion for the first time by the end of 2019. Because of its continued success, Pinterest has been working towards advertiser investments for the last couple of years. While advertising may be down across the web, Pinterest may be one of the only platforms to come out on the other side of the pandemic doing better than before if advertisers will bite.

If you’re on Pinterest, use the increase in traffic to promote your content—write about life after the pandemic and things to look forward to, as well as things to do while people are still in lockdown, and then optimize it for Pinterest. Your content could likely end up on someone’s ‘Post-Quarantine’ or ‘Surviving Lockdown’ Pinterest board

[/et_pb_text][et_pb_text admin_label=”May 26 Updates” _builder_version=”4.4.6″ header_3_font=”Open Sans||||||||” custom_padding=”||0px|||”]

— May 26, 4:50pm PDT —

Ad rates continue to improve through the end of May and stayed above 55 the entire weekend.

This week should be more telling of ad rate improvement now that Memorial Day is over and any potential related ad campaigns will have stopped.

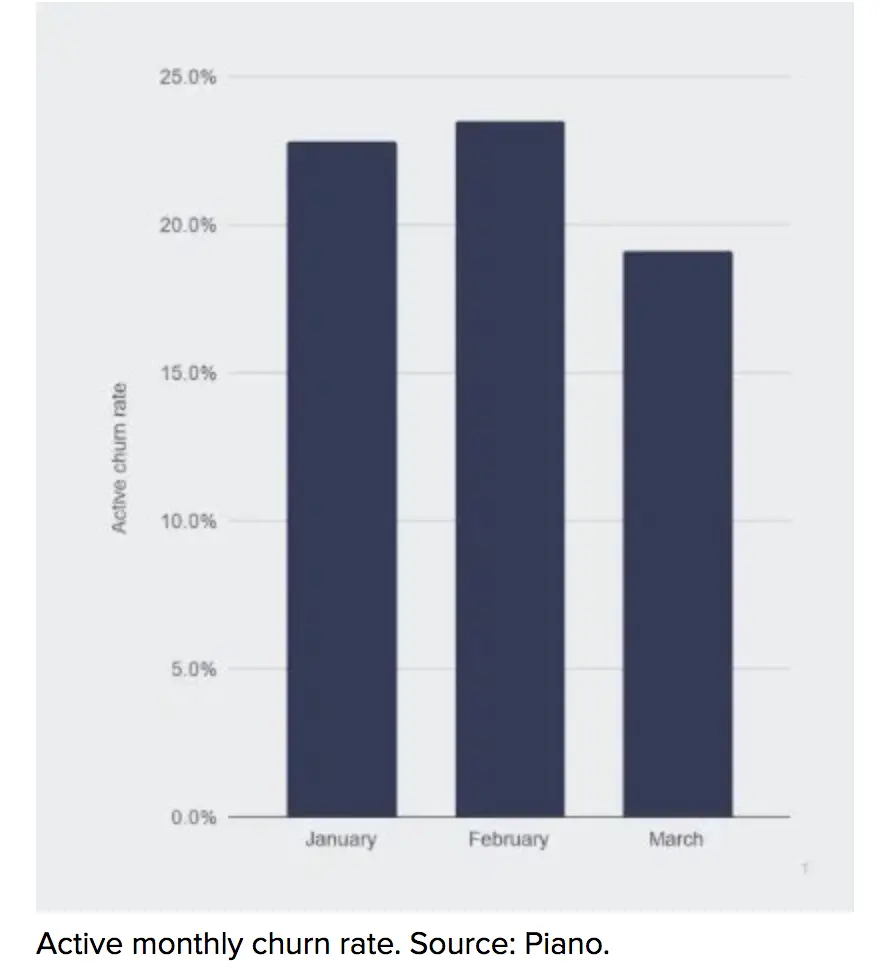

Low churn rate for publishers with new subscribers

Publishers who now rely predominantly on subscriptions for revenue are reporting that many of those subscribers are sticking around. Subscribers who joined in March were 17% more likely to keep their auto-subscribe for the next month than those who subscribed in January or February. This rate is largely due to Europe, whose first-month churn decreased by 34%, while the United States churn rate was flat. A flat churn is still an improvement compared to other months, however.

Additionally, auto-renewal rates were improved; the rate at which subscribers turned off auto-renew decreased by 23% in March when compared with the previous two months.

While there is still no direct evidence to show that publications with subscriptions will continue to have more successful churn rates after coronavirus, readers are becoming more accustomed to paying for quality content than before. This is especially true in Europe, where many publications continue to require subscriptions throughout COVID-19, while many U.S. publishers have been providing content for free.

Subscriptions work for some publishers, though many of the publishers in the report are enterprise publishers, like Bloomberg, The New York Times, and The Guardian. These publications have the reputation and financial bandwidth to implement and improve subscription models. We do not recommend publishers switch entirely to subscriptions, especially without testing; even for these larger publications, subscription increases are still not making up lost ad revenue.

Looking ahead: what publishers expect for 2021

Many publishers are looking ahead to what life might be like on the other side of the worldwide pandemic.

One of the biggest-hit niches during coronavirus is travel. Many travel publications have had to skate by in 2020 while international restrictions keep airlines grounded and borders closed.

However, as these restrictions have begun lifting, travel publishers are shifting their attention from the present traveling situation to the near-future; many are seizing the moment to publish more travel content for both real, physical travel and virtual travel. For example, publishers may now begin posting how to travel Europe in autumn and provide advice for traveling safely as coronavirus continues to pass.

All niches are already looking forward to 2021, even though there have been many reports that say 2020’s ripple effects will continue into 2021.

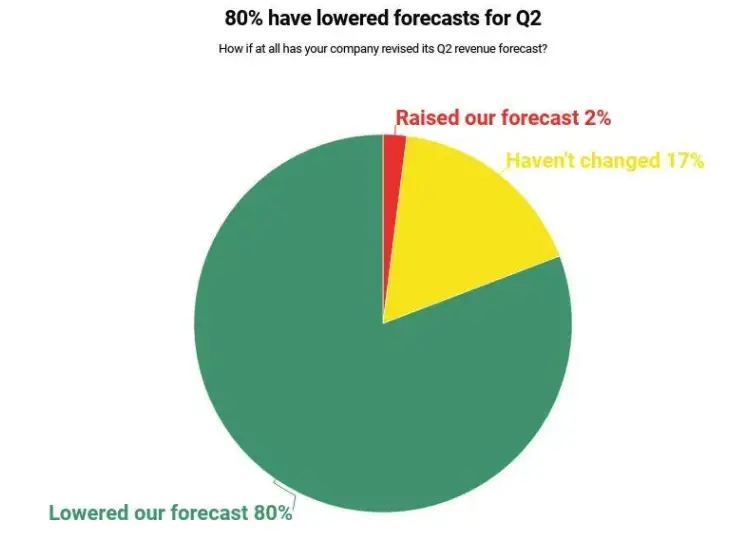

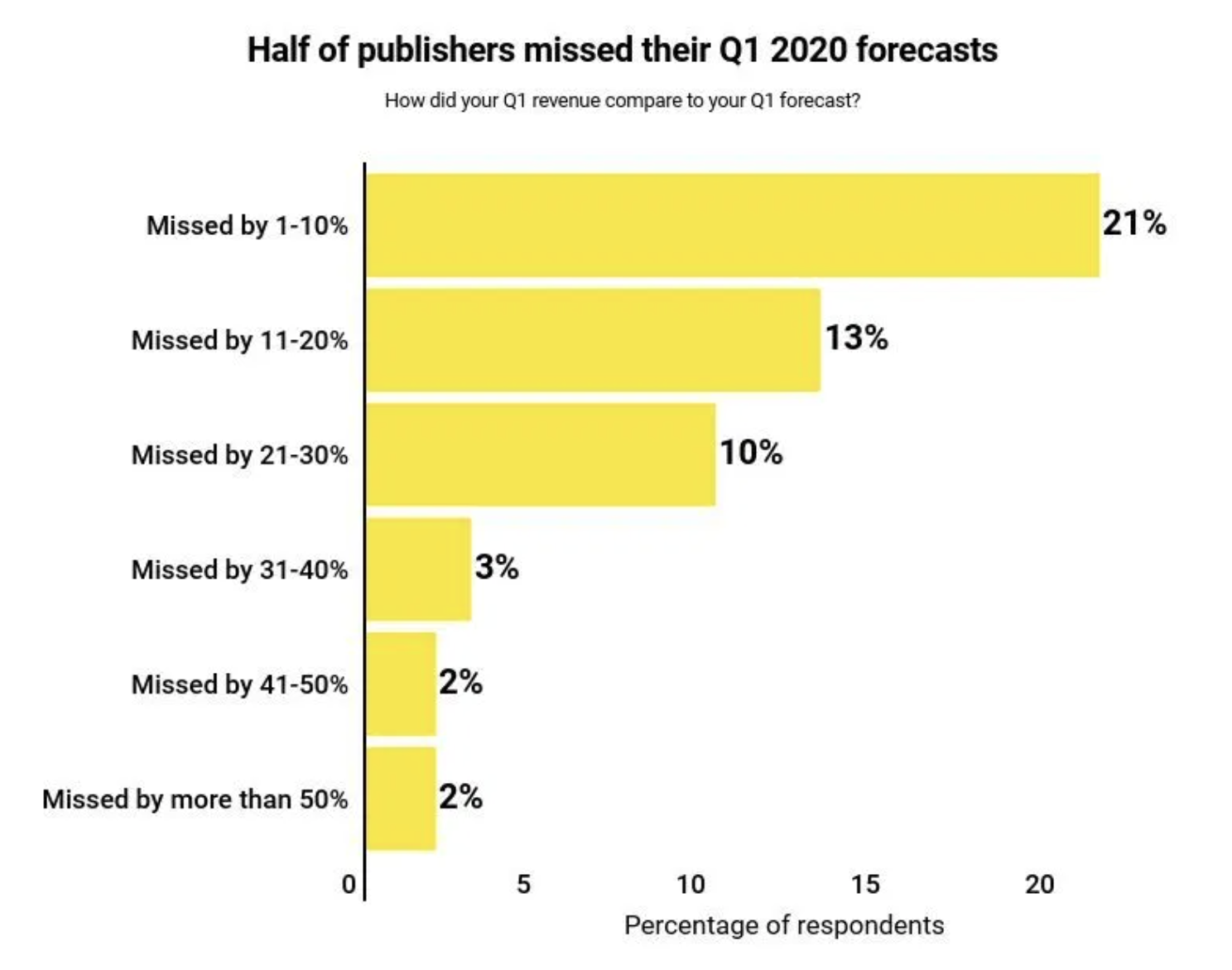

A recent study by Digiday reports how Q1 looked for many publishers this year. It will not surprise many that over half of publishers missed their first quarter forecasts, with news publishers getting the worst of it.

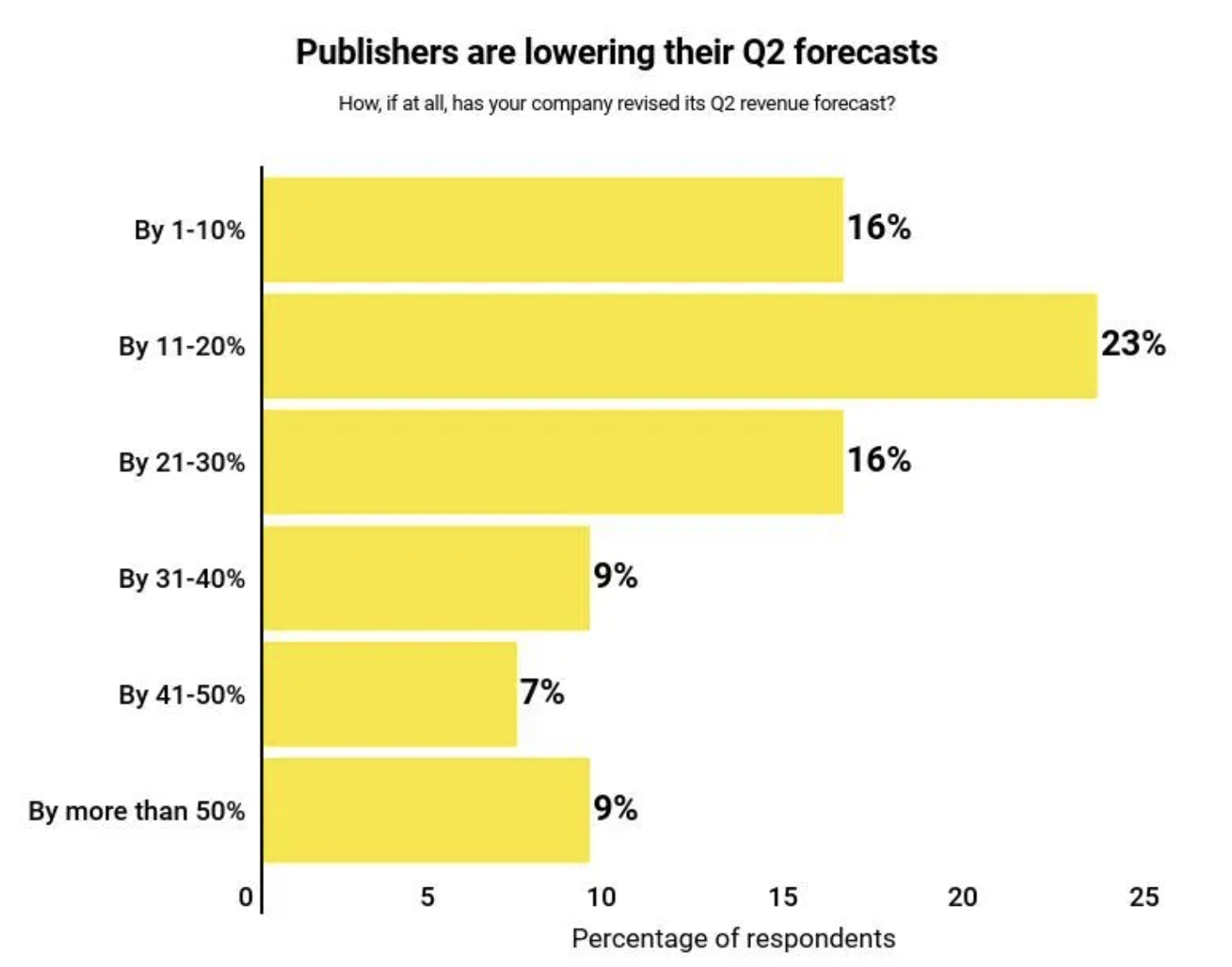

In light of current predictions that Q2 losses will be even more significant than Q1, many publishers have lowered their Q2 forecasts, with 70% of news publishers lowering their Q2 forecasts.

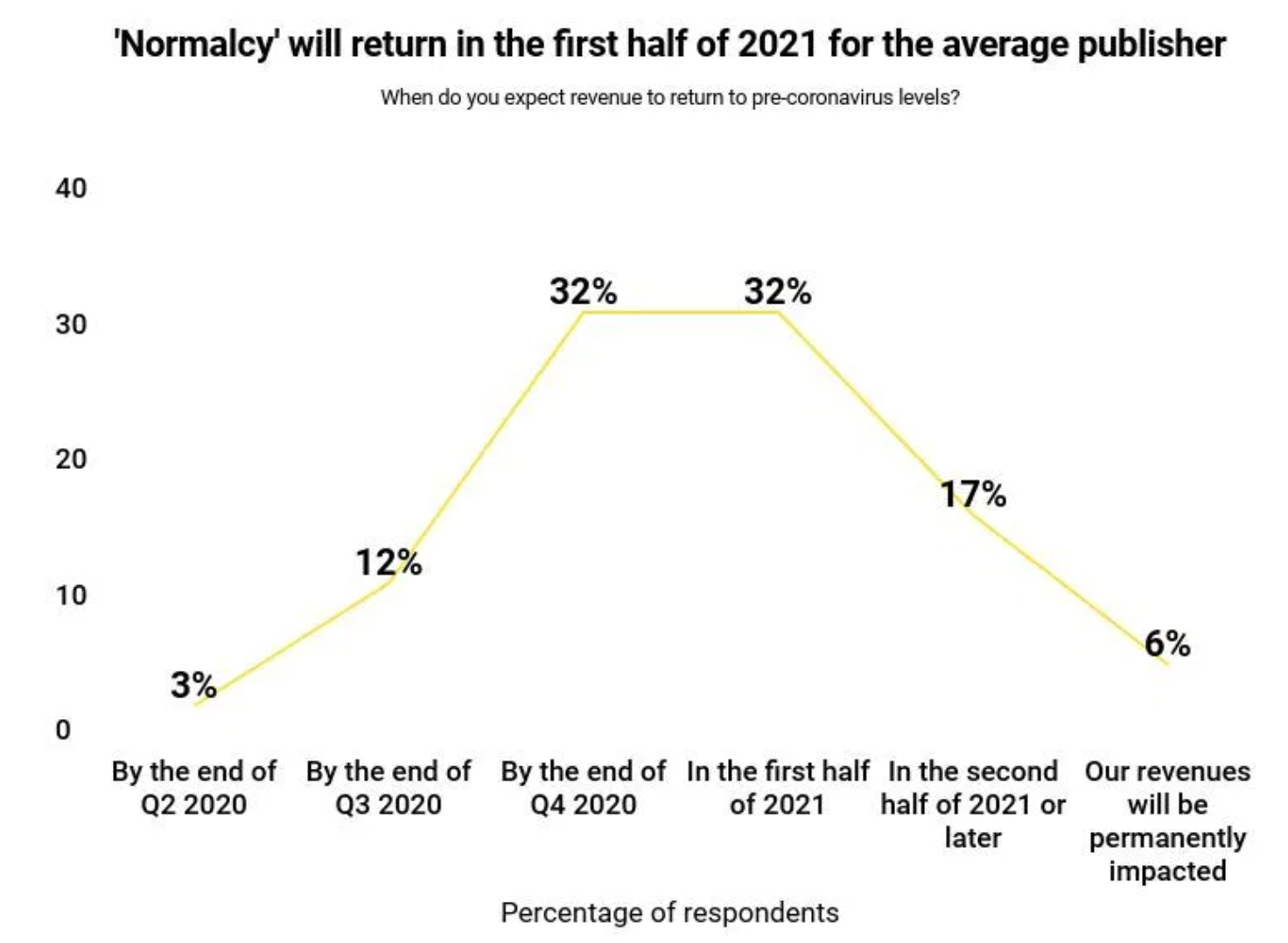

With these major losses, many publishers are wondering when things will begin to level out. Unfortunately, it is predicted that ‘normalcy’ will not return until at least Q1 and Q2 of 2021 by publishers who responded to the survey.

80% of these respondents also answered that their traffic is up during the pandemic, with 25% experiencing more than a 50% increase from before coronavirus. However, many publishers will also note that increased traffic is not followed by an increase in ad revenue. 65% of publishers in the survey reported that their ad revenue decreased in Q1 with continued losses into Q2.

