The Supply Reset: How Buyer Spend and Deals are Reshaping Monetization

The programmatic advertising ecosystem enters the new year with bold ideas and meaningful resets. For more than a decade, growth on the web was primarily driven by expansion: this means anywhere from more demand sources to more intermediaries. That approach worked when signal loss was limited and media quality wasn’t a priority. Today, however, the economics have changed and suddenly ‘more of everything’ doesn’t equate to long-term success. The expression less is more couldn’t be more true nowadays. Identity fragmentation and rising buyer scrutiny have shifted the focus away from sheer reach and toward control, predictability and signal quality.

What we’re seeing across the entire supply chain in ad tech are visible changes on how ad spend is flowing and how deals are being structured.

From Dominant Channels to Diversified Revenue

For years, Google display revenue was the default backbone of publisher monetization. That was true for nearly every major ad partner in the ecosystem. But the dynamic has steadily changed.

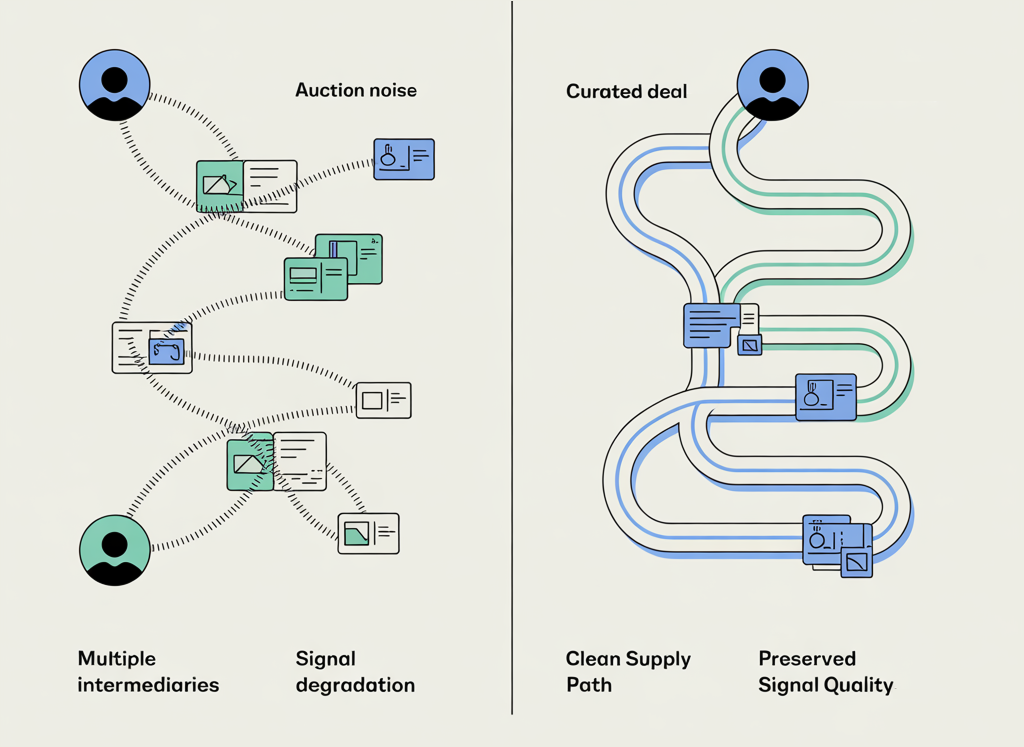

Industry-wide, buyers are reassessing where value is actually created in the auction. As supply paths have grown more complex, agencies and DSPs have become less tolerant of duplicated impressions and signal loss. More and more parties are enforcing supply path optimization (SPO) mandates, prioritizing environments where impression delivery is transparent, behavior is predictable, and unnecessary intermediaries are removed. As Bidscube indicated, publishers are actively reducing the number of vendors they work with in favor of partners that offer more transparency and predictable behavior.

"The coming year will reward publishers who choose stability over reach. Reducing the number of intermediaries lowers noise in auctions and improves buyers’ signal quality."