SEO workloads and COVID-19

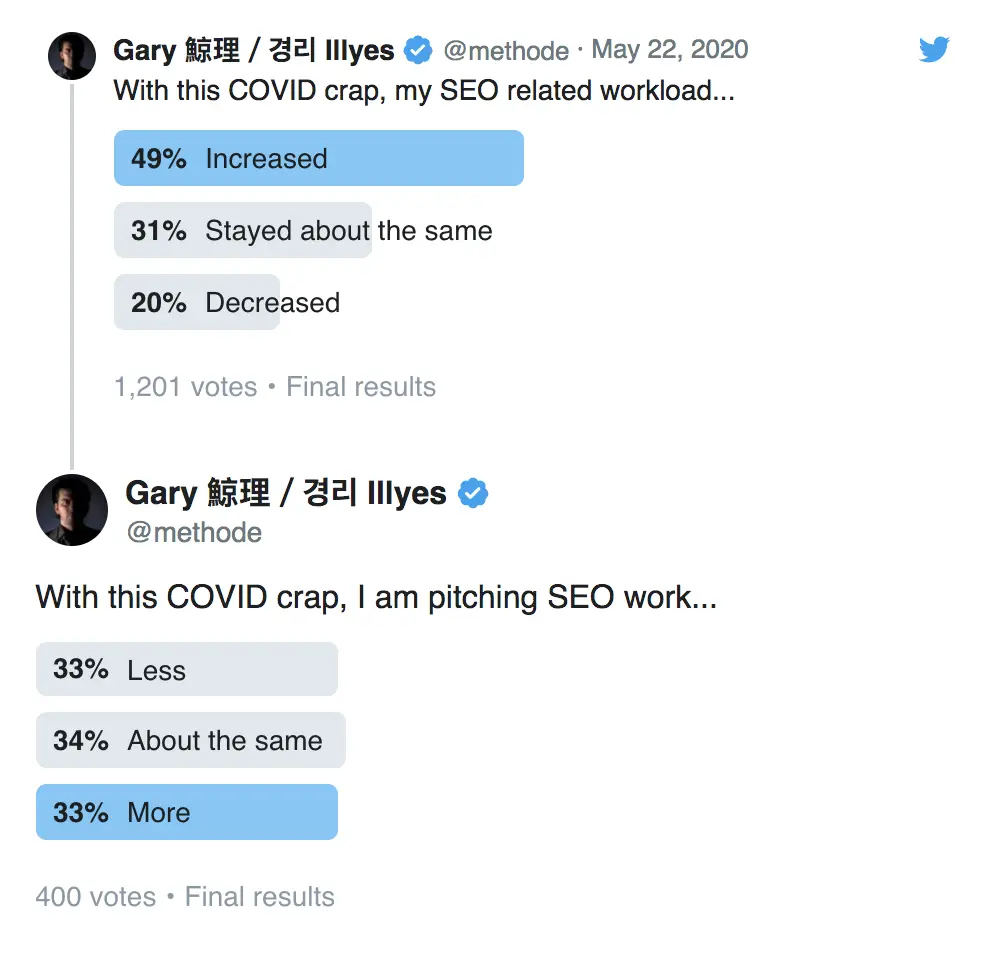

During such volatile times, on top of some major Google updates, SEO has taken many curveballs. Gary Illyes, Google, recently asked SEOs how their workload has been effected by coronavirus.

The majority of respondents (48/6%) stated their SEO-related workload had increased, while 30.9% said it stayed about the same and 20.5% stated it decreased. The majority also responded that they are pitching SEO work more (33.8%) but it has gotten harder (37%) to convince decision-makers about their SEO ideas. Respondents also said working with developers on SEO projects stayed about the same (54.8%).

— May 22, 3:22pm PDT —

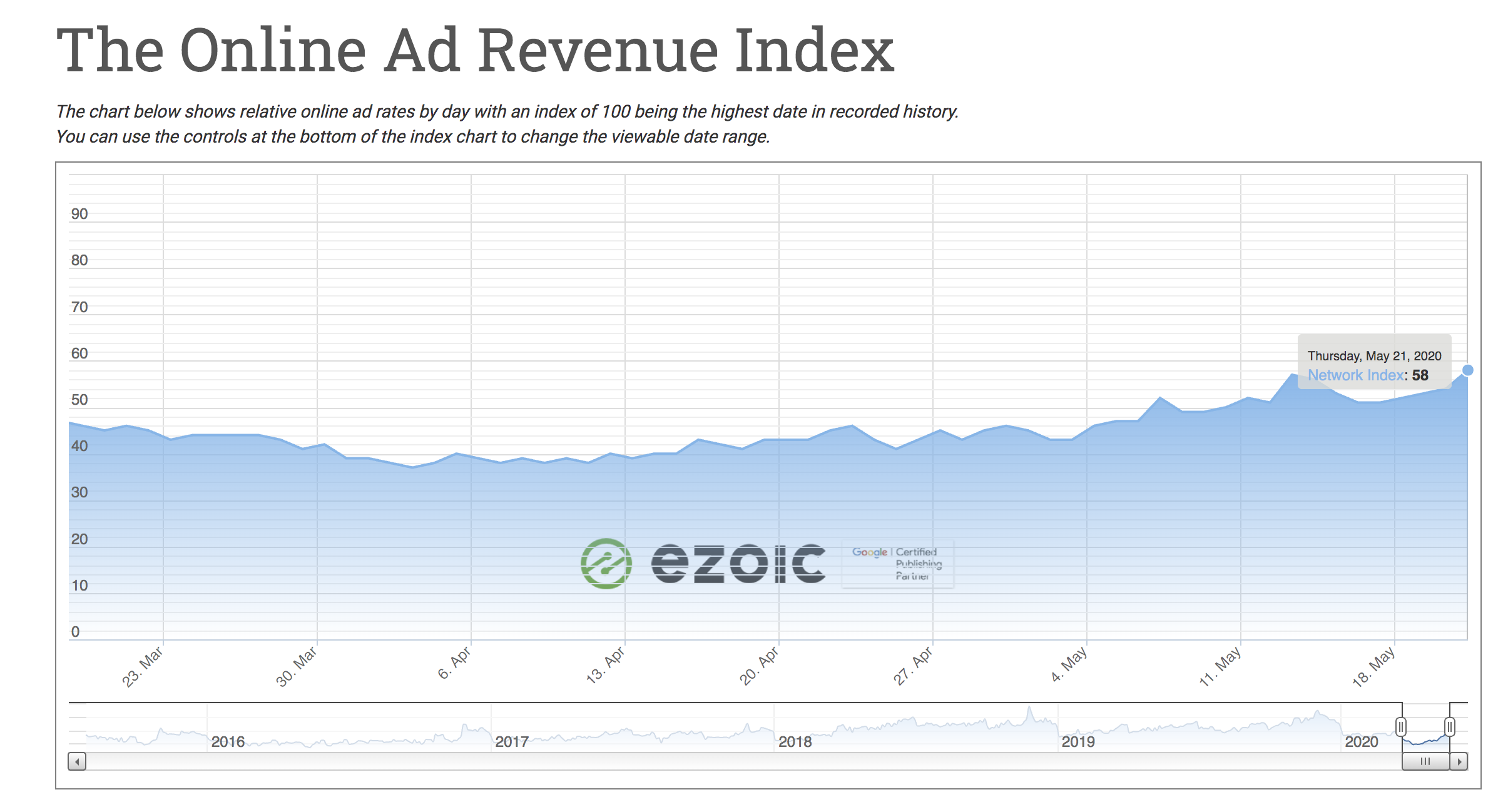

The ad revenue index was the closest its been to 60 since the beginning of the pandemic in the US.

This could be partially due to Memorial Day advertisements for big sales, such as mattresses and cars, but the general trend has been upwards since the beginning of April.

April and May programmatic advertising trends

Reports for April and May’s programmatic ad spend is becoming available as May closes in roughly a week. MediaRadar, an advertising and analysis company, reported that overall, advertising through programmatic decreased 8% between April and March. The industries hit hardest in April were travel, automotive, and events. News, food and drink, and style and fashion have also seen decreases.

- Travel: -79% MoM

- Automotive: -40% MoM

- Events: 34% MoM

Larger companies like Google, Facebook, and Snap have suffered losses during this as well, but have made up for those initial losses through direct response advertising. Direct response advertising is advertising that urges viewers to take an action quickly: a coupon with an expiry date, business reply card, toll-free telephone numbers, hotspots for users to click, etc.

Meanwhile, the largest industries, unsurprisingly, were education and training (including content to educate children), technology, and toiletries and cosmetics. All three categories experienced increases of over 35%.

View Pubmatic’s entire report here.

Other categories faring well are government campaigns, home entertainment—including technology—sports, family and parenting, and shopping. In many facets of these categories, marketers are spending more than usual on advertising during the pandemic than in less trying times.

Since these categories are faring well through the pandemic in programmatic advertising, they are also good content topics, since these advertisers will will want to advertise on content relevant to their ads. Consider how you can create content related to children’s education or entertainment, popular technology, or home entertainment (or government campaigns, if you can swing it).

What else can I focus on during coronavirus?

If your content is not relevant to the pandemic or you’re trying to diversify your content away from coronavirus, this is the perfect time. The initial surge and absorption of information, news, and quarantine-survival strategies has faded and restrictions are slowly being lifted. Now, more than ever, people are going to be looking for things to do and read that are unrelated to coronavirus or that are just simply different than the first round of coronavirus content.

If you equally focus on both pandemic content and non-pandemic content, you’ll not only be providing some much-needed balance between the two, you will better be able to gauge how your website is going to perform once coronavirus passes. The pandemic won’t be around forever, and so if your best-performing content is all related to COVID-19, you are going to slowly sink as things return to normal.

Another angle to consider? The good news out there.

It’s also important to see what trends have been fast-tracked because of the pandemic. Things like video, eSports, and online retail shopping were already growing in popularity before coronavirus, and have blown up since it arrived. These categories are only going to continue growing, even past the pandemic, so you should be considering how you can take advantage of them in your content and website strategy.

Additionally, focus on everything that matters in running a website regardless of outside circumstances—write great content, work on your website’s layout and responsiveness, optimize your ad inventory and ad placements on your website, and stay up-to-date on SEO.

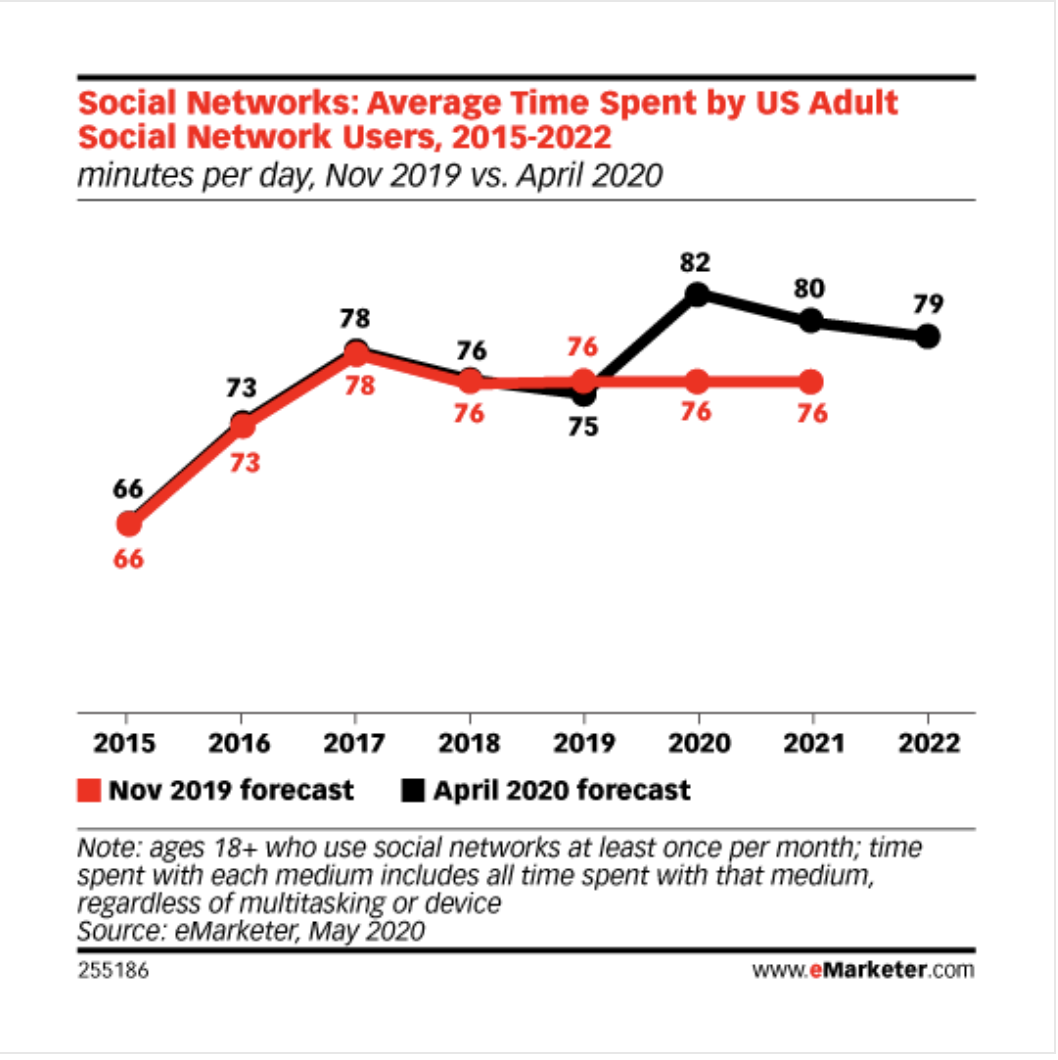

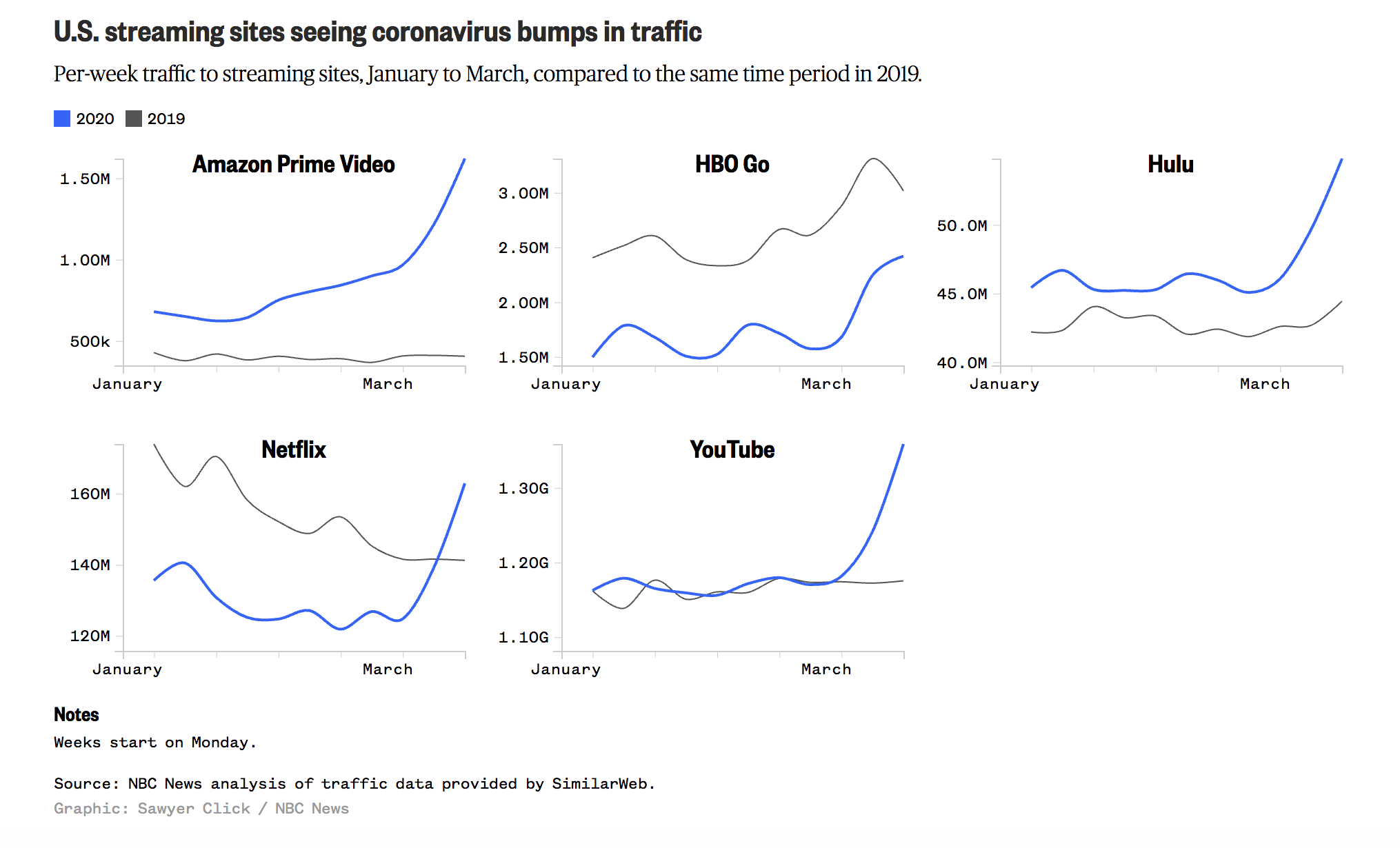

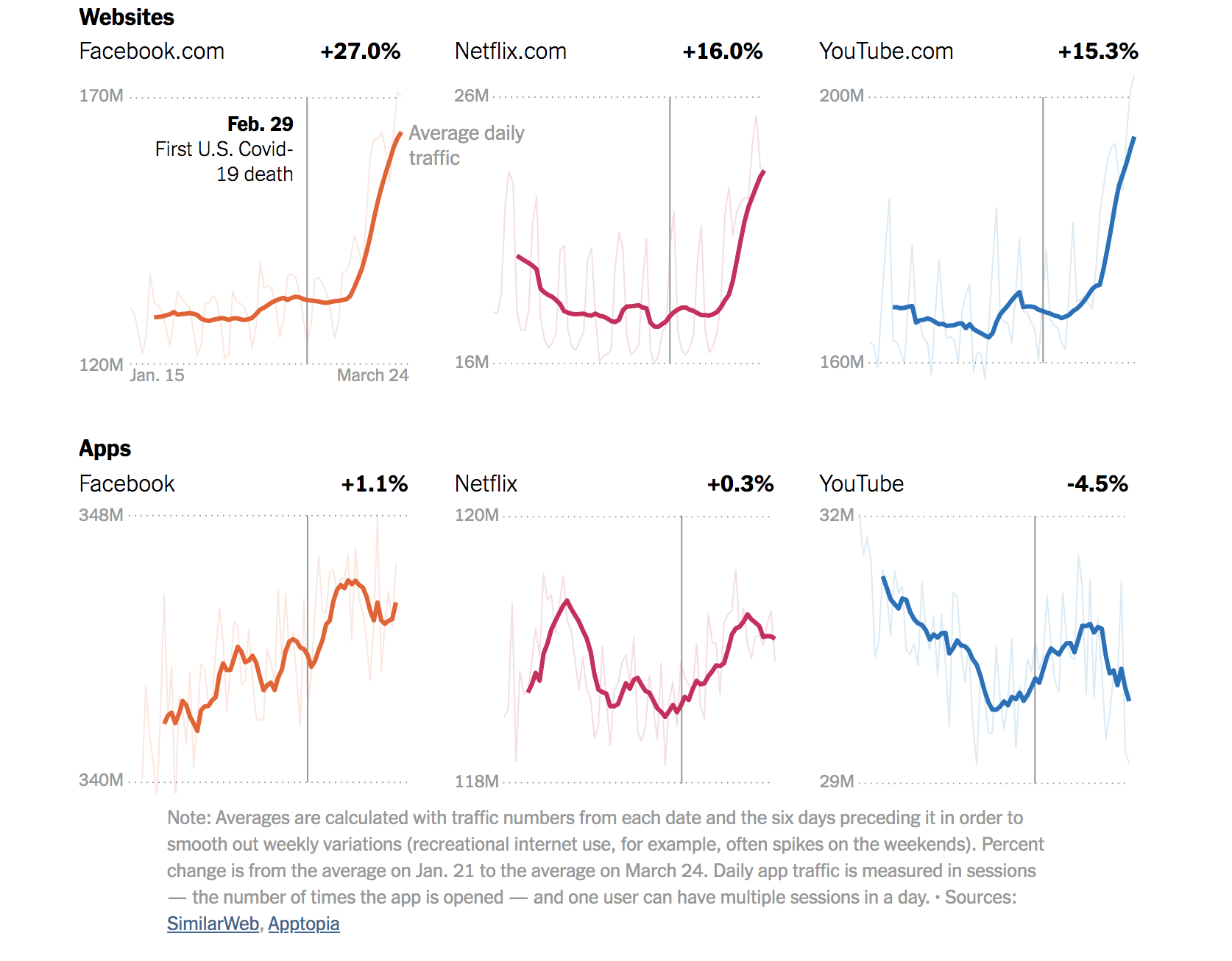

Social networks engagement up, but unequal

In November 2019, eMarketer estimated social network use would continue its slow increase over the next few years. However, this was before the pandemic spread and became an international affair; no one could have guessed just exactly what life would be like now.

Social network use was far above their projections and even higher than social network’s initial surge in 2017.

They also predicted only slight growth for Snapchat and Instagram, while actually believing there would be a decrease in Facebook use. These predictions have fallen way short of the reality, however, due to the pandemic.

Social channels should be given extra attention during the pandemic if it makes sense for your website or brand, as the opportunity to get eyes on your posts has never been higher.

Final Google May 2020 Core Update fluctuations and the return of Google Translate for Websites

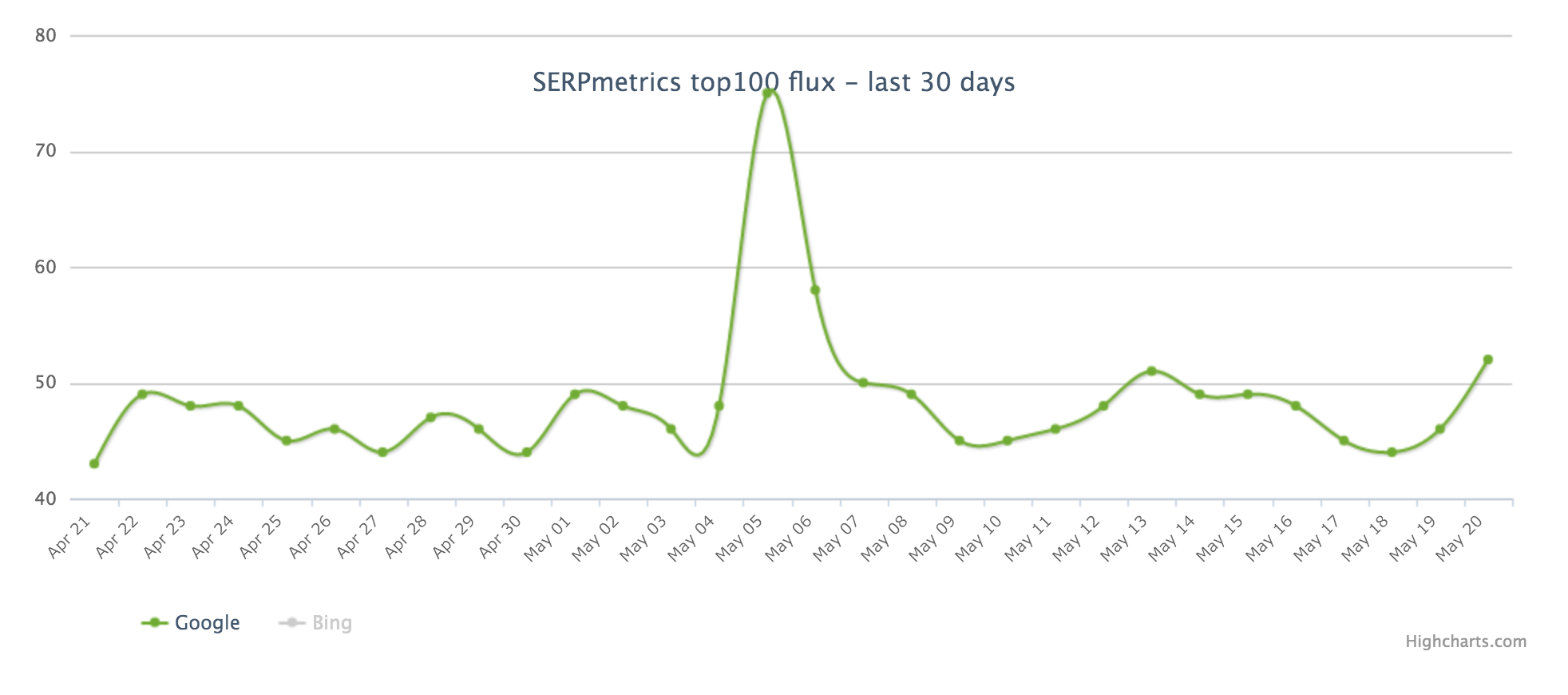

Many across the web have felt the affects of some sort of final update from the Google May 2020 Core Update earlier this month. SERPmetrics’ graph indicating fluxes shows a swing upwards on May 20.

Remember, this update is supposed to help visitors find local news stories and accurate coronavirus information. If your site was negatively effected in the last few days, consider what specific changes you’ve noticed based on real data, not hearsay, and wait it out a bit longer to see if things level out.

Google is reopening access to the Google Translate Website Translator to assist publishers during coronavirus to help better spread important related and accurate information. Webmasters covering coronavirus can translate their material into other languages by signing up here.

— May 18, 10:47am PDT —

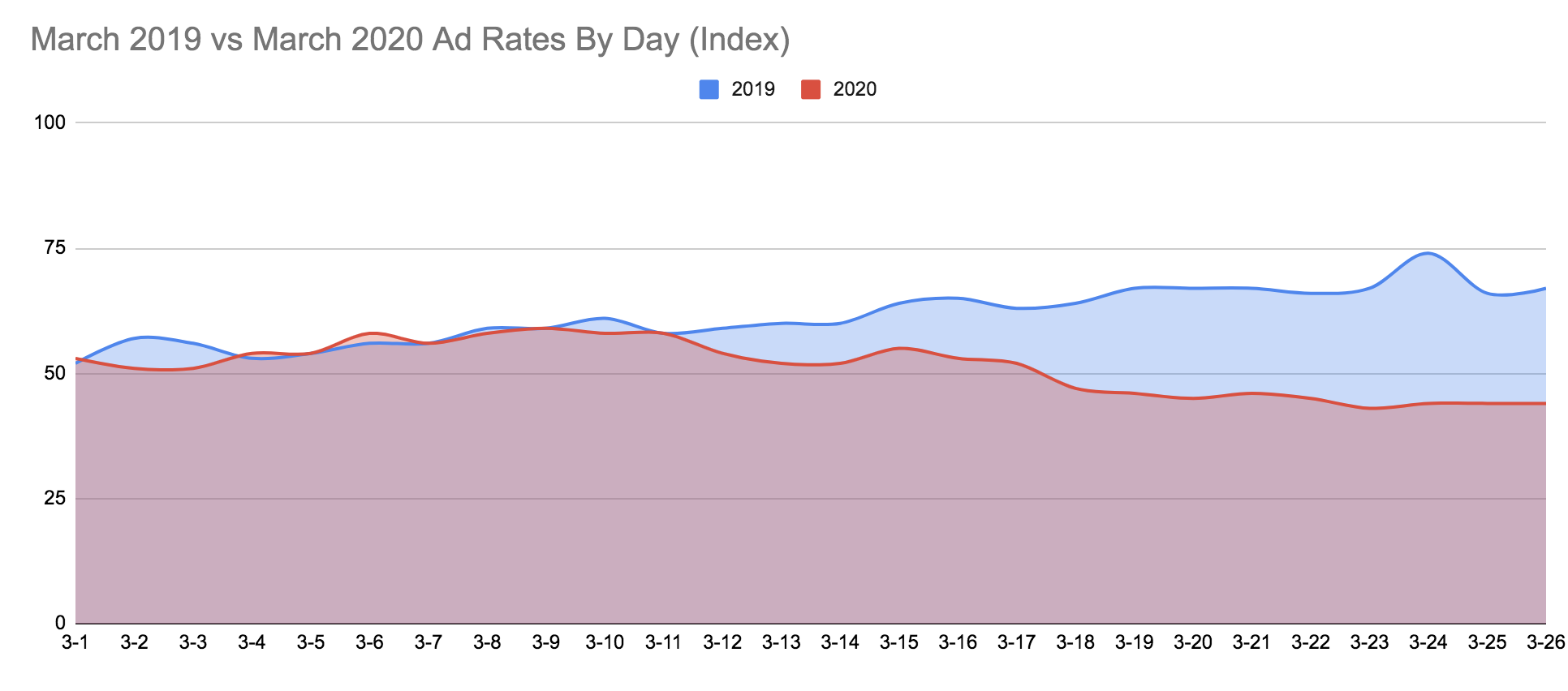

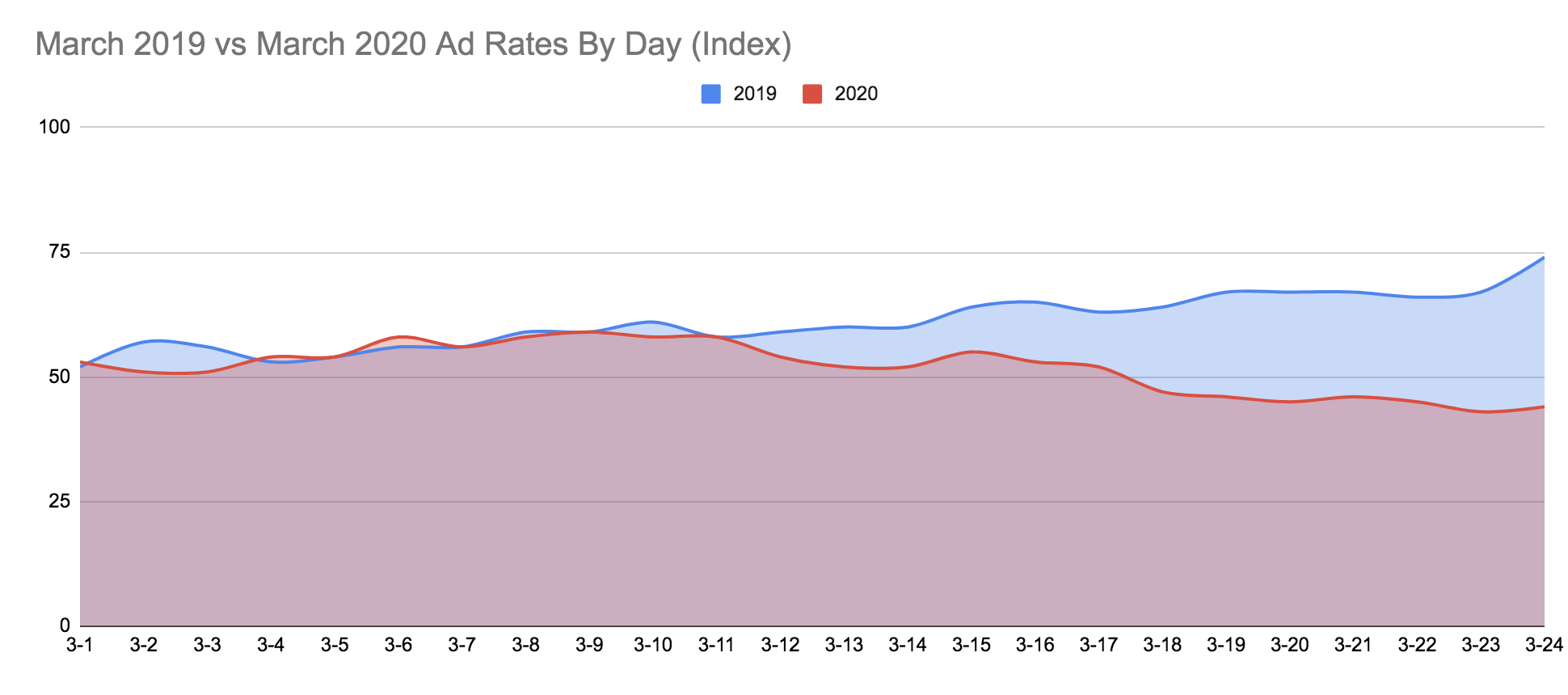

Ad rates have improved since April but still hover roughly ten points below ad rates in 2019.

Rates dipped over the weekend, which is normal for any time of year or circumstance. It is predicted they will stay above 50.

Rates dipped over the weekend, which is normal for any time of year or circumstance. It is predicted they will stay above 50.

Google’s May Core Update and AdSense Approval Slowdowns

Google announced today that the 2020 May Core Update rollout is officially completed. Data collected on the update shows it was quite a large one, which many publishers may have already noticed due to ranking changes. We have discussed data on the initial rollout effects in earlier post updates and will continue to provide data once it is readily available about the end of the core update.

Now that the update is complete, we recommend studying your analytics to see what, if anything, changed for your website.

The May 2020 Core Update rollout is complete.

— Google SearchLiaison (@searchliaison) May 18, 2020

Google AdSense is currently unable to do some site reviews due to COVID-19. Many have posted in Google’s support center about the delay, but no further information has been provided by Google yet.

Ad sales ‘middle class’ is disappearing

Publishers may have noticed that many of their ad sales have either been really big or really small, especially if you’re a larger publisher. It seems that either advertisers are ready and willing to drop a lot of money at once or are playing it safe with smaller deals. This has created a “lumpy” advertising market with random spurts of deals and sales rather than any sort of consistency. This puts even more pressure on publishers within the advertising space.

Some publishers have tried to offset this by welcoming in new advertisers rather than relying on what they’ve been using historically, even if those sales were going to be smaller than usual. Other publishers are looking to strengthen relationships with brands they have worked closely with in the past and to capitalize on content topics that advertisers will be interested in, especially as regulations lift.

We recommend reviewing your ad partnerships for quality and considering what other partnerships you may begin during the pandemic. It is extremely important to verify that these new advertisers are legit and high-quality, especially during such a tumultuous time. While it may be tempting to reach for low-hanging fruit just for the revenue, keeping your ad inventory standards high will make your more money in the long-term; advertisers bid based on historical data, so you want that historical data to be top-notch.

We also recommend looking at your content to see what has performed well and to consider what kind of content advertisers may want to bid on. If you’re a lifestyle publisher, it may have made more sense to create content for make up tutorials and spring cleaning at the beginning of the pandemic. Now, with the increase in e-commerce and regulations lifting on stores opening, it may be time to begin writing about upcoming summer fashion trends and deals.

Do you have a newsletter?

During the COVID-19 pandemic, people are consuming news at a higher rate than we’ve possibly ever seen. This includes both national and local publications.

Much of this news is absorbed through weekly or daily newsletters, some of which have only been around since the pandemic began. Data from three local news sites in New England—NJ.com, MassLive.com and LehighValleyLive.com—showed a 25% increase in newsletter subscriptions, with click rates increasing 50% and newsletter impressions increasing by 32%. These sites’ newsletter revenue also increased during this time.

If you currently do not have a newsletter but have a substantial audience, you could be missing out on more dedication to your publication, traffic, and revenue. As we’ve stated in previous updates, it is more important than ever to diversify revenue streams.

The pandemic has accelerated trends that were already happening beforehand and has created trends that will continue after the pandemic; for instance, medium-sized ad deals fading out and newsletters growing in popularity. It is important to know what these trends are and how your publication can adapt for the long-term.

Decisions made right now should be less focused on short-term goals and more on how you can use what you’re doing now to grow and improve your website for the long-term.

[/et_pb_text][et_pb_text admin_label=”May 15 Updates” _builder_version=”4.4.6″ header_3_font=”Open Sans||||||||” custom_padding=”||0px|||”]

— May 15, 5:46pm PDT —

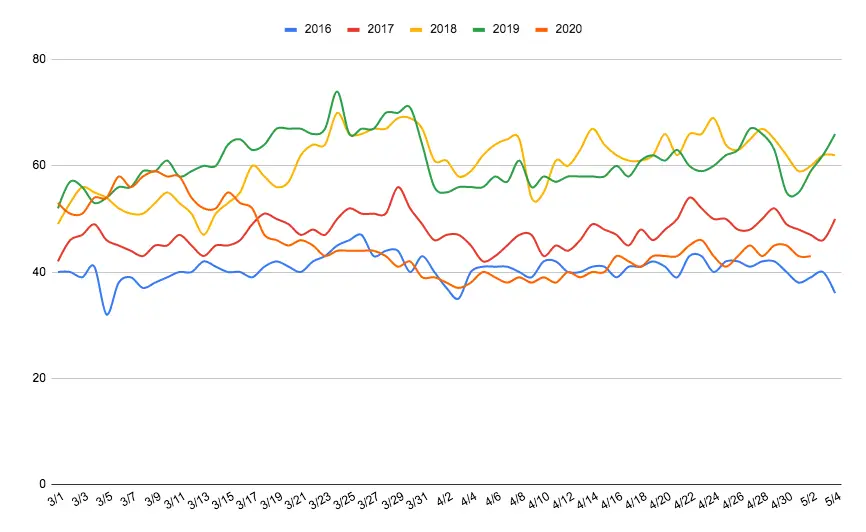

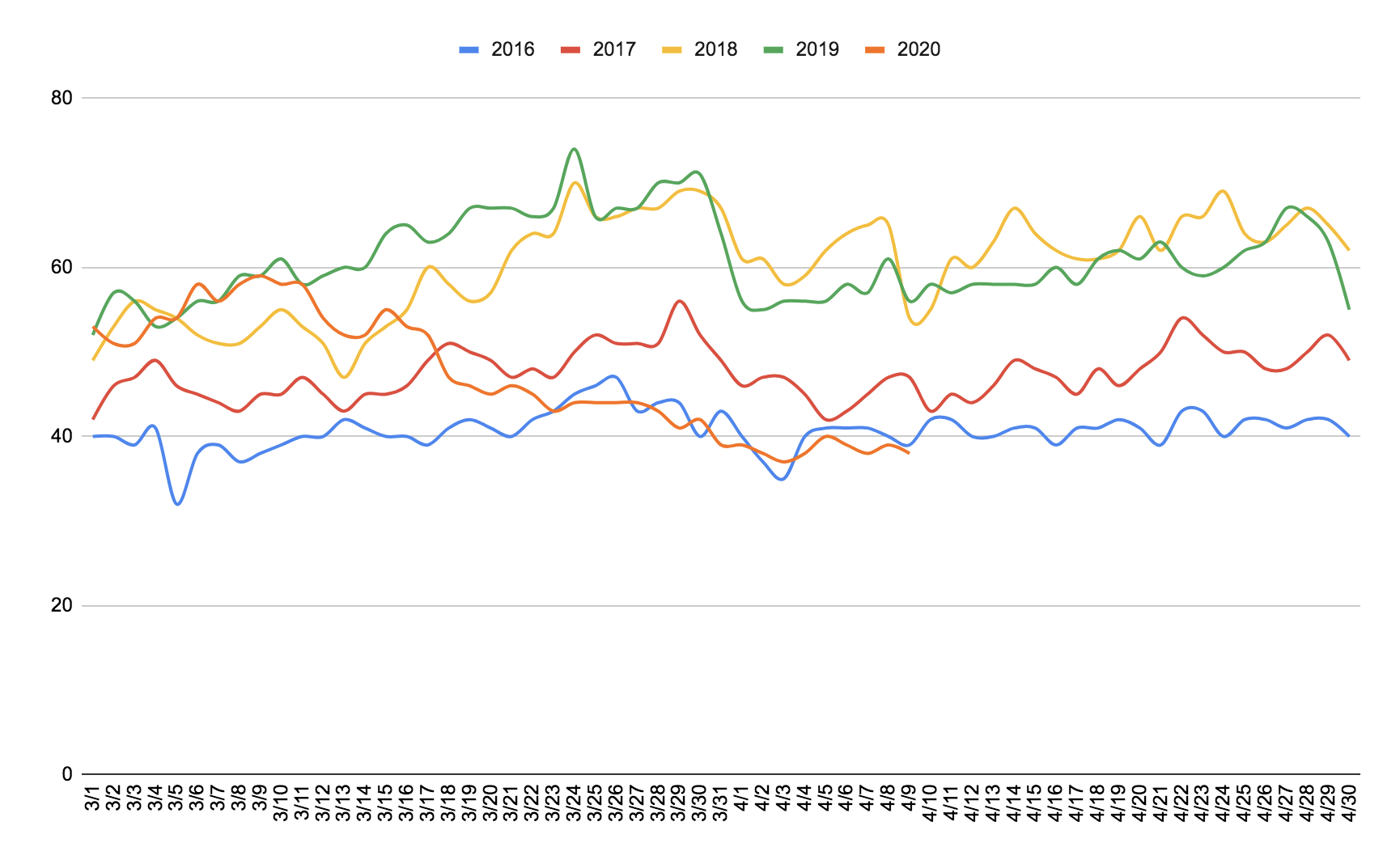

Ad rates are still recovering. It looks as if April will be the worst month ad rates will see, but with more regulations lifting, companies will be increasingly more comfortable spending money on advertising.