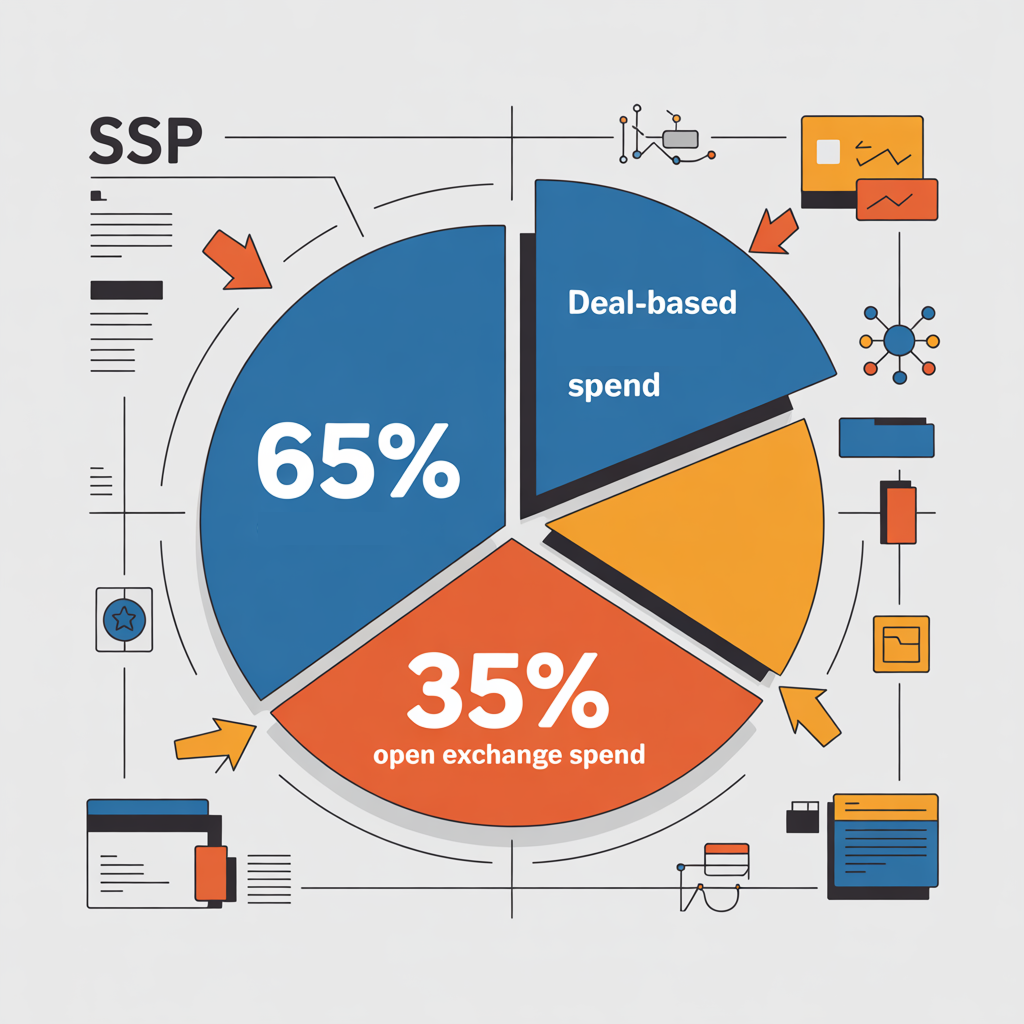

Where Ad Spend is Consolidating

We’re seeing a clear shift in buyer spending behavior: more spend is moving into deal-based transactions versus the open exchange. Buyers are increasingly prioritizing environments where they can define audiences more precisely and achieve more predictable outcomes. As supply paths become more intentional, curated deals offer buyers a way to reduce noise, protect signal integrity, and align spend more closely with performance objectives.

Ezoic’s role in this evolution is shaped by the diversity and scale of our portfolio. Because we work with high-quality sites and across many verticals, we’re uniquely positioned to help carve out audience segments that resonate with virtually any advertiser target. That capability allows us to support deal-based buying strategies that go beyond site-level placements and toward audience-driven outcomes.

Importantly, this work doesn’t happen in isolation. Ezoic collaborates directly with buyers, curators, and SSP teams to define, package, and activate these opportunities, ensuring that publisher inventory is included in deals where it has the highest likelihood of success.

The Rise of Curated Demand

Curated demand has accelerated as both DSPs and SSPs compete for data advantage. The modern web produces a high volume of micro-signals (e.g. engagement depth, session behavior, device type, contextual cues), that can meaningfully improve media outcomes. But when impressions pass through fragmented supply paths, those signals degrade over time. This dynamic has fueled what many now describe as a “signal war,” where platforms differentiate themselves by how effectively they preserve and activate data.

As 33Across outlines in its analysis of DSP–SSP competition, control over signal flow is becoming a defining battleground for the next phase of programmatic growth.

"Signal loss is no longer a side effect of programmatic complexity. It is a competitive disadvantage.”— 33Across, The Signal Wars

Curated deals respond directly to this challenge. By shortening and clarifying the supply path, this allows buyers to spend on the exact inventory and audience segment they are targeting to get the most out of their spend. For publishers, this results in more predictable revenue and fewer performance swings. For buyers, it creates confidence that impressions are sourced cleanly and optimized against real engagement.

Ezoic’s Position in the Supply Chain

Ezoic sits at a critical intersection in this evolving ecosystem. On one side, we work directly with our clients and understand how real users engage with content. On the other hand, we collaborate closely with SSPs to ensure this inventory is packaged and surfaced in ways that align with modern SPO requirements.

At the same time, DSPs are expanding their influence across the web. Amazon, in particular, is expected to gain additional DSP market share in 2026 through investment in agnostic inventory, SSP partnerships, and premium supply. As Adswerve notes, Amazon’s push into the open web reflects a broader buyer demand for scalable, transparent supply outside of walled gardens.

"Amazon is positioned to take meaningful DSP market share in 2026 as it expands into open-web, SSP-agnostic inventory.”— Adswerve, 2026 Marketing Predictions

Ezoic works seamlessly within this new reality with a deliberate focus on depth, quality, and long-term alignment across the entire supply chain. We continue to work with industry-leading partners across all parts of the ecosystem, ensuring broad access to demand while maintaining rigorous standards around transparency and performance. At the same time, we actively acknowledge where the industry is heading. Rather than spreading inventory thin across every possible path, we lean into deep, trusted relationships with SSPs and other key supply chain partners who consistently demonstrate value.

Our team plays a central role in translating market shifts into results for Ezoic users. This includes managing and strengthening SSP relationships, enabling and scaling curated deal opportunities, and continuously optimizing demand sources based on real performance signals. That balance is why Ezoic inventory is increasingly included in high-quality, SSP-led curated deals designed and why our clients are well-positioned as buyer priorities continue to evolve.