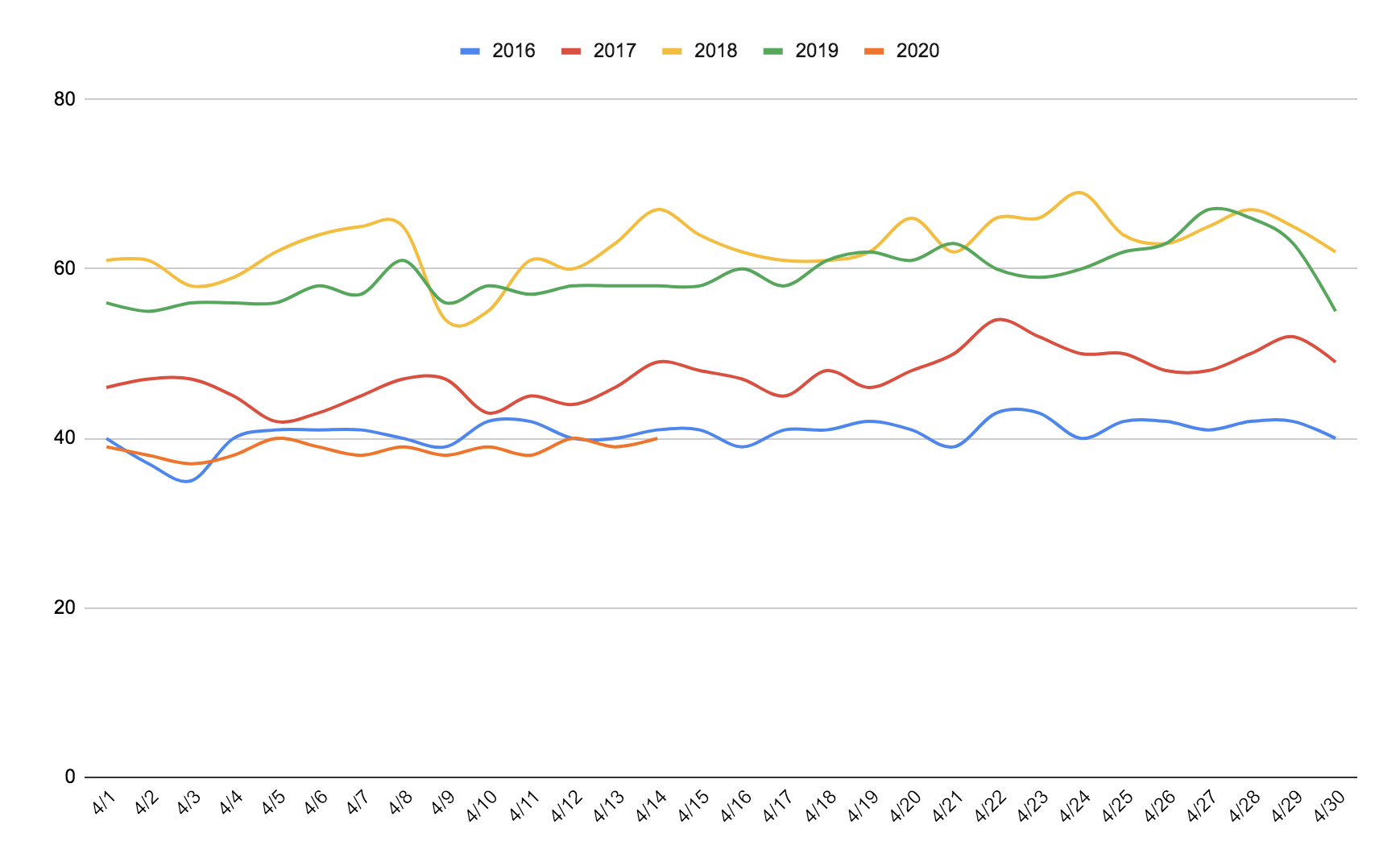

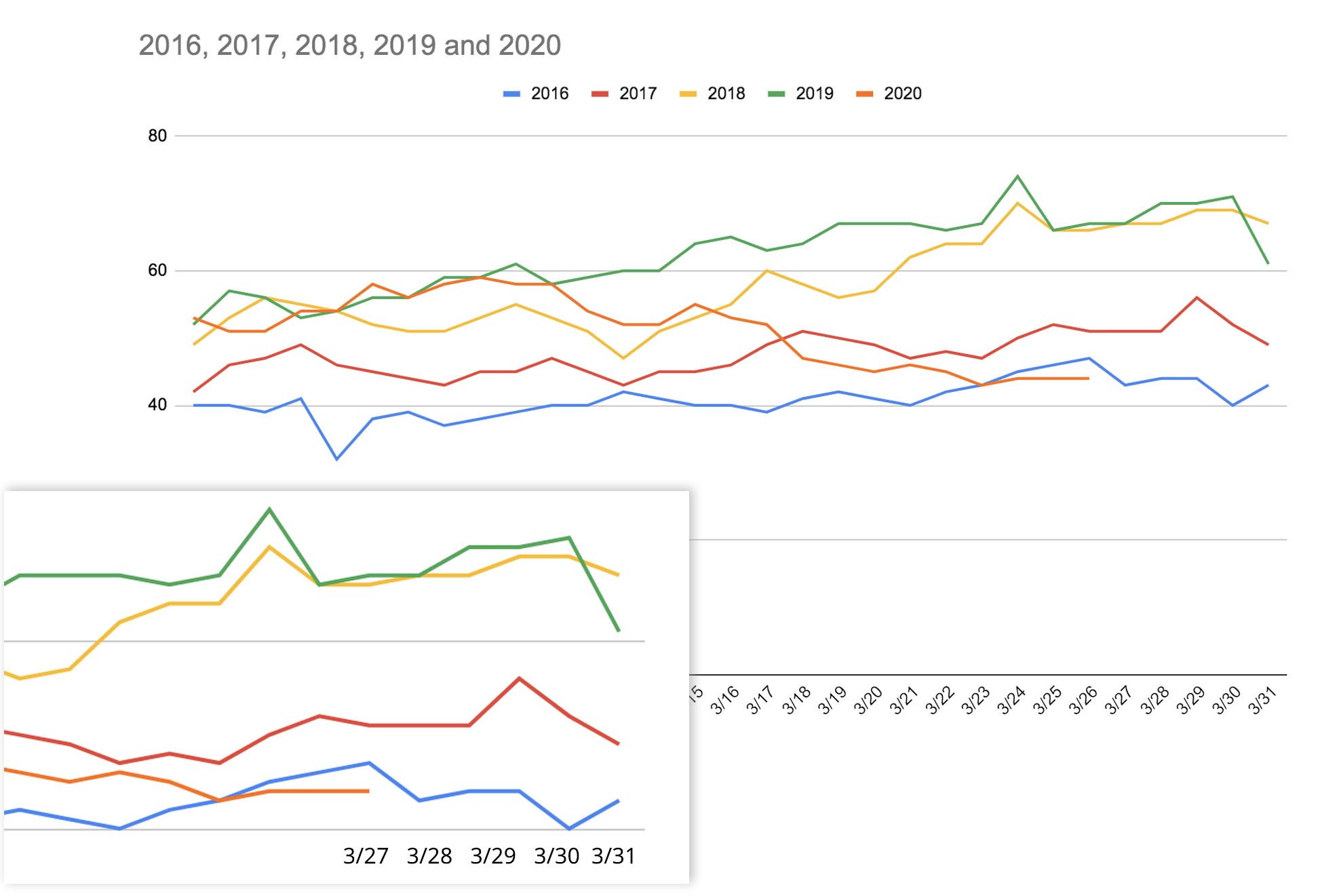

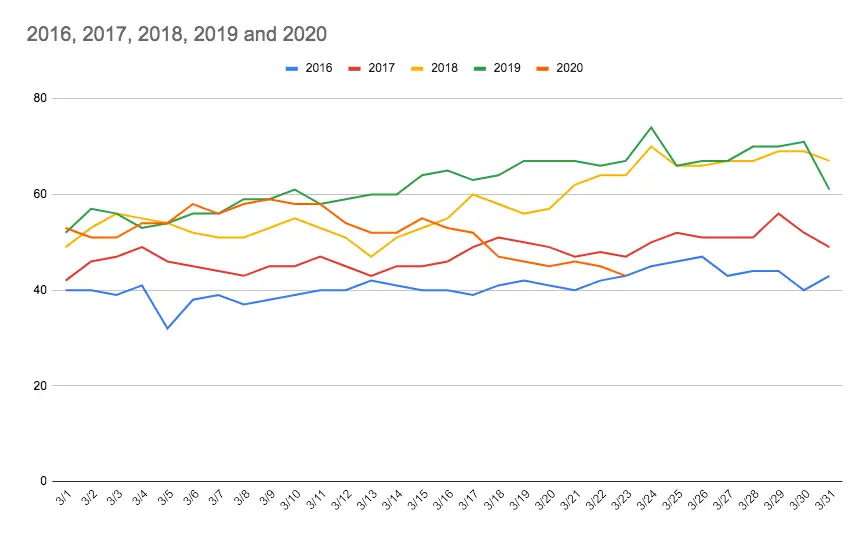

Even though ad rates are improving and will continue to do so—ad rates are currently above both May 2016 and 2017’s ad rates—it is predicted that many companies will still not make their 2020 and even 2021 projections.

E-commerce soaring during the pandemic

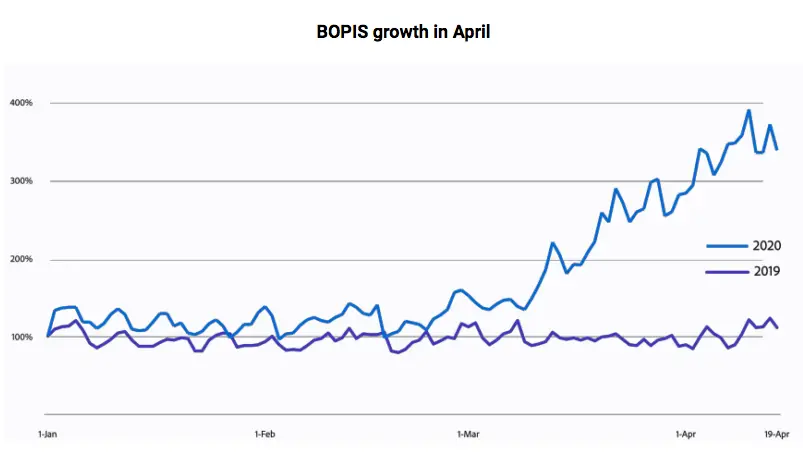

Though retail sales were down 8.7% in March—the worst decline on record—e-commerce saw intense growth during the same period. E-commerce spending especially went up right around the time people received their government stimulus payments. Adobe’s Digital Economy Index reported that e-commerce grew by 49% since the beginning of the year and that buy-online-pick-up-in-store sales has increased 200%

For many companies, e-commerce is hitting Black Friday-type traffic and revenue. PayPal had its largest single-day transactions day on May 1st, surpassing their Black Friday or Cyber Monday transaction rate.

Now is the time to get into e-commerce if you’ve ever wanted to try it out or add it as a part of your website for almost all categories. If e-commerce isn’t something you want or can get into, you may still benefit from the success of e-commerce; many businesses will be competing against each other to get viewers’ attention and will use advertising to do so. As shown above, ad rates are currently improving already.

Growth is slowing for subscription-based publishers

Recent data from major publishers like Bloomberg Media, The New York Times, The Wall Street Journal, and The Guardian shows that though the subscription-based model they implemented earlier this year was successful, that rate is slowing down.

Subscriptions rose across the board during the start of the pandemic as users wanted reliable, accurate information and updates. That peak was around mid-March, with three times the average rate of subscription sign-ups. While subscriptions are still doing better now than they have in the past, April showed that rate had dropped to 2.4 times the average.

Publishers smaller than these major brands may wonder if subscriptions is the right choice for them.

We typically say no to subscription-based models. There is certainly, across the board, more willingness to pay-to-subscribe right now, even for non-news-related content. People are still panicked and looking for answers, tips, and advice to make it through the pandemic, whether that be financially or personally.

Some publishers may survive on the subscription model in a post-pandemic world, but these publishers are typically larger brands like the aforementioned. Once things return closer to normal, people will begin returning back to their old habits and everything will not feel as urgent. It is likely that though small publishers may benefit now from subscriptions, it will not last on the other side of COVID-19. However, we always recommend you test any theories or experiments you want to conduct, which our platform makes easy.

Google and COVID-19: response and free digital skills training

In Google’s interview with Dr. Karen DeSalvo, Google’s Chief Health Officer, Dr. DeSalvo discussed what Google is doing to help curb misinformation during a time when correct or incorrect could effect lives. Dr. DeSalvo stated Google’s Search team has designed the ranking systems to put forth the most relevant and reliable information, and that this was built upon when the pandemic began. We discussed in an earlier update that Google’s recent May Core Update included helping searchers find legit health information from local authorities. Google is actively removing both content and videos from YouTube that provides misinformation.

Google’s Grow with Google—a program designed to help teach digital skills all over the country—usually involves travel and in-person meetings at schools, libraries, and nonprofit. Now, Google is offering digital skills training through Grow with Google OnAir. Participants will be able to listen to interviews with people within the industry, marketing fundamentals, building an online presence, making the leap to e-commerce, and much more.

This can be a great resource for publishers looking to expand their knowledge in the digital space, both during the pandemic and after.

— May 11, 3:26pm PDT —

Ad rates continued to stay in the upper 40s and lower 50s over the weekend. It is likely that increased online shopping, more economic stability, and lifting restrictions have made the advertising ecosystem a little bit more active and lucrative.

Free and open insight into consumer behavior, by Google

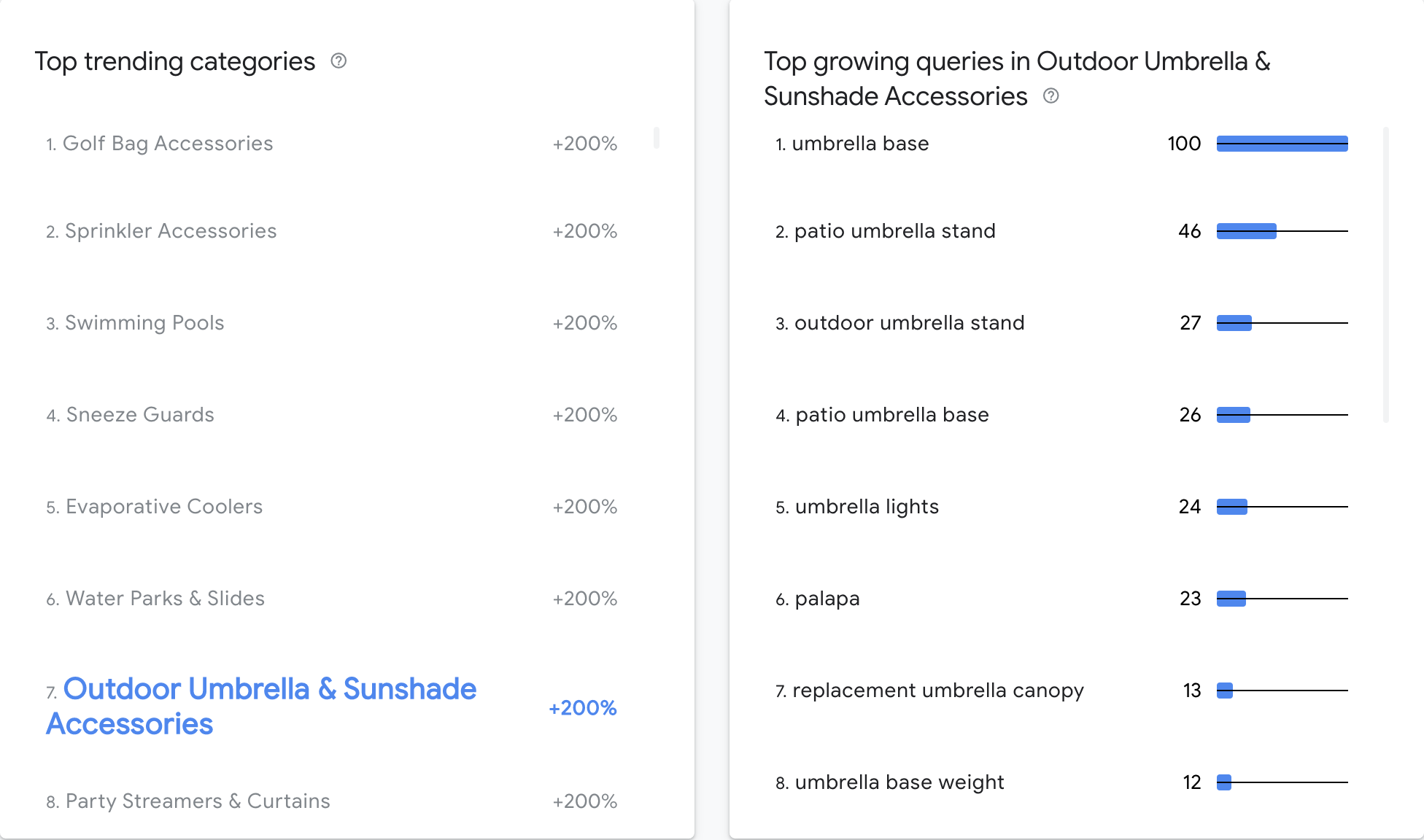

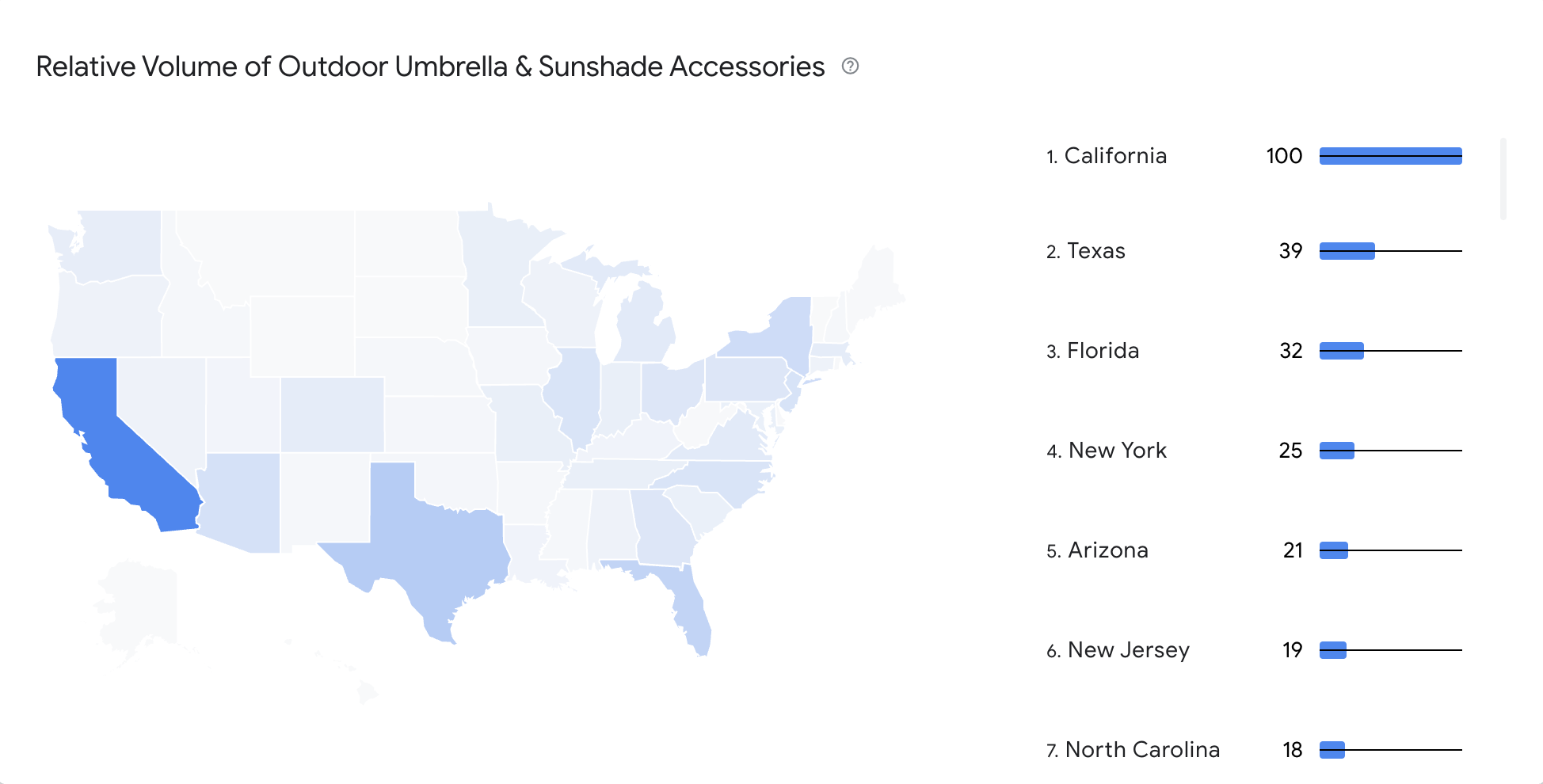

COVID-19 has changed consumer behavior across the board; consumer behavior has never been in such constant flux with big sporadic bursts and quick 180s. To assist retail and brand manufacturing partners during such dynamic behavior, coupled with the overall economic downturn, Google has created Rising Retail Categories. This tool works similarly to Google Trends but shows “fast-growing, product-related categories” for queries and geographic areas where those product categories are most popular.

This is the first time Google has offered free research and insight on things people are actually searching for.

Google May 2020 Core Update’s effect on coronavirus-related queries

Effects of Google’s May 2020 Core Update are becoming more apparent and data compilations show certain categories are more effected than others. To read more in-depth about the update, visit our recent blog post.

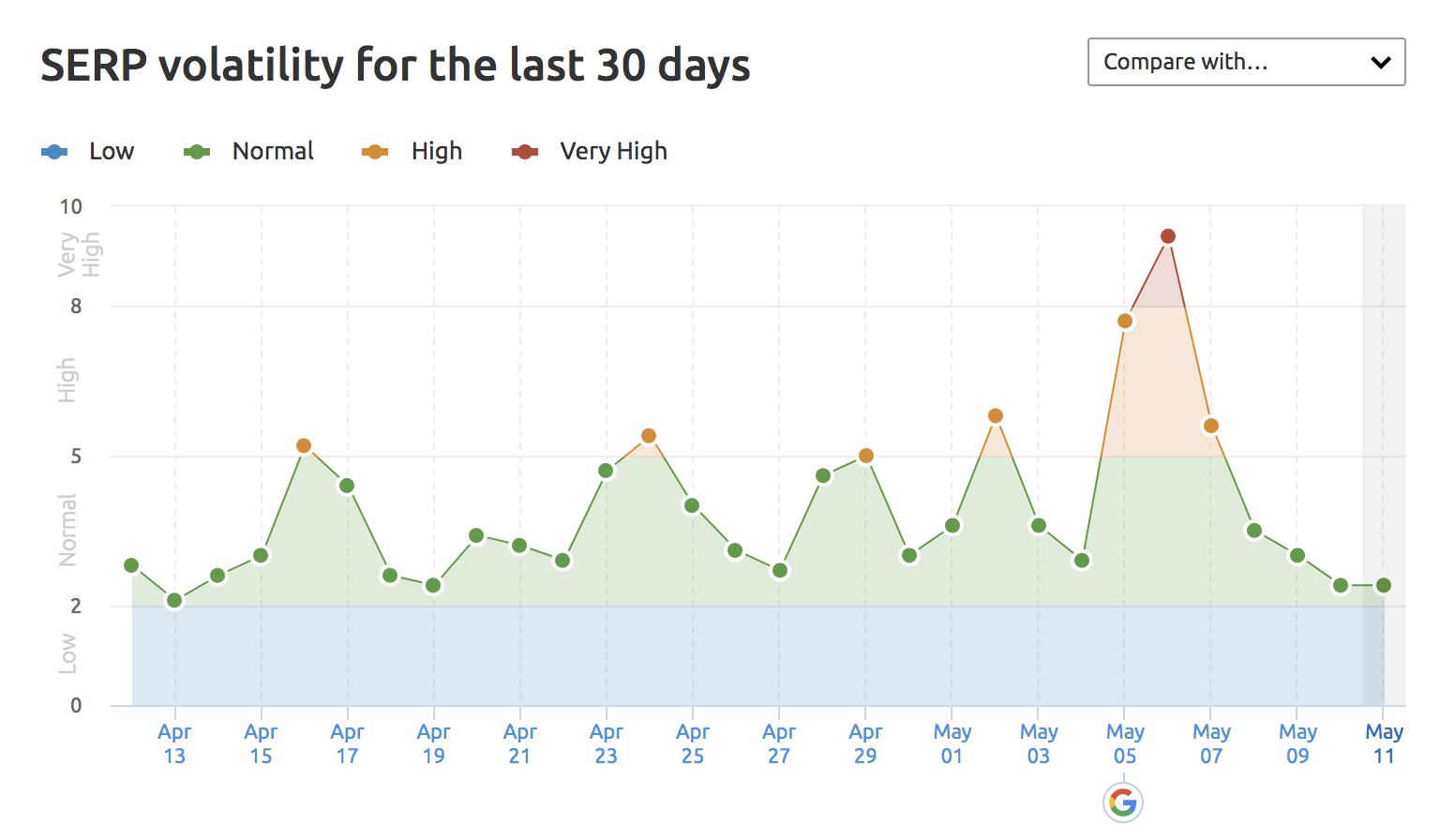

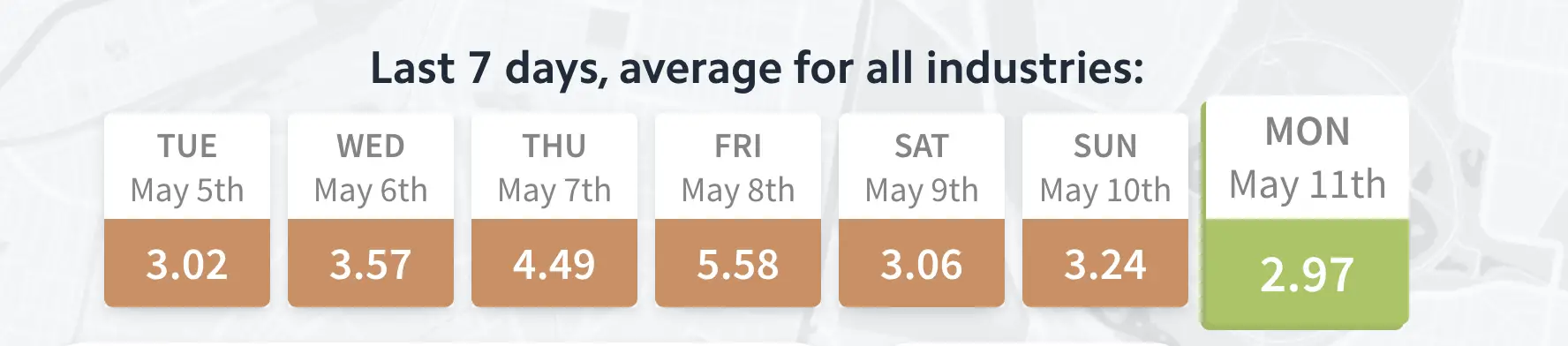

SEMrush’s sensor tracking tool, which shows Search Engine Results Pages (SERP) volatility, showed a score of 9.4 when the update began rolling out; the update from January was only around an 8.

A lot of the update that has been rolled out thus far seems to be related to how coronavirus is affecting search. We already know that an update from about one month ago helped local news stories appear in the top stories carousel on Google Search, but this update is much more influential and seems to focus less on E.A.T. (expertise, authoritativeness, and trustworthiness in SEO).

A lot of the update that has been rolled out thus far seems to be related to how coronavirus is affecting search. We already know that an update from about one month ago helped local news stories appear in the top stories carousel on Google Search, but this update is much more influential and seems to focus less on E.A.T. (expertise, authoritativeness, and trustworthiness in SEO).

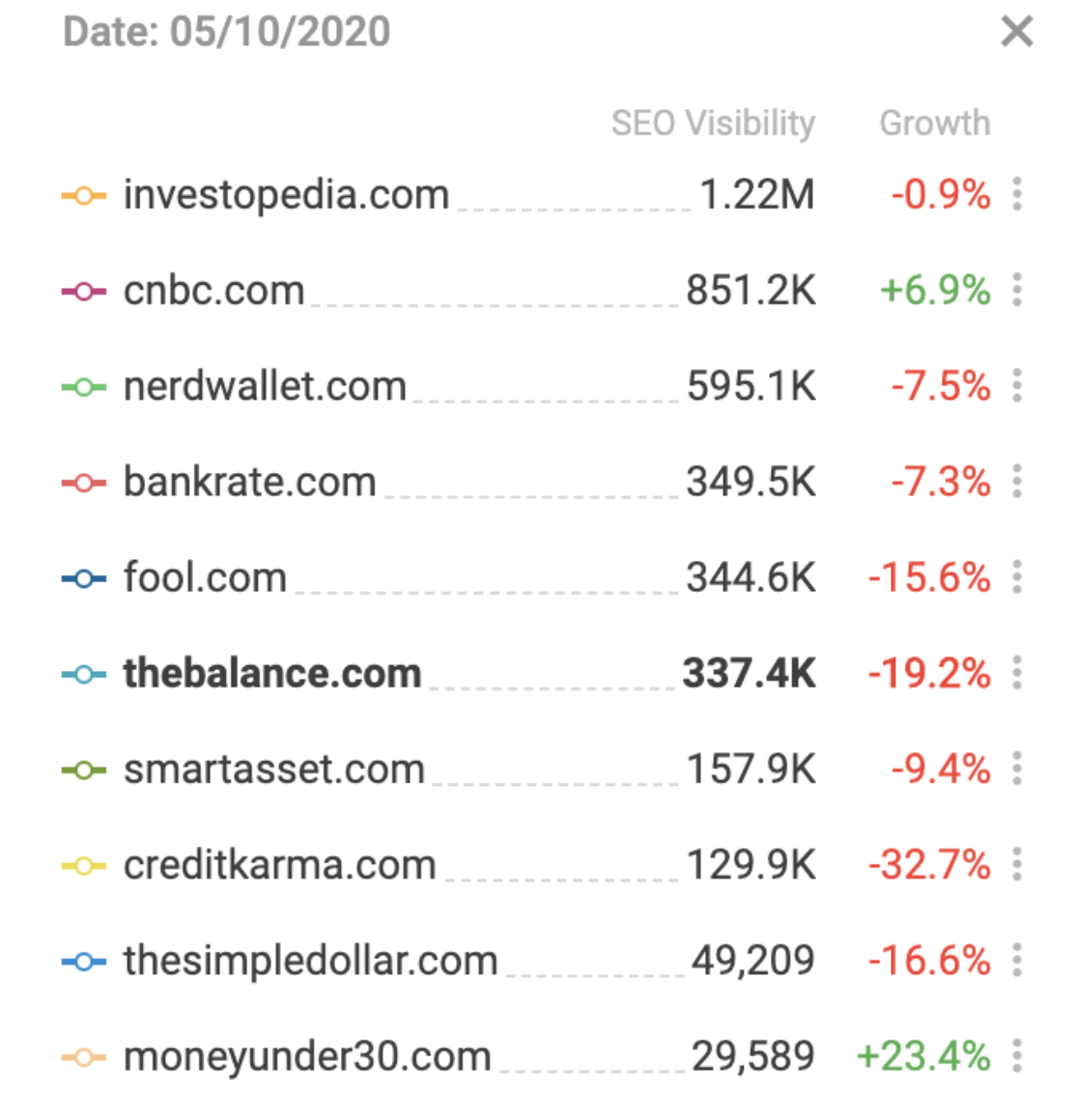

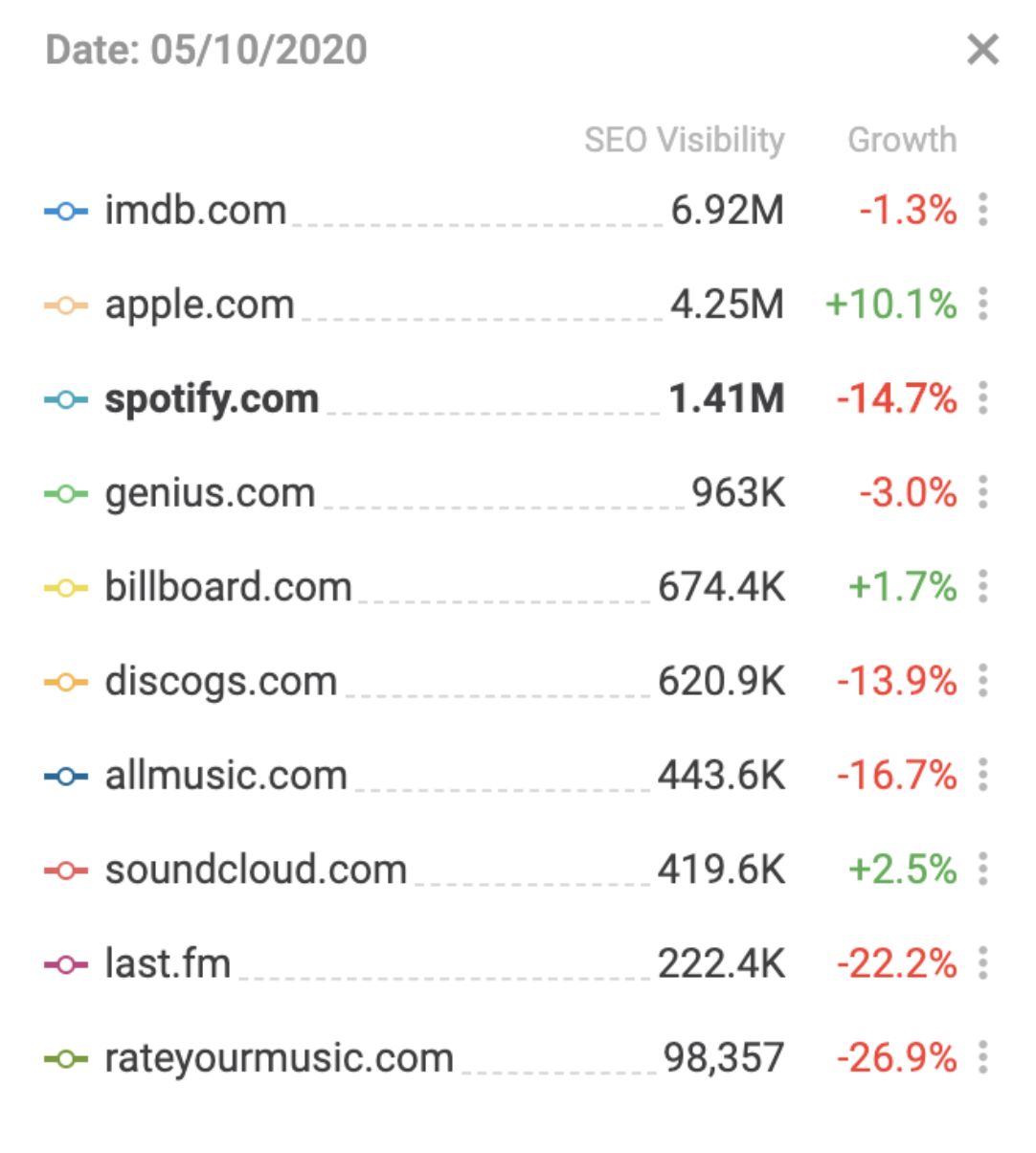

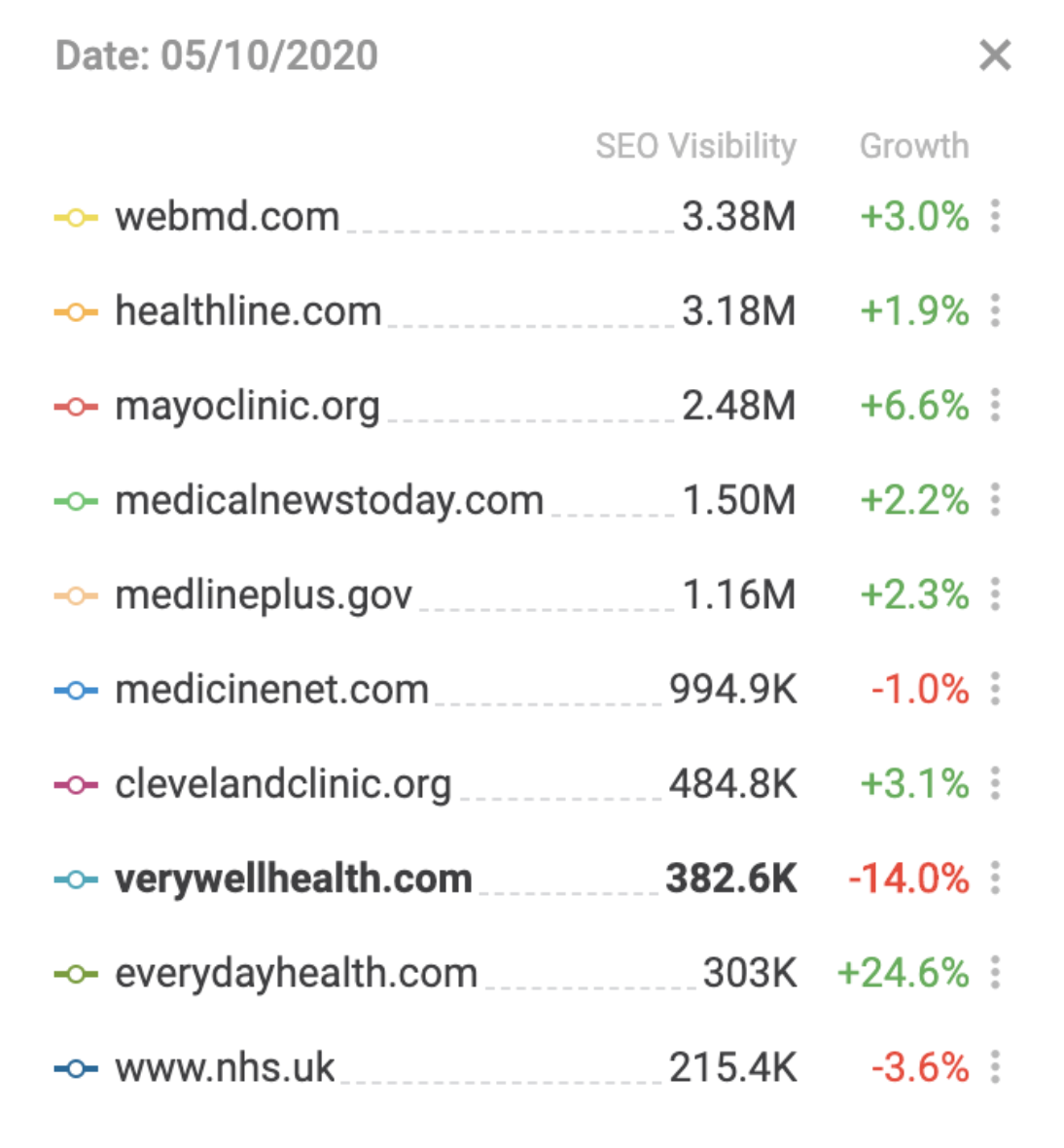

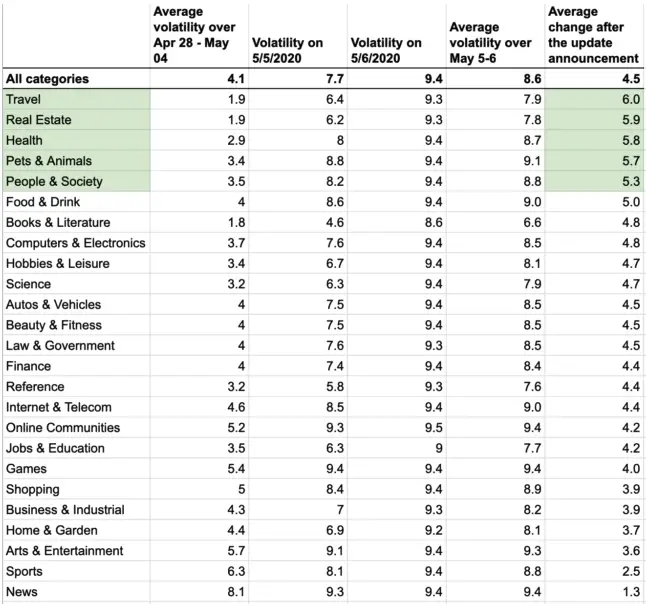

Here are some of the influenced categories across the web.

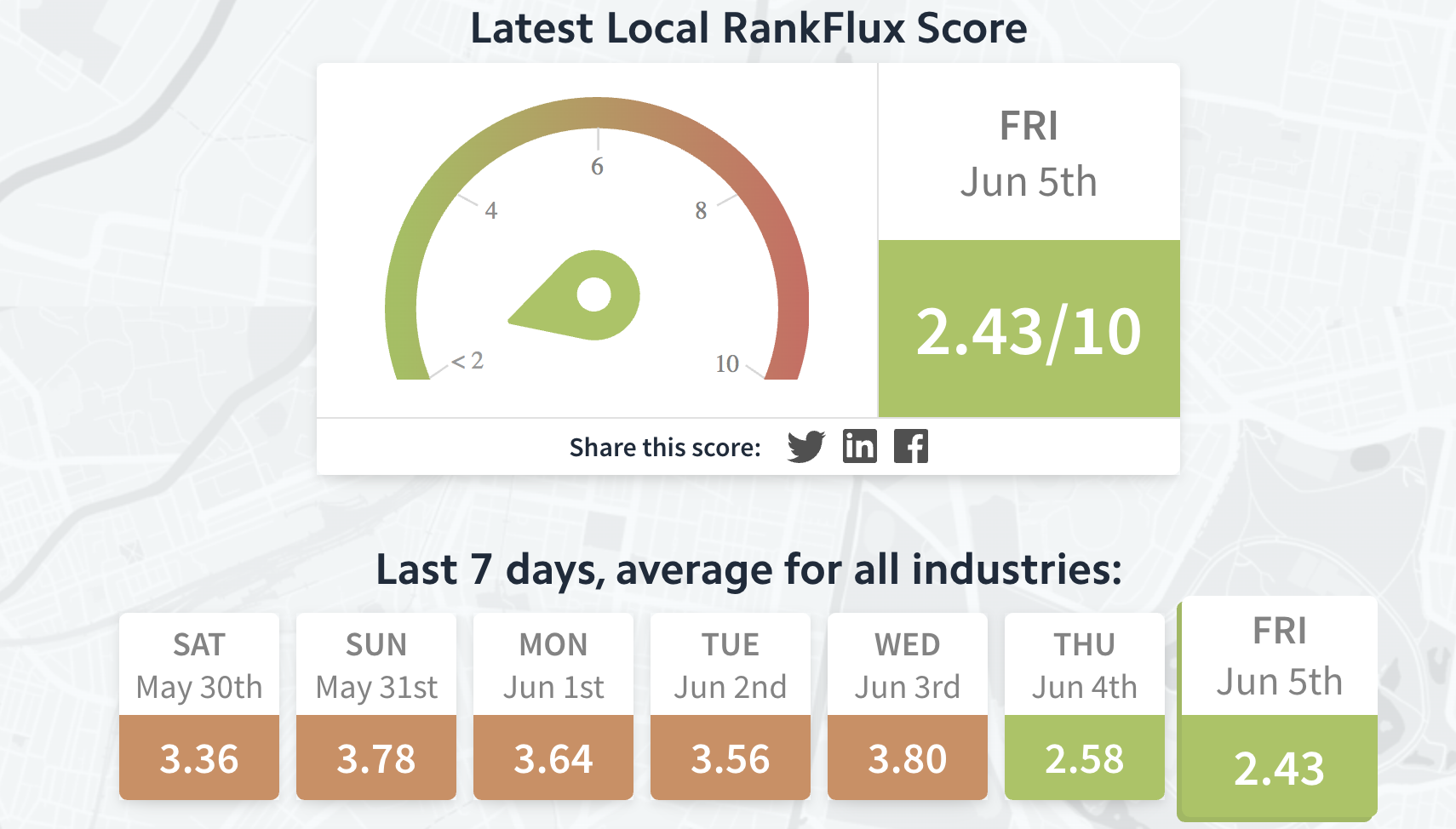

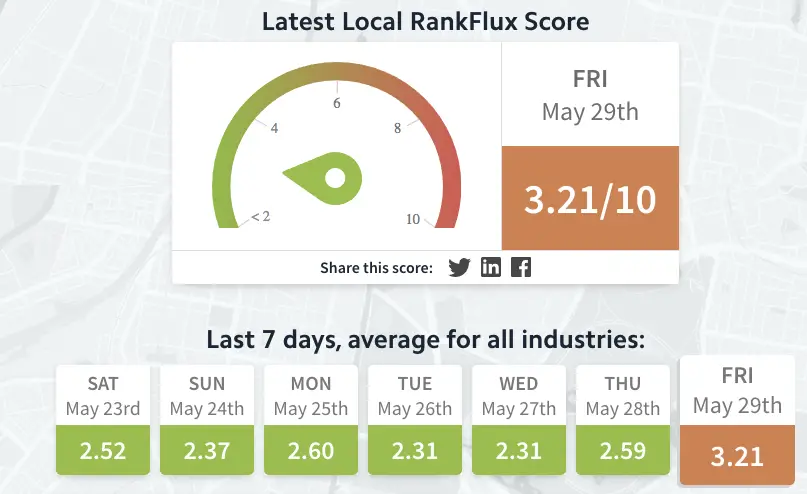

Google says that there is no major local search update included in the core update specifically, but acknowledges that some publishers are seeing affects. Per Google’s request, publishers are sending examples of this happening. RankFlux, a ranking fluctuation monitoring tool for local search, shows that there have been major fluctuations in the past week.

You can see a feed of real publishers posting about how the core update affected their website on Search Engine Roundtable.

Google and Facebook stepping up to help the news industry

Google and Facebook have often relayed to publishers that they do not want to be relied upon or used as a crutch for struggling publishers, despite praising publishers’ use of the two giants and using them as guinea pigs for new products.

However, due to the current online ecosystem as a result of coronavirus, Facebook and Google will now take on the part of patrons for the local news industry. Within the next couple of months, Facebook and Google will spend a combined quarter billion dollars supporting local news. This will come from emergency relief grants, more marketing dollars geared for ads on publishers’ sites, and waiving fees Google usually charges for using its ad server. Facebook has already provided $16 million to 200 different newsrooms and Google predicts its funding will help 4,000 different publishers.

Google and Facebook have experienced pressure from foreign governments to pay publishers directly for the content they use but American antitrust laws keep U.S. publishers from banding together like those in foreign countries. To assist American news publishers in a similar fashion, Google is rolling out independent news emergency relief. This will help news businesses that will otherwise go under from lack of ad revenue if they do not receive emergency funding.

— May 8, 7:32pm PDT —

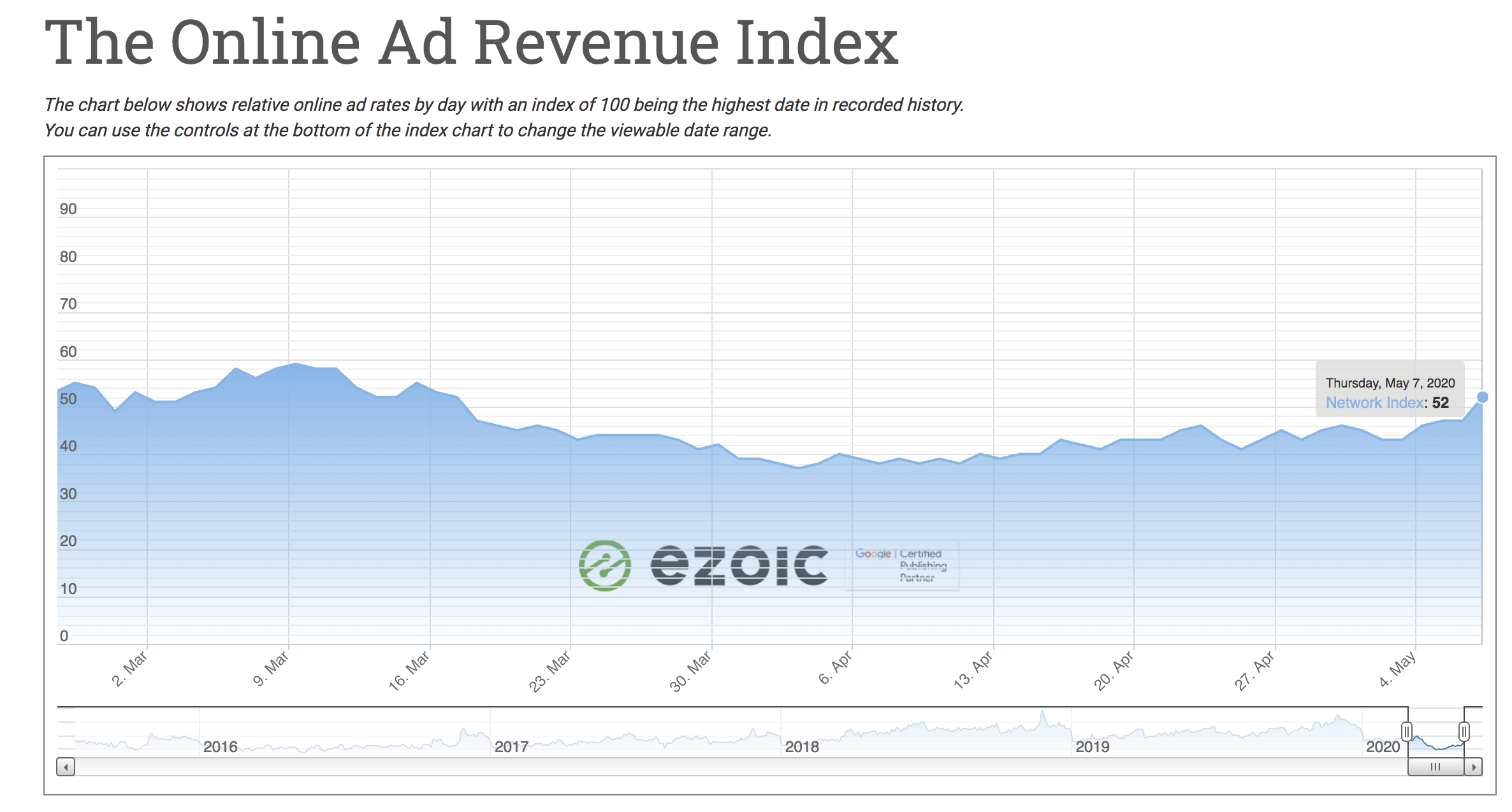

Ad rates have continued to improve and even reached over 50 on May 7.

Google update in the middle of COVID-19

Google’s update, which is continuing to be rolled out during this blog update, has already shown some of its colors when we look at rank volatility.

SEMrush pulled together data to show the most volatile industries.

It is not surprising that travel and real estate are the most volatile at the present moment.

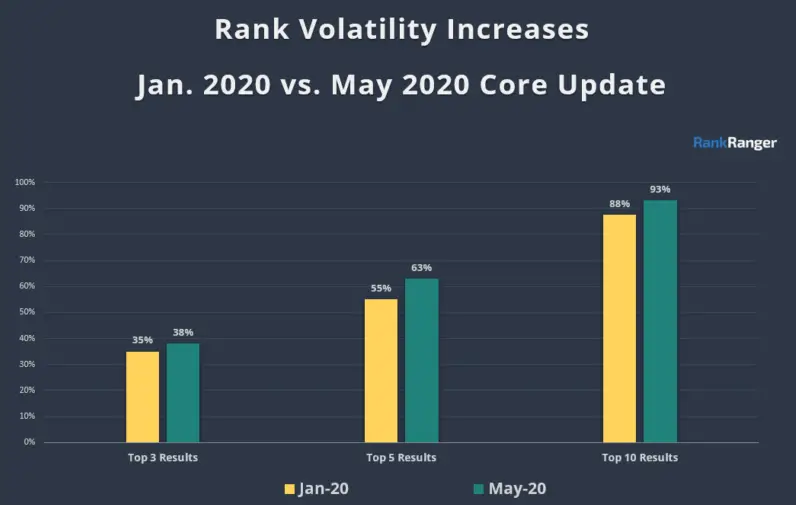

Rank Ranger also recently published rank volatility comparing the January 2020 update to the May 2020 update.

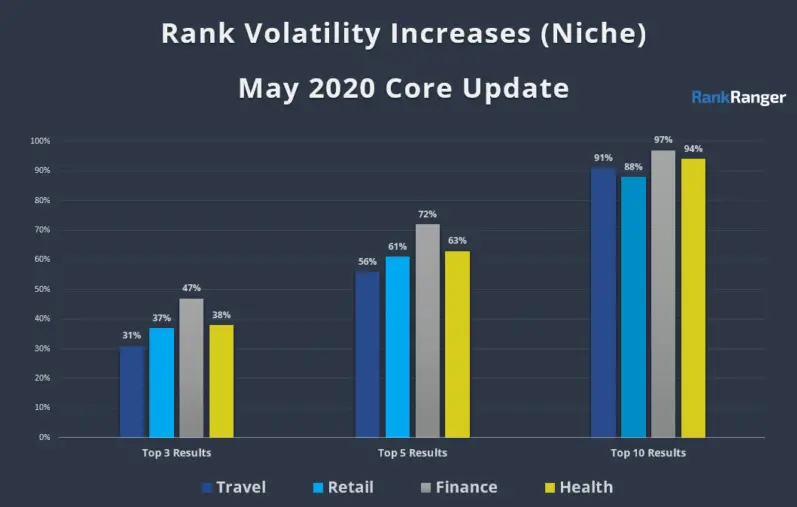

When we look at volatility by niche, we can see that the May 2020 core update increases rank volatility highly affects the top 10 results in travel, retail, finance, and health. Overall, this update affects ranking and positions more than the January 2020 core update.

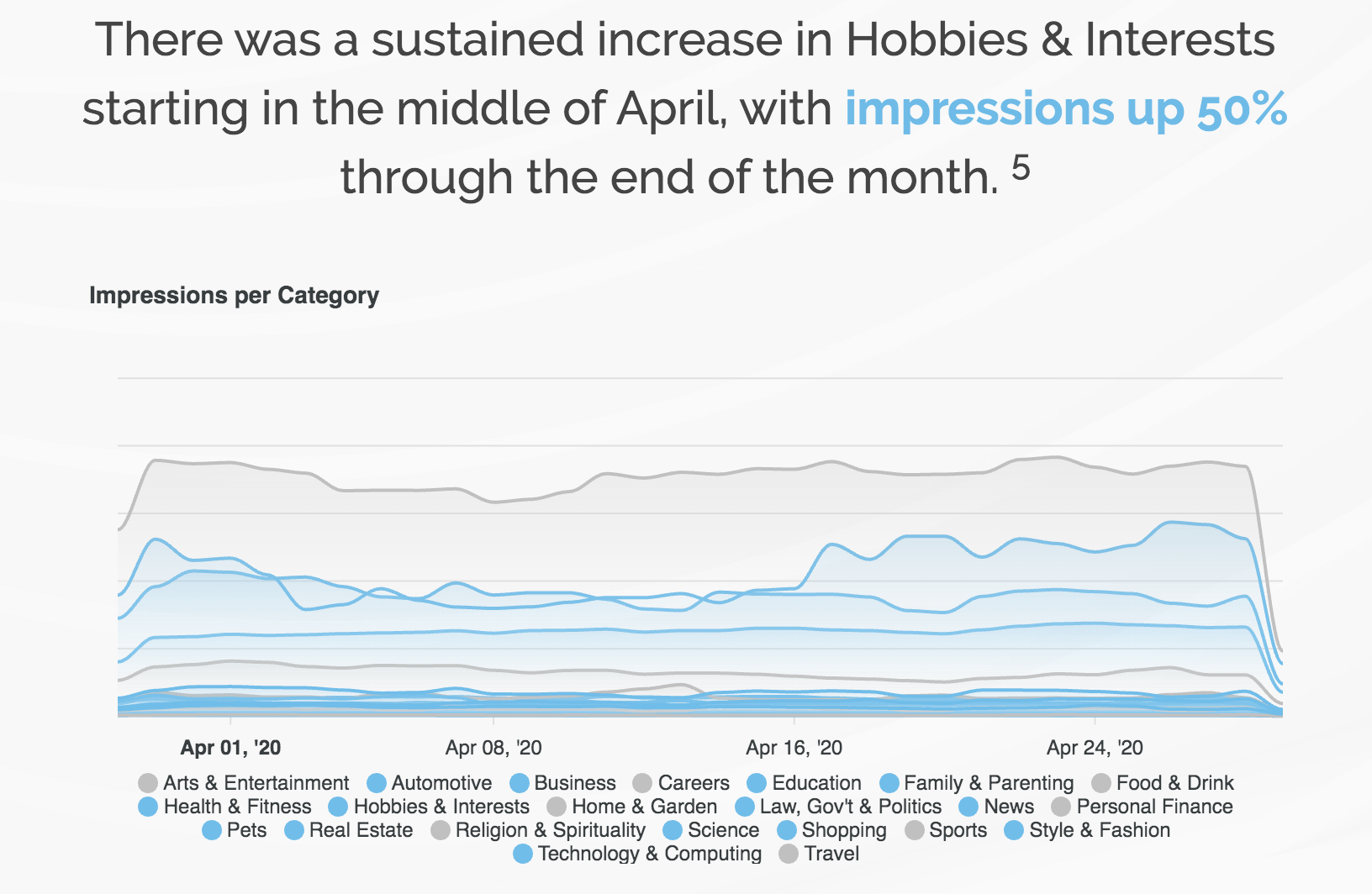

While these niches are in negative flux, others are doing very well. The Hobbies & Interests category, probably unsurprisingly, experienced a 50% increase in impressions from mid-April to the end of the month. This undoubtedly was a result of persistent lockdown measures, especially as it became clear by the end of the month that not much was going to change come May.

“New essentials” are also experiencing increases in online attention. Shopping and time is being spent on gaming, make up, office supplies, home improvement, health and fitness, toys, and housewares currently make up almost 40% of sales online.

Since it is likely most of May will also be spent in quarantine, people are looking for ways to stay entertained or busy. They will be looking for new hobbies, how-to guides for home improvement, make up tutorials and cosmetic information, game reviews and discussions, and ways to stay fit and healthy while stuck inside. Consider how you can capitalize on these high-performing topics in the next month.

Publishers are protecting their revenue

In the hopes of gaining a bit of control of their destiny, publishers are taking action on advertisements amongst all of the financial uncertainty from COVID-19.

Many publishers fear that as ad tech struggles, they will also fail to pay them what they are owed (much like the Sizmek situation from 2019). To safeguard against this, some publishers have become more apt to check in with their vendors and use data to determine which ones are potential risks. Some points publishers are looking for are the number of sites an ad vendor is selling across, how many bids fail, and poor customer service. This provides publishers with a better understanding and control of their programmatic revenue.

“We’ve seen a drop of between 20% and 30% in the prevalence of SSPs and bidders from the end of February to the end of April,” said Chloe Grutchfield, co-founder of RedBud, a company for data ad tech consulting. However, some worry that a reduction in SSPs will mean tech giants like Google will gain more power.

While some publishers are cutting ties with ad suppliers, others are pulling their inventory.

Much like publishers suffered financially from too much supply and not enough demand, they are hoping now to turn the tables on the ad industry by reducing their supply and increasing advertisers’ demand. Many hope that short-term losses will mean long-term improvements and that by preventing an overall flatline, CPMs and RPMs will have an easier time recovering.

While it would take hundreds of thousands of publishers to make a difference across the board, many are thinking more insularly. Since advertising is bidding, and all bids are created by historical data, publishers are hoping to keep their rates higher and thus keep future bids higher.

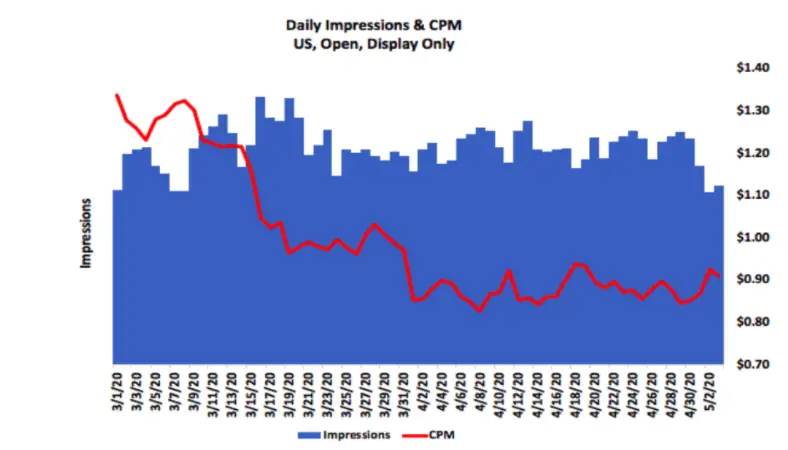

The average open auction U.S. display ad CPM’s high on March 1 at $1.34 fell to its low on April 8 at $0.83. Since then, the rate has risen to $0.91 on May 3 but there is little to show it will reach a high again any time soon. While some publishers may have the financial bandwidth to look over their ad tech stack and adjust price floors, many publishers don’t have deep enough purses to lose more revenue right now.

Some publishers are considering something called prebid, which is a way to try to improve header bidding results. There are two kinds:

- Prebid.js is code

- Prebid server is hosted or on the server-side

Using prebid can give publishers a way to be actively involved in their tech stack in ways that traditional advertising tools can’t provide and can increase publisher revenue over 50%. There is a caveat, however, as with most good things.

Setting up prebid properly requires extreme sophistication and expertise needed to do it right and is often even more than most publishers’ ad ops teams can handle. Prebidding requires knowledgeable configuration, management, and optimization in order to set up, activate, and make money from it. Additionally, you need to know how it is going to interact with all of your other ad demand and bidding.

AdExchanger suggests the following three steps if a publisher and their ad ops team feels up to prebids:

- Find what works best for your visitors’ user experience

- Plan ahead for release control and new settings you will be implementing

- Don’t do anything without data and testing, and then never stop testing

For the short-term

It is important for publishers to find a balance right now between, supply, demand, revenue, and quality. While you may need the revenue, also consider how this may affect your bids in the future. If you have some wiggle room, think about how you can keep your ad rates as high as possible so the recovery isn’t as tedious later on. This may mean pulling some of your inventory for a period of time.

This will also protect your ad space from being filled by lower-quality advertisers, who may have not been able to win a bid until now. Low-quality advertisers can affect future bidders just as much as low bids.

Moreover, consider your ad tech stacks. Which ones seem unreliable or unlikely to pay? It may be time to say goodbye to companies who are going to leave you high and dry.

Keeping revenue diversified is key right now. As we’ve seen with ad demand and Amazon affiliate cuts, nothing is for-certain, especially during times of crisis. Whether this means considering prebid if you have the means or working on your direct deals, it is never good to put all your eggs in one basket, pandemic or not.

Lastly, keep up on the latest topic trends after the Google update and as quarantine continues. There is a lot of opportunity right now to gain a bigger audience and earn their loyalty and readership even after things return to normal.

— May 4, 3:34pm PDT —

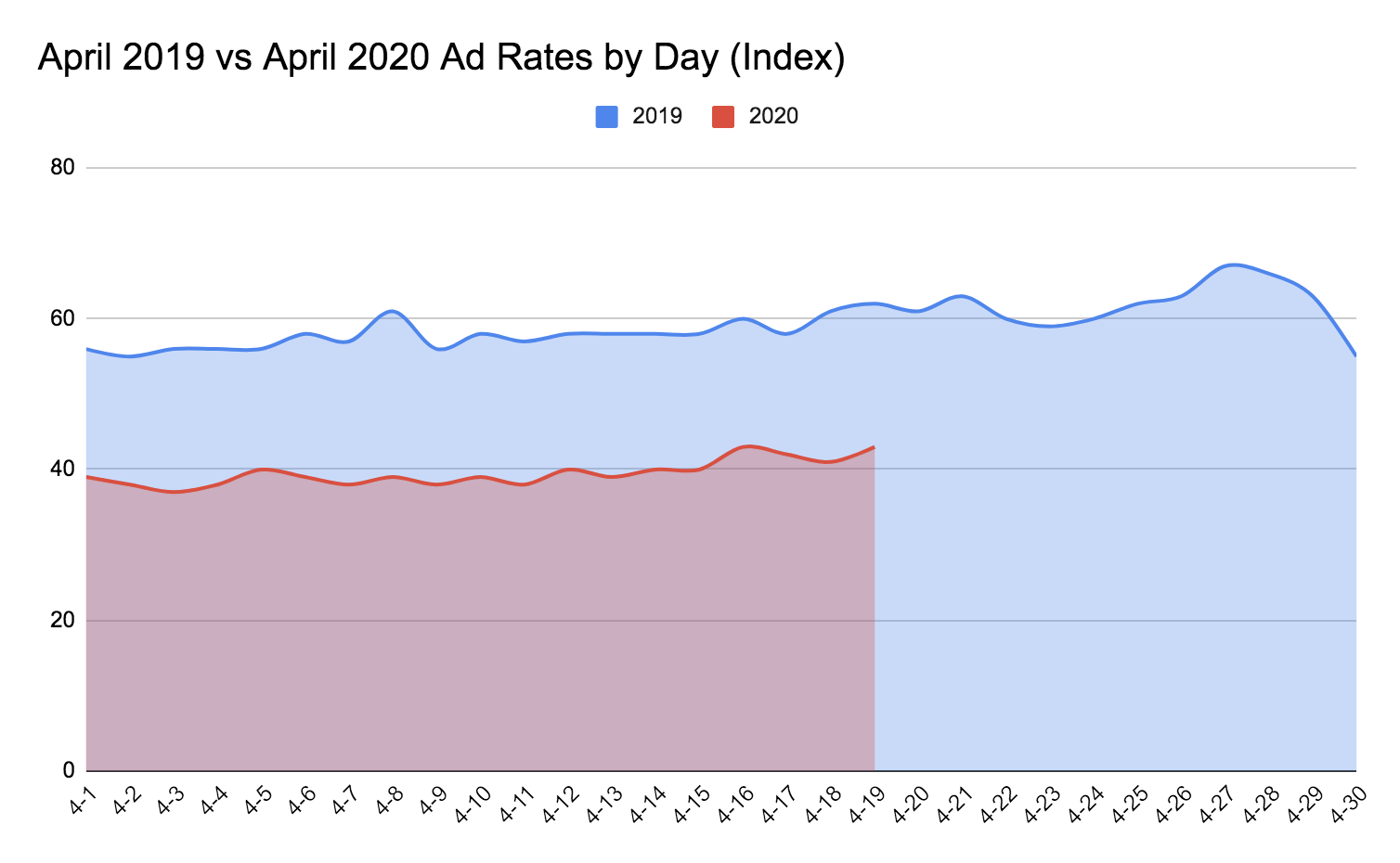

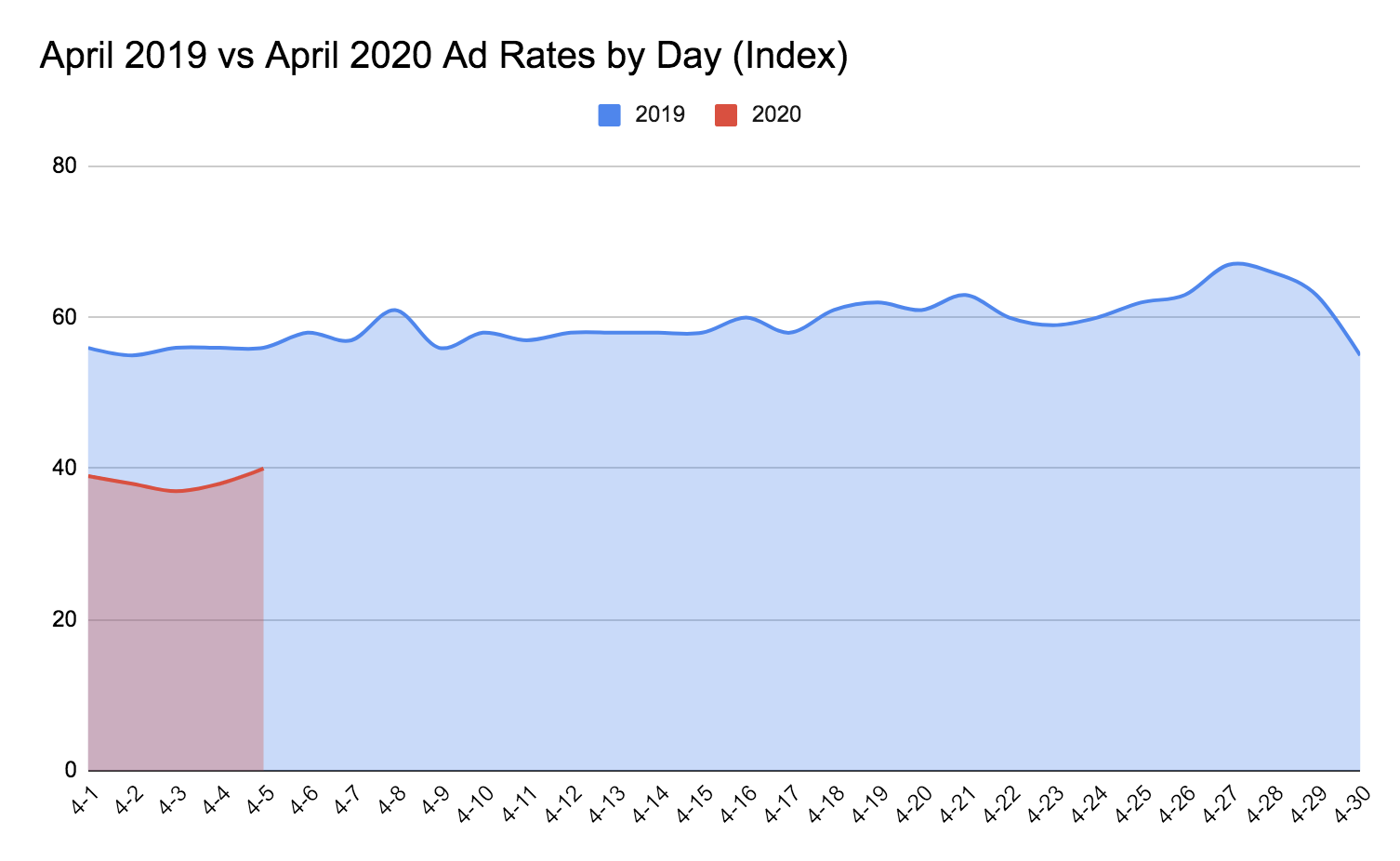

Ad rates have remained recovered into the 40s for the end of April and into the beginning of May.

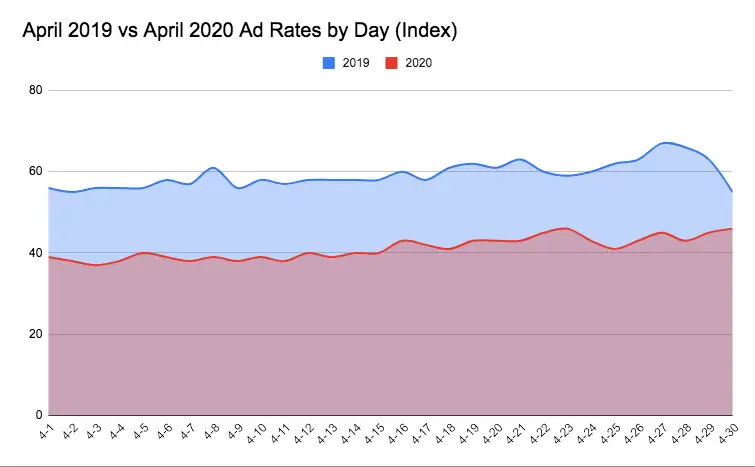

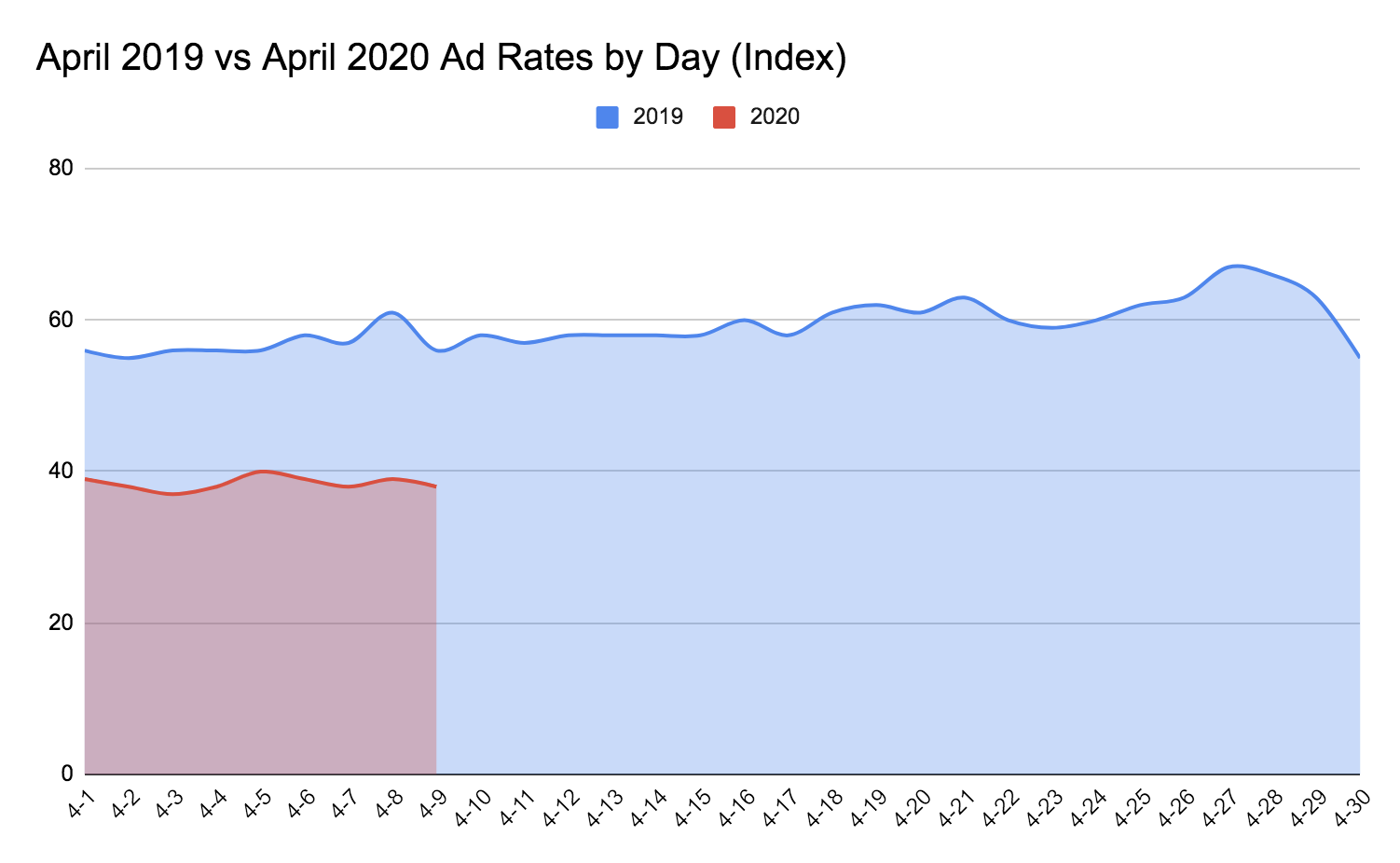

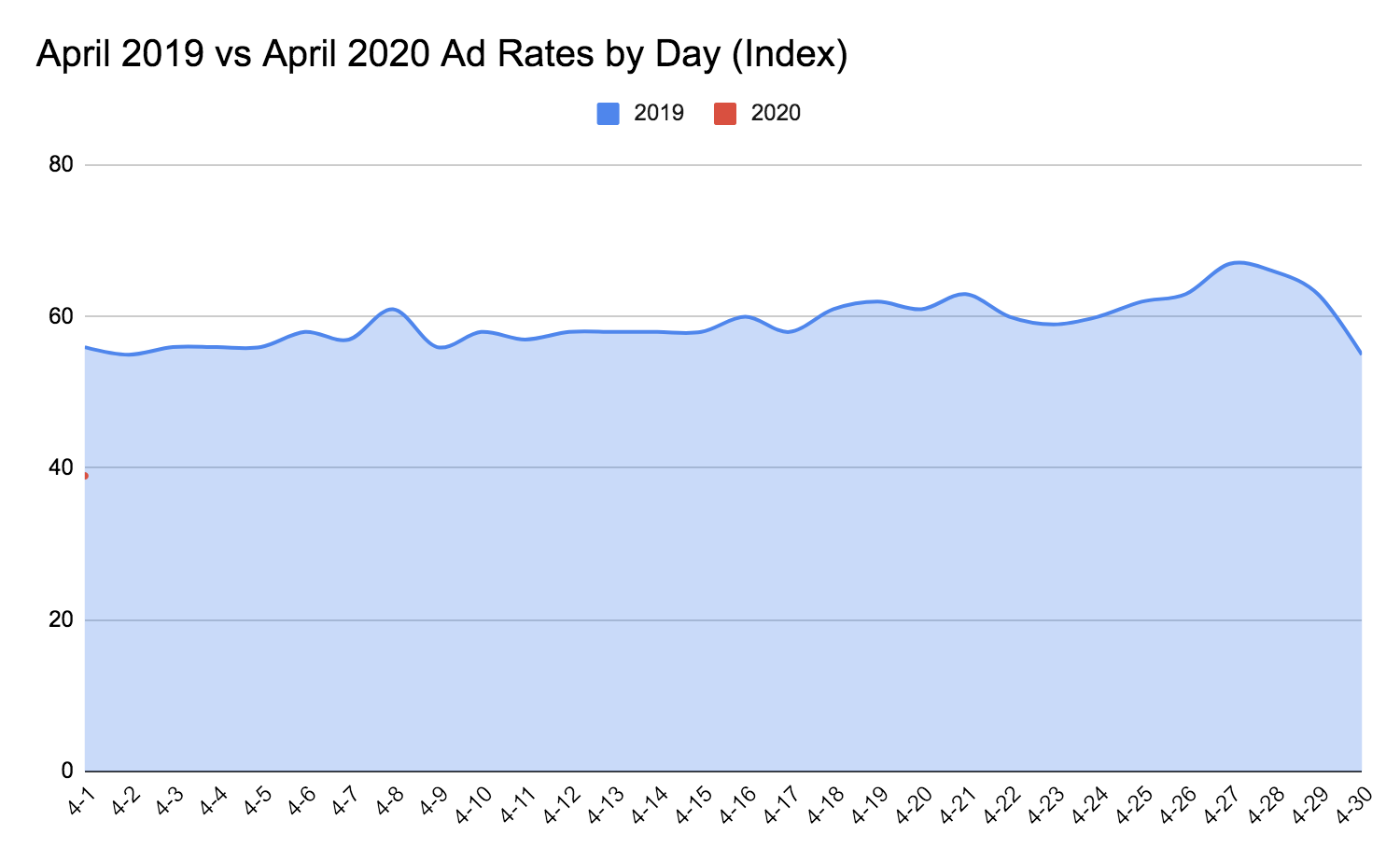

April came to an end off of last year’s trend, which saw a decline at the end of the month. This year, they increased slightly before taking the expected weekend dip for the beginning of May.

Ad rates also remain above 2016’s numbers despite the dip we saw at the end of March and beginning of April.

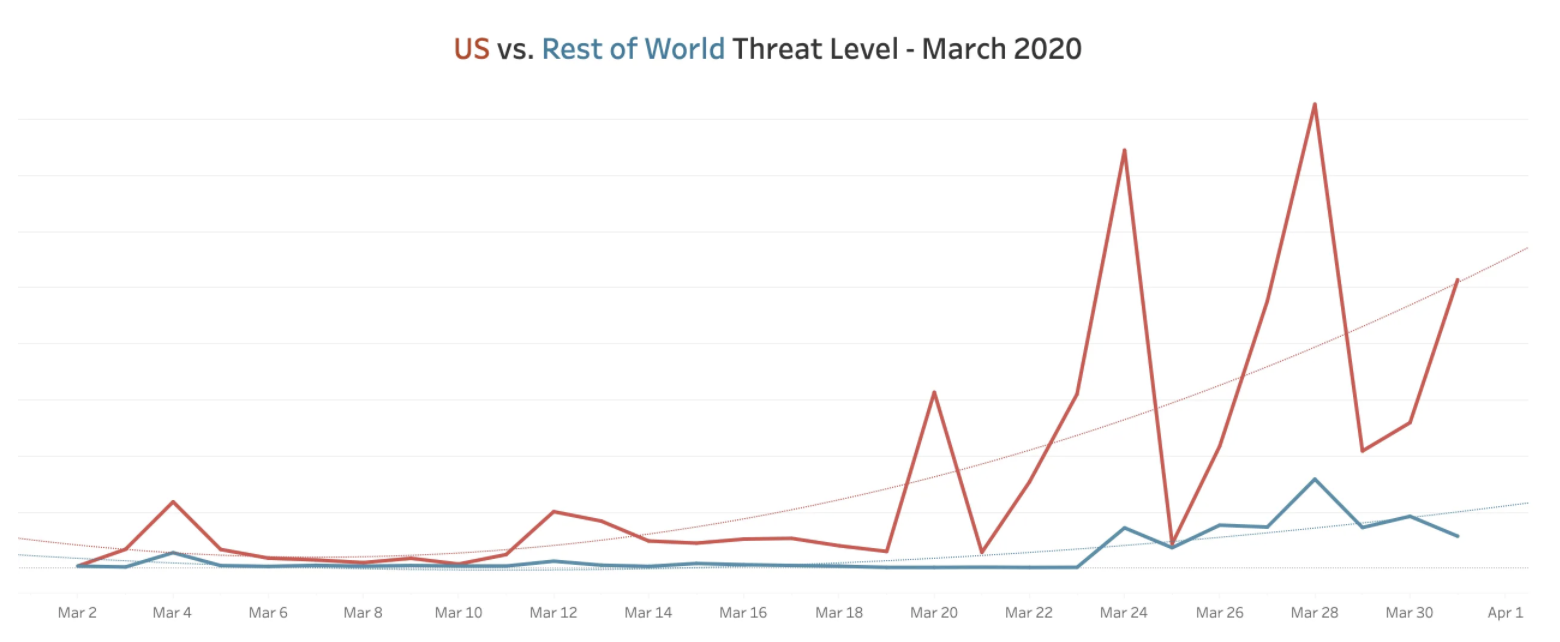

40% of advertisers are still blocking keywords related to coronavirus / COVID-19, even though it is still a top-performing keyword. Though using words related to COVID-19 still boosts traffic, many publishers know firsthand that more clicks does not equal increased revenue.

This is a combination of blocked keywords and reduced ad spending, which is still down by 63%.

In the UK, there are movements to end blocking words related to the virus, as many publishers and online entities are using terms related to the pandemic in related content but are still getting blocked from advertising. This keeps viewers from seeing possibly the most relevant content to their query and hurts publishers’ revenue—data from the Advertising Association and Warc projects revenue for national news brands in the UK to decrease by 20.5%, 24.1 for regional news, and 25.1% for magazines, summing to a roughly £50m decrease in ad revenue.

UK Culture Secretary, the Internet Advertising Bureau (IAB – UK), the Institute of Practitioners in Advertising (IPA), and the Incorporated Society of British Advertisers (ISBA) have all begun pleading to major marketers to stop inappropriately blocking ads related to the virus and to double check their policies. They have been successful with a handful of brand safety companies—like DoubleVerify, Integral Ad Science, and Oracle Data Cloud—in creating an updated keyword guidance for brands.

Some agencies are not blocking coronavirus if it is part of the title or a central theme in the content but even then, publishers are taking a chance. Since nothing has changed quite yet, only use words like ‘coronavirus,’ ‘COVID-19,’ or ‘pandemic’ if the majority of your content is discussing the outbreak. Otherwise, it is still suggested that you avoid them because most advertisers will be blocking them for the foreseeable future.

Search is changing right now away from specifically those terms anyway. While the term ‘coronavirus’ is still popular, with 17% of all impressions last month including the term, its growth has stopped and terms like ‘working from home’ or ‘staying at home’ are growing. Consider how you can work these types of phrases into your titles, h2s, and content without every mentioning ‘pandemic.’

Google’s core update during coronavirus

Google released a core update today, despite the uncertainty of the advertising and publishing space. Per usual, Google suggests focusing on creating great content and looking at the search quality rating factors if your website seems affected. Raters are looking for the E-A-T factors: expertise, authoritativeness and trustworthiness. Though Google will never say what is and isn’t a ranking factor, the update suggests that following EAT factors may help signal to Google’s ranking systems. Also, as always, it is important to not take any negative occurrences on your pages as definitively a part of the core update.

Things publishers can control

- SEO still drives 22% of all website visits. Though Google is pushing out a new core update, aggressively changing anything is not recommended during this time. Keep optimizing for SEO but do not try anything super new or big; otherwise, you won’t know if the changes are from the new Google core update or from your new strategy. Wait first to see how your website is affected by the update and then consider any updates to your SEO optimization.

- Mobile phones are more than 60% of all visits. Make sure your website is optimized for mobile, even if the majority of your visitors come from elsewhere.

- Content is still King during these times. If you’re going to be writing about coronavirus, make sure your information is accurate and that your data is from reputable sources—now, more than ever, readership is increasing for sites that people trust and visitors will quickly abandon your site for good if they sense something is off.

- Programmatic housekeeping is growing in popularity amongst publishers right now while advertising is down. Consider how you can improve things like page-load times, ad tech stacks, and keeping yourself and your team educated on current programmatic developments. Ezoic’s Site Speed Accelerator promises nameserver-integrated desktop and mobile sites an 80+ Google Pagespeed Insights score with built-in features taken straight from Pagespeed Insights.

— April 27, 9:48am PDT —

Ad rates are consistently staying above 40 as businesses are trying to anticipate when the economy may open back up. In the post prior to this, we discussed how many advertisers are putting increasingly more money in advertising, at the cost of pushing payment terms with publishers. Many of these businesses are hoping for higher conversions since online shopping is more popular than ever. They are also trying to get out in front of their competitors as the economy slowly opens up.

Specifically, many B2B brands are spending more on advertising because they are cycling through PPC campaigns at a much faster rate. It was originally thought that buying cycles would slow because almost all businesses are working from home but this has actually proven the opposite—many are going through buy cycles at 12 times the usual rate. This is largely be due to companies trying to find things for employees to do during WFH and less red tape to get things moving.

This can be an opportunity for publishers if they have advertising relationships with B2B brands; these companies are cycling through their campaigns very quickly and will need to begin new campaigns at a higher rate. If you’re able to position yourself properly, you could reap the benefits.

People are on their phones increasingly more—are you?

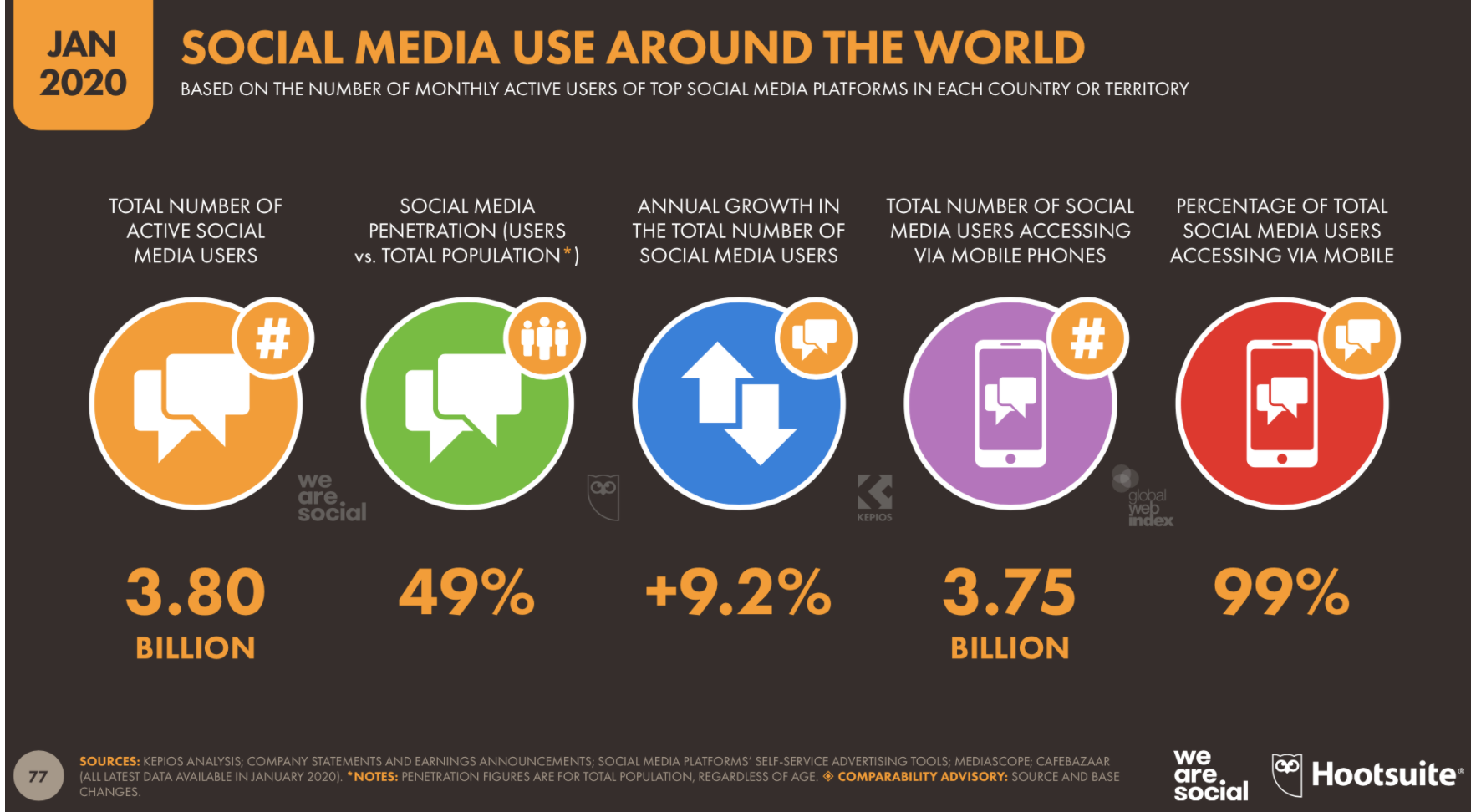

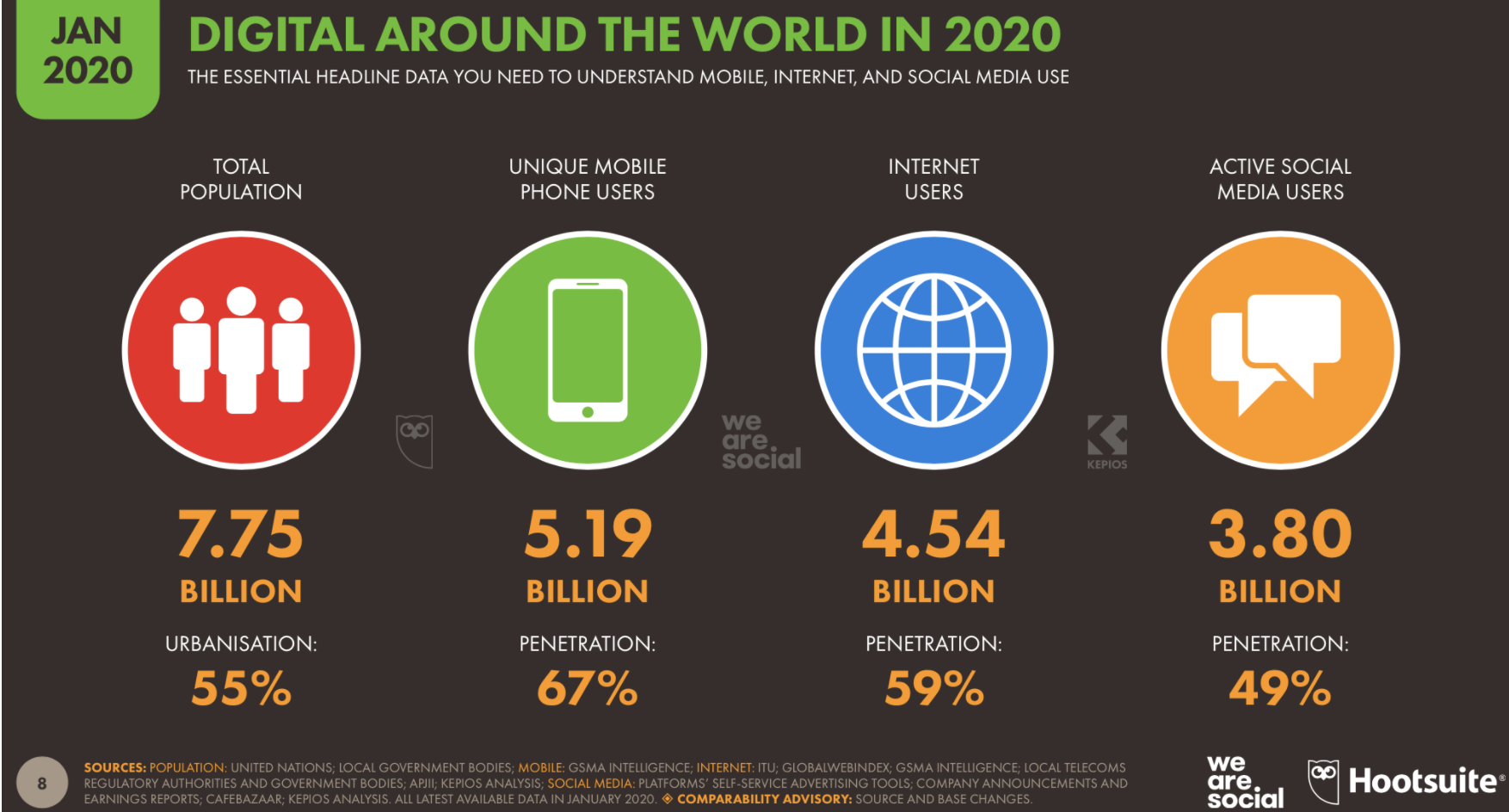

Some advertisers are spending more money on social media than on Search or Display during COVID-19, which signals how important these platforms are right now. Even despite coronavirus, it is expected that social network ad spending will increase 20.4% during 2020, bringing the total to $43 billion.

Ezoic always encourages publishers to practice mobile-first optimization just as much, if not more, than desktop, but right now it is more important than ever. In previous posts, we have reviewed multiple sources that report people are on their phones more than ever during COVID-19. Mobile has been taking over desktop for awhile now but has increased at an unprecedented rate during the pandemic. According to Statista, a business data platform, social ad impressions are up 20%, year over year.

While this rate will likely not hold after coronavirus, some things will certainly not ‘go back to normal’ and in many instances, some have expedited. These times have caused a heightened personal and emotional response by viewers and how publishers and brands react will stick with people long after the pandemic passes. This is why is it so important to make sure your site is mobile-friendly and to invest in your social media accounts right now. Consider how you can make social media users’ experience coherent; many people want order and familiarity right now, so consistent messaging is extremely important.

Q4 will not save the day (or year)

Many advertisers and publishers came into Q2 knowing it was a wash with the way Q1 ended, most focusing on what they could do to avoid layoffs and furloughs, and just stay afloat until the economy is more stable. Though coronavirus infection rates and deaths are slowing, many now also believe Q3 is not going to make much of a difference. This leaves many looking for Q4 to be their Hail Mary.

Leaders in this environment caution against that mentality, however. Though it is likely Q4 will be better than Q2 or Q3, it is not going to be the quarter that recoups revenue for the entire year, even with Black Friday